The Match Out: ASX ends higher in a choppy session, Z1P buys SZL and raises equity

The ASX closed higher today however by a lesser margin than the futures had implied on Saturday morning (+165pts) following a strong rally on Wall Street, the weekend news flow took some of the sheen off Friday’s impressive gains. Still, the ASX finished +0.70% despite US Futures trading -2.7% lower at their worst today while Asian markets also fell into the red. Materials and Energy stocks were well supported while the risk-off IT sector led the other side of the ledger.

- The ASX 200 finished up +51pts/ +0.73% at 7049.

- The Material sector was the best on the ground (+2.99%) while Energy (+1.35%) and Real-Estate (+0.85%) were also strong.

- IT (-0.58%) and Financials (-0.33%) the weakest links.

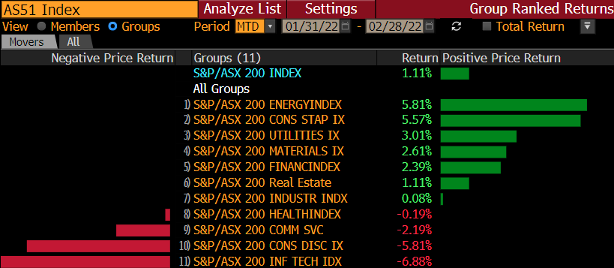

- For the month of February, the ASX actually closed up, though it certainly didn’t feel like it. But a +5.80% gain from Energy and a +5.57% advance from Consumer Staples was key.

- Zip Co (ASX: Z1P) was in a trading halt today raising $149 million via institutions at $1.90, it also announced the acquisition of Sezzle (ASX: SZL) and their 1H22 results.

- Sandfire (ASX: SFR) -4.29% delivered a weak 1H22 result missing consensus at the profit line by ~20%.

- Reporting season is pretty much in the rear-view mirror now and overall, it’s been strong – on UBS numbers, the beats outnumbered misses 4:3 while we’ve seen overall earnings growth estimates upgraded by 2%.

- The Energy, Financials and Media sectors were particularly strong. Energy's strength was due to price support, but Financials and Media provide a positive read-through for the broader economic picture.

- Supply chains and labour shortages were an issue and most companies think these will persist, that’s also feeding inflationary pressures however most companies are successfully passing through increased costs to the end consumer, therefore maintaining margins.

- All in all, we think it was a good reporting season against a challenging backdrop.

- Iron Ore was up ~2% in Asia today.

- Gold rallied $US19 at $US1908 at our close.

- Asian stocks were mostly lower, Hong Kong -0.81%, Japan +0.19% while China was flat.

- US Futures are all lower, Nasdaq down -2.36%, S&P down -2.2%.

ASX 200

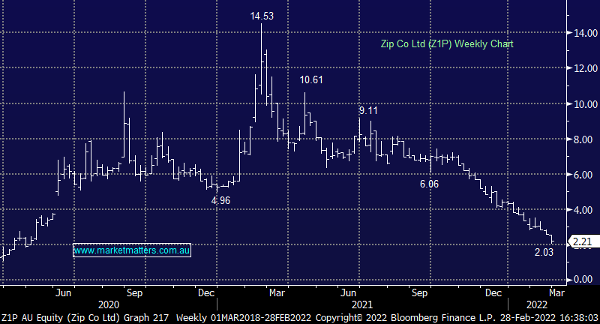

Zip Co (ASX: Z1P) $2.21

Z1P Trading Halt: The Buy Now Pay Later (BNPL) company was in a trading halt today following the announcement of their 1H22 results, the acquisition of competitor Sezzle (ASX: SZL) and a around $200 million equity raise priced at $1.90, $149 million of which is underwritten. The price of $1.90 represents a 14% discount to the last close. We attended a management presentation today as they went through the rationale for the deal with the big one being scale. While the timing could be better in terms of both the geopolitical backdrop and the level of the Zip share price, it seems clear that a combined group will have a better chance of reaching profitability in a palatable time frame, with a better platform in the US to attract large merchants.

Zip Co

Sandfire (ASX: SFR) $6.70

SFR -4.29%: the copper & gold miner was out with a soft 1H22 result today. NPAT of $US55 million was well below consensus at $US69 million and an interim dividend of 3 US cents a share was two-thirds of what analysts had expected. The numbers were largely overshadowed by the company's first update on the recently completed acquisition of MATSA mine in Spain with Sandfire taking control at the start of Feb. Sandfire expecting 26kt of copper in the five months of this year out of their new asset while looking at expansion options. They also maintained guidance at the flagship DeGrussa asset.

Sandfire

Sectors in February (Source: Bloomberg)

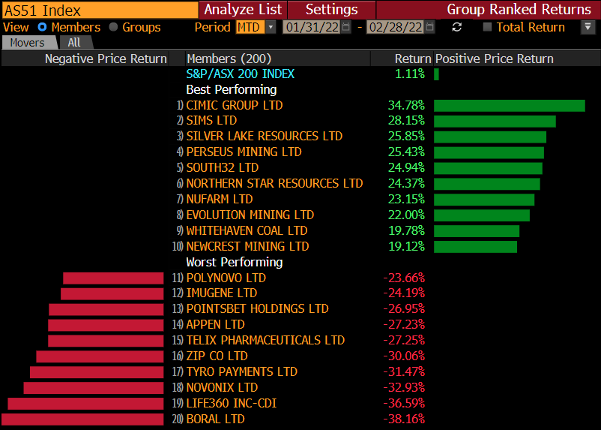

Stocks in February (Source: Bloomberg)

Broker moves

- Mayne Pharma Cut to Hold at Bell Potter; PT 26 Australian cents

- Domino's Pizza Enterprises Cut to Neutral at Goldman; PT A$89.90

- Bravura Cut to Neutral at Goldman; PT A$1.90

- Brambles Cut to Neutral at Macquarie; PT A$10.55

- Nearmap Raised to Outperform at Macquarie; PT A$1.40

- Cochlear Rated New Underperform at RBC; PT A$149

- Qantas Cut to Neutral at Citi; PT A$5.51

- Medibank Private Raised to Buy at Citi; PT A$3.65

- Charter Hall Group Raised to Outperform at Credit Suisse

- Adbri Cut to Neutral at JPMorgan; PT A$3.30

- Kogan.com Cut to Neutral at Credit Suisse; PT A$5.53

- Bravura Raised to Overweight at JPMorgan; PT A$2.35

- National Storage REIT Raised to Overweight at JPMorgan

- Brambles Raised to Hold at Jefferies; PT A$8.91

- Medibank Private Raised to Add at Morgans Financial Limited

- Lynas Raised to Buy at Canaccord; PT A$12.

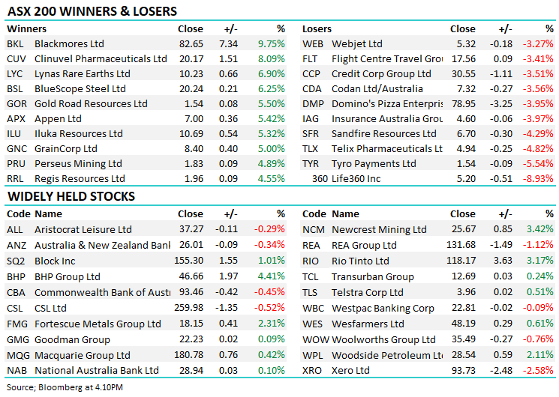

Major movers today

Enjoy your night,

The Market Matters team.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

3 stocks mentioned