The chart the media doesn't show you about LICs and LITs

Risk Return Metrics

The chart on LICs you don’t see in the media

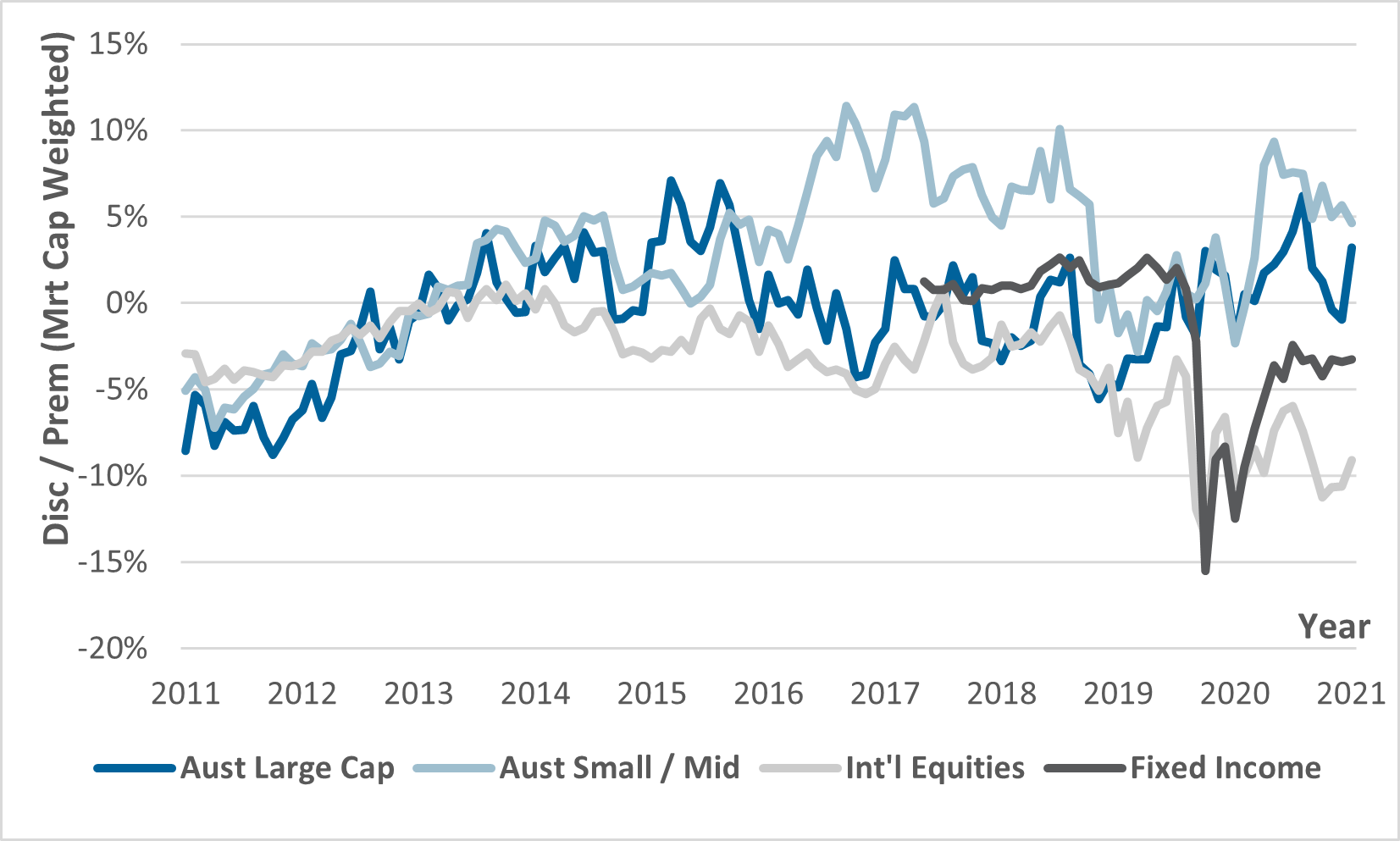

Just as all leading equities market indices are based on a market cap weighted methodology, on a FUM or market cap weighted basis, the key segments of the LIC sector are, and have generally historically, traded at a premium to NTA. The chart and analysis you do not see in the ‘sensationalist’ media coverage - the media only illustrates the median analysis. However, it is the FUM weighted or market cap weighted basis that is the true measure of investor experience based on the weight of dollars invested. Further analysis can be found on pages 7 & 8 of the report.

Image: Premium / Discount by Market Cap Weight

Are NTA discount control initiatives all in vain?

The Monthly also takes a dive into discount control mechanisms, specifically buybacks, conditional tender offers and conversions, and conclude that, which the exception of the unappetising (for an investment manager) of the latter option, managers are largely banging their collective heads against a brick wall. At least with respect to immediate / shorter term impacts. And the end of the day, only performance, yield and investor communications are likely to address a persistent and material discount to NTA.

And the two sides of the coin continue: Gryphon Capital Income Trust (ASX: GCI) raises additional capital (oversubscribed) while Antipodes Global Investment Company Ltd (ASX: APL) has announced a surprise ETMF conversion to closely aligned sister ETMF strategy, AGX1, while MHH announced its expected delisting / conversion to ETMF date comes into effect shortly on 31 August.

Access the full report

Download the full PDF report below to view comprehensive profiles on 90 LICs / LITS, performance tables sector performance ranking analysis and monthly news flow.

Not an existing Livewire subscriber?

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

4 topics

2 stocks mentioned

Investment analyst with particular experience in listed and unlisted investment strategies, equities and structured products.

Expertise

Investment analyst with particular experience in listed and unlisted investment strategies, equities and structured products.