The Match Out: ASX closes higher but gives up early strength, NAB 1Q impresses, CIMIC an all-round disappointment

It was a strong start to the day with buyers picking up where they left off yesterday afternoon. The ASX was carried back over 7,300 for the first time in three weeks but ultimately failed to hold that level, closing 48pts off the intraday highs. Tech was once again the winner, carried by strength in the larger index weights of the sector. The market heavyweights – Financials and Materials – were also well bid, helping to ensure a green day for the index.

- The ASX 200 finished up +20pts/+0.28% at 7288.

- The IT stocks followed up yesterday’s effort with another +2.61%. Financials took the silver (+0.9%) with the National Australia Bank (ASX: NAB) quarterly helping the sector higher.

- Staples (-0.79%) were hit today though the big supermarkets doing most of the damage there. Healthcare (-0.83%) was the worst of the sectors though with some broad-based selling.

- NAB reported its 1Q numbers, beating expectations despite further pressure on net interest margins.

- AMP (ASX: AMP) reported its full-year set today. Strong performance fees for AMP Capital drove a 10+% beat.

- CIMIC (ASX: CIM) reported a miss in today’s full-year result, though work in hand (WIH) continues to climb thanks to strong infrastructure investment.

- ASX Limited (ASX: ASX) (-3.81%) reported in-line earnings but costs were guided higher which weighed on the stock today.

- Bapcor (ASX: BAP) caught a bid today and recovered all of yesterday’s slide on the back of an upgrade from Ord Minnett, whose analyst said yesterday’s result showed they’ll start to benefit from improvements to the distribution network

- All eyes will be on US inflation numbers tonight, expected to come in at +7.2% yoy. Core Inflation of 5.8% YOY is expected.

- Iron Ore was up around 1.5% today in Singapore.

- Gold was flat at $US1,834 at our close.

- Asian markets were mixed, Japan +0.37% but the Hang Seng -0.5% at our close.

- US Futures are mostly lower, the S&P looking at a 17bps decline and Nasdaq -0.3%.

ASX 200

National Australia Bank (ASX: NAB) $29.67

NAB +4.51%: The last cab off the rank for the banks this period, NAB beat expectations to round out the group. Earnings were +19% on the prior corresponding period to $1.8 billion, with higher revenue the driver. Volume growth in housing and business lending and recovery in Markets & Treasury revenue saw group revenue jump 8%. Like its peers, NIM remained under pressure, falling 5bps to 164bps on higher liquids and competitive pressures, but this didn’t stop the mortgage book from growing 2.6%. Expenses grew 2% on the 2H21 average but guidance suggests this will fall through the rest of the year. The consensus was expecting EPS growth of just 1% so with earnings up and a buyback in place, this update is a healthy beat to what the market was after.

MM owns CBA, BOQ & VUK among the banks.

National Australia Bank

CIMIC (ASX: CIM) $15.89

CIM -7.13%: The engineering company was the worst performer today after coming in at the low end of guidance in the full-year result. Earnings were up 15%, but a 5% miss to consensus at $405 million. Operating cash flow was a disappointing loss of $172 million despite 8% revenue growth. The company is seeing a tailwind of infrastructure spending, which helped the company win more than $20 billion in work for FY21. But its guidance also disappointed me. NPAT for FY22 of between $425 million and $460 million is expected, a 6% miss to consensus at the midpoint.

CIMIC

Broker moves

- Temple & Webster Rated New Hold at Barclay Pearce Capital

- BHP Shares Decline After Exane Downgrades to Underperform

- CBA Raised to Buy at Bell Potter; PT A$108

- Temple & Webster Raised to Buy at Bell Potter; PT A$12.10

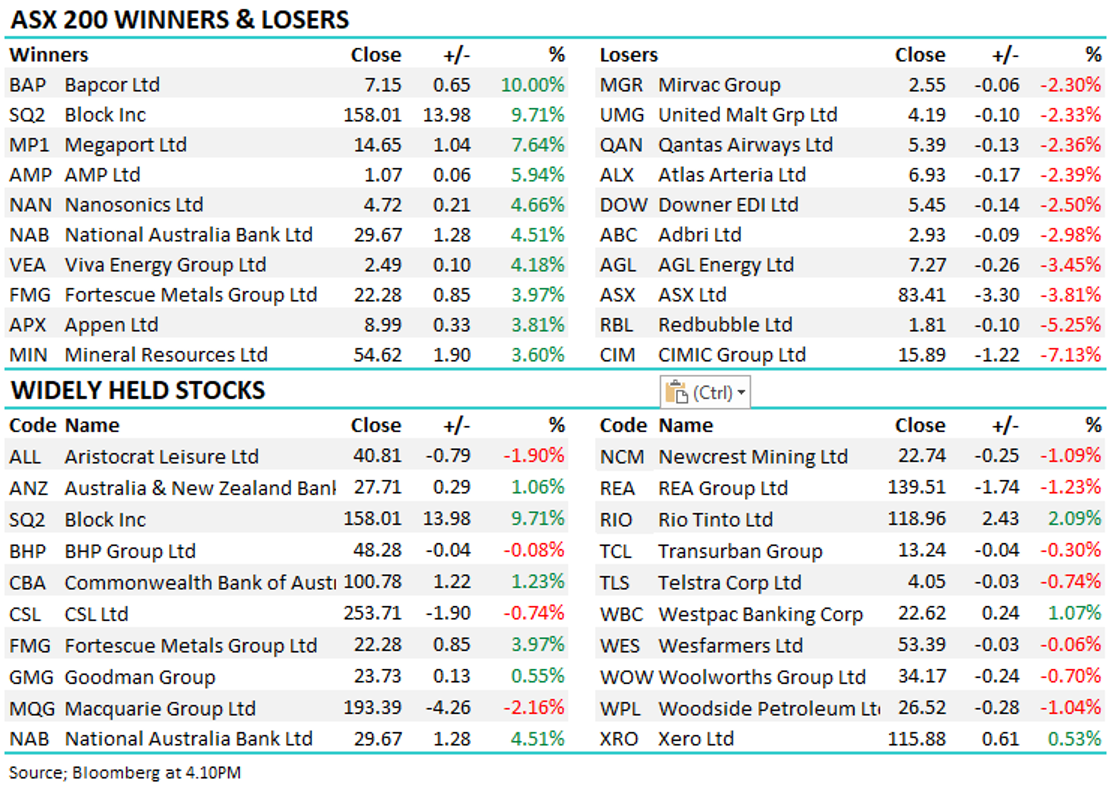

Major movers today

Enjoy your night,

The Market Matters Team.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

5 stocks mentioned