The Match Out: ASX bounces, RBA comments support buyers, Zip rallies on strong November

Equities were higher throughout the day, but it was the RBA that lit a fuse under the market into the afternoon. The central bank’s comments lifted the market more than 50 points from 2pm before easing at the final bell. The RBA was more accommodative than many feared and confirmed the market has central bank support through until at least February. when it next meets. Surprisingly, the Aussie dollar was also reasonably well supported after the announcement and has now rallied more than 1%, after testing the 70 cent level versus the greenback yesterday morning.

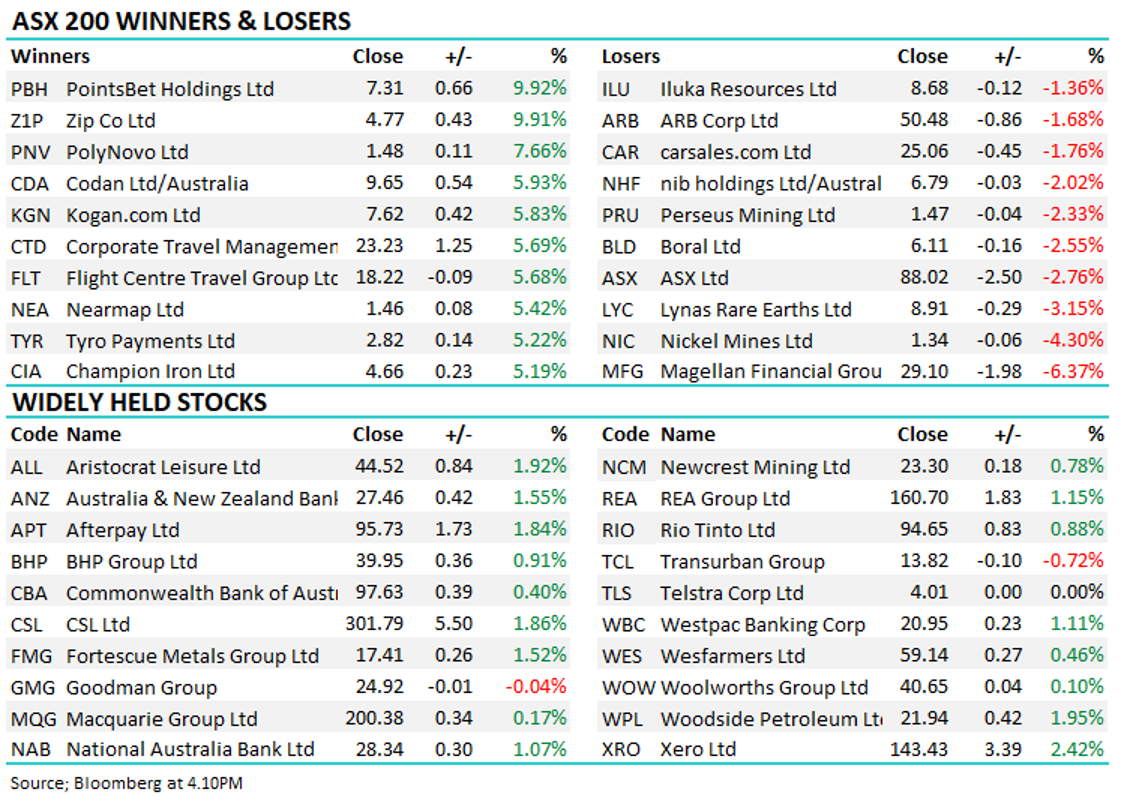

- The ASX 200 finished up +68pts/+0.95% at 7313 – futures have also put on around 20 points since the cash market close, a late rally in SPI for the second day running.

- The energy sector was the “best on ground,” up +2.07% followed by IT +1.90% while the Utilities was the only sector to finish lower.

- The RBA held rates at 0.1% as expected, the market enjoying several snippets from the commentary including indications the bond-buying program will continue at $4 billion a week until mid-February. The RBA said inflation pressures in Australia are less severe than in other countries and expects it will be some time before conditions are met for a hike in rates.

- Magellan (ASX: MFG), -6.37%, was smacked after the CEO made a hasty exit just weeks after the AGM. Selling picked up after an Australian Financial Review article about the situation over at the listed fund manager landed around midday.

- Bank of Queensland (ASX: BOQ),+4.21%, rallied on a positive update at its AGM. We will touch on this in the Morning Report tomorrow.

- PointsBet (ASX: PBH), +9.92%, caught a bid following a positive initiation report from Bernstein, kicking off with a buy and a $12 price target.

- Oil Search’s (ASX: OSH) merger deal with Santos (ASX: STO) was approved by shareholders; the PNG courts are now due to give the final sign off. The merged company could be trading on the ASX as soon as Monday.

- Gold was flat in Asia today $US1777 at our close

- January Iron Ore Futures up +8.74% today in Asia, iron ore miners were higher but left a lot on the table relative to the commodity price move

- Asian markets were mostly higher, Nikkei +2.48%, Hong Kong +1.98% while China was up +0.05%

- US Futures are higher by around 0.45% each.

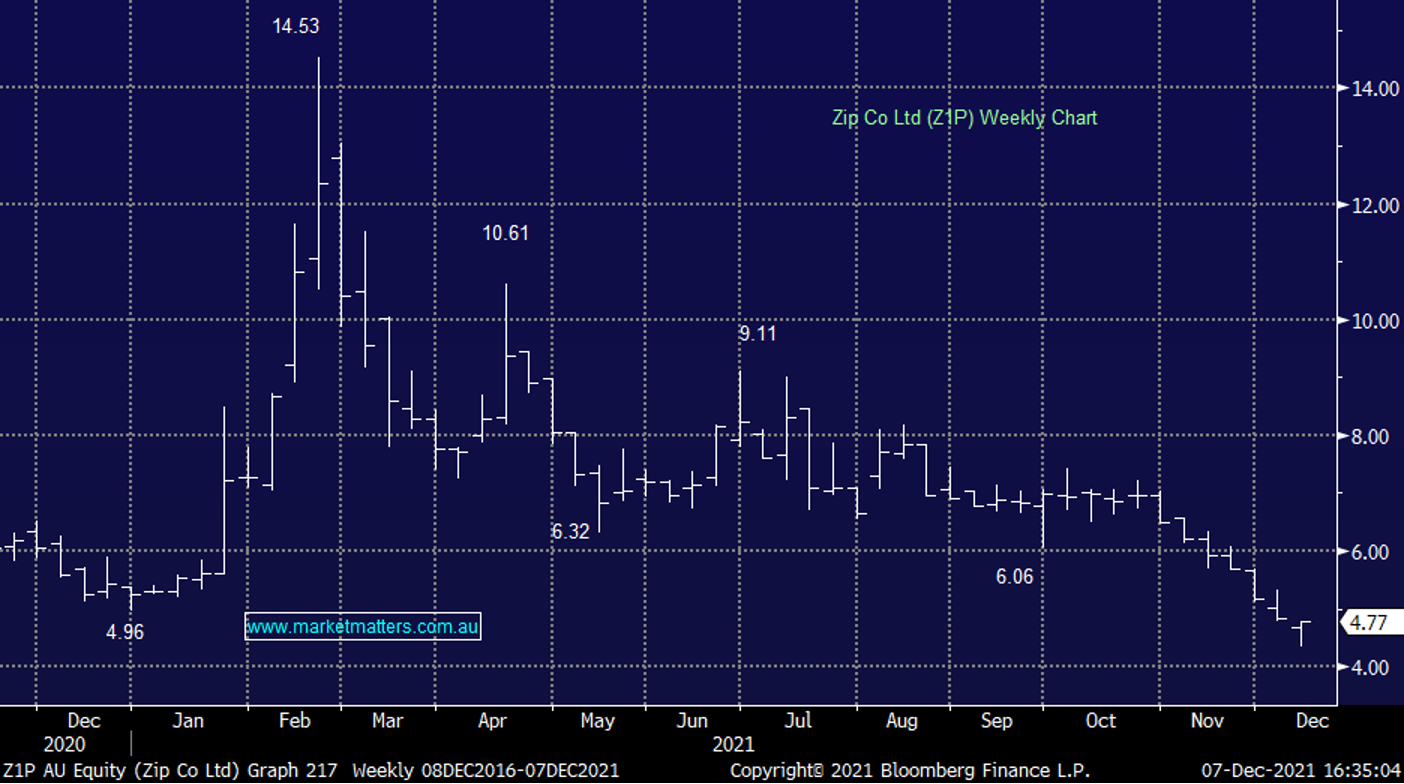

Zip Co (ASX: Z1P) $4.77

Z1P +9.91%: November update from the BNPL company was strong helping recovery some of the selling seen in the past few weeks. Total transactions in the month topped $900 million, 52% above the same period last year and is now annualising more than $10 billion. Customer numbers are also swelling, cracking the 9 million mark for active customers in the quarter, up 86% on last year. International markets are the focus for Zip currently, the recent acquisition of Twisto providing a launchpad for Europe and a deal with Singtel in place ahead of a Singapore launch. Despite all of the good news, the stock has been under significant pressure and it’s unlikely one good announcement will see it turn the corner just yet.

MM is neutral Z1P.

Zip Co

Broker moves

- Paladin Energy Rated New Buy at Mackie Research Capital

- Metcash Raised to Outperform at Macquarie; PT A$4.70

- Metcash Rated New Hold at Barclay Pearce Capital; PT A$4.26

- Metcash Cut to Negative at Evans & Partners Pty Ltd; PT A$3.99

- Qube Reinstated Sector Perform at RBC; PT A$3.50

- Sigma Healthcare Cut to Neutral at Credit Suisse

- Sims Reinstated Buy at Goldman; PT A$20

- Bluescope Reinstated Neutral at Goldman; PT A$24

- PointsBet Rated New Outperform at Bernstein; PT A$12

- a2 Milk Rated New Neutral 1 at Barrenjoey

- Sigma Healthcare Cut to Hold at Jefferies

- Westgold Reinstated Buy at Bell Potter; PT A$3.20

Major movers today

Have a great night,

Harry, James and the Market Matters team.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

5 stocks mentioned