The correct flight path: Sydney Airport

The successful completion of the takeover of Sydney Airport in March 2022 marks the conclusion of 20 years as a listed entity. Since the inception of the Cromwell Phoenix Property Securities Fund (the Fund) in April 2008, Sydney Airport (ASX:SYD) has been a core holding and a big positive contributor to the Fund’s returns.

From the early days, the potential upside of airports made for a compelling investment case for the Cromwell Phoenix Property Securities Fund. Airport ownership provides a myriad of opportunities to invest in commercial activities, particularly via the unregulated retail, car parking and property opportunities, which combined can often represent a greater proportion of airport revenues than aeronautical activities.

With respect to aeronautical activities, the privatisation of Sydney Airport was accompanied by the removal of price controls on aeronautical charges, enabling more flexible arrangements between airlines and the airport allowing for the provision of services to meet the demands of airlines.

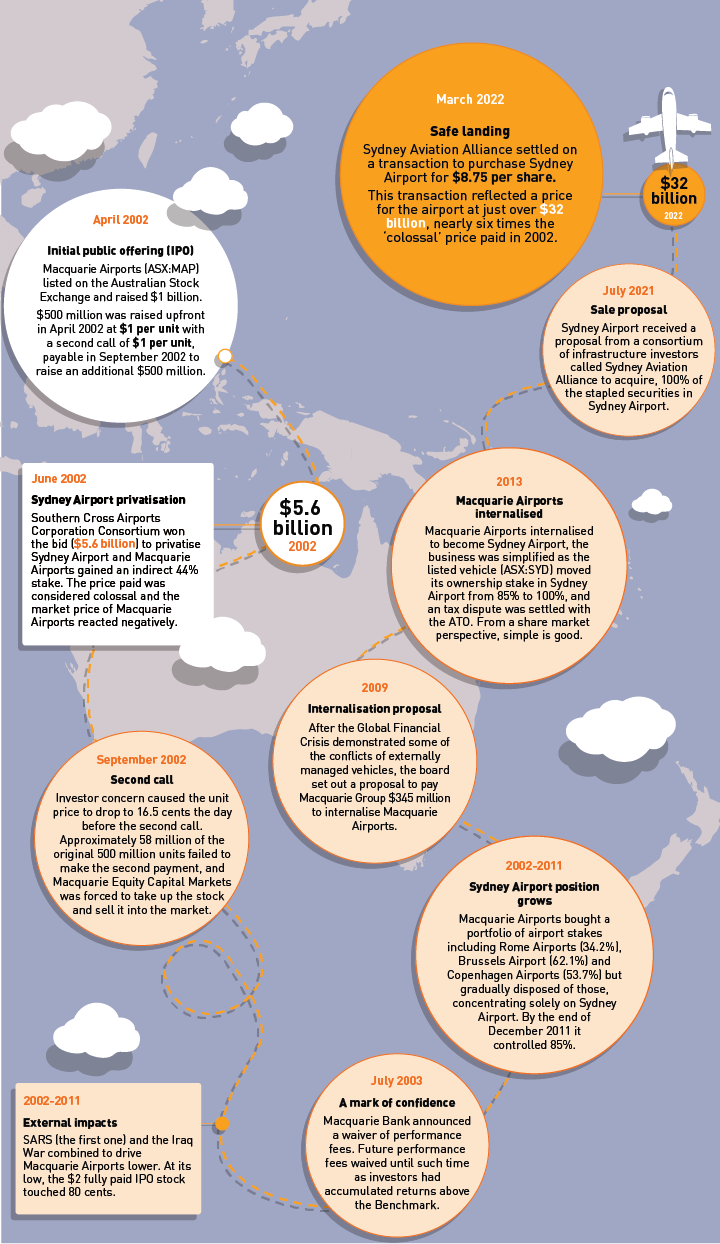

The infographic below provides a timeline of Sydney Airport’s ascent, turbulence and smooth landing.

Running out of runway – a turbulent first year

In the aftermath of the September 2001 terrorist attacks on the World Trade Centre and the subsequent demise of Ansett in March 2002, Macquarie Airports (ASX:MAP) listed on the Australian Stock Exchange on 2 April 2002. Timing is everything!

Macquarie Airports, which was many years later to become Sydney Airport, started life as an externally managed fund with a mandate to invest in airport assets in Australasia and Europe.

The seed asset was a 36.7% stake in Macquarie Airports Group Limited, which gave Macquarie Airports an 18.4% exposure to Bristol Airport and an 8.9% exposure to Birmingham Airport, both in the UK.

The other significant attribute at inception was its participation in the Southern Cross Airports Corporation consortium which was Macquarie Bank’s bidding vehicle for the privatisation of Sydney Airport.

The Macquarie Airports initial public offering (IPO) raised a whopping $1 billion. Partly to reflect the size, and partly to give Macquarie some flexibility, the deal was structured in the form of partly paid shares, with $500 million raised upfront in April 2002 at $1 per unit, and a second call of $1 per unit, payable in September 2002 to raise an additional $500 million.

The stock listed at a small discount to its issue price and then commenced a glide path. Unless there are extremely favourable thermals, glide paths rarely point upwards.

On 25 June 2002, the Australian Federal Government announced that the Southern Cross Airports Corporation Consortium had won the bid to privatise Sydney Airport. Macquarie Airports, via its 40% direct stake in the winning consortium and also indirectly via its stake in Macquarie Airports Group, also part of the consortium, became a 44% investor in Sydney Airport.

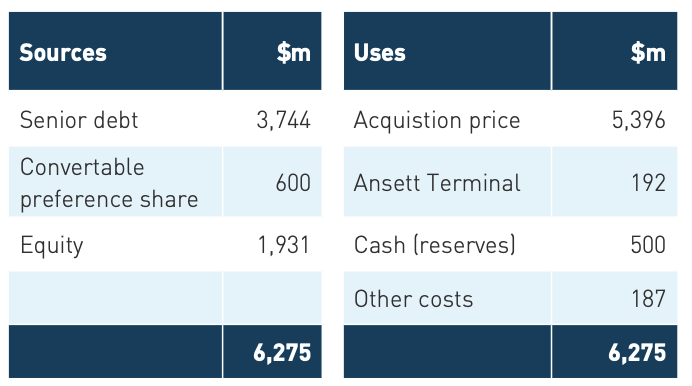

The winning bid comprised $5.396 billion for the airport, and a further $192 million for the Ansett terminal. This was considered colossally high at the time and the market price of Macquarie Airports reacted negatively.

The price paid represented a multiple of 14.3 times forecast June 2003 earnings before interest, tax, depreciation and amortisation (EBITDA1) of $377 million and a forecast project level internal rate of return of 12.1%.

Given the geared structure of the consortium, the direct equity cost to Macquarie Airports for its 40% stake in the consortium was $815 million.

Not deterred by a slumping unit price, on 16 July 2002, Macquarie Airports announced a second large acquisition, also via a Macquarie consortium, for the purchase of a 28% stake in Aeroporti di Roma which owned 100% of the Rome airports Fiumicino and Ciampino.

Given the acquisitions of stakes in both Sydney and Rome in quick succession, and not to mention Macquarie’s appetite for fees, the transaction also required a further capital raising, this time at $1.50 per unit on a fully paid basis (compared to the $2 initial price, paid over two instalments)2 .

While still digesting the Rome acquisition and to further add to the woes of Macquarie Airports, Rome’s profit for the half year to June 2002 was initially poorly received by the market (albeit a little misunderstood). This subsequently sent the Macquarie Airports unit price lower ahead of the final call of the initial IPO stock.

The day before the call was due, the unit price hit 16.5 cents, with many investors worried about what had happened to their original $1 investment. So much so, that approximately 58 million of the original 500 million units failed to make the second payment, and Macquarie Equity Capital Markets was forced to take up the stock and sell it into the market.

As we subsequently moved into 2003, the effects of SARS

(the first one) and the Iraq War combined to drive Macquarie

Airports lower. At its low, the $2 fully paid IPO stock touched

80 cents before commencing what would ultimately become

a staggering rally.

In July 2003, Macquarie Bank, in recognition of the tumultuous journey that investors had been on since listing, announced a waiver of performance fees due in respect of Macquarie Airports. Furthermore, future performance fees would also be waived until such time as investors had accumulated returns above the Morgan Stanley Capital Index World Transportation Infrastructure Index (the Benchmark). A mark of confidence indeed.

While the share price had not climbed above its fully paid

IPO price by the time of the first full year results call in

August 2003, the company was able to demonstrate that

Sydney Airport’s EBITDA figures were in line with the

assumptions made on acquisition, despite international

traffic impacted by SARS and the Iraq war. The underlying

performance of the assets was crucial to management

credibility and to support the strategy of developing a

portfolio of airport stakes.

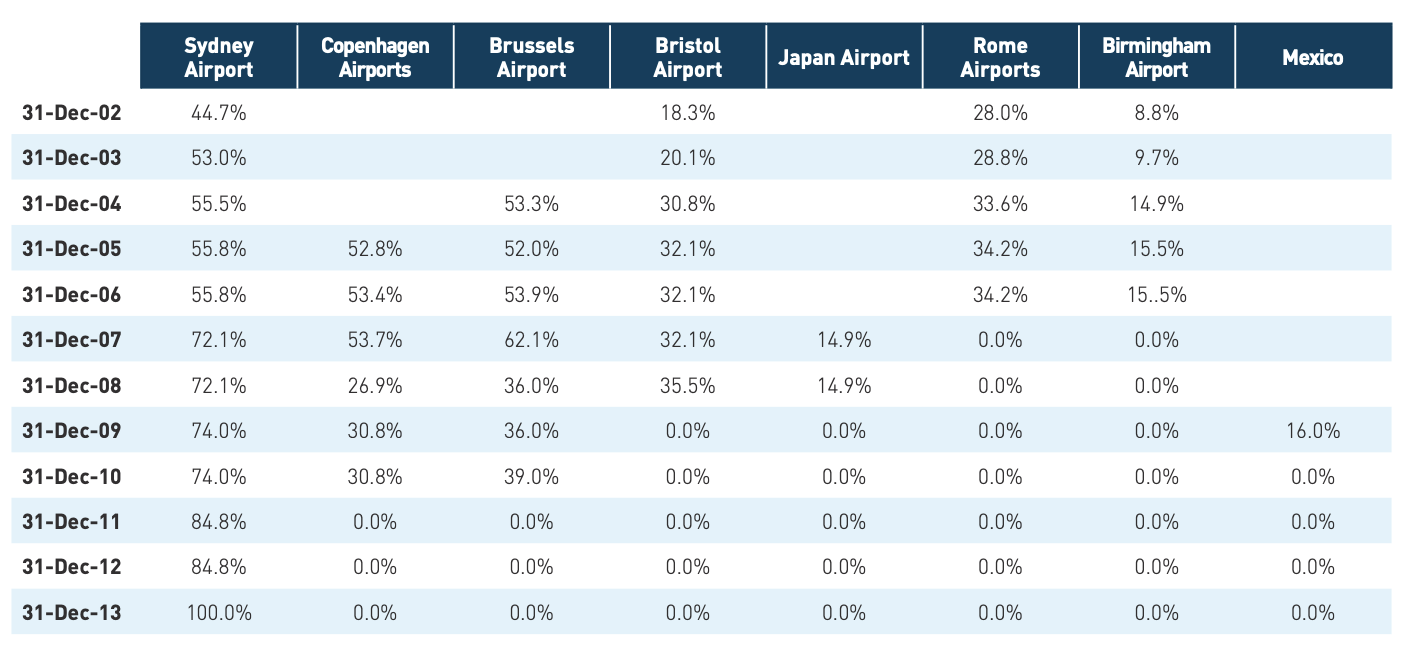

In for the long haul – how the mix changed over time

Over the next decade, Macquarie Airports, along with

partners (predominantly other Macquarie vehicles), bought

a portfolio of airport stakes with positions peaking in assets

including Rome Airports (34.2%), Brussels Airport (62.1%)

and Copenhagen Airports (53.7%). However, the jewel in the

crown, the position in Sydney Airport continued to grow and

by the end of December 2011, Macquarie Airports

controlled 85% of Sydney Airport and through a series of

transactions the position had become the sole asset in the

portfolio. The table below sets how the stakes changed

through time.

In 2009, after the Global Financial Crisis demonstrated some of the conflicts of externally managed vehicles, the board set out a proposal to pay Macquarie Group $345 million to internalise Macquarie Airports. This was highly controversial, given shareholders could theoretically terminate Macquarie by a majority vote, and alternative proposals were put forward.

However, the board persisted with the plan, arguing the need for Macquarie’s co-operation to avoid triggering change of control and pre-emptive rights clauses in debt facilities and shareholder arrangements. Ultimately the internalisation occurred, with the chairman at least being forced to acknowledge that there was no legal obligation to pay Macquarie, just a moral obligation. A very expensive ‘moral’ obligation in our view.

Despite the bumpy path, by the end of the 2013 calendar

year, Macquarie Airports had internalised to become Sydney

Airport, the business was simplified, a tax dispute settled

with the ATO, and ownership of Sydney Airport had moved to

100%. From a share market perspective, simple is good.

Despite early turbulence, the vision was clear

From the early days, the potential upside of airports made for a compelling investment case for the Cromwell Phoenix Property Securities Fund. Airport ownership provides a myriad of opportunities to invest in commercial activities, particularly via the unregulated retail, car parking and property opportunities, which combined can often represent a greater proportion of airport revenues than aeronautical activities.

With respect to aeronautical activities, the privatisation of Sydney Airport was accompanied by the removal of price controls on aeronautical charges, enabling more flexible arrangements between airlines and the airport allowing for the provision of services to meet the demands of airlines.

Accounting tricks aside, airports require lots of capital and it is often difficult to determine what is regular maintenance capital and what capital is required to grow revenue. However, on acquisition of Sydney Airport, we were able to take comfort that it had been the recipient of lots of capital in the process of getting Sydney and its infrastructure ready to host the Sydney 2000 Olympics.

Another appealing feature of Sydney Airport has always been the monopolistic nature of the asset. In a geography as vast as Australia’s, unlike in Europe, there really is only one way to efficiently travel between major capital cities. This is somewhat supported by the Sydney-Melbourne route being the third most busy airline route in the world.

Furthermore, the only moderate level of future competition

was in the form of Western Sydney Airport, where Sydney

Airport always had the right of last offer to participate. With

light-handed regulation and a focused management team,

good things happened.

Aggressive financial structure in the early days

Love it or loath it, Macquarie Airports started life as a complex triple stapled structure that invested in other complex structures, making the accounts opaque and difficult to understand. Couple that with a new asset class and many investors struggled.

In Macquarie Airports’ early days, financial leverage was

also considered to be high, particularly for an asset with

plenty of operational leverage. The initial Southern Cross

Airports Corporation consortium that won the bid for Sydney

Airport was aggressively structured as shown in the table

below. Less than a third of the capital to fund the acquisition

was pure equity.

Correct flight path

Recall at the time of acquisition that Sydney Airport was forecast to grow EBITDA to $377 million. In the 2002 calendar year, the company’s cash generation before interest was sufficient to cover its interest bill by 1.2 times. That provides very little margin of safety. By contrast, that same ratio was over 3 times by the end of the 2019 calendar year.

The steady improvement in balance sheet strength enabled the company to weather most storms, including the Global Financial Crisis. Only the devastating impact of COVID-19 resulted in an equity issue to bolster the balance sheet.

The decision to focus on Sydney Airport stands the test of time. Based on Phoenix Portfolios Pty Ltd (Phoenix) calculations, setting aside recent COVID-impacted financials, for the 18 years ending December 2019, Sydney Airport generated a cumulative annual growth rate in revenue of 8.5%, and given margin expansion throughout the period, an EBITDA growth rate of 10.3% per annum.

This didn’t come for free. Phoenix estimates over $5 billion has been spent over the last 20 years on various capital projects that have facilitated passenger growth and contributed to the spectacular EBITDA growth.

In addition, a further $2 billion of capital was injected into

the business by shareholders to cope with the difficulties

thrown up by COVID-19. However, offsetting this has been a

steady and robust stream of distributions.

Grounded, but ready for take-off again

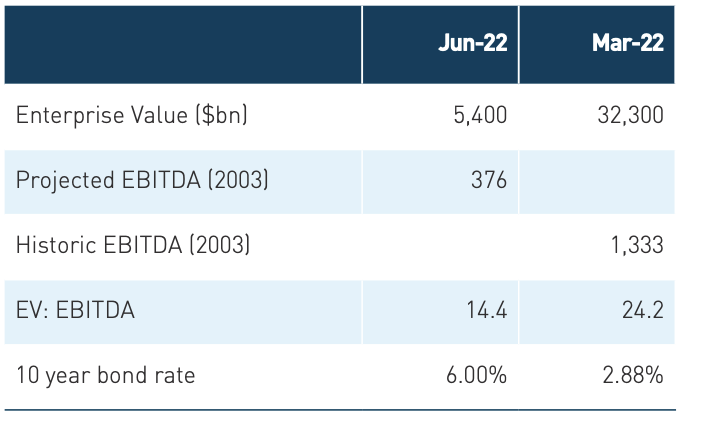

Sydney Airport has enjoyed some magnificent tailwinds through the last 20 years, which combined with an active management approach has grown EBITDA by 350%. The robustness of the cash flows, along with steadily declining interest rates, has facilitated high multiples to be used when valuing such assets.

On 5 July 2021, Sydney Airport received a proposal from a

consortium of infrastructure investors called Sydney Aviation

Alliance to acquire, by way of scheme of arrangement and

trust scheme, 100% of the stapled securities in Sydney

Airport. The Consortium comprised:

- IFM Investors (Nominees) Limited as trustee for IFM Australian Infrastructure Fund; Conyers Trust Company (Cayman) Limited as trustee for IFM Global Infrastructure Fund;

- QSuper Board as trustee for QSuper; and

- Global Infrastructure Management, LLC (on behalf of its managed and advised clients and funds).

This transaction was ultimately consummated on 9

March 2022 with a payment of $8.75 per stapled security.

This reflected an Enterprise Value for Sydney airport of

approximately $32 billion.

As shown in the table below, we believe this transaction fully

values the asset.

Going forward, Sydney Airport must navigate its way out of the COVID-19 pandemic, deal with potential structural changes to the aviation market, contend with rising interest rates and the opening of Western Sydney Airport. We absolutely believe these challenges can be managed, but the returns are unlikely to be as robust as the last 20 years.

Phoenix estimates the internal rate of return of an

investment in Sydney Airport from the IPO to the sale in

March 2022 was approximately 17.9%. By comparison,

the S&P/ASX 300 REIT Accumulation Index returned 6.5%

over the same period. Since the inception of the Cromwell

Phoenix Property Securities Fund, the Sydney Airport

holding has delivered an annualised return in excess of the

property benchmark by approximately 10%.

Please click here for a PDF of this article.

About Cromwell Property Group

Cromwell’s property team actively manage all property assets in-house. We oversee the strategic management of all assets, ensuring that tenant requirements are met, space is leased, buildings are operating efficiently and projects are delivered on time and on budget. Click here to find out more about our products.

1 topic

1 stock mentioned

1 fund mentioned