The Hitchhiker's Guide to Hybrids

Livewire Markets

Last week, at one of our Livewire team meetings I told my colleagues that I'd been getting interested in Hybrids, especially since the listing of the brand new BetaShares ETF - Australia Major Bank Hybrids Index ETF (ASX:BHYB).

I can best describe the response as … non-plussed. Brows furrowed. Eyes searched the ceiling. Someone dropped a paper clip in an adjacent room. And then a teammate voiced something I’ve come to suspect many people might think: "I've never understood hybrids, they just don't make sense."

Well, that really sparked my interest. I began to ask friends and family and most of them had no idea what a Hybrid is.

So to feed my own curiosity, and hopefully spark your interest, this three-part collection will act as a Hitchhiker's Guide to Hybrids, detailing useful information about this asset class and why you might consider them in your portfolio.

With the help of a few hybrid experts, I'll walk you through hybrids and hopefully answer a few of your questions. In part two, our experts will weigh in on why hybrids deserve a spot in your portfolio, and then finally in part three, they will provide you with some ideas on how to get exposure.

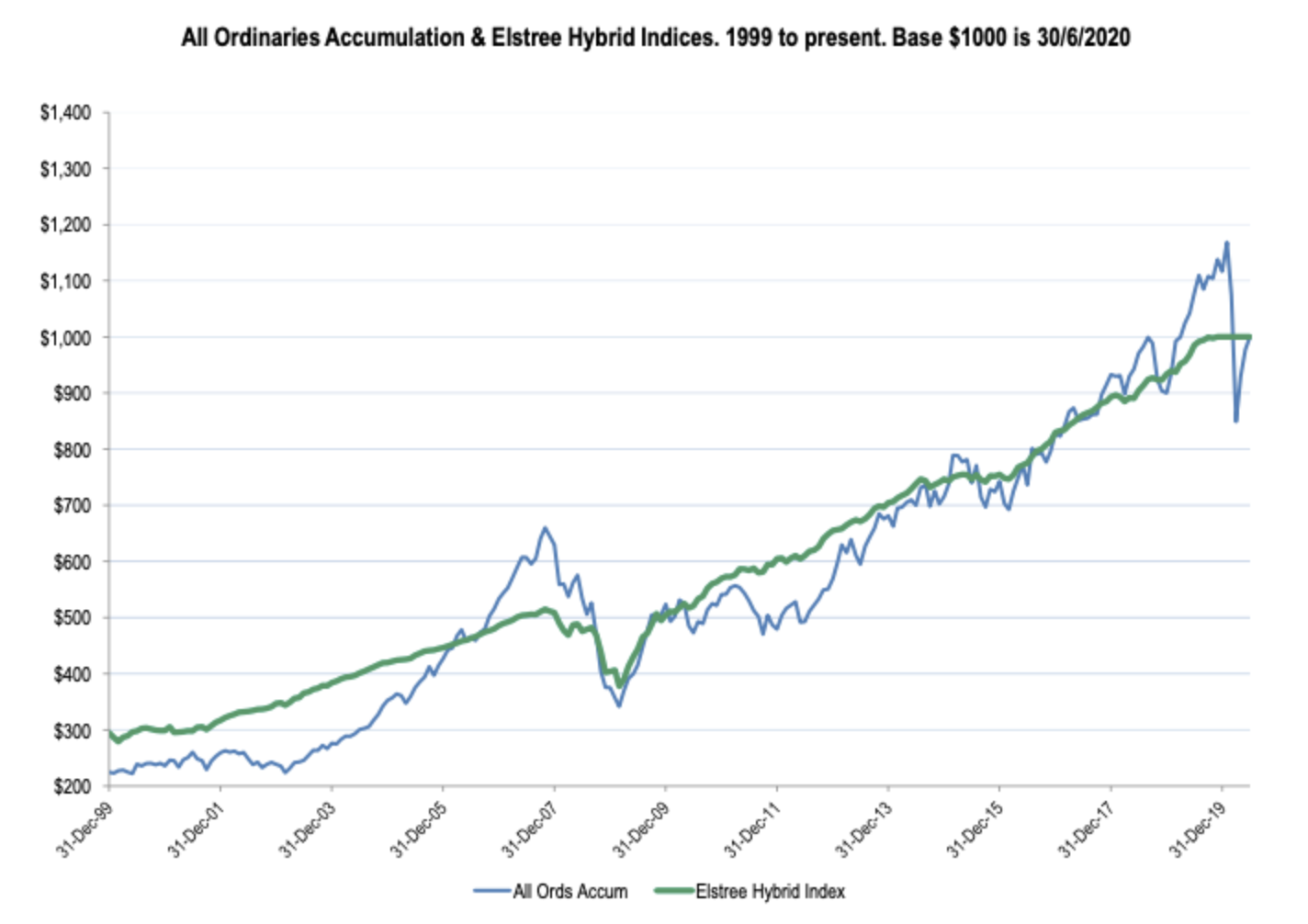

Source: Elstree Asset Management

What is a hybrid?

This is of course the golden question.

The ASX defines a hybrid as "a security that combines elements of debt securities (eg bonds) and equity securities (eg shares). Hybrid securities typically promise to pay a rate of return (fixed or floating) until a certain date, in the same way a bond does. However, they also have share-like features that can mean they may provide a higher rate of return than bonds."

In other words, a hybrid is composed of many factors that are similar to a typical debt instrument and are therefore usually placed in the fixed income bracket. They can be a handy diversification tool and have a history of being far less volatile than traditional equities, whilst offering higher returns than conventional fixed income.

Yet, hybrids represent qualities of both equities and bonds, but what does this mean?

They are like debt in the sense:

- Far less risky than equities and the money you invest at the beginning should be returned in full

- Pay regular income

- Last for a certain period of time, as opposed to a limitless term

They are like equities in the sense:

- Trades on the ASX

- Labelled capital by the issuer

- An investor has the ability to lose 100% of the money they invest

Basically, and the way I like to think of it, is that hybrids are an instrument that allows an investor to invest in a company's debt. The company will then pay you an interest rate for lending them money and you get all your money back after a certain term. I know, why didn't I explain it like this earlier!

Who issues hybrids and why?

Hybrids are typically issued by banks and other large financial institutions. The purpose for banks issuing hybrids lies primarily with the idea of it being cheaper than issuing regular shares. On average, to issue ordinary shares, it costs banks 12-14% of the bank's return on equity (ROE). Comparatively, to issue hybrids it costs between 7% and 9%. Whilst not as popular as regular equity, bank hybrids are cheaper to issue for banks and can be safer for investors.

Aside from banks, insurance companies and other financial institutions offer hybrids on the ASX. Some of the most popular hybrids outside the big four banks are:

- Macquarie Group Hybrid (ASX:MQGPD)

- AMP Hybrid (ASX:AMPPA)

- Bank of Queensland Hybrid (ASX:BOQPE)

Risks associated with hybrids

You, as I was, may be thinking - "is there ANY downside to hybrids?" They seem like a safe bet - put some money in, get paid interest rates and then get your money back. But unfortunately, if investing was this easy everyone would be as well off as Warren Buffett.

I reached out to Campbell Dawson of Elstree Investment Management who is a connoisseur in the hybrid market. Elstree specialises in attaining capital stable franked income return and have recently established the Elstree Hybrid Fund (Chi-X: EHF1). I won't pretend to know as much as him and therefore, I'll let him tell you why there are risks associated with hybrids, although they may not be that significant.

The equity characteristics of hybrids are that coupons/distributions can be stopped (if the bank ceases to pay dividends on ordinary shares), the expected redemption date can be altered and you can be given $100 worth of shares instead of $100 cash. If a bank/insurer hybrid issuer is considered “’non-viable” the hybrids can be forcibly converted to equity. To date, these equity-type risks have not been material.

There has been no bank/insurer hybrid that has stopped paying coupons/distributions, and there has only been one bank/insurer hybrid that has not been repaid on the first redemption date (it was repaid 5 months later).

There have been over 200 issues detailed in the Elstree Hybrid Index since 1999 and only 7 of those have not been repaid on the first redemption date.

“Non viability” has never been defined but, if the experience of the more troubled European banking sector is any guide, it will take a lot for an Australian bank to become “non-viable”.

In the 10 years since regulators adopted the concept, there has been one sizable Spanish bank and three other small Italian banks where the regulators took over and converted hybrid type securities to equity. The most charitable description for these four European banks was "zombie-ish," which contrasts with the profitable and well-structured Australian banks.

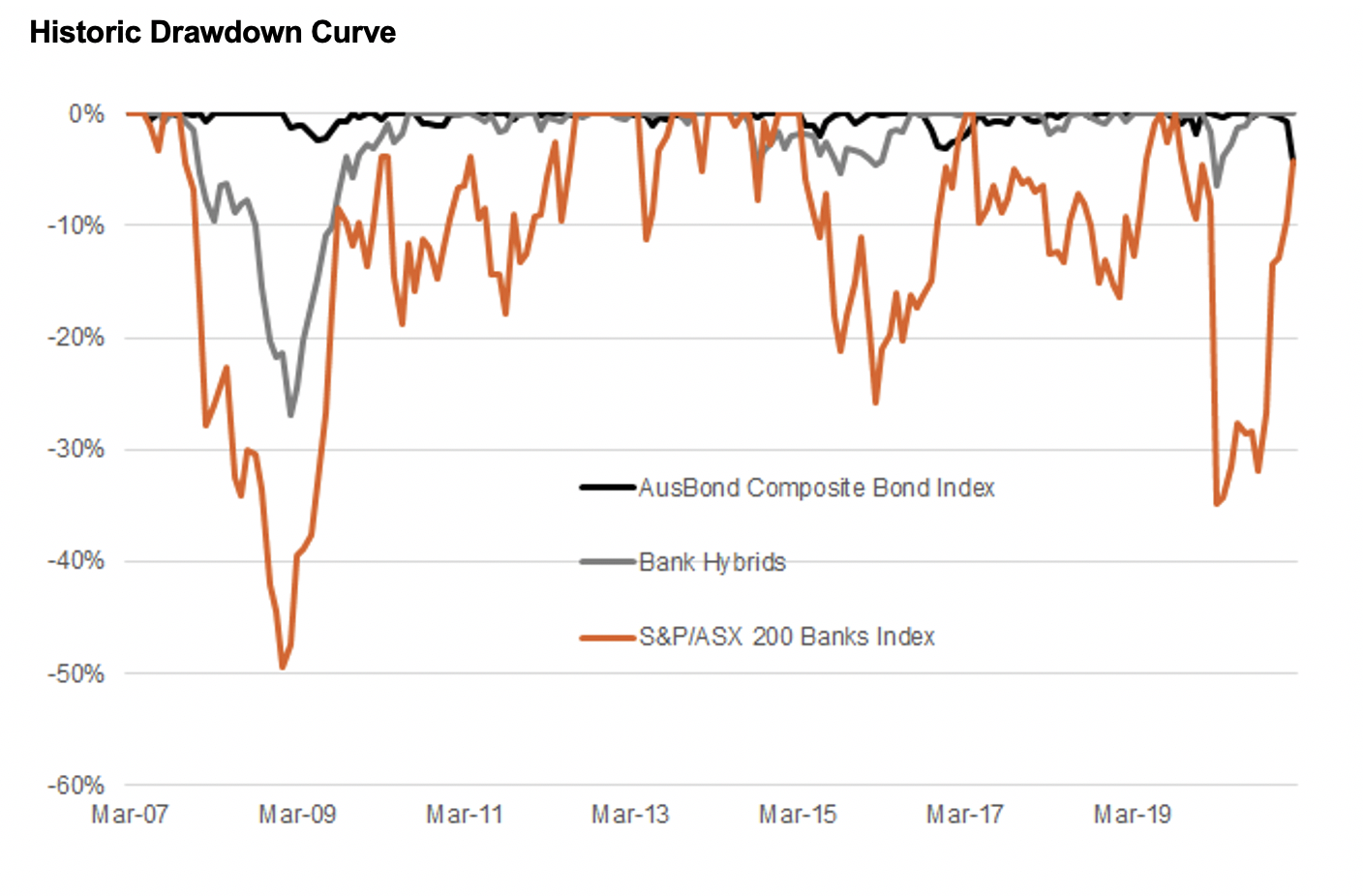

Because hybrids do have some equity characteristics, they demonstrate some price volatility. The usual price volatility of the hybrid market is around +/- $3 a year, which is comparable to bond market levels and around 20% of equity market volatility. During times of severe equity market stress, hybrids will be more volatile, but far less than equities.

Source: Betashares

The moment you've been waiting for - returns

If you've made it this far, I hope it means you're interested in hybrids. The good news is, we're at the fun part - returns!

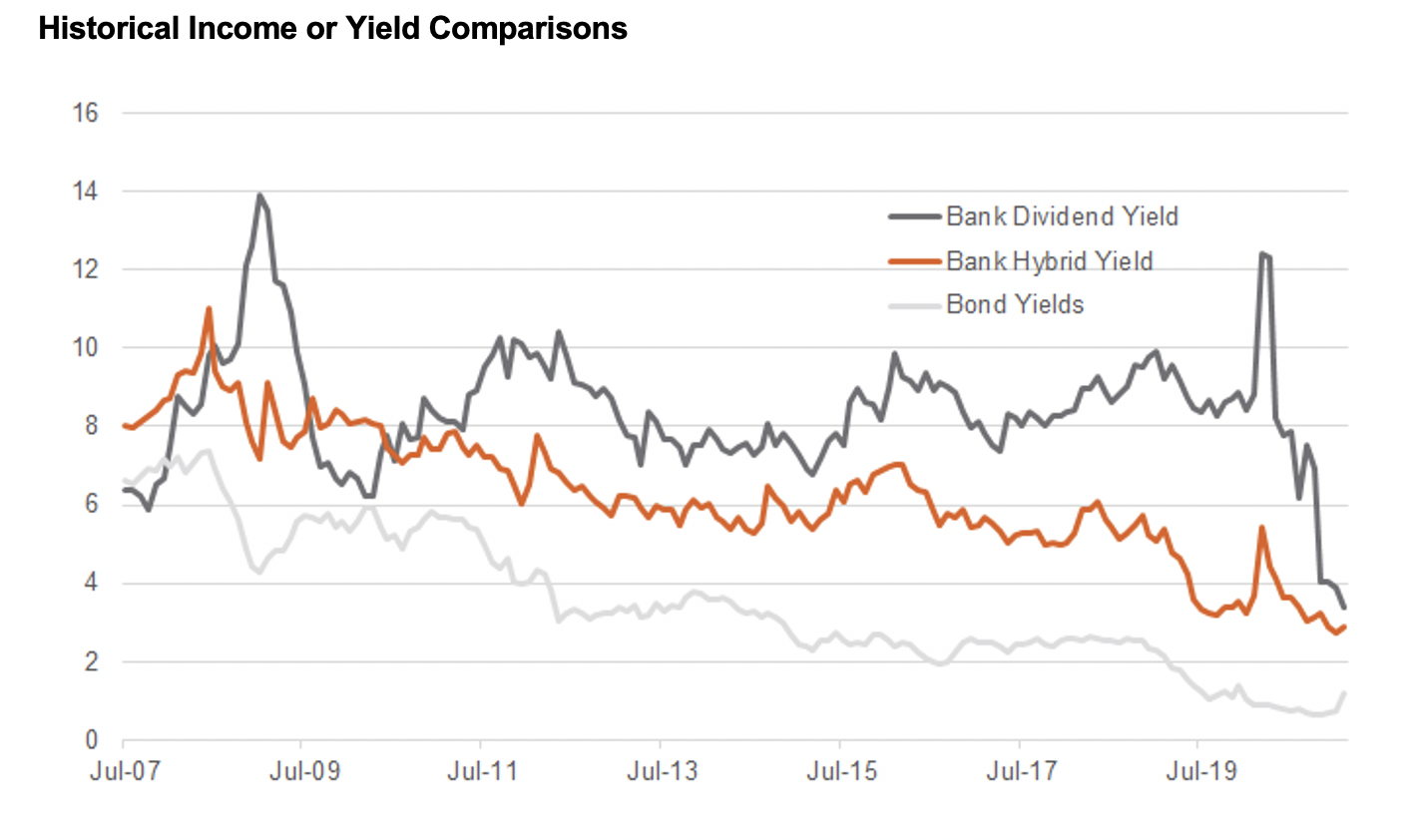

Historically, hybrid securities have offered high yield comparative your traditional methods of fixed income like a term deposit or government bond. But, as to be expected with low-risk securities, the income is lower than that of equities (depending on your stock picking skills).

Source: Betashares

The chart above demonstrates that yield can sit anywhere between 3% and 11%. In a time where income is hard to come by, that looks pretty good to me. Whilst it may not be as much as bank dividend yields by way of traditional equity, you'll notice that comparatively, hybrids are a lot less volatile.

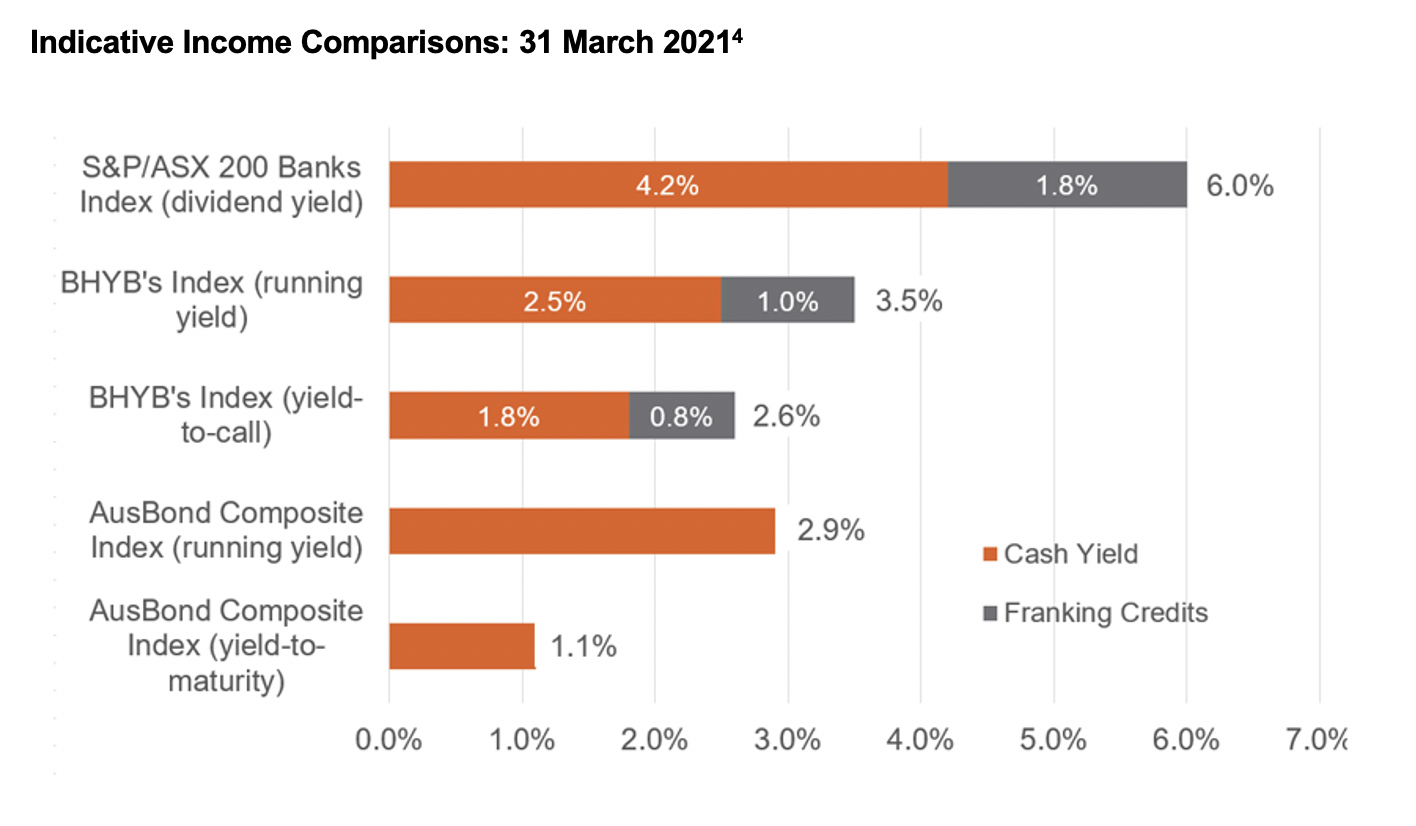

In data kindly provided by BetaShares, income across various asset classes was compared. It is clear that whilst high dividend yield delivered by those ASX-200 stocks may be tempting, hybrids aren't far behind.

Source: Betashares

In a low-income world, and an uncertain horizon ahead, hybrids look attractive. They may not deliver the high yield of dividends, but with their low risk, decent return appearance, they might just deserve a spot in your portfolio.

Resources

Hybrids are a great beast to tackle as I've learnt over the last week or so and they're definitely a complex idea to get your head around. To get to this point, I've needed to do quite a bit of reading. If you're interested in reading more about this asset class, below are some resources I found helpful:

Hybrids... a 'how to' guide

Now that you know all about what a hybrid is... where do they fit in your portfolio? In the second part of this collection, our experts will discuss how they incorporate this security into their portfolios. Make sure you click FOLLOW so that you're updated when I publish part two.

1 topic

2 contributors mentioned

Bella is a Content Editor at Livewire Markets.

Expertise

Bella is a Content Editor at Livewire Markets.