The investments that helped return +93% in FY21

There were three key moments of FY21.

The first was right at the beginning, on 1 July. The market had rallied hard off the March 2020 coronavirus lows which to many looked like a soon-to-be-reversed anomaly. We were, after all, in the middle of a pandemic, with major cities from London to New York still locked down.

As it turned out, this was the beginning, not the end. Staying invested and not trading out of long-term positions for a short term win was drove our returns twelve months later.

The second key moment was in February earlier this year when growth stocks went vertical. We made a few mistakes here. We correctly sold down a few companies, like Plug Power which at one point was up twenty times, and others that were up more than ten times.

However, we ended up investing the proceeds of these sales into companies that, if anything, were lower quality than those we had sold, giving a net effect of reducing the quality of the portfolio.

This became apparent in the third key moment of the year three months later in May, when growth stocks plunged on inflation fears and a reversal of the ebullience of months prior.

We stayed long, steadily increasing our net exposure by 10%, exited the few companies that reported poor fundamentals, and managed to get some buying done at the lows. On average, our portfolio company fundamentals actually accelerated through this period, which set us up for a sharp recovery.

We wrote at the time that we saw these lows as a buying opportunity, as indeed, are most sell-offs (the two macro concerns we would take seriously are austerity and revolution).

So we got two of three key moments of FY21 correct and can add the mistakes of February to the long list of bloody noses and scars accumulated over fifteen years that serve as a reminder never to go down the quality curve.

Of course, we should have known that well enough.

Life sciences

We spent a lot of time researching different platforms and going deep into mRNA, various methods of gene editing, and particular areas of interest like Alzheimer’s.

Ironically, the FDA’s startling decision to approve Biogen’s treatment for Alzheimer’s, which we, along with many, thought was absurd, lit a fire under the entire sector and our own Alzheimer’s investments rallied hard.

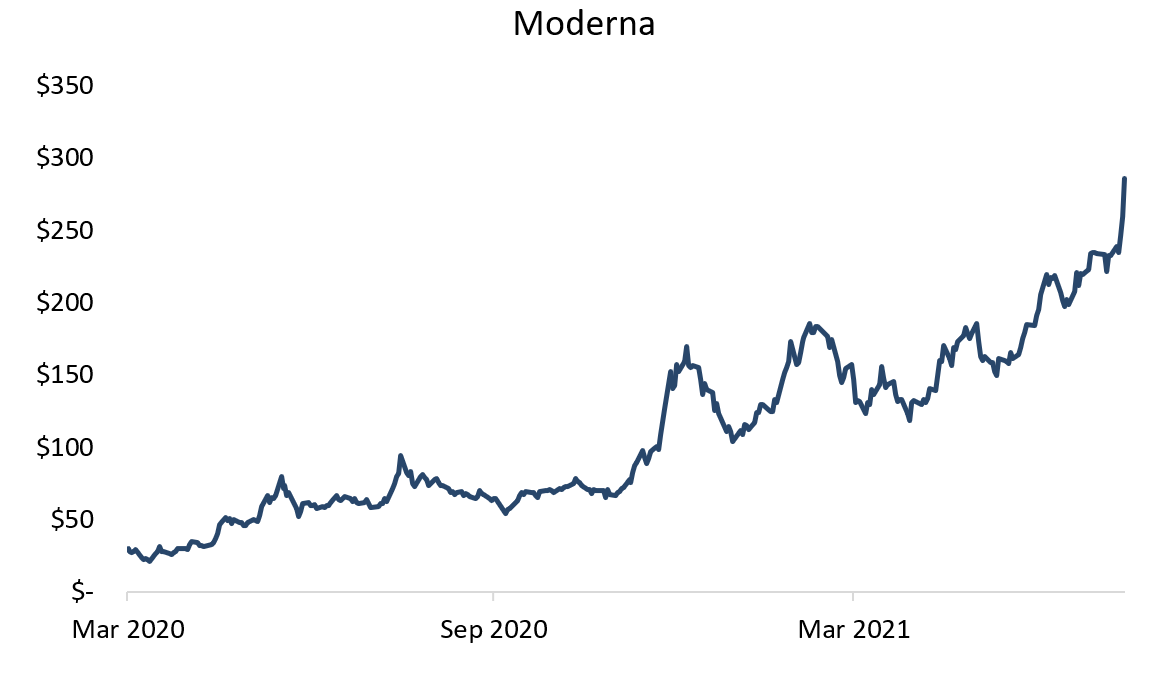

The vast bulk of our investments are in revenue-generating platforms with the proven ability to launch treatment after treatment. Moderna has now advanced well over 10x from purchase, and it’s increasingly clear that booster shots are going to be required well into the future. The firm could easily generate $35-40 billion of high margin revenue over the next two years. In light of that, the $100 billion price tag doesn’t seem so crazy.

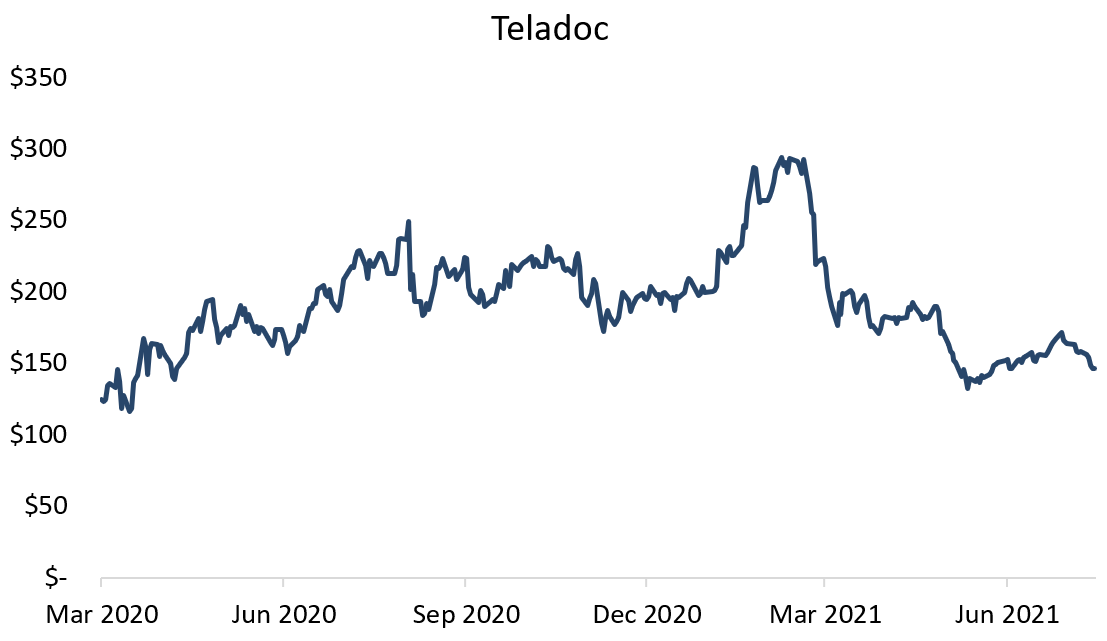

Digital health had some curious moves. Teladoc seemed about to launch to the moon along with the rest of the growth space in February, only to more than halve. The stock is up on our initial and average purchase prices, but is actually down over the last 12 months, quite an achievement in an epidemic.

This is at least partly due to indigestion caused by the buy-out of our preferred play, Livongo. This serves as a good demonstration of why we focus so much on organic growth.

Companies with a penchant for acquisition and share counts that rise too rapidly often end up with charts like this one:

E-Commerce

Rather than guess whether the coronavirus boom would be lasting or temporary, we are taking our usual data-driven approach. As of mid-July, these companies are still firing, as is the entire consumer sector.

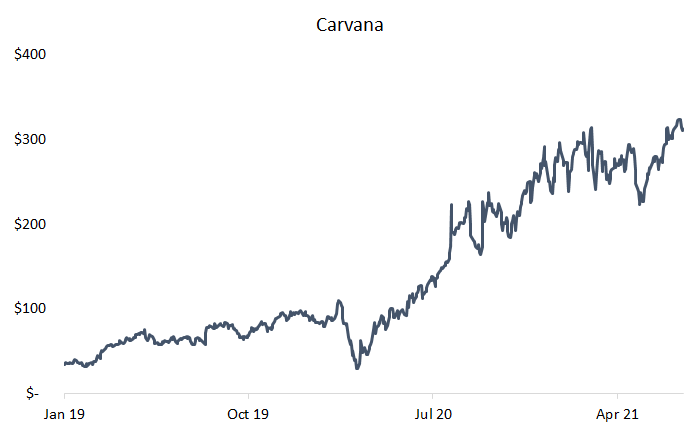

This was beneficial for our investment in Carvana, which is just shy of 10x from when we invested and wrote about it at the time.

Part of this was luck: used car prices have increased by an unprecedented 87% over the last year and are now accounting for about a third of the recent bout of inflation. As supply shortages ease we expect this to reverse, but the habit of buying a car online, with all the advantages that entails, is here to stay.

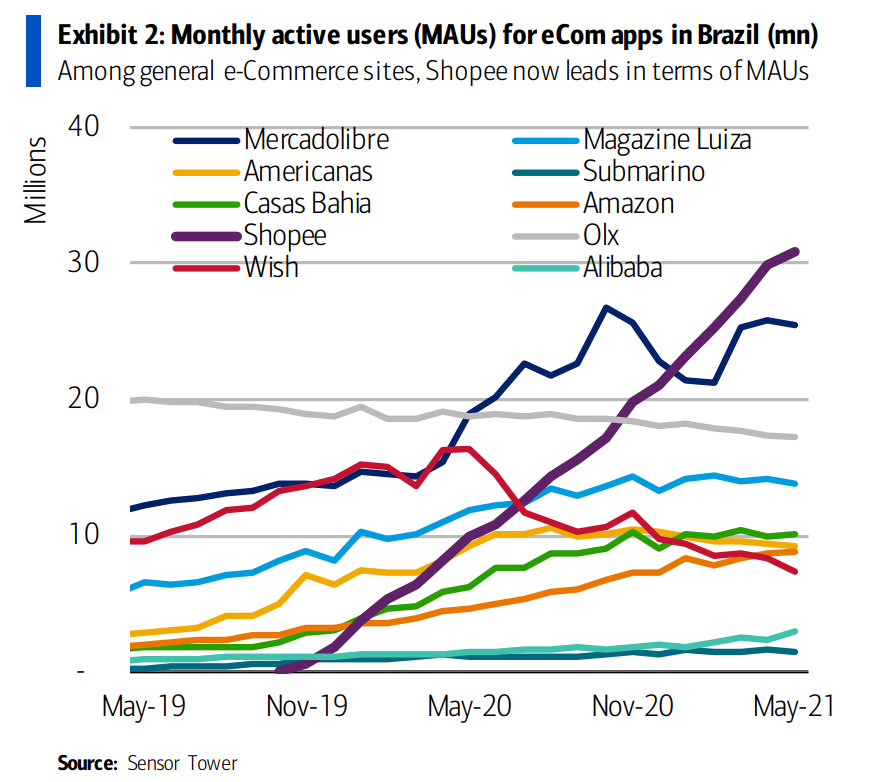

Sea, the e-commerce leader of South East Asia, entered South America, a region we assumed would be won by MercadoLibre. Now, we are not so sure. There is plenty of room for multiple e-commerce companies, but the dynamics of online retail generally favours one winner, and Sea has immense cash-flows from gaming to fund growth.

Sea’s Shopee app is now the most downloaded in Brazil:

Sea downloads and monthly active users in Brazil

MercadoLibre seems relatively unconcerned – publicly anyway – and happy to leave higher volume and lower margin markets to Sea, who is investing heavily in gaining market share (in this context, investing means running at a loss to gain market share).

Complacency rarely pays in tech, and Sea’s management team knows what they are doing. Accordingly, we have adjusted our relative exposure to own more of the faster growing new entrant.

We remain highly optimistic on MercadoLibre’s prospects in payments in a continent where 85% of transactions are still settled in cash, and the tailwind for e-commerce in both South America and South East Asia are immense.

A recent local win was in Cettire (ASX:CTT) in Australia, which we bought in IPO and added along the way. There was a lot of fuss in the press quoting fund managers who thought the company overvalued, which we largely ignored. The business is real. Of course, we will hold the firm to the highest levels of fundamental performance, but will use data rather than opinion to make that assessment.

We continue to be amazed at the amount of opportunities available for entrepreneurs in Australia. Cettire didn’t exist a few years ago and is now a >$800m company.

Fintech

Payments are still agonisingly baroque. It continues to frustrate us as to why there is no metadata around purchases. It should be straightforward to make a payment and have a corresponding receipt sent to a bank account or platform like Xero.

This is largely due to legacy systems: payments were one of the first major digital applications and extraordinarily advanced at the time, but that once-innovative legacy is now an ancient handbrake.

Some 43% of banking systems still run on COBOL, a 60 year old language that took CBA five years and a billion dollars to replace when they tried in 2012. COBOL still handles 95% of ATM swipes and 80% of in-person card transactions.

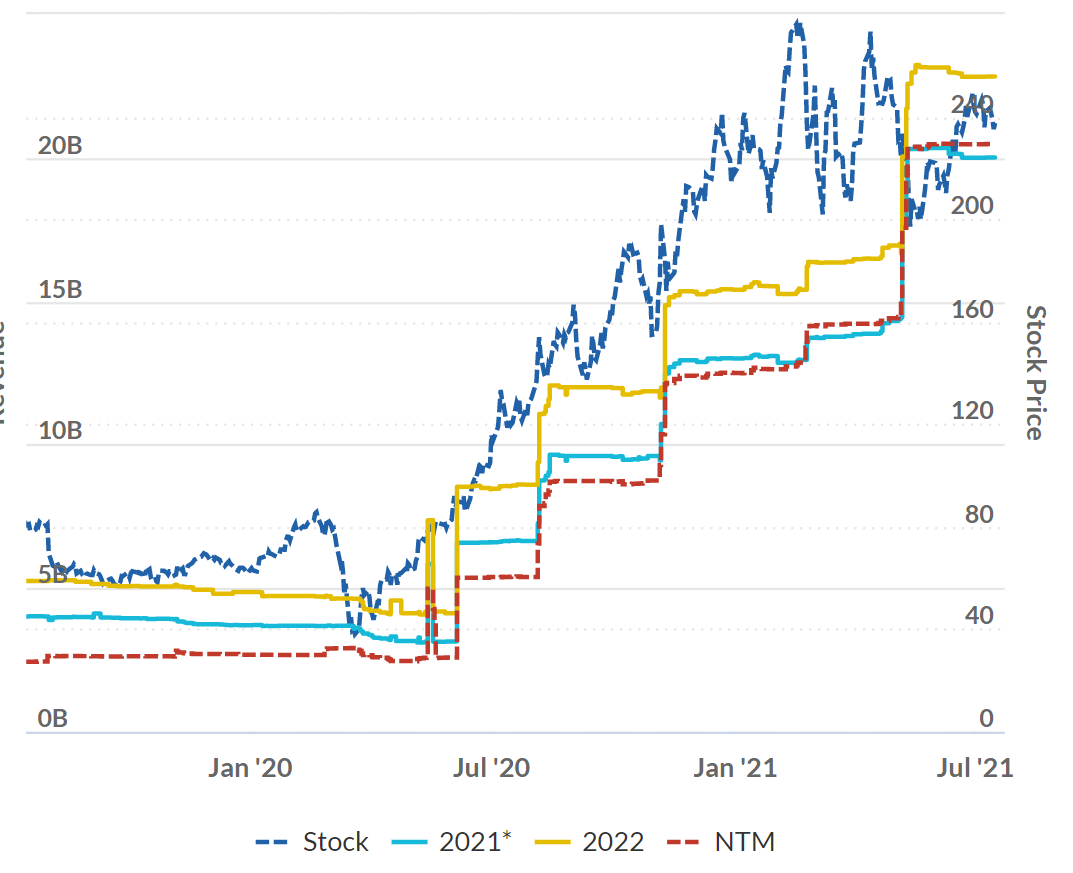

Square has continued to smash estimates. The lines in the chart below show average analyst forecasts for particular years, and, as we see in most of our high performing stocks, there is a clear and consistent trend from bottom left to top right – which is what we always want to see!

Square: average analyst projections for revenue in particular years. Note revenue includes low margin cryptocurrency revenue.

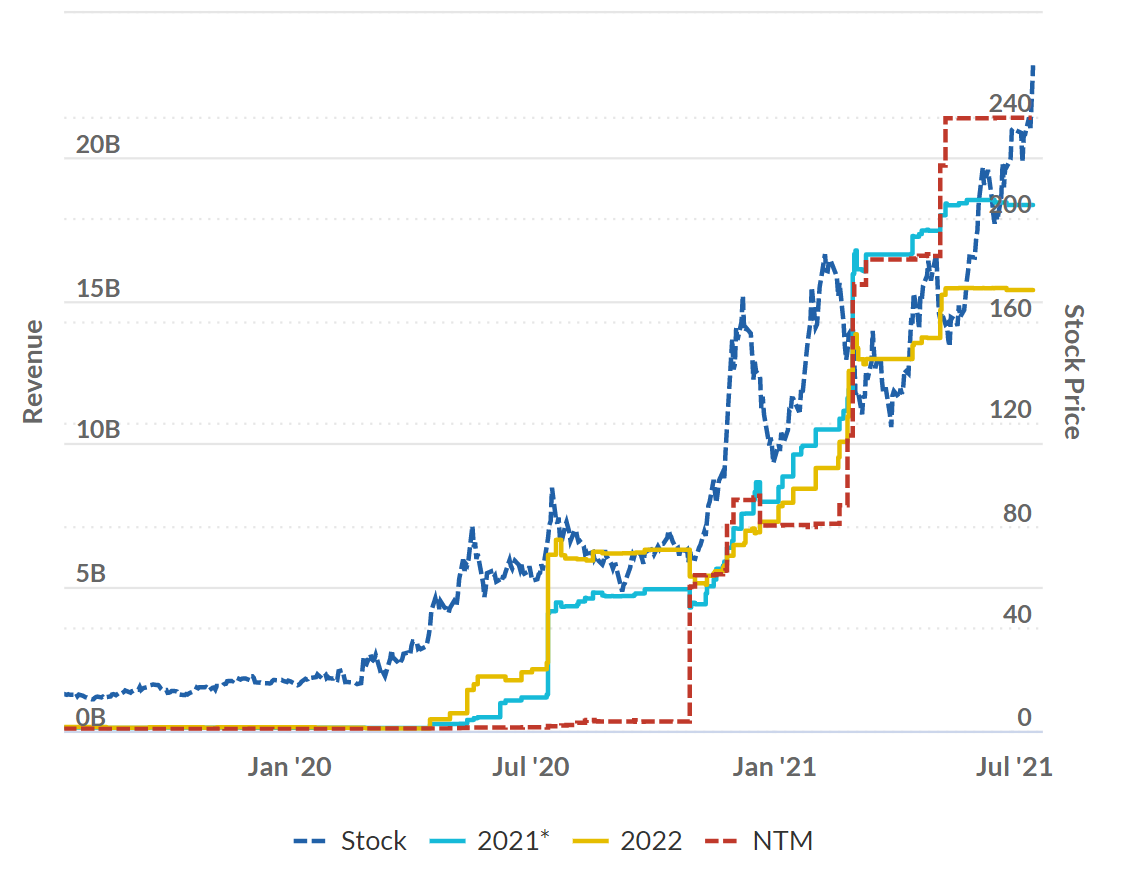

The chart for Moderna is even more spectacular:

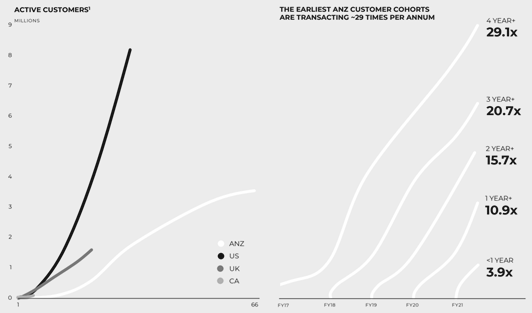

We added to Afterpay for the first time in over a year after the price halved from $160 to the $80s. BNPL is clearly maturing in Australia, their active customer base plateauing around 3.5mn users as at 1HFY21.

Fortunately this is only part of the story as users continue to utilize the platform more every year, with the >4 year cohorts transacting over 29x a year.

One of the more insightful ways to value Afterpay is to value each customer – and increasing frequency is a key driver of that value.

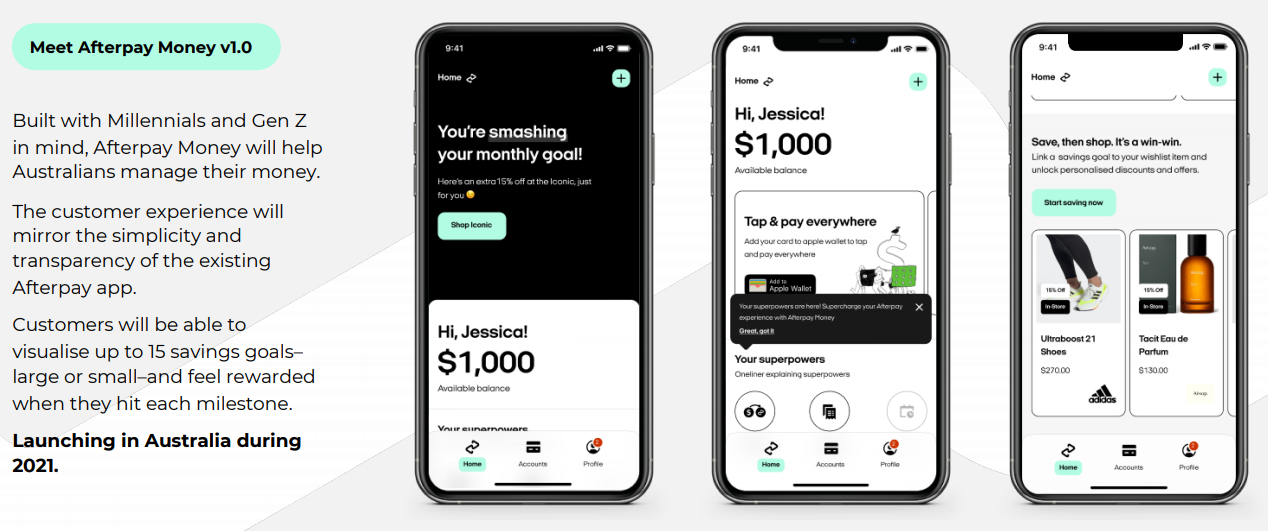

There is also scope to increase margin. Afterpay is launching a transaction account and will be able to capture significantly higher margins from customers who buy things with Afterpay, using cash in their app. Transaction costs and the like still chew up over 1% of GMV margin.

Streaming

It seems the US market has finally reached some level of saturation when it comes to streaming. Netflix, Disney, Amazon, Apple – everyone is going for the same wallet and the same number of hours in the day. For the first time, the net number of streaming subscribers started to contract.

A mistake we made a few years ago was to invest in iQiyi, the Chinese Netflix (to a first approximation). As it turned out, the Chinese were far more interested in short form video, like Bilibili and Tik Tok. Revenue and market value followed where the kids were spending their time.

Now the West is experiencing something similar, as tech saturation means social media, mobile apps, gaming, long form video and short form video all compete for attention – a competition that Tik Tok is increasingly winning. Facebook has largely trashed their product by stuffing it with ads and favouring addictive, radicalising algorithms, but for better or worse, this has been great for profits and their stock price. (As a reminder we don’t invest in Apple/Amazon/Facebook/Google/Microsoft etc).

China

Chinese regulatory risk was in the headlines as Didi was pulled from app stores merely days after IPO – a startling move.

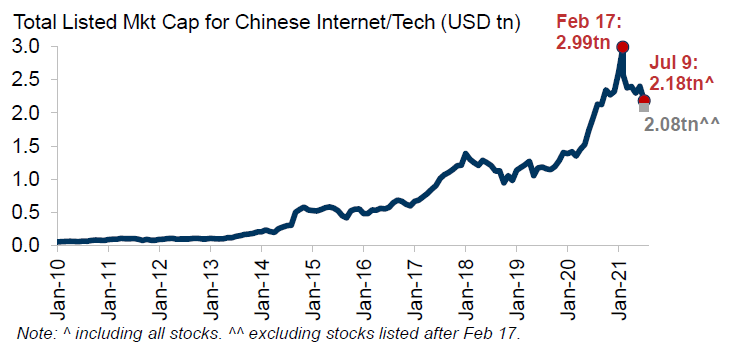

Since the highs in February, almost US$1 trillion, or -33% of market value, has been lost in China tech which is the largest sell-off in dollar value in history, even surpassing the move in 2018 triggered by Trump’s US/China trade war.

At the time we had a third of the fund in Asia so remember that episode well!

On the surface, the move looks hyper-aggressive.

However, Didi was apparently warned by the Chinese regulators and chose to push ahead anyway. If I was a Chinese CEO listing a company … I’d listen to the regulator. Of course, if I was listing an Australian company I’d listen to the Australian regulator too!

In that context, the move isn’t quite as startling as it first appeared.

Ride-sharing is particularly sensitive as it can show all kinds of important information: movements of key people, the true use of certain buildings, etc.

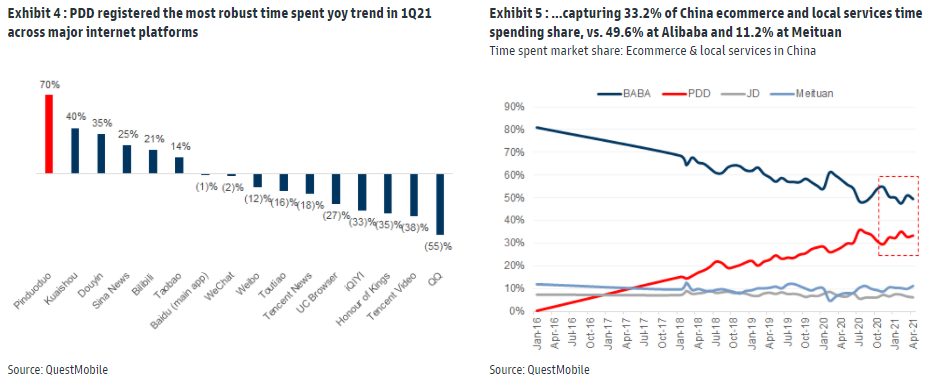

Third party data for Pinduoduo continues to impress. Pinduoduo is now the largest e-commerce provider in the world with a market cap of $135 billion. The stock has almost halved since February:

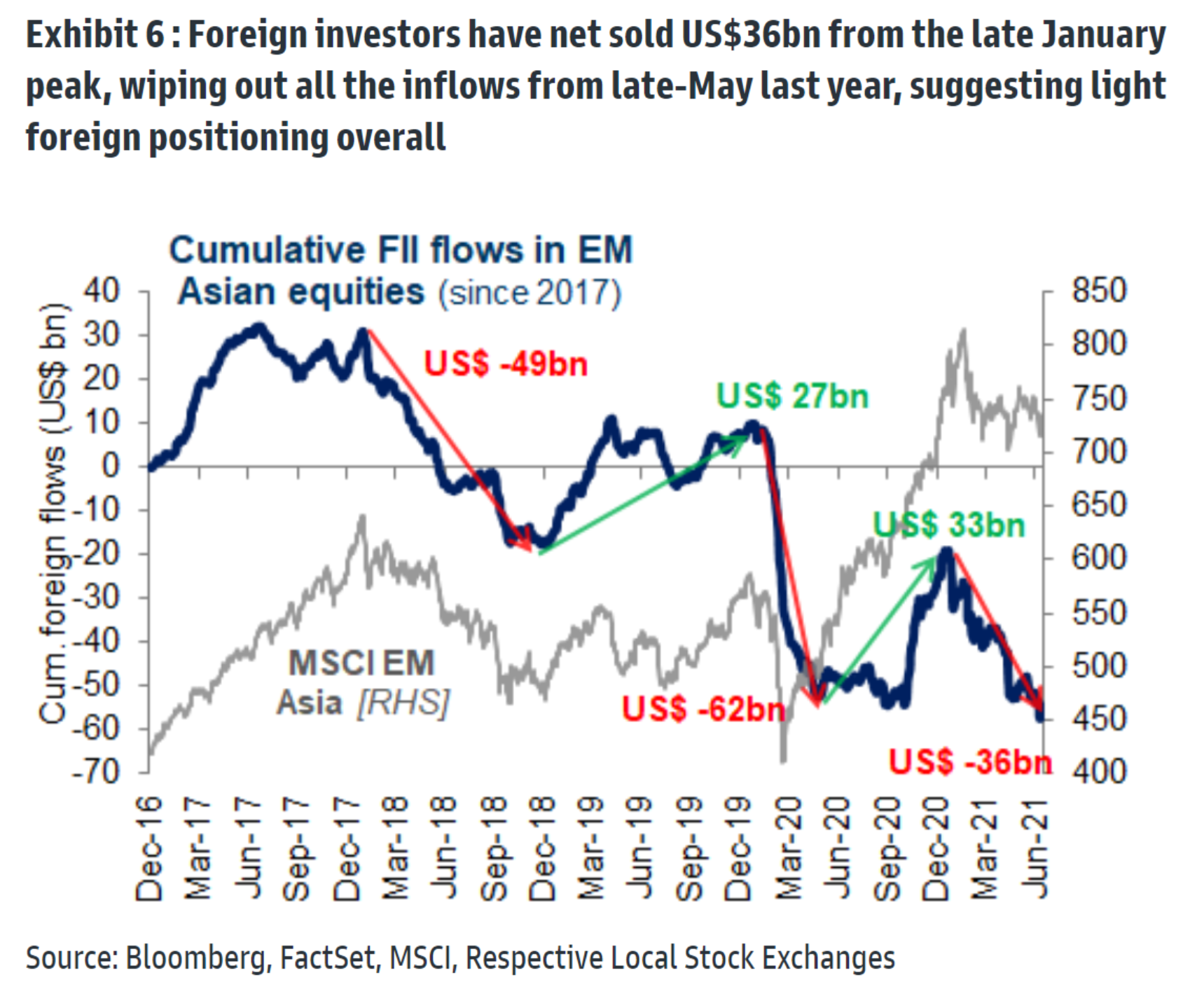

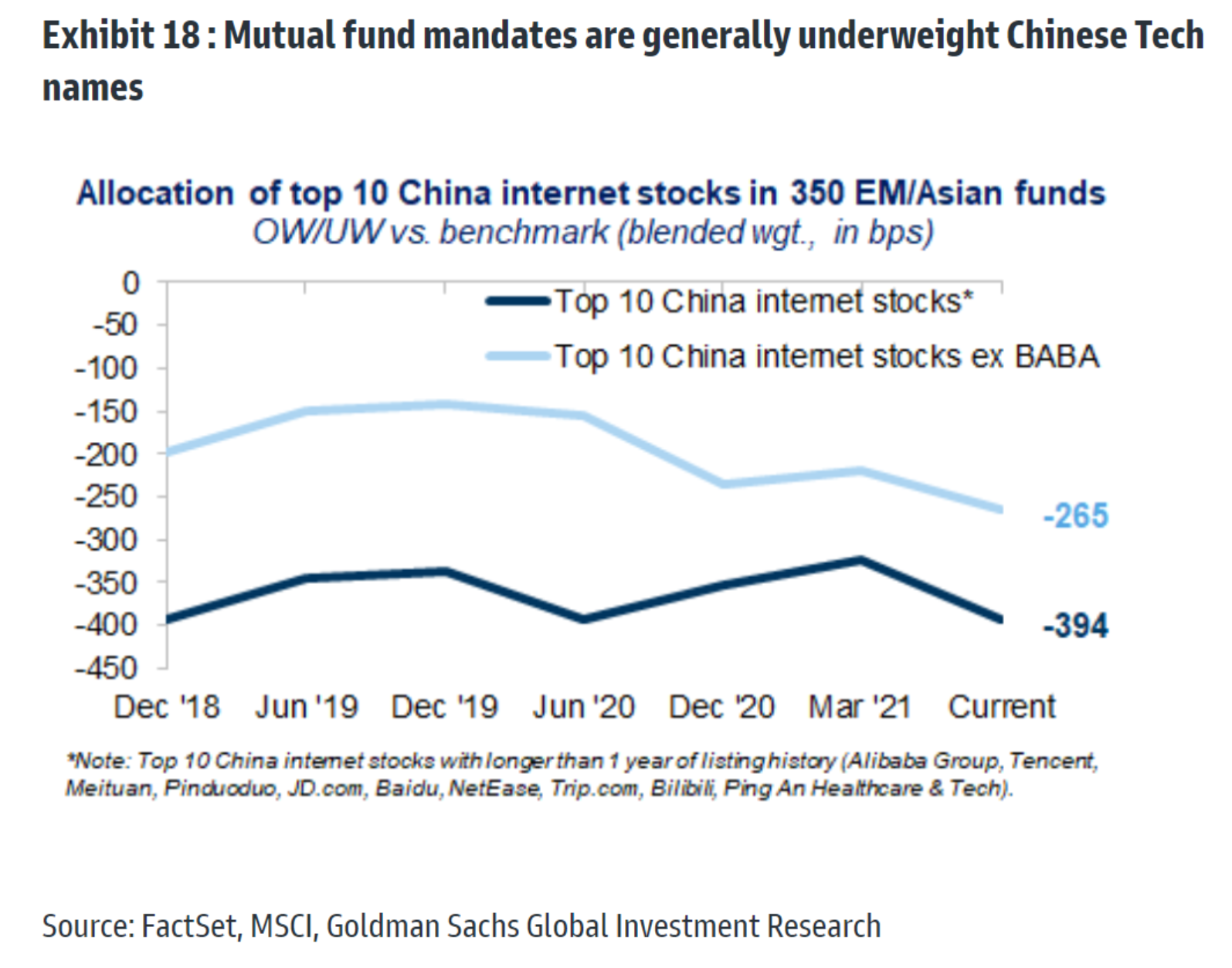

Managed fund exposure to foreign-listed Chinese firms has been falling for some time. Goldman Sachs put out some interesting charts:

Outlook

The last three years have been marked by sharp volatility, multiple periods of rising and falling interest rates, trade wars, left and right-wing Governments, and all kinds of twists and turns. We seemed to do better as things got more volatile, even though the strategy steadily simplified over the years.

The real money was made by those who held onto their assets and ignored the noise, and looking back there were extraordinary opportunities in technology.

If I had to guess, I’d expect the two salient features of 2021 to continue: falling multiples and explosive growth in our portfolio companies.

But the next five years will likely tell a similar tale: many twists and turns, all kinds of interest rates moves, perhaps a surprise macro shock or two (hopefully not a new epidemic), but companies that add users and double in size every 1-2 years will be worth many multiples more then than they are now, and that’s the core of our strategy.

It has never been clearer where growth will come from and what kind of companies will deliver outstanding long term returns.

Learn more

Stay up to date with all our latest Livewire insights by clicking the follow button below, or fill out the contact form for more information on Frazis Capital.

2 stocks mentioned