The Match Out: ASX falls, The market finally starts to notice rising interest rates, Have a great weekend all

It was a very weak session to end the month with all sectors on the ASX finishing weaker. The real estate stocks were hit hardest on the expectation of rising interest rates curtailing asset prices, while Healthcare stocks proved defensive, down by just 0.1%. For the month of October, the market was flat - five sectors outperformed led by IT & Healthcare.

- The ASX 200 fell -106pts /-1.44% to 7323 today – the sell-off was very consistent throughout.

- The banks finally felt the brunt of rising interest rates today with yields rallying strongly across the curve – the 10 year Aussie bond yield cracked 2% while the three-year finished the week at 1.22% - more on that below.

- Recent portfolio addition Resmed (ASX: RMD)+4.21% reported quarterly earnings this morning, beating expectations by around 5% at the revenue line and around 10% in terms of profit. Operating profit was up around 20% for the period – a good outcome.

- Macquarie (ASX: MQG) was in a trading halt today following a good first-half result with a profit of $2 billion, broadly in line with expectations. It is also tapping the market for $1.5 billion in fresh capital.

- Dubber (ASX: DUB) -0.65% released first-quarter 2022 results this morning, which was broadly in line with our expectations. We like this stock and hold it in our Emerging Companies Portfolio.

- Vulcan (ASX: VUL) -16.54% back online following this week's “short report”.

- Gold was flat in Asia today at $US1795, it just can’t get a move on above US$1800.

- Iron Ore Futures were also lower, down around 3%.

- Asian markets were mixed, Japan up +0.27%, Hong Kong -0.13% while China added +0.60%.

- US Futures are down but not materially so – the sell-off in Australia today was very focused.

ASX 200 Chart

Bond Markets

We’ve written extensively over recent months about rising bond yields, however, even this week’s move surprised us. The three-year bond yield closed the week out at around 1.22%, having started at around 0.73% - a huge move in any market, but particularly so amongst bonds. As the AFR rightly pointed out this afternoon, and it’s taken a while for the media to catch onto this, bond traders that backed the RBA’s view of the world were broken. Last week saw the RBA step into the market to suppress yields. Many thought it would do the same this week, but this didn’t occur, reinforcing the view that the RBA will drop its guidance of no rate increases until 2024 in response to rising inflation. The three-year yield is certainly now pricing that in.

Australian 3 year bond yield

Sectors this week (Source: Bloomberg)

Stocks this week (Source: Bloomberg)

Broker moves

- Coles Group Raised to Overweight at Jarden Securities

- Reece Raised to Neutral at Macquarie; PT A$18.40

- Platinum Asset Raised to Neutral at Macquarie; PT A$3.15

- JB Hi-Fi Raised to Outperform at Macquarie; PT A$52.50

- Alliance Aviation Raised to Overweight at Wilsons; PT A$4.50

- Damstra Holdings Cut to Market-Weight at Wilsons

- ANZ Bank Raised to Buy at Jefferies; PT A$34.15

- Nickel Mines Raised to Buy at Shaw and Partners; PT A$1.24

- Collins Foods Rated New Buy at Litchfield Hills; PT A$9.32

- DEL AU Raised to Speculative Buy at Morgans Financial Limited

- Reece Raised to Hold at Morgans Financial Limited; PT A$18.40

- Chalice Mining Rated New Hold at Jefferies; PT A$7.20

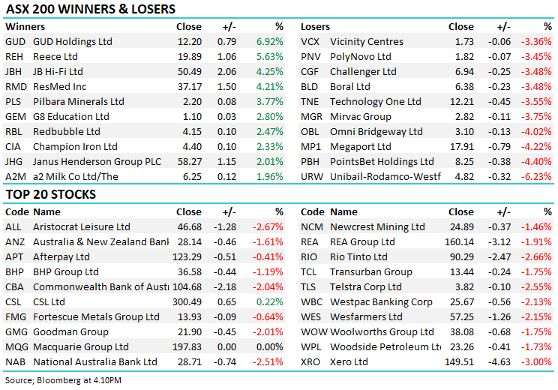

Major movers today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

4 stocks mentioned