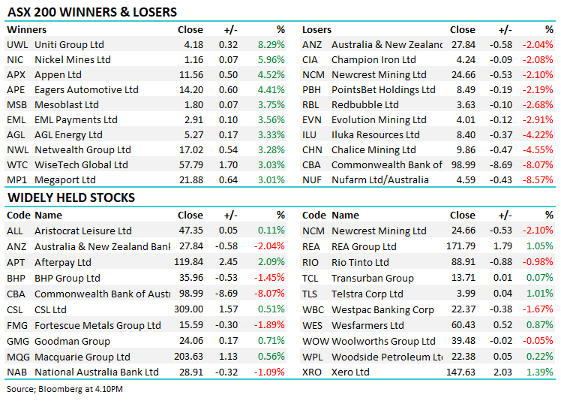

The Match Out: ASX down again, CBA’s 8% dip comprising 90% of the fall, AGM season soldiers on

It was another softer session for the market today thanks largely to a weaker-than-expected quarterly update from index heavyweight Commonwealth Bank (ASX: CBA), which weighed heavily on the financial sector. And for good measure, the other barbell of the market – materials – also finished lower.

- The ASX 200 finished down -49pts/-0.67% today at 7420.

- Financials weighed on the index today, Commonwealth Bank down a huge -8.07% which alone took 45pts off the index. The result also put pressure on the other banks, the best of the big 4, National Australia Bank (ASX: NAB) still down more than 1%. See below for more on the CBA result.

- While the market was lower, more stocks actually finished in the green today, so it wasn’t all bad news despite the feeling of a tough session.

- In the Market Matters Video update this week, James and Harry discuss today’s update from CBA, along with three stocks they would buy here and now – Click here to view.

- AGM season continues, with a bunch of other companies out today. Below, we touch on two key positions in the Emerging Companies Portfolio that hosted theirs today – Praemium (ASX: PPS) and EML Payments (ASX: EML).

- We met with the management of Capitol Health (ASX: CAJ) today after its AGM. The business continues to perform and greenfield growth opportunities are progressing nicely. For the most part, it’s just too cheap and we continue to like it.

- We also had the Westpac Bank (ASX: WBC) CFO in the office this morning providing an update. It’s all about simplification and cost out, so the bank can take advantage of the economic upswing.

- Barrenjoey initiated coverage of BHP Group (ASX: BHP) today, with a buy-equivalent and price target (PT) of $45. Analyst Glyn Lawcock was one of the high profile exits from UBS last year – he’s good.

- Gold was up marginally in Asia, +$US2 to trade $US1852 at our close.

- January Iron Ore Futures fell marginally through our session.

- Asian markets were mixed, Nikkei -0.17%, Hong Kong -0.29% while China was up 0.26%% at the time of writing.

- US Futures are marginally higher.

ASX 200

Market Matters Weekly Video Update

Was CBA's result “that” bad? Plus three stocks we are happy to buy here and now…James and Harry cover that and more in this week’s Market Matters Video Update. As usual, please ‘like’ the video if you do and subscribe to the Market Matters YouTube Channel for more updates.

Commonwealth Bank (ASX: CBA) $98.99

CBA -8.07%: It’s not often we see CBA down around 8% in a session, taking a whopping 45 points from the index. But today was one of those rare days, as a weaker than expected first-quarter trading update and a very bullish share price leading into it broke the camel’s back.

- First-quarter cash earnings of $2.2 billion imply FY cash earnings of around $8.8 billion, which was some 4% below the current market consensus of $9.12 billion for the year.

- Management talked to margin pressure in delivering its FY21 results in August, and today’s update sang a similar tune. In addition to higher liquid asset balances, there is increasing home loan price competition – and customers (me included) are switching to lower margin fixed-rate loans, plus of course the issues created by historically low interest rates.

- The key takeaway for MM is that even CBA’s strong franchise is not immune from the elevated margin pressures that result from low rates. Remember, as MM has written numerous times, banks borrow short and lend long, so the rise in short term rates relative to longer-term rates (that is, a flattening of the yield curve) creates an issue.

In the last two weeks, we’ve had CFOs from both NAB and Westpac in, and all banks are saying similar things. Economic momentum is strong but lower low rates are an issue. At MM, we think rates will go higher over time and this margin pressure should subside.

We remain bullish on CBA and see weakness under $100 as a buying opportunity.

Commonwealth Bank

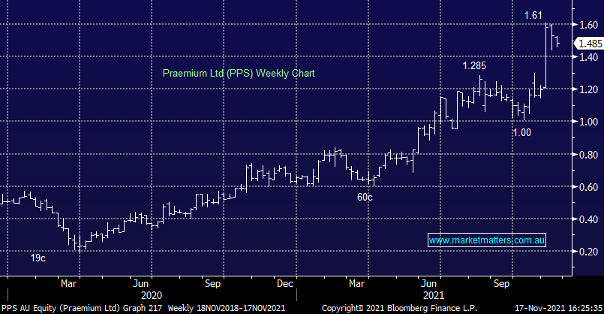

Praemium (ASX: PPS) $1.485

PPS -0.34%: the investment platform business hosted its AGM today with two key areas in focus. While business is chugging along nicely through the first quarter, the key focus was on:

- Any news around the divestment of the international arm, and

- An update regarding a potential new bid from Netwealth.

The CEO said the company is in the final phase of the sale, saying legal and separation terms. It was a positive update but also implied there was only one serious buyer in the mix, which may weigh on the price. Management was less open around the Netwealth proposal, essentially saying there would be a price that would entice but it remains business as usual for now.

MM is marginally bullish PPS around $1.50.

Praemium

EML Payments (ASX: EML) $2.91

EML +3.56%: The main focus for EML shareholders in today’s AGM was the ongoing remediation work in EML’s Irish PCSIL business. The company remains on track to have the bulk of the work wrapped up by the end of the year, with some minor changes rolling into the first quarter of 2022 – which is the same commentary put out at the result a few months ago. EML has also cleaned up the business in the process, moving out of lower margin work to make room for more attractive growth once the Irish Central Bank gives the green light. While regulation is rarely a positive, it seems EML is making the most of it, while the market is giving it very little – the PCSIL business accounted for around 30% or revenue but the stock is down around 40% since the regulators took aim.

MM is bullish EML under $3.

EML Payments

Broker moves

- Abacus Property Rated New Buy at Moelis & Company; PT A$3.75

- Domino's Pizza Enterprises Raised to Buy at Citi; PT A$144.35

- Rural Funds Cut to Market-Weight at Wilsons; PT A$2.81

- Star Entertainment Rated New Buy at Jarden Securities; PT A$4.77

- Crown Resorts Rated New Overweight at Jarden Securities

- Aurizon Cut to Underperform at RBC; PT A$3.30

- Rio Tinto Rated New Neutral 1 at Barrenjoey; PT A$95

- BHP Rated New Overweight at Barrenjoey; PT A$45

- Step One Clothing Rated New Add at Morgans Financial Limited

Major movers today

Have a great night,

James, Harry and the Market Matters team.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

6 stocks mentioned