The Match Out: ASX drops like a rock to finish the week, fresh COVID fears spark sell-off, Appen smashed on downgrade

After weeks of being more or less pinned to 7400, the index finally cracked today. Initially it looked to be a pretty subdued end to the week for the ASX given Futures were little changed and the US market closed overnight for the Thanksgiving Holiday, however traders got the jitters and the index was smacked to a new 5 week low. Fears around a new COVID strain appears to be the main thing concerning investors with travel stocks firmly in the firing line.

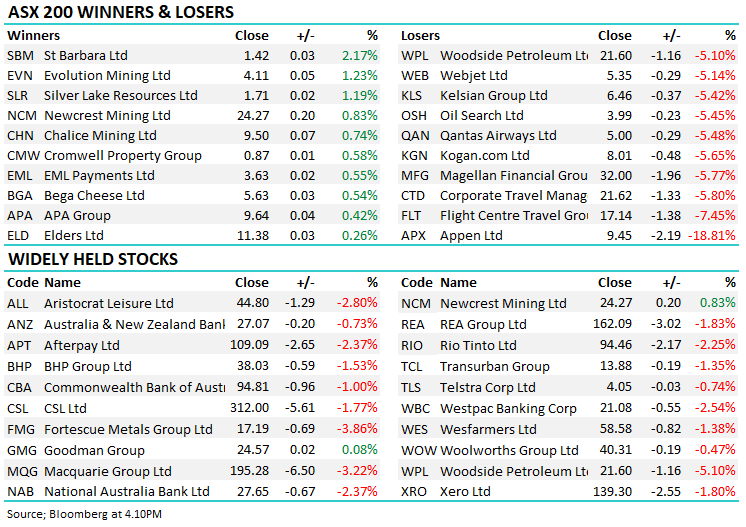

- The ASX 200 finished down -128pts / -1.73% to close at 7279.

- All sectors closed lower for the day though the consumer staples sector was the least bad.

- Local Retail sales data for October came in with a big beat, up 4.9% MoM vs +2.2% expected, perhaps stemming some of the selling in consumer facing stocks.

- Gold stocks were well supported taking the first 5 places on the leader board today.

- Appen (ASX: APX) fell nearly 20% on the back of a downgrade from Macquarie. The broker essentially saying customers are likely to be taking their annotation work in house, fearing downgrade near term particularly given the company’s lack of visibility on earnings.

- Travel stocks were hit hard – Flight Centre (ASX: FLT), Corporate Travel (ASX: CTD), Qantas (ASX: QAN) and Webjet (ASX: WEB) all falling more than 5% following news of a new COVID variant that appears vaccine resistant.

- Asian markets were also sold off hard, Japan’s Nikkei off -2.95% at the time of writing, the Heng Seng down -2.5%.

- US Futures pointing to a weak session though not as severe as seen locally. S&P down 1% but the Nasdaq futures only down -0.5%.

ASX 200 chart

Sectors this week (Source: Bloomberg)

Stocks this week (Source: Bloomberg)

Broker Moves

- SCA Property Cut to Neutral at Macquarie; PT A$2.94

- Appen Cut to Underperform at Macquarie; PT A$9.50

- EML Payments Raised to Buy at Canaccord; PT A$4.50

- Crown Resorts Raised to Outperform at Credit Suisse; PT A$13

- Vulcan Steel Rated New Outperform at Credit Suisse; PT A$8.90

- F&P Healthcare Cut to Neutral at Goldman; PT NZ$33.68

- Arena REIT Cut to Neutral at Evans & Partners Pty Ltd; PT A$4.32

- Bapcor Cut to Equal-Weight at Morgan Stanley; PT A$7.80

Major Movers Today

Have a great night

James, Harry and the Market Matters Team.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

5 stocks mentioned