The Easter Bunny faces rising inflation

Firetrail Investments

With all the talk about rising commodity prices and food inflation, spare a thought for the Easter Bunny this year.

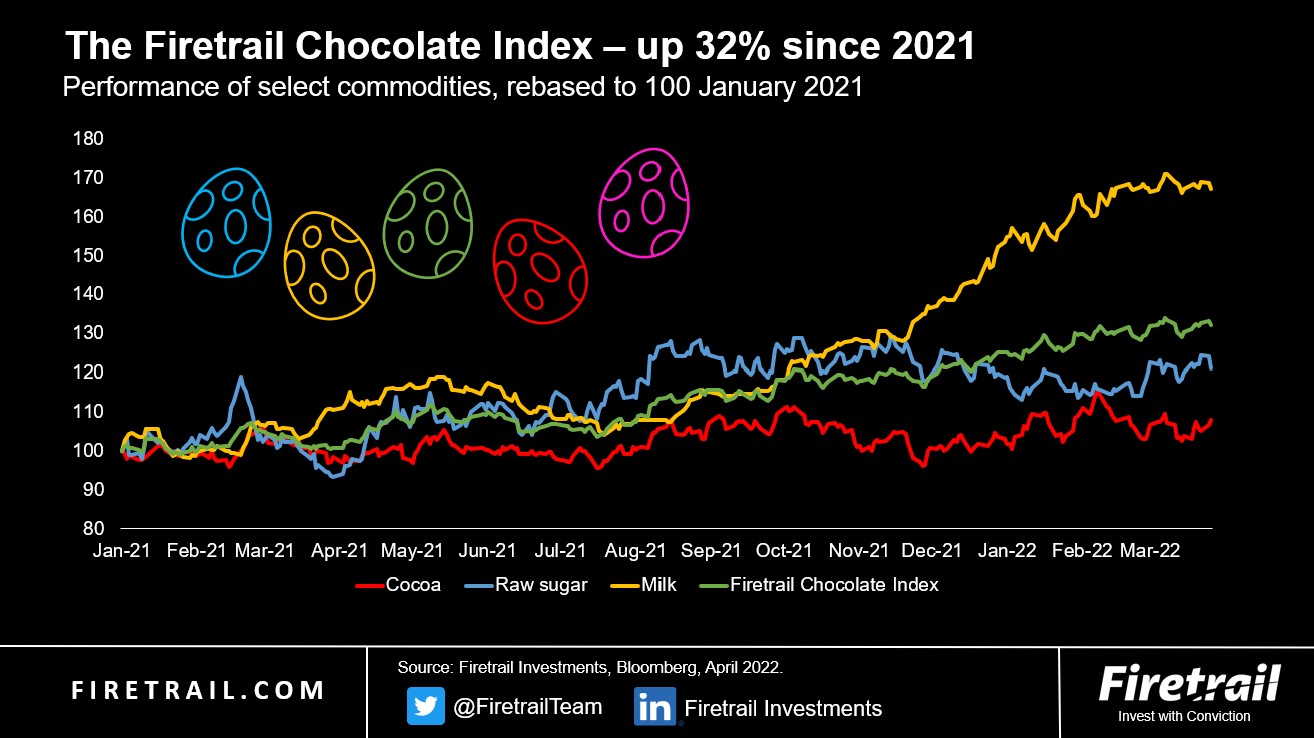

Class IV milk, which is used to produce butter and milk powder, has risen by 67% to around $US25 per hundredweight. Class IV milk prices are now at record highs. Raw sugar has risen from $US15.75 to $US20.31 per pound, while the price of cocoa has risen from $US2,472 per metric ton to $US2,667.

Prices of milk, raw sugar and cocoa - like many other commodities – have ratcheted higher following pull-back of supply following pandemic lockdowns in 2020. With economies re-opening, demand has shifted higher for many commodities, resulting in higher prices.

The Firetrail Chocolate Index, which represents the average performance of the three commodities, has risen by 32% since the start of 2021.

Rumours that the Easter Bunny will be substituting chocolate Easter eggs for fruit appear unfounded, much to the delight of kids (and adults) across Australia.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

3 topics

Expertise