The Match Out: ASX edges higher, Commodities bounce back led by Energy

It was a reasonable day for Australian stocks despite a hotter than expected inflation print in the US overnight, the index opening on the front foot and remaining firm for the session. Buying in the technology, energy and materials sectors was the obvious takeaway, which certainly suits our current positioning.

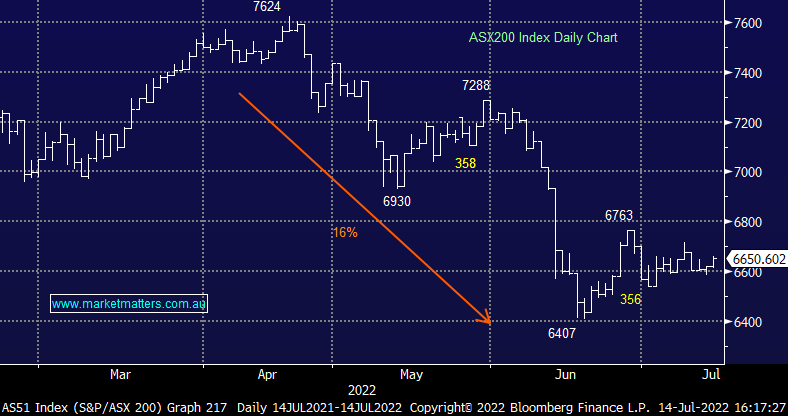

- The ASX 200 finished up +29pts/ +0.44% at 6650

- The IT sector was best on ground (+2.07%) while Energy (+1.74%) & Materials (+1.56%) were also strong.

- Real-Estate (-1.06%) and Financials (-0.83%) the weakest links.

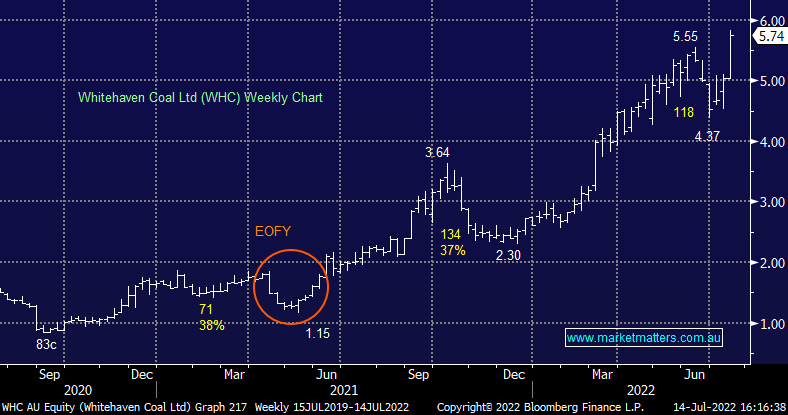

- Coal stocks rallied hard on news that China may lift the ban on Aussie Coal – Whitehaven (ASX: WHC) +6.49%, New Hope (ASX: NHC) +5.72%

- Lake Resources (ASX: LKE) -10.37% came back online and fell following the short report out from J Cap.

- Pilbara Minerals (ASX: PLS) +3.8% rallied despite achieving a marginally lower price for a recent shipment.

- Commodity stocks bounced back across the board – BHP +1.3%, Oz Minerals (ASX: OZL) +2.19% and Fortescue Metals (ASX: FMG) +2.47%.

- Select Harvest (SHV) +1.35% edged higher on a better than feared trading update – the sting in the tail from the Bee’s not as bad as feared.

- Bega Cheese (ASX: BGA) -8.45% whacked on higher milk prices which will hurt earnings.

- Netwealth (ASX: NWL) +4.74% rallied on good quarterly flows of $2.72 billion vs. $2.64 billion QoQ.

- Iron Ore was flat in Asia after a tough period

- Gold was hit, trading down ~US$17 at ~US$1717

- Asian stocks were mixed Hong Kong was down -0.27%, Japan +0.98% while China was flat.

- US Futures are all lower, down around -0.60%

ASX 200 chart

Market Matters – Weekly Video Update

In this week’s video update, James & Harry discuss the annual performance of Market Matters Portfolios – a tough year but it’s so important to cover performance in the good times and during periods of weakness. They also discuss the inflation print, market positioning & dynamics along with the upcoming reporting season in Australia.

Coal markets

Coal stocks ripped higher today on the back of this headline….

MARKET SOURCES SAY CHINA MAY REVERSE ITS UNOFFICIAL BAN ON AUSTRALIAN COAL IMPORTS IN AUGUST OR SEPTEMBER AND SOME STEEL MILLS ARE ALREADY MAKING PREPARATION - SXCOAL.COM.

The backstory is that in 2020 China put bans on using Aussie coal which impacted met coal (used in Steelmaking) more so than thermal coal (used in power generation) suggesting that any ban unwind might benefit met coal volumes and prices. It’s been an amazing couple of years in the coal market - the so-called old energy on a pathway to oblivion … yet the best commodity performer in FY22 and the best so far in FY23 to date. This has clearly supported coal stocks with Whitehaven Coal (WHC) being our best portfolio performer during FY22, the company is now printing ~$300m of free cash flow per month, clearly a huge number.

Whitehaven Coal (WHC)

Pilbara Minerals (PLS)

PLS +3.81%: auctions off a small amount of its production and the prices achieved were slightly lower than the prices achieved three weeks ago for a similar sort of cargo implying that Lithium prices may have peaked. The discount was small (~2.5%) and the bidding was still strong, but the heat has come out of the market it seems. That shouldn’t come as a surprise and the equities have clearly priced this in, hence the move higher today given the discount was only slim.

Pilbara Minerals (PLS)

Select Harvests (SHV) $5.27

SHV +1.35%: the almond grower provided a trading update following the completion of their latest harvest saying 100% of the almonds had now been secured. There were some drawbacks though with wet weather meaning a portion of the crop would need to be mechanically dried at a cost, while freight remains an issue and will likely push out any cash flow. These issues were largely well understood and the market was comforted by their update on the Varroa mite infestation saying it had seemed to be contained which should lead to a relaxation of restrictions hopefully in time for pollination next month. Select was also bullish on almond prices, securing $6.64/kg for the initial 62% of the crop while California’s production outlook continues to be downgraded.

Select Harvests (SHV)

Broker moves

- IDP Education Raised to Add at Morgans Financial Limited

- 29Metals Cut to Underperform at Credit Suisse; PT A$1.15

- OZ Minerals Cut to Underperform at Credit Suisse; PT A$13

- Evolution Raised to Neutral at Credit Suisse; PT A$2.50

- Sandfire Cut to Underperform at Credit Suisse; PT A$2.70

- Viva Energy Rated New Hold at Barclay Pearce Capital; PT A$2.82

- ASX Raised to Equal-Weight at Morgan Stanley; PT A$80.50

- Viva Energy Cut to Neutral at Credit Suisse; PT A$2.77

- IDP Education Raised to Positive at Evans & Partners Pty Ltd

- Hotel Property Raised to Overweight at JPMorgan; PT A$3.80

- Dexus Raised to Overweight at JPMorgan; PT A$11.50

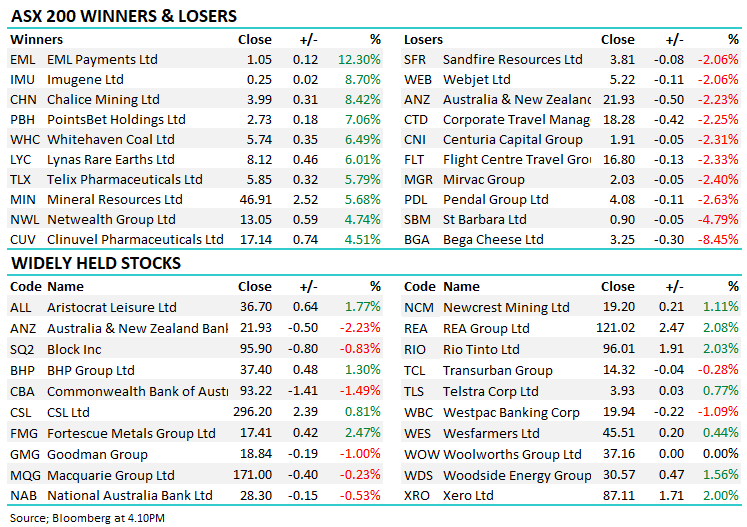

Major movers today

Have a great night,

The Market Matters team.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

8 stocks mentioned