The market has a carrot

If the year past has shown investors one thing, it's that taking too bearish a view on the outlook for equities and bonds is seldom and only briefly rewarded.

Equity indices, including the ASX200 in Australia, might well be staring at their first negative monthly performance since... September last year! But it's hardly looking like disaster-territory given the seasonal pattern and the potential worries that are on investors' minds.

Yet, it might equally be folly to assume this market will simply keep on powering on, and ignore everything that could change the landscape dramatically; from slowing economic growth, to central banks moving in tightening mode, to the Evergrande fallout, to higher bond yields and the rising awareness of downward pressure on corporate profit margins.

Probably the most straightforward observation to make is that most economic insights and indicators, be they here in Australia, offshore in China, the US, UK or Europe, are no longer surprising on the upside. They have a tendency to now fall short of market forecasts, and they have been doing so for a number of weeks.

The message here should be clear: global economic momentum is softening, and it is likely to soften further over the weeks and months ahead. The more optimistic forecasters see momentum recovering in the final quarter of this year. If one's less optimistic, this could be the return to the low growth environment that persisted pre-COVID.

What happens at the macro-level impacts the micro and company earnings estimates have stopped trending upwards in Australia.

This process has accelerated in September as companies such as Clover (ASX:CLV), Kathmandu (ASX:KMD) and Sigma Healthcare (ASX:SIG) missed expectations with their FY21 performances, but most of all because of a sharp -50% fall in the price of iron ore.

Earnings estimates for US companies are now starting to trend downwards as well as analysts are looking forward to an unfavourable combination of rising costs and slowing sales.

Historically, such periods of negative earnings momentum tend to last about six months and, unsurprisingly, there's usually not much on offer in terms of net positive return as investors, understandably, tend to become more cautious during such times of greater uncertainty and greater potential for negative surprises.

Analysis by Morgan Stanley makes it very clear: the Australian share market's average return during periods of positive earnings revisions is circa 10%, but during periods of negative momentum the average net return reduces to -2%.

2021 might be different

However, this year the overall picture is a lot more blurred, with most investors and analysts considering the virus and renewed lockdowns responsible for the negative impact on growth and forecasts. Thus far, this has translated into far more lenience offered to those companies under the spell of the virus, as better times surely are but a matter of patience?

Look no further than the share price of travel agent Flight Centre (ASX:FLT) to back up that statement.

Source: Supplied.

On my observation, share markets can remain stronger-for-longer as long as there is a carrot dangling in front of them. Think Trump tax cuts, for instance. This year and last, the prospect of a successful vaccine-rollout, leading to re-opening borders and economies with cashed-up consumers ready to unleash their wallets on travel, leisure and other services, is likely acting as one such giant carrot.

Regardless, the prospect of higher input prices against a background of tougher sales growth will put a number of businesses under pressure from here onwards and it is anyone's guess who will be issuing the first serious profit warning, and when?

The old saying is that no profit warning is ever fully priced-in. Investors might be reluctant to sell the market as a whole, at a time of growing nervousness and generally elevated valuations, I doubt whether individual profit warnings won't be punished in the good old fashioned manner: quickly, fiercely and without thinking twice about it.

Straightforward logic tells us the most vulnerable business models should be the cyclicals and the lesser-quality business models; those with no pricing power - see iron ore in recent times, but the current context is that US bond yields are still expected to rise to 1.60%-1.80% by year-end and this should, all else remaining equal, reinvigorate the reflation trade, i.e. commodities, cyclicals and financials.

Why would bond yields break out after two months of largely low-volatility, sideways movement?

Last week's FOMC meeting might just have provided enough impetus for US bond yields to move higher as the time-schedule for tapering has been brought forward and with Chair Jerome Powell providing sufficient clues that tapering (i.e. reduced buying of bonds by the Federal Reserve) should be interpreted as the first step towards higher interest rates - albeit not anytime soon.

A "tightening" Fed, ahead of all other major central banks, and rising bond yields, also supported by the prospect of additional borrowing by the Biden administration later this year, should translate into a stronger US dollar, which might somewhat keep the brakes on commodity prices, but also bring major disappointment for the gold bugs.

As I never tire to point out, US bond yields are the major determinant for the direction of gold priced in USD. Rising bond yields accompanied by a firmer USD might prove too strong a combination for gold in the months ahead, especially in the absence of a major share market sell-off or otherwise major investor discomfort or panic.

The latter two scenarios are by no means completely out of the question.

Plenty of reasons for reduced comfort

Financial markets have remained quite sanguine about China's major property developer Evergrande facing corporate failure, but investors would be wise not to become too complacent about what is happening inside China. Authorities are likely to find ways to prevent this from becoming a local melt-down event, but not all repercussions can be avoided.

As some of the smarter market observers have already pointed out: corporate bond yields in China have responded and the sector overall will be facing tougher scrutiny and higher financing costs, maybe indefinitely. Chinese construction is slowing, with flow-on impact for the Chinese economy and demand for materials generally. It's almost a guarantee there will be more corporate failures in the sector.

Evergrande's failure has equally placed the Chinese property sector in the global limelight; with valuations in places like Shenzhen, Hong Kong, Beijing, Shanghai and Guangzhou, when measured against average total household income, multiple times more expensive than properties in, say, Tokyo, London, Vancouver and Sydney.

Chinese property ownership has drastically changed in recent years with investors and speculators now commanding most of the buying activity against mostly owner-occupiers previously.

To those wary because of macro concerns, Evergrande is but the canary of what can be expected once central bank tightening moves further down the process. The world is laden with debt and leverage. Central banks are starting to tighten against a background of rising costs and slowing economic momentum.

It would almost be a miracle if there were no more casualties, in particular in emerging economies. But also: remember it is estimated some 18% of all corporates today could be zombie companies, i.e. not able to meet interest payments out of operational cash flow.

And yet, it might just be that good old crude oil is readying itself to play an active role in the ongoing 'transitory versus permanent'-inflation debate. The price of Brent has rallied to a fresh new high since October 2018, once again approaching US$80/bbl, and quite a number of sector analysts are anticipating ongoing upward pressure.

Further interruption from hurricane Ida and the flow-on impact from rising natural gas prices are, apparently, meeting a faster-than-projected recovery in demand, ahead of winter in the Northern hemisphere. Goldman Sachs just upgraded its year-end price target to US$90/bbl from US$80/bbl previously.

Markets have thus far remained quite confident this year's spike in consumer price inflation will prove largely transitory, but persistently higher prices for energy have the ability to disrupt the market's -and central banker's- confidence. This time last year, the price of oil was temporarily circa -50% lower than today.

Market strategists are divided

Meanwhile, in the background of all of the above, strategists at the likes of Citi and Morgan Stanley keep reminding their clientele equities have seldom, if ever, looked as richly valued as they are in 2021, in particular in the US. Moreover, index targets set for year-end or even mid-2022 have already been exceeded, with those strategists refusing to lift their targets.

Australian equities might be in a different position, but that's entirely dependent on the outlook for resources and financials. Certainly, that same carrot is hanging in front of local investors.

Market strategists at Ausbil Investment Management, while acknowledging the shorter-term uncertainties and challenges, report their view is that corporate Australia will post yet two more years of strong EPS growth as balance sheets are in great form and vaccination targets and re-openings are set to release pent-up consumer demand.

Inflation is not expected to spoil the party, though Ausbil does admit it maintains a "diligent watch on the global inflation numbers".

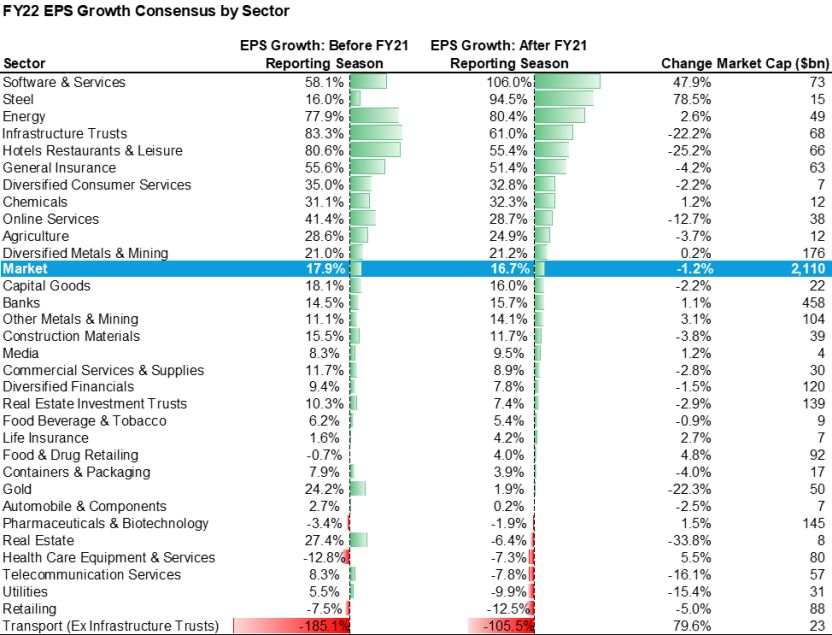

As per the table below, 25 of 32 sectors in Australia are expected to generate positive earnings growth in FY22 and, as per Ausbil's confidence, growth numbers for FY23 should pick up as we progress through the year ahead.

Source: Supplied.

Combining all of the above, I think it is more than likely some hard questions will be asked from financial markets in the months ahead and only a brave man, or a fool, would pretend to know what all the responses will be.

Previously, I have written that having some cash on the sideline, for comfort, but also to jump on opportunities that might open up, seems but appropriate for investors with only a moderate appetite for risk and, let's call it that, "adventure".

I think that statement remains valid, without getting too bearish or panicky about what can possibly lay ahead.

Follow me for more like this

Click the 'follow' button below to be among the first to be notified of my next post on Livewire.

This resource has been contributed to Livewire by the team at FNArena.

4 stocks mentioned