The Match Out: ASX down, Materials and Energy weigh, Uniti Wireless gets a bid

The holding pattern continues for the market, with the ASX giving back around 50% of yesterday’s rally. With little clarity in negotiations between Russia and Ukraine, the Federal Reserve meeting in the US on Thursday morning our time (25 basis points rate hike expected), the growing COVID situation in China, and rumblings around whether or not China is going to / has already helped Russia, it’s easy to see why things are subdued. It actually feels more resilient than anything, given the shopping list of risk factors that one can point to.

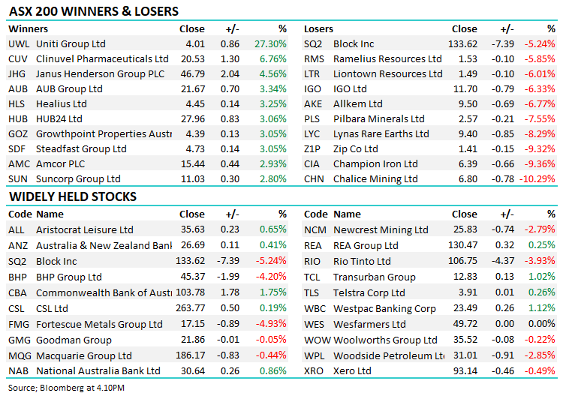

- The ASX 200 finished down -52pts/ -0.73% at 7097.

- For a second consecutive session, Financials were the best on the ground today (+0.99%) while Communications (+0.74%) also bucked the negative trend.

- Materials (-3.74%) took the brunt of selling while Energy (-2.90%) was also weak, the weakness here telling us that despite the negative headlines still front and centre, things could be improving.

- Commodities are cyclical and while we are medium-term bulls on the sector, we’ve tactically lightened in the short term.

- Chinese stocks are still in the spotlight today with the Hang Seng Tech Index down 7% early, however it rallied from those lows to be down ~2% at their lunchtime break.

- Better than expected economic data from China helped with Industrial production +7.5% v +4% expected, Retail Sales +6.7% v +3% expected while the PBOC didn’t cut rates as expected.

- We also heard one of Beijing’s most explicit statements yet on the prospect of American penalties for China’s supposed support for Russia, the Chinese Foreign Minister said “China is not a party to the crisis, nor does it want the sanctions to affect China.”

- The US clearly thinks that China is supporting Russia, the old East v West scenario which is not a great thing, let’s hope that is not the case.

- Uniti Wireless (UWL) +27.3% on a takeover – Harry covers below.

- Iron Ore was down 2.52% in Asia.

- Gold was also lower, down US$17 in Asia today, to be around $US1932 at our close.

- Copper was actually higher in Asia, it was weaker early before recovering, now at US$452 a pound, having been as high at US$492.

- Asian stocks were mostly lower, Hong Kong off -3%, Japan +0.24% and China was off -2.53%.

- US Futures are flat.

ASX 200

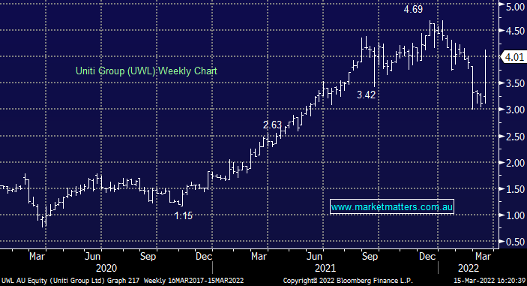

Uniti Wireless (ASX: UWL) $4.01

UWL +27.3%: this morning The Australian reported that the telco had received a takeover offer from an unnamed bidder. Shares were placed in a trading halt soon after the open, and by mid-afternoon, the company had confirmed that infrastructure group Morrison & Co had put forward a $4.50/sh offer, a 42% premium to yesterday’s close, though it was trading at that level in January this year. Morrison & Co is a serious bidder having been amongst the buyers of a stake in Telstra’s towers business last year. They get a chance to cross-check the numbers with due diligence expected to last for six weeks. There are also rumours Macquarie-backed Vocus was having discussions, while there is plenty of money searching for a home in infrastructure assets, Morrison & Co’s bid could be the domino that brings other interested parties to the table.

Uniti Wireless

Broker moves

- Bluescope Raised to Outperform at Macquarie; PT A$23.35

- Xero Raised to Overweight at JPMorgan; PT A$107

- CBA Raised to Neutral at Credit Suisse; PT A$102.80

- Bendigo & Adelaide Raised to Outperform at Credit Suisse

- South32 Rated New Overweight at Barrenjoey; PT A$5.70

Major movers today

Enjoy your night,

The Market Matters team.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

1 stock mentioned