The company shattering ultra-high earnings expectations... again

When it last reported in August, this company recorded a 37% increase in revenues and a 44% increase in earnings. Its margin percentage was world-class and its contract wins continued to come from all corners of the globe. The only problem most investors had about the company - including the many of you who reached out to us in the comments section - was that it was simply way too expensive.

Think of it: Who in their right mind would normally pay for a company given its forward P/E ratio is in excess of 150 times?

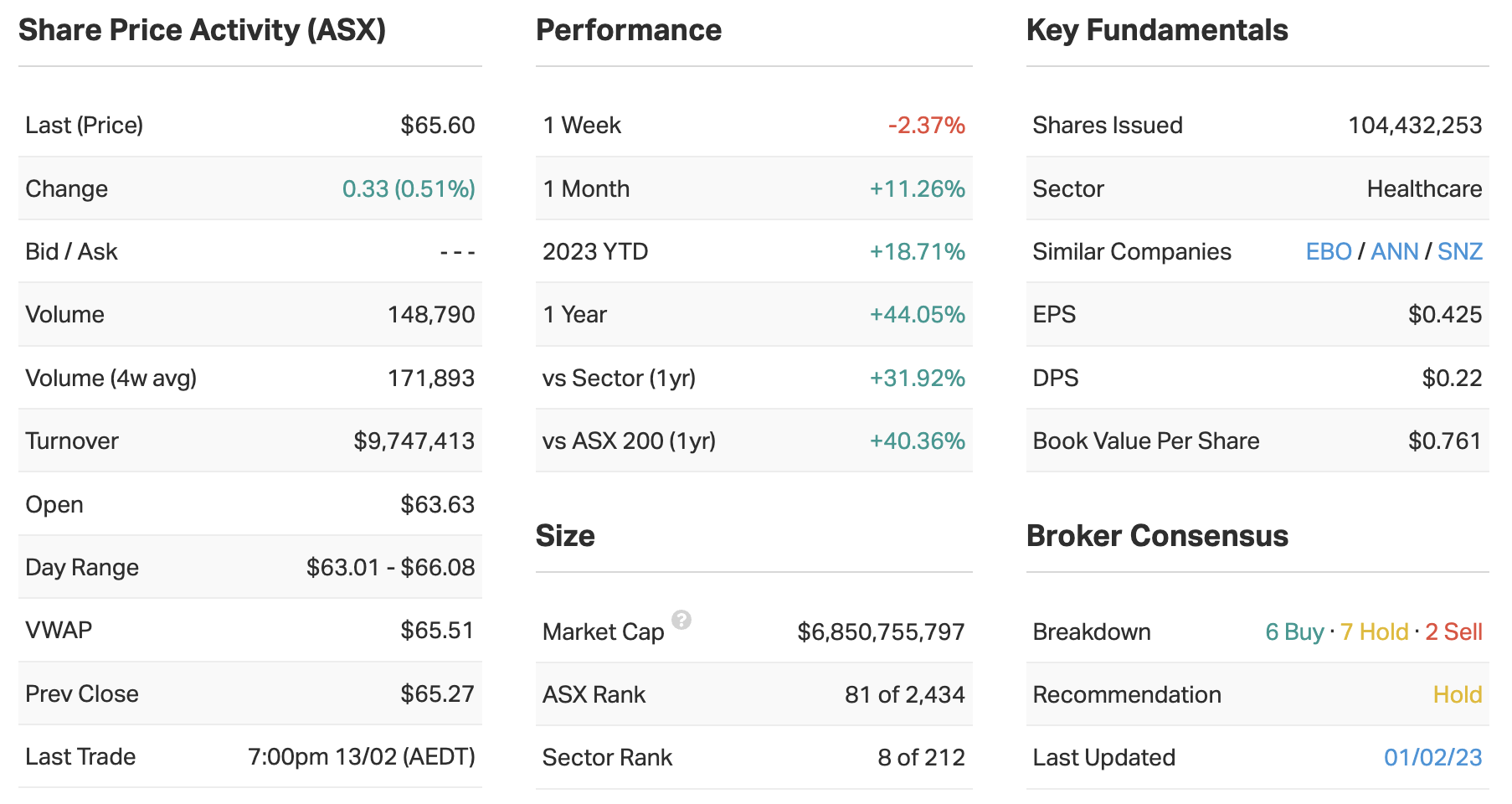

But Pro Medicus (ASX: PME) seems to be different. The share price is up 44% in the last year and only two sell-side analysts (out of 15) have SELL ratings on its stock.

Today, Dr Sam Hupert and his team handed down another earnings report that smashed analyst expectations. It features another four contract wins (and a renewal) in North America, leading to a 32% gain in net profits. Oh, and it was a record result - again.

To discuss the result and what it means for shareholders, I sat down with Dr Melissa Benson from WILSONS Advisory fresh off the report's release.

Note: This interview took place on Wednesday 15 February 2023. Pro Medicus is among WILSONS' highest conviction stocks for its long-term growth potential, as signified by its place on the firm's Focus List. PME was also named one of the firm's top six ASX healthcare picks for 2023.

Pro Medicus (ASX: PME) H1 Key Results

- Revenues up 28% to $56.9 million

- Net profit up 32% to $27.2 million

- Cash on the balance sheet of $94.5 million

- Four new contract wins plus a renewal in North America

- Interim dividend of 13 cents a share

Key Company Data

MarketMeter

PME was ranked ninth in the ASX 101-200 MarketMeter institutional investor sentiment research with regard to CEO Effectiveness. For more information on MarketMeter, please click here.

In one sentence, what was the key takeaway from Pro Medicus' results?

Strong business performance and growth remain, with earnings meeting our bullish estimates. This means the market should be upgrading its second-half forecasts.

What was the market's reaction to this result? Was it an overreaction, an underreaction or appropriate?

The market reaction is fairly muted but it feels like an overreaction for the growth that was delivered here and the quality of the earnings. PME, given its high earnings multiple, does perhaps have even higher expectations built-in of outperformance – which to be fair, they have done here versus where consensus expected the result to sit.

So we would have perhaps expected a more positive reaction, noting today is a down market. This could come as the result is digested and second-half upgrades are put through by analysts. We also cannot discount the incredible run we have seen in the share price over the last six months or so, and there may be holders out there keen to recognise some profits.

Were there any major surprises in this result?

No major surprises in my view, as they met our expected forecasts largely. The operating cash flow this half was much lower than anticipated but seems to be a timing issue for some large contract implementations, which will be recaptured in the second half – so not a systemic issue to worry about.

The margins delivered continue to be impressive. We were anticipating more of a softening with the return of travel and conference expenses. However, it seems the sales leverage that’s developing in the business is counterbalancing this, keeping margins stable and above where we modelled (at an EBIT margin basis). That is not a major surprise but a pleasant one for the outlook and how we model the business going forward.

Note: We are not able to ask for Melissa's buy, hold, or sell rating on Pro Medicus for legal and compliance reasons. The following is a tweaked version of that question.

How do you think Pro Medicus' result will sit with shareholders?

I think it will be well received, in the sense that they delivered ahead of earnings expectations – which were high. And in the current market, the ability to do so feels like it's perhaps worth more than a pass.

So, from a shareholder’s perspective, there is nothing from this result that would stimulate me to sell at all. I expect shareholders are keen to get more clarity on where the new growth levers come from, particularly in the form of new products and such. There was not a lot of colour provided on that today, other than to say we will see launches this year, which may disappoint some, but perhaps should not be unexpected.

What's your outlook on Pro Medicus and the healthcare sector over 2023? Are there any risks to Pro Medicus and its sector that investors should be aware of given the current market environment?

We have a bullish outlook for PME. The broader adoption of cloud-based healthcare IT systems in hospitals is accelerating and this is tailwind for PME.

This is particularly the case given Visage is one of only three cloud-native radiology viewer options, which is the fastest and highest user rated of them all. So cloud is key, as is the organic demand profile. Clinicians continue to use diagnostic imaging more and more – and we are just seeing that accelerate – which of course feeds perfectly into PME’s business model that is based on imaging volumes.

On the risk front, specific to PME - the risks are competitive – and related to their technology offering. This will always be a risk to any market-leading product. We are comfortable with that risk. PME’s R&D team is second to none, and the IP fencing of the Visage product to prevent duplication seems comprehensive.

Once you also become the embedded choice, it's harder to lose customers – so that is where PME is focused right now – becoming that embedded choice for all radiology departments.

On a healthcare sector level, I am also positive about the outlook. A lot of companies have been cycling tricky COVID-impacted periods making it very hard to see where the business performance is sitting back in a more normalised environment, CSL (ASX: CSL) being one of them.

This year, we finally seem to be getting past those adjustments – and so far, many in healthcare have received a boost from COVID that they are only getting the opportunity to leverage now.

From 1 to 5 where 1 is cheap and 5 is expensive, how much value are you seeing in the market right now? Are you excited or cautious about the market in general?

Rating: 3 (Sector-level rating, given Melissa does not cover the broader market)

The level of value is definitely sector and stock specific. In my focus area of healthcare, there is abundant value in many biotech stocks that have been oversold during the past six to nine months just due to the macro environment. In some instances, their share price is sitting more than 50% below this time last year and yet they are objectively more valuable businesses.

Immutep (ASX: IMM) is a great example. Its share price is down 30% or more from this time last year, and yet since then, they have more positive clinical data on their lead drug, they have progressed it further down the pipeline to later-stage studies, and they have less risk associated with the path forward.

This doesn’t match with the share price today – so that presents value. And there are many more examples like this.

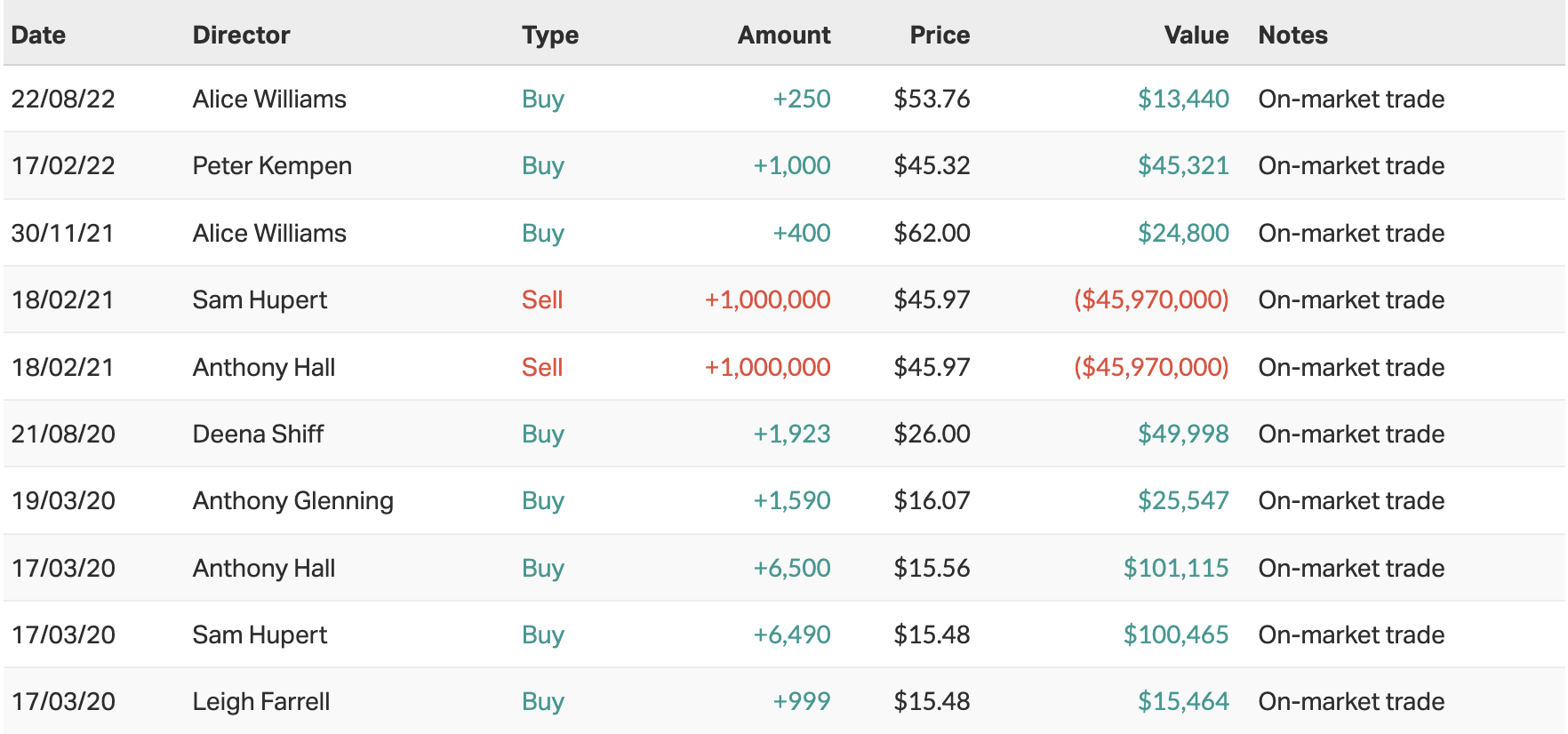

10 most recent director transactions

Catch all of our February 2023 Reporting Season coverage

The Livewire Team is working with our contributors to provide coverage of a selection of stocks this reporting season. You can access all of our reporting season content by clicking here.

3 topics

3 stocks mentioned

1 contributor mentioned