The demand for green hydrogen

In March 2021, we explored the use of green hydrogen in our article, Green hydrogen – a European case study, amidst the growing excitement around hydrogen as a decarbonisation tool. We also recently had our first site visit to a green hydrogen plant, and heard how trials were progressing.

In this article, we revisit the topic and look at whether, among the myriad of facts, figures, and proclamations, the hype has died down, or whether it’s genuinely progressing as a key element in the path towards net zero.

Hydrogen demand is growing

Well, just how big is the demand for hydrogen? The answer to this isn’t straightforward, as there are many different estimates about the future demand profile.

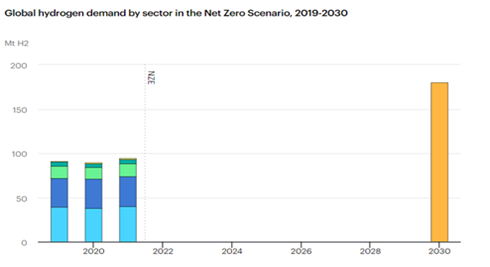

The International Energy Agency (IEA) estimates that to move the world towards net zero, global hydrogen demand will need to double from ~94Mt in 2021 to over ~180Mt by 2030[1]. In Europe, it’s estimated that more than a six-fold increase in hydrogen power from 300Twh to over 1,900Twh will be required by 2050[2].

Estimates of demand growth are arguably legitimised by the current pipeline for electrolysers, the key supply-side technology that transforms electricity and water into green hydrogen. According to analysis from Aurora, the global electrolyser pipeline is currently 957GW, with 202GW scheduled to be operational by 2030[3]. This includes early-stage projects (most of which probably won’t reach operation or final investment decision), but as a simple example highlights the scale of interest, as there’s only ~300MW of electrolyser capacity today. The amount of renewables required would also be massive, with the total pipeline needing to consume power roughly equivalent to current renewable output globally[4]. Moreover, year-on-year, electrolyser manufacturing capacity has doubled to almost 8GW annually, demonstrating how fast the industry is moving[5].

Governments are accelerating targets with more supportive policy

Policy support is critical for industry development, and to stimulate demand. Naturally, the last few years have seen a notable acceleration of green hydrogen-related policy. Some examples include:

EU with their RePower EU ambitions

- Targeting 20 million tonnes of green hydrogen by 2030 (10m domestically produced, 10m imported), doubling the 10m total in July 2021, requiring ~80GW of electrolyser capacity.

United Kingdom

- Targeting 10GW of electrolyser capacity by 2030 (increased from 5GW in July 2022).

US Inflation Reduction Act (IRA)

- The IRA is arguably the biggest development globally for renewables, including green hydrogen.

- Unlike the bulk of global hydrogen-related policy and targets, the IRA explicitly focuses on costs, with up to a $3/kg incentive for green hydrogen. This arguably makes it cheaper than blue hydrogen, and decreases the amount of time it’ll take to achieve cost parity with grey hydrogen.

Green hydrogen has been boosted by conflict, cost reduction, and improved access to financing

Russia / Ukraine conflict

There was previously strong debate around green, blue and grey hydrogen[7]. The consensus was that blue hydrogen would play a strong role in decarbonisation efforts alongside low-carbon green. Following the Russian invasion of Ukraine, it appears that this narrative has changed. Surging gas prices have caused the world, and particularly Europe, to accelerate renewable proliferation, in order to ensure energy independence and reduce exposure to market volatility. With Europe looking to wean itself away from gas, naturally it has brought into question the viability of grey gas-dependent hydrogen versus green electricity-produced hydrogen.

Costs

The two key costs for green hydrogen production are electrolysers and renewable energy.

Despite recent cost inflation amidst supply chain issues, the medium- to long-term levelised cost of energy (LCOE) estimates renewable energy (namely wind and solar) are expected to continue to fall. Similarly, electrolyser costs are dropping rapidly, with new competition and technology improvements. The IEA estimates that electrolyser costs could fall 60-64% by 2025, and 68-72% by 2030[8].

As touched on earlier, the icing on the cake for green hydrogen cost competitiveness is supportive policy. Whilst the EU has been first in establishing hydrogen goals and targets, these goals have lacked financial incentives to kickstart the industry. By contrast, the IRA has focused on economics, which makes it cheaper to produce and sell green hydrogen. Blue hydrogen will also struggle to take advantage of the IRA’s tax credits, as lifecycle emission calculations include scope 1&2 and methane leaks, which further support green hydrogen.

Finally, in response to the IRA, it’s expected that the EU will imminently introduce more tangible financial incentives to increase demand and encourage investment in the region.

Financing

The financial landscape for hydrogen-related projects is also evolving. Initially, projects tended to be either equity funded or corporate-financed. Now, with improving technology, regulation, and contract structures, we’re seeing banks starting to provide non-recourse / project financing for specific types of projects, which lowers capital costs and helps accelerate industry development.

Heavy industry is the best use of hydrogen, with the greatest impact on emissions

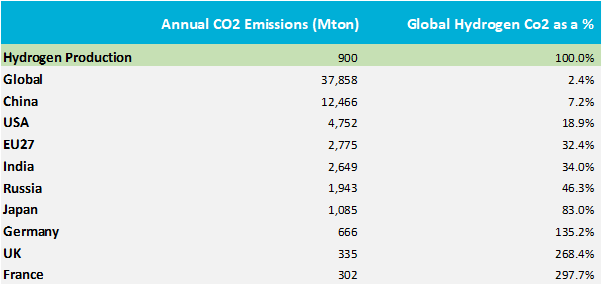

Despite the protestations of the numerous hydrogen use cases, it’s clear that the best use for hydrogen is in industry. Hydrogen production in the chemical and petrochemical industries is responsible for greater than 900Mt of CO2 emissions[9] To put this in context, this is almost 3x the UK and France’s annual emissions, and equivalent to 2.5% of global emissions. As such, simply switching from grey to low-carbon hydrogen in these hard-to-abate sectors can have a profound effect on emissions reduction. The technical challenges for this generally would be low as the IEA says, ‘it is a like-for-like substitution rather than a fuel switch’[10].

In transport, hydrogen fuel cells are often preferable to batteries in high-use applications where faster refuelling, space optimisation, and productivity are key considerations[12].So, while hydrogen is generally less attractive than lower-cost electric vehicles, its merits are growing in public and industrial transport. For example, electric buses or trucks may need longer to recharge batteries, which may require a bigger fleet than their hydrogen counterparts. However, hydrogen buses or trucks may not be suitable for urban use, as frequent stopping gives battery-powered vehicles an advantage. Longer term, hydrogen use for shipping and aviation is expected to grow as technology improves.

Finally, hydrogen for residential and commercial use will likely remain limited given the various challenges in transport (such as technical limits on pipes and hydrogen blending), costs and overall disadvantages versus electrification. However, initiatives around blending may continue to help fuel overall hydrogen adoption and wider industry growth.

Site visit

Our recent site visit to the Lloseta green hydrogen plant in Mallorca helped confirm the progress being made on green hydrogen.

The plant produces green hydrogen from two solar PV plants and a 2.5MW electrolyser, which can produce up to 330 tons per year. It’s part of the Green Hysland European project, and aims to deploy a fully-functioning green hydrogen ecosystem, turning the island into the first hub in Southern Europe[13]. The project has secured several off-takers, including the Palma Public Transport company, which will initially use green hydrogen for five fuel cell powered buses, while Spanish hotel operator, Iberostar, will use their supply to produce heat and electricity for their local hotels. The project has the potential to help avoid up to 21,000 tons of CO2 emissions per year, and aims to be replicated across other EU island territories.

In Mallorca, we also heard from AccionaPlug, the joint venture between Acciona Energia, one of the world’s leading renewable operators, and Plug Power, one of the leaders in fuel cells. The joint venture was formed in recognition of the massive opportunities in the sector, and aims to invest over €2bn to reach a 20% market share of the Iberian green hydrogen market by 2030. They highlighted examples of companies like Lidl, ASDA, and Amazon, which have all started (or aim to start) using fuel cell material handling vehicles/forklifts in their high-frequency distribution centres to take advantage of refuelling efficiencies while decarbonising their operations.

Conclusion

Green hydrogen’s appeal as a decarbonisation tool continues to gain traction. However, further developments in regulation, infrastructure, funding, policy support, and research and design are all required to ensure long-term green hydrogen adoption. At 4D, we’re best leveraged to the theme by our investments in utilities and renewable developers. Ultimately, green hydrogen requires a massive scaleup of green energy, and our investments in renewable leaders like Next Era, Iberdrola, and ENEL will be key beneficiaries of increasing hydrogen adoption.

4 topics