The big red flag plaguing the ASX

Plato is well known for our 100+ Red Flags which are integral to our investment process. These Red Flags have been built up over many years to help identify potential landmines on the long side and also short opportunities.

A question that clients ask time and again is which red flag is the most worrisome? While all of Plato’s Red Flags are linked with poor future stock price performance, one of the most potent is also one of the simplest - negative operating cashflow.

This is the amount of cash a company generates in the course of everyday activities.

A company can have negative underlying earnings, but this can be easily manipulated to give a positive result. Unfortunately, this practice is rife, particularly in Australia.

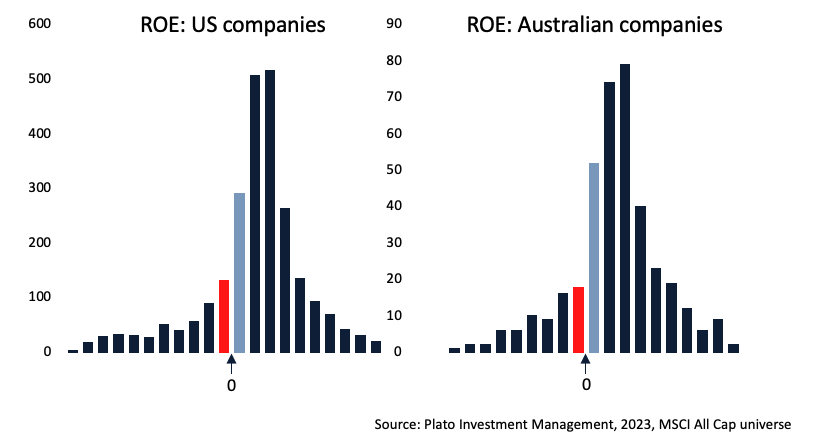

The two charts below show the distribution of ROE (net income divided by shareholder equity) for all US and Australian companies in the MSCI All Cap index.

If companies are distorting the accounts to present a positive net income number to the market, for example by prematurely recognising revenue, then there will be a kink in the distribution at zero.

This is exactly what we see below. There are less red bars (net income just negative) than expected, and more light blue bars (net income just positive) than expected. The kink is much more pronounced in Australia than in the US, which the skeptic would suggest indicates more earnings manipulation.

Because net income is so easy to manipulate, Plato focusses more on operating cashflow. As they say, earnings is an opinion, cashflow is a fact.

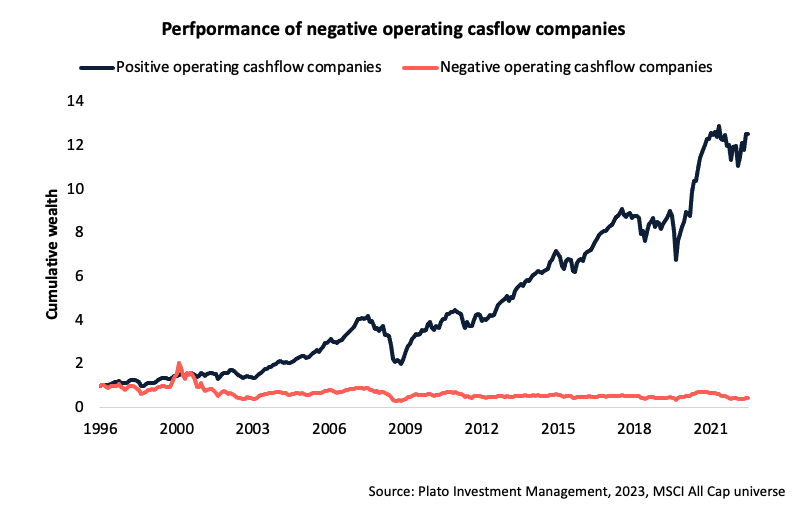

How do companies with negative operating cashflow perform on average? Very poorly.

Below we show the cumulative wealth from investing one dollar in companies with negative operating cashflow (over the prior three years) versus companies that do not for the period 1997-2023. The hypothetical portfolios are rebalanced monthly.

One dollar invested in companies with positive operating cashflow at the start of each month would have grown to $12.37. One dollar invested in companies with negative operating cashflow would have shrunk to a paltry $0.41 with far more volatility along the way. The phrase “return-free risk” comes to mind.

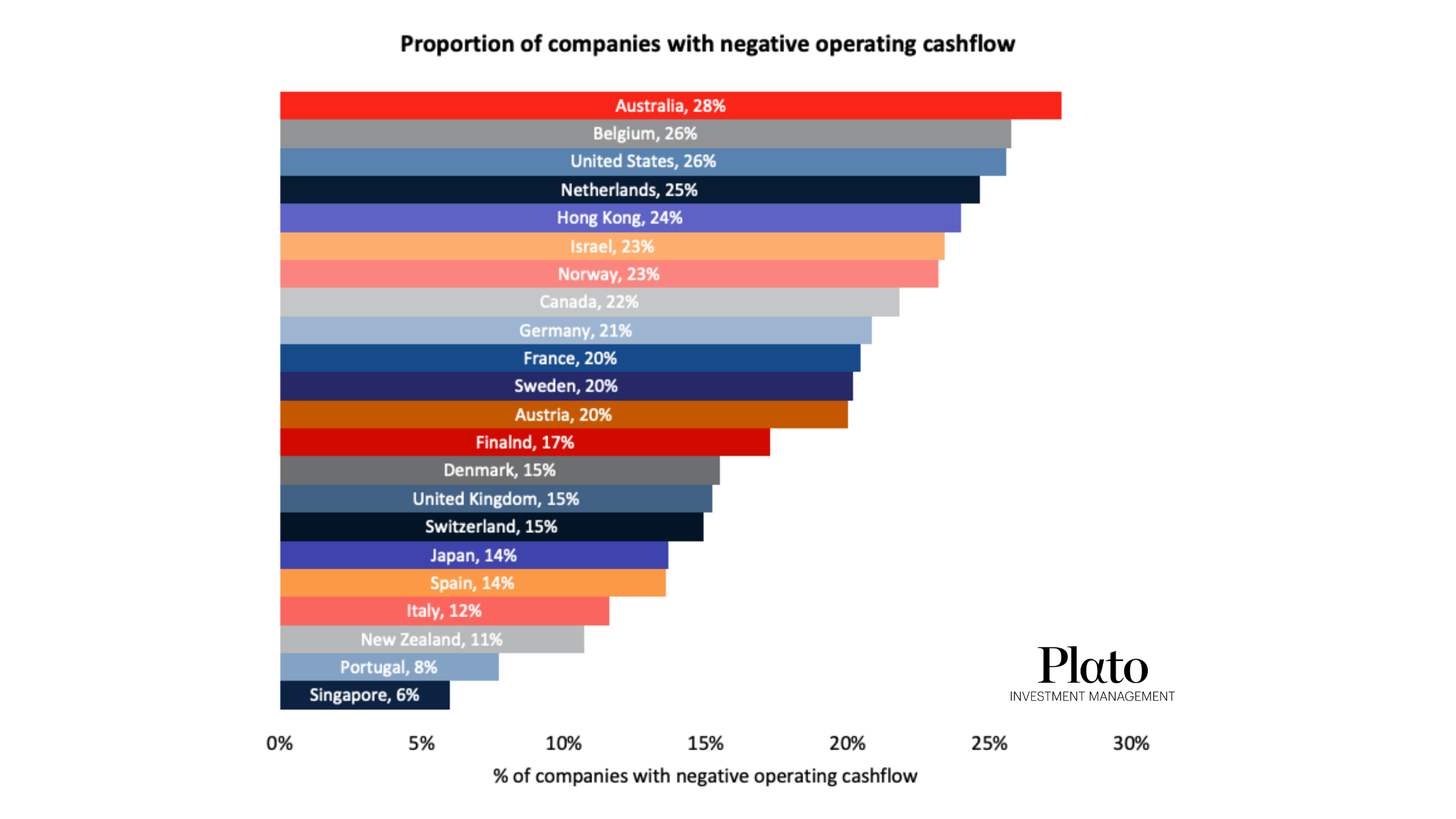

Of particular concern is that Australia has a higher proportion of companies with negative operating cashflow than any other country in the MSCI World index. A whopping 28% of companies have negative operating cashflow over the preceding 12 months.

This of course does not mean Australia is not a good place to invest, simply that is important to be discerning.

The good news is active managers who can sidestep these landmines are well poised. And what this also highlights is why fund investors should consider managers who can short. While a decade-long bull market saw many investors overlook the benefits of a shorting capability, times have certainly changed recently.

Learn more about Plato's Long Short Global Equities Fund

Details about the Plato Global Alpha Fund can be found here.

For more global investing insights, follow Plato Investment Management on LinkedIn.

1 fund mentioned