The Match Out: ASX consolidates recent gains, Commodities rally as China kicks into action

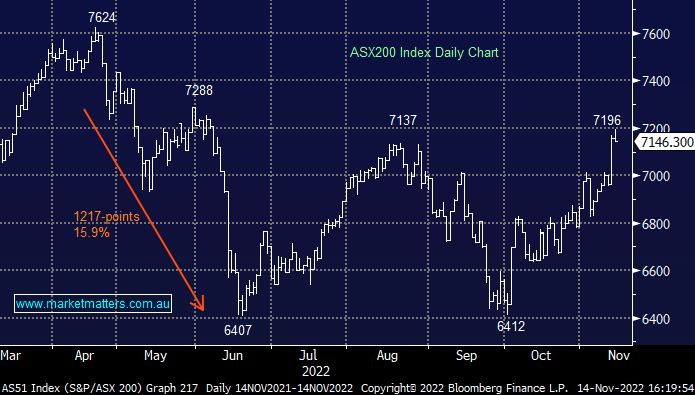

The market consolidated recent gains today with the ASX opening well before tracking lower as the day progressed. This is the sort of two steps forward and one back trading action we think will play out as the world continues to grapple with a large cross-section of economic challenges, although we reiterate that we remain positive into early 2023.

- The ASX 200 finished down -11pts/ -0.16% at 7146, having traded just 3pts shy of our long held 7200 target in early trade.

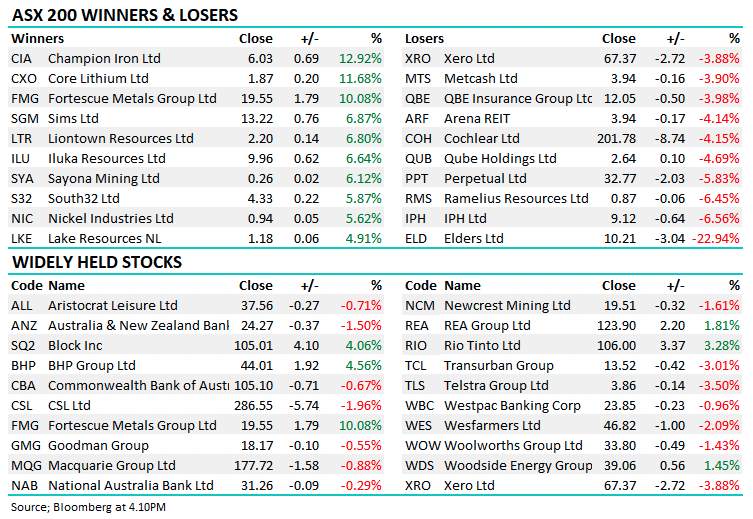

- The Material sector was best on ground (+3.34%) while Energy (+0.92%) was strong.

- Industrials (-2.28%) and Healthcare (-2.13%) the weakest links.

- Positive news from China today relaxing some Covid restrictions + launching a plan to rescue the struggling property sector.

- That underpinned a +5.5% rally in Iron Ore building on Friday’s +5% gain, Fortescue Metals (ASX: FMG) +10.05% was the standout however the resources were strong across the board.

- While resources followed the MM script today, IT stocks didn’t, the sector was lower.

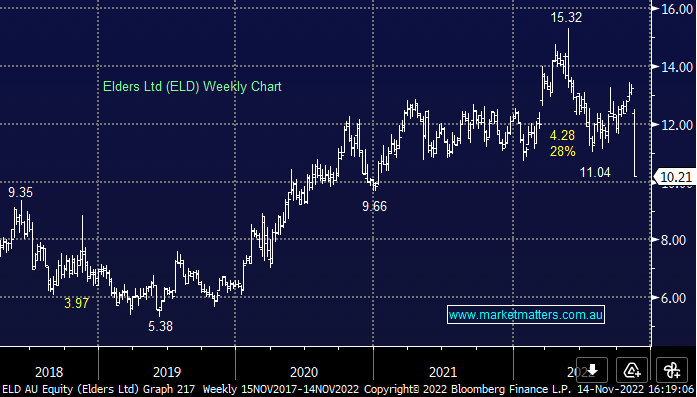

- Elders (ASX: ELD) -22.94% announced the departure of their CEO and gave weak guidance.

- Flight Centre (ASX: FLT) -3.76% lower on AGM commentary around margins, and guidance they don’t expect to return to pre-covid levels.

- Telstra (ASX: TLS) -3.5% apparently lost money on FTX, with some $$ in their venture fund as reported in the AFR this morning – not a material amount but reputational damage nonetheless.

- Pinnacle (ASX: PNI) +4.78% rallied on good AGM commentary, their funds are doing reasonably well and attracting decent flows of higher margin retail money.

- Citi cut Ramsay Healthcare (ASX: RHC) -0.57% to a neutral rating.

- Pendal (ASX: PDL) -0.95% & Perpetual (ASX: PPT) -5.83% appeared before the Supreme Court of NSW agreeing to stand over proceedings till 16th November. Regal Partners (RPL) +4.69% was the only one of the trio to rally today.

- Iron Ore now trading back up at US$101.40

- Gold gave back some recent gains in Asia, off $US12 to US$1760

- Asian stocks were mostly higher, Hong Kong up +2.29%, Japan -0.81% while China was up +0.31%

- US Futures are all down, around -0.40%

ASX 200 Chart

Elders (ELD) $10.21

ELD -22.94%: the ag group posted solid FY22 numbers today for their September year-end, but shares struggled with the CEO departing and soft outlook commentary. EBIT was up 39% to $232m, near the top of their guidance range and in line with estimates. NPAT was only marginally higher and below estimates with the company saying a change in tax realisation weighed on growth here. CEO Mark Allison announced plans to retire in 12 months with a global search for his replacement already getting underway. We spoke to Mark & the company’s CFO this afternoon and while management was upbeat about further growth in the business, significant rainfall has impacted the start of FY23. They also flagged lower volumes and falling prices in their livestock business, while growth through acquisitions may slow despite a strong pipeline of opportunities.

Broker Moves

- Ramsay Health Cut to Neutral at Citi; PT A$62

- Lovisa Rated New Neutral at Goldman; PT A$29.25

- Accent Group Rated New Buy at Goldman; PT A$2.20

- Universal Store Rated New Buy at Goldman; PT A$7.20

- Acrow Formwork Rated New Buy at Shaw and Partners

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

8 stocks mentioned