The gold price hasn't moved: Here's why we believe it will

There is currently plenty of confusion about the outlook for the gold price.

In particular, the traditional set-up for a strong gold price is clearly in place: US money supply growth has been significant; inflation is back at its highest level since the early 1980s; and, linked to that, fiat currencies have been meaningfully debased in the past 24 months. Theoretically, in that environment, gold should hold its purchasing power and perform well.

Instead, the price has gone nowhere for the past two years (broadly speaking). It’s therefore not serving as an inflation hedge, nor an ‘alternative’ to fiat money.

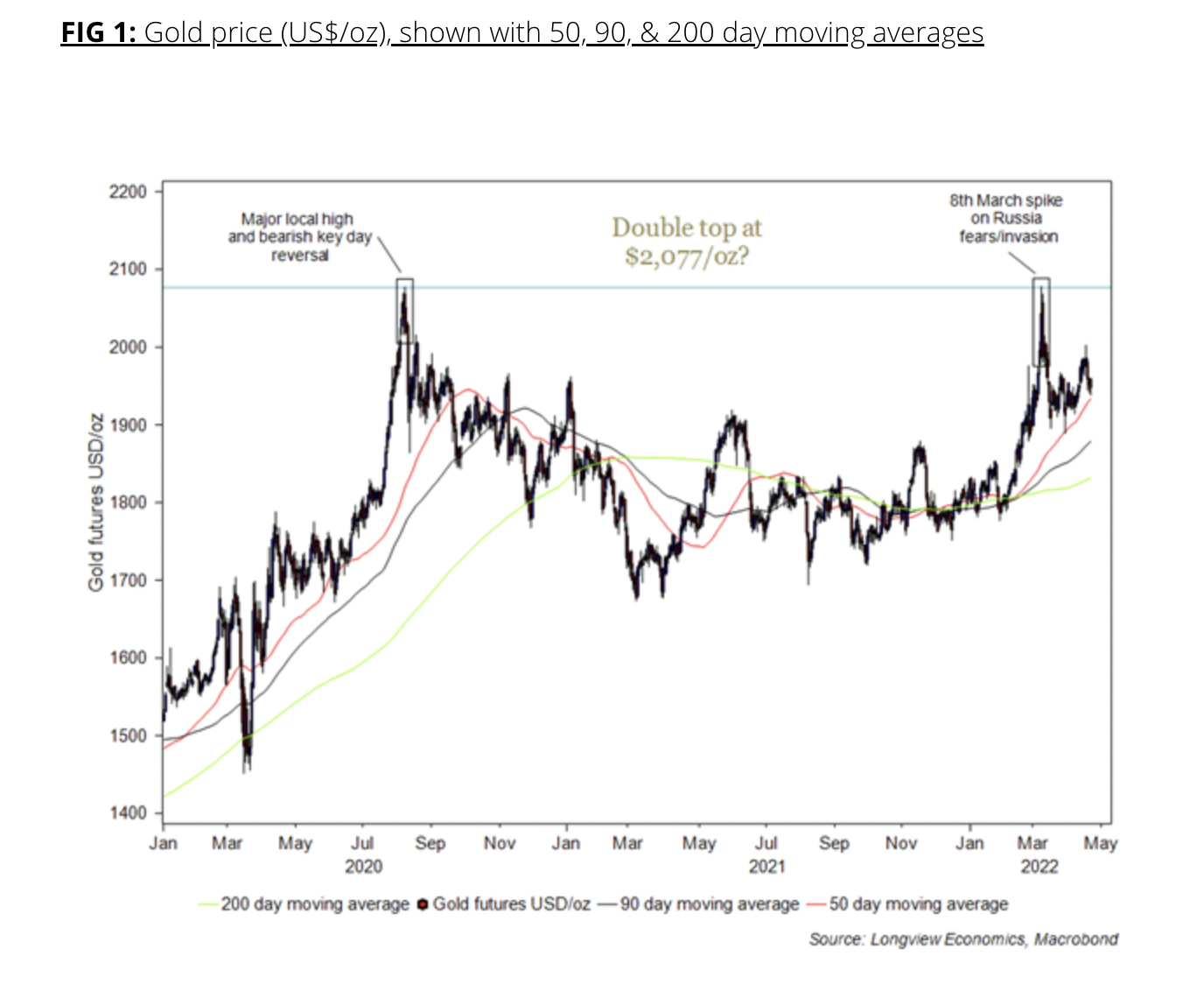

Furthermore, gold price action is poor: Safe haven buying on the Russian invasion was short-lived and, instead of a breakout above the 2020 high, the price so far looks like it’s made a ‘double top’ (FIG 1).

We would argue, though, that gold has been remarkably resilient.

Of note, and while there’s strong evidence that gold is an inflation hedge over long periods of time, short-term price direction is determined by other factors.

Those factors relate to the ‘tightness of money’ and include:

- Real interest rates, as measured by the 10-year TIPS yield;

- US interest rate expectations (e.g. implied 2 year Fed funds rates); and

- The US dollar.

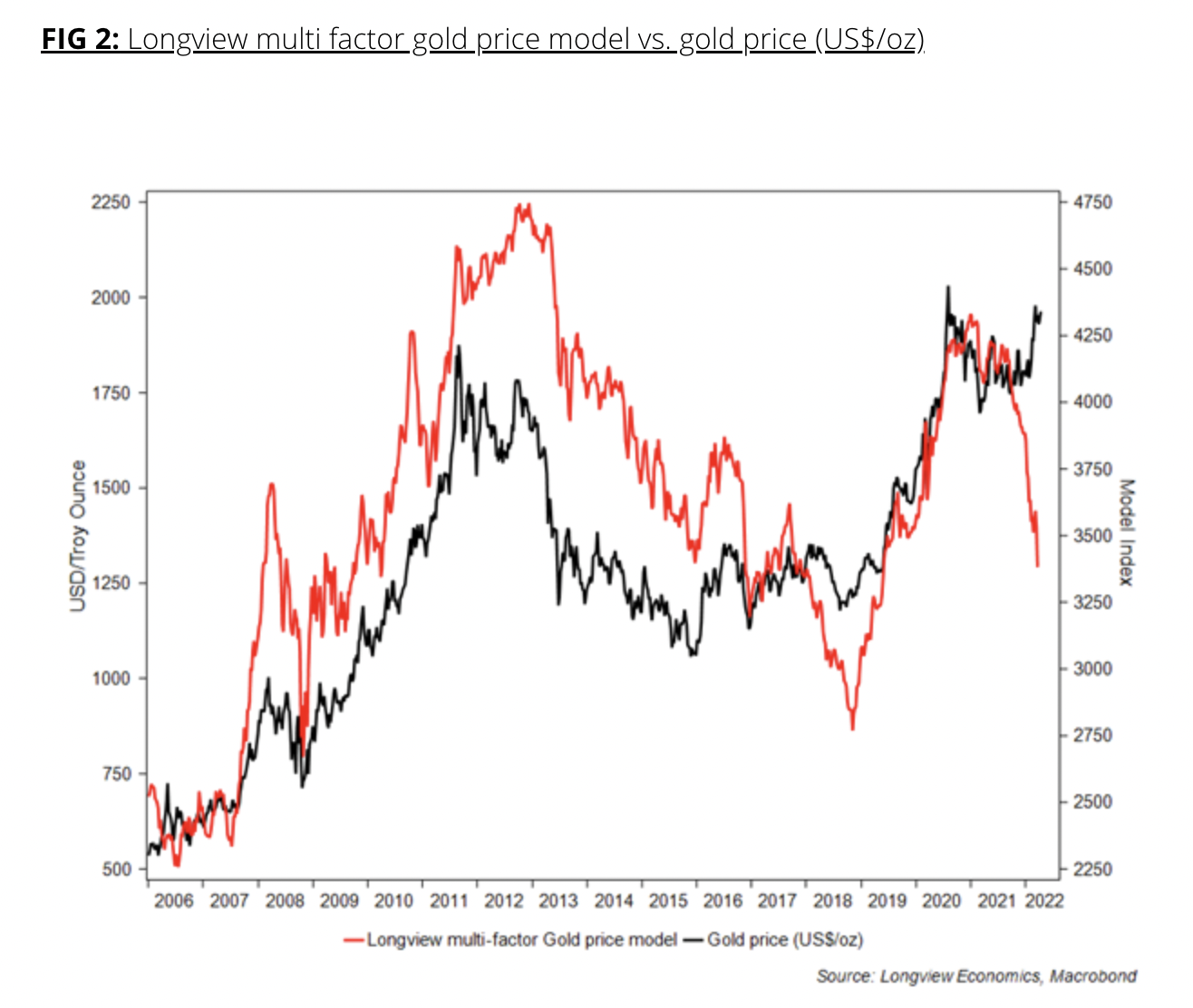

Despite that, gold has rallied – with a somewhat dramatic breakdown in the usual correlation between gold and our multi-factor model (FIG 2). In other words, gold has been remarkably resilient in the face of those key headwinds.

The question, therefore, becomes: Will the usual correlation re-establish itself? And if so, how will that happen? And is the gold price rally ‘false’, and only driven by a flight to safety (given the war in Eastern Europe)? Or, in fact, is the gold multi-factor model about to start moving higher?

Gold: Are Headwinds about to become Tailwinds?

Our central view is that it’s the latter, i.e. real yields, Fed rate expectations, and the dollar are likely to ‘top out’ and move lower in the near term (over the next few months).

If that’s correct, then recent headwinds for the gold price should become tailwinds, with gold likely to break above its key resistance level (i.e. the ‘double top’ high of $2,077/oz).

That view is supported by both: (a) the current technical, sentiment, and positioning set up in the dollar and the bonds/rates market; as well as (b) a number of macro and inflation-related factors.

With respect to (a), it’s clear that the narrative around rates (and the dollar) has become largely one way in recent weeks. That’s not surprising given the sustained/strong backup in bond yields. The consensus towards Treasuries, though, is now notably negative, suggesting that the trade has become crowded and the SELL-off is therefore advanced (if not complete). For that reason, we closed our ‘pay 5-year dollar rates’ trade this week.

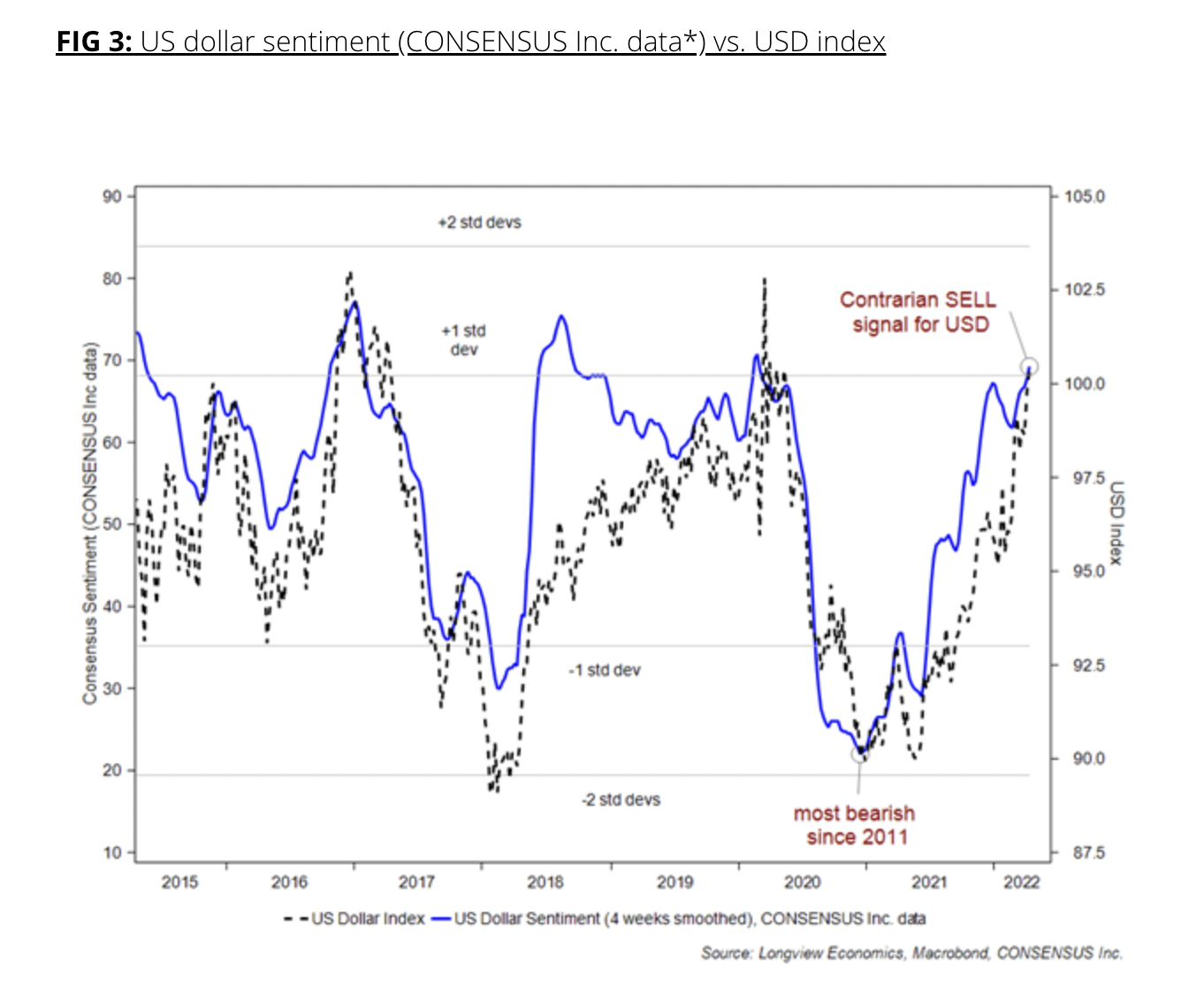

In a similar vein, positioning in the dollar is extreme. Measured sentiment, for example, is back at high/bullish levels (FIG 3)...

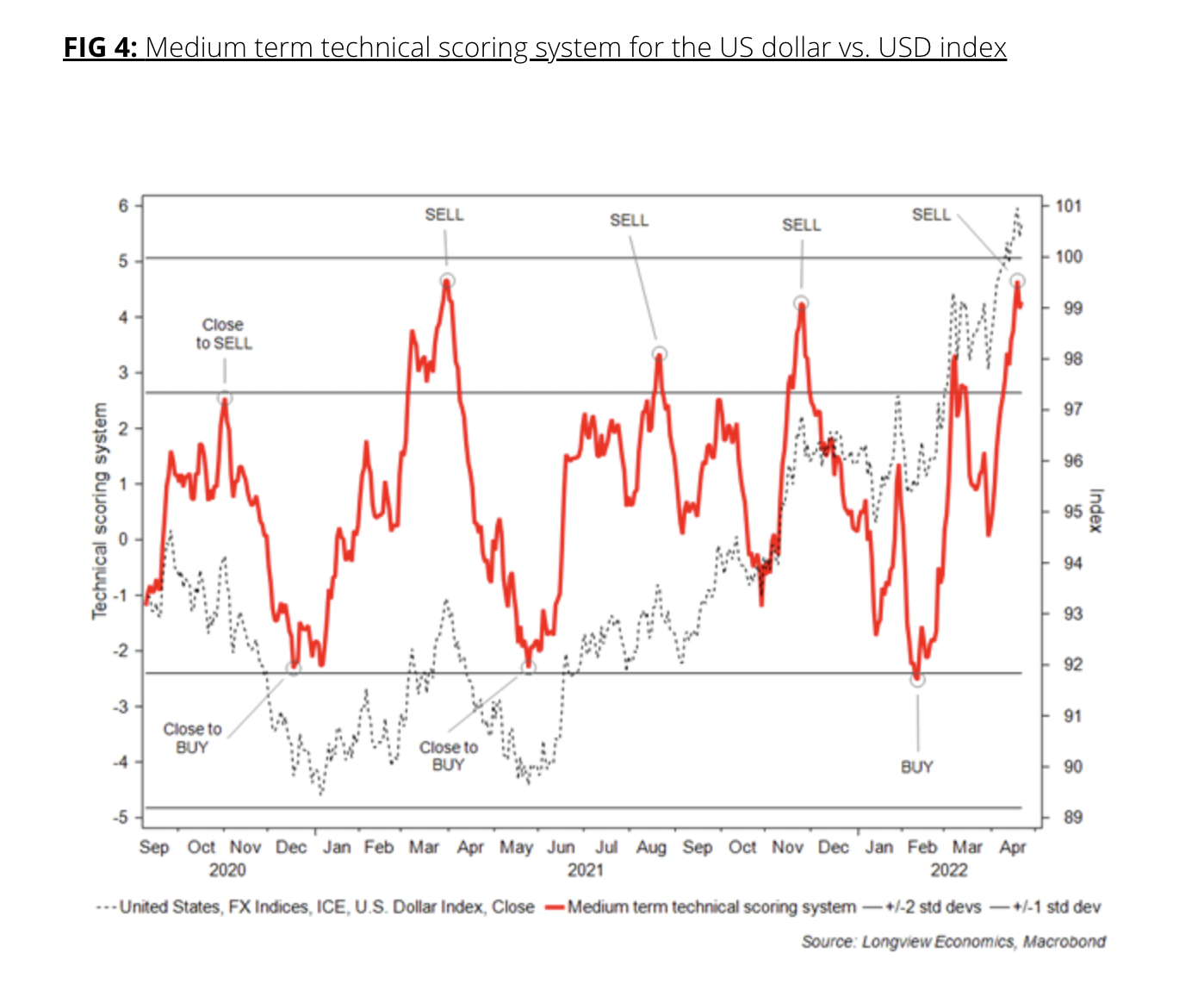

…while technically the dollar is overextended to the upside (FIG 4)….

…and positioning remains net LONG and reasonably crowded (FIG 5).

With respect to (b), and as we’ve highlighted in the past, inflationary pressures in the US economy have potentially peaked (at least for now).

That’s the message of our key inflation models as well as other indicators, including the Atlanta Fed core ‘flexible prices’ (which occasionally leads to ‘sticky’ prices).

Added to this, base effects are likely to push inflation lower in the coming months, while there’s growing evidence that supply chain pressures are continuing to ease (e.g. see yesterday’s Philly Fed supplier delivery index, FIG 6).

Linked to all of that, there are growing signs of softness in key cyclically sensitive parts of the US economy (most notably housing and manufacturing – as we examined earlier this week).

Therefore, we anticipate adding gold exposure to our recommended macro fund in the coming days.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics