The big themes and stocks L1 and Ellerston are backing

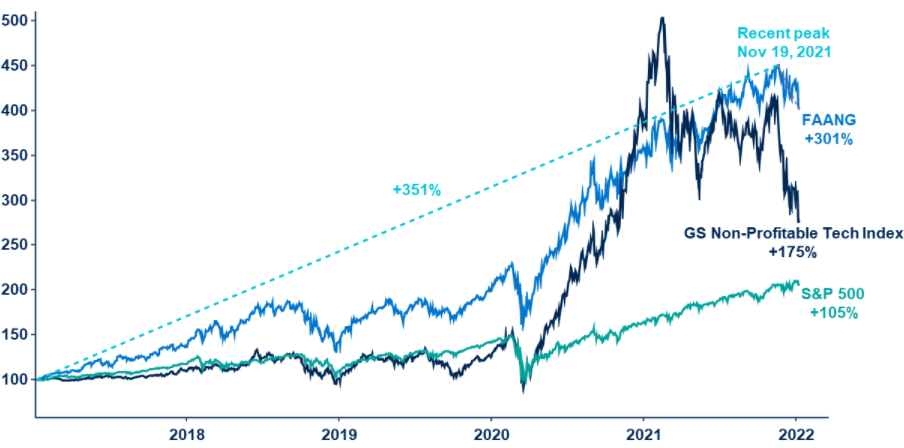

“That part of the market is a joke,” said Mark Landau Australia’s top-performing long short equities manager, pointing to the 50% drop in US technology company share prices in recent months. He referred specifically to those reflected in Goldman’s non-profitable tech index, as shown below.

Non-profitable technology firms provide plenty of shorting opportunities for L1’s flagship Long Short Fund, which returned a category-leading 11.5% after fees in the first quarter of 2022, partly on the back of getting these calls right.

Some of the biggest fallers L1 has shorted in the past include Peloton, Shopify and Logitech, whose shares are down between 50% and 90% from their 12 month highs.

The Goldman Sachs "non-profitable" technology index

Landau and Ellerston Capital portfolio manager Bill Pridham recently spoke with Caroline Gurney, CEO of Future Generation about their respective market views and some individual Australian and global stock calls.

Both head up funds that are part of the Future Generation investment portfolio and its listed investment companies Future Generation Australia (ASX: FGX) and Future Generation Global (ASX: FGG). These vehicles help deliver investment returns to charities focused on children, youth at risk, and youth mental health, with a stream of social investments equal to 1.0% of the companies’ net tangible assets each year.

But what stocks are headed higher?

Among the biggest drivers of the L1 Long-Short Fund’s performance recently are its long positions in both new and old energy stocks – lithium and copper in the former and oil in the latter.

“About 18 months ago we built up our biggest sector net long to oil because we could see that, as we emerged from COVID, there was going to be a shortage of investment in supply,” Landau said.

At the same time, demand would accelerate very fast partly because of COVID but also because of “structural growth” as developing-world consumers buy their first motorcycles and cars. “And people are continuing to underestimate the persistence of that,” he said.

3 of Landau's big themes

The key themes Landau believes will drive his Fund’s performance from here include:

The reopening trade: The travel sector is an area of focus here, Landau pointing to recent comments from leading US airline CEOs from Delta, American Airlines and United as “the strongest conditions seen in around 30 years.

What stocks? Australian company Webjet (ASX: WEB) and French firms Airbus (EPA: AIR), an aircraft manufacturer, and Safran (EPA: SAF), which builds aircraft engines and components.

Sportsbetting: Some of the best, fast-growing online gaming companies are benefiting as consumers’ gambling habits shift from physical casinos.

What stocks? With a 60% market share between them, Landau singles out Entain (LON: ENT) and Flutter (LON: FLTR), not only for their business models but also their higher levels of social consciousness in helping ensure they don’t foster problem gamblers.

Energy: Noting the ongoing rise of people resuming their drive to work as on-site working returns for many of us, and people start flying again as global travel restrictions are lifted, demand for oil is up, but the supply shortfall will probably remain for a while yet.

What stock? Canadian listed oil stock Cenovus Energy (TO:CVE).

2 Aussie stock picks

The L1 co-founder has fine form with the stocks nominated during his chats with Future Generation. After discussing oil and gas services firm Imdex (ASX: IMD) in his last appearance, its share price doubled in the ensuing 18 months.

Landau doesn’t expect Qantas (ASX: QAN) to be a multi-bagger – at least, not over a comparable timeframe. But he expects the “flying kangaroo” might deliver a similar level of share price gains over three or four years.

Why is he so bullish on this stock? Even if you haven’t been to an airport lately, you’ve likely heard about the queues (and the delays). That highlights the mammoth spike in demand as COVID-induced travel restrictions have been relaxed in Australia and in many international destinations.

“You’ve got really strong demand, strong pricing and a billion-dollar cost out that management did in the middle of the crisis," Landau says.

The other part of the story is fuel hedging – Qantas having bought large volumes of fuel at lower prices before the spike in recent months. Major domestic competitors Virgin and Rex have very limited fuel hedging, while Qantas is fully hedged until the middle of 2022.

“So even though they're getting negative impacts from higher fuel costs, they're getting the benefit first." Landau said.

At the current share price of around $5.50 at Tuesday’s close, Qantas stock is trading on a valuation multiple of around 5.5 times earnings.

“But in a normal world, if you assume Qantas trades at the same discount to market that it’s traded on over the 10 years – about a 40% discount to the ASX 200 Industrials,” Landau said.

He sees an almost 120% upside from today’s share price, expecting a big share price increase over the next one or two years.

Also brought to you by the letter “Q”

Turning to another “Q” stock, the other company Landau highlights is general insurer QBE Insurance Group (ASX: QBE).

It’s a company he knows well, as Invesco was a shareholder during the five years he was a large-cap analyst there. Back then, the share price went to $35 from $4 in around six years and was one of the firm’s biggest holdings.

Over 15 years, the QBE share price has gone from $35 and is currently trading at $12.15 as of Wednesday's market close. The company has struggled to lift insurance premiums – the primary source of revenue – for much of the last decade. But in the last couple of years, QBE’s Gross Written Premiums is up between 10% and 20%.

And when you factor in the rising costs for insurers – a number that currently has a 4 in front – that gives you the underwriting profit margin for the company.

“If you look in detail at the last result of QBE’s profits, if you take away all the actuarial assumptions that effectively lower their profit, their profit was actually 40% better than what they told the market.”

Crunching the numbers on what he regards as one of the most complex companies on his books now, Landau believes the profit is "40% better again."

“The share price has gone down roughly 70% over 15 years, so people hate the stock and have given up on it. But they’re missing this inflection point similar to what we had in 2001.”

Where bonds and insurance meet

This is also driven by the rising yields of the $28 billion of short-term bonds QBE holds on its books. For every 1% increase in bond yields, the insurer gets a roughly 20% increase in profits.

If QBE's bond yields average 2% higher than last year, you've got a 40% increase in profits, Landau said. And even if the bond yield lift we’ve seen in recent months was to reverse and half that increase disappeared, it still leaves a 20% profit uplift, “which for QBE is massive,” he said.

“This is a company on a PE of 10 on 5% dividend yields. No one has expected any increase in profits, let alone 20% on top of the underlying insurance business.”

Despite the low expectations from much of the market – or perhaps because of them – Landau expects QBE to deliver good news in the next year or two.

"The market has moved on"

From a fund that holds predominantly Aussie large caps, the conversation also covered small- and mid-cap international stocks.

Kicking off his chat, Ellerston's Bill Pridham noted markets are currently in the shadow of “the largest European war since World War 2,” as the conflict in Ukraine sadly rages on.

Pridham conceded he doesn’t try to predict what will happen in the market – beyond the outlook for high volatility and “difficult conditions” to continue. And on the question of how much is already priced into the market, a recession is “a matter of when not if – it’s going to happen.”

"How severe will it be? I can’t call that, but consumer balance sheets in the US are fantastic," said Pridham. He also emphasised:

- Home equity in the US – collectively, US homeowners have between US$6 trillion and US$7 trillion of property equity.

- Many still have unspent stimulus cheques in the bank

- Banks are over-capitalised.

“The market has clearly moved away from pricing the context in which businesses are promising cash flow and earnings way out into the future and is more focused on near-term fundamentals. There’s already a lot that’s factored into markets now," Pridham said.

Pridham’s picks

The first of the two stocks Pridham names is Connecticut, US supply chain management firm GXO Logistics (NYSE: GXO). The NYSE-listed company is benefiting from three themes:

- Warehouse automation - companies are obsessing over labour prices.

- Ecommerce

- Outsourcing – companies are realising it's better to outsource supply chain management because of the difficulties of running them in-house.

For Pridham, some of the highlights include its US$800 million of new contract wins last year and an outlook for revenue growth of between 8% and 12% this year.

The share price has been knocked by concerns linked with the war in Europe but with the “strong secular drivers” above, Pridham sees a bright couple of years ahead, during which he believes the stock will be a strong performer.

Pridham’s second stock is TKH Group (AMS: TWEKA, a Dutch firm that provides 2D and 3D “Smart Vision” systems for security, communications and industrial applications.

"It's one of those few stocks that are exposed to several megatrends in the market today. And as a diversified business, it also has exposure to renewable energy, connecting many offshore and onshore wind farms," he said.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

3 topics

4 stocks mentioned

2 funds mentioned

4 contributors mentioned