The Match Out: ASX flat, Real estate rallies, Several AGMs and production reports today

There’s been plenty going on from a corporate perspective today, with a bunch of AGMs and trading updates attracting most of the attention. Property stocks were the best on the ground, while Energy fell again – but it was very quiet indeed at the index level. From a seasonal perspective, the end of October, November and the start of December are generally flat at best before the Christmas rally kicks into gear towards the end of December. While there’s no guarantee that will play out, we do take seasonal influences into account.

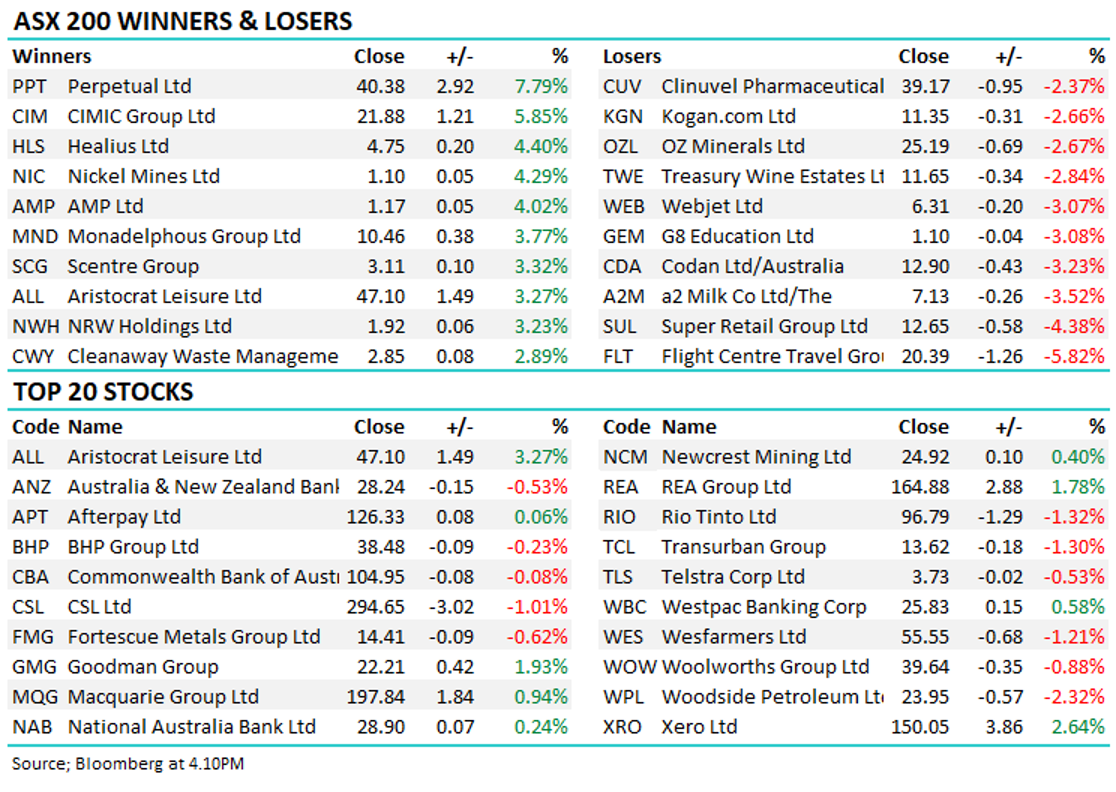

- The ASX 200 added 1pt /+0.02% to 7415.

- Property and IT led the line, Energy and Staples were weak.

- Healius (ASX: HLS) +4.4% was strong after the diagnostics company reported a 44% increase in first-quarter revenue, driven by COVID-19 testing.

- Aristocrat (ASX: ALL) +3.17% was strong on the first day of trade after the gaming machine manufacturer successfully bought British gambling software developer Playtech.

- AMP (ASX: AMP) reported Australian wealth management net cash outflows for the third quarter of $1.39 billion versus outflows of $1.95 billion year-on-year – so, not good, but getting less bad – the stock rallied 4.02%.

- Flight Centre (ASX: FLT) -5.82% is raising money via a convertible note to repay a Bank of England COVID-19 Corporate Financing Facility on maturity in March 2022 plus to fund future growth opportunities. The deal involves an equity hedge of 3.5m shares done at $21. Expect the stocks to become more subdued around the $21 mark.

- A decent production update from South32 (ASX: S32) today. Operationally, the company is doing well and tailwinds across key commodities – met coal, nickel, aluminium, alumina and now lead and zinc – will certainly assist margins heading in FY22. The stock was +0.26%.

- Ditto for Iluka (ASX: ILU) with good production and sales scorecard. Downstream markets continue to be strong with some supply uncertainty which has kept prices high.

- Gold was higher in Asia, +$US14 to $US1784, Iron Ore Futures were flat.

- Asian markets were mixed, Japan down -1.5%, Hong Kong -1% while China added +0.20%.

- US

Futures are trading flat

ASX 200

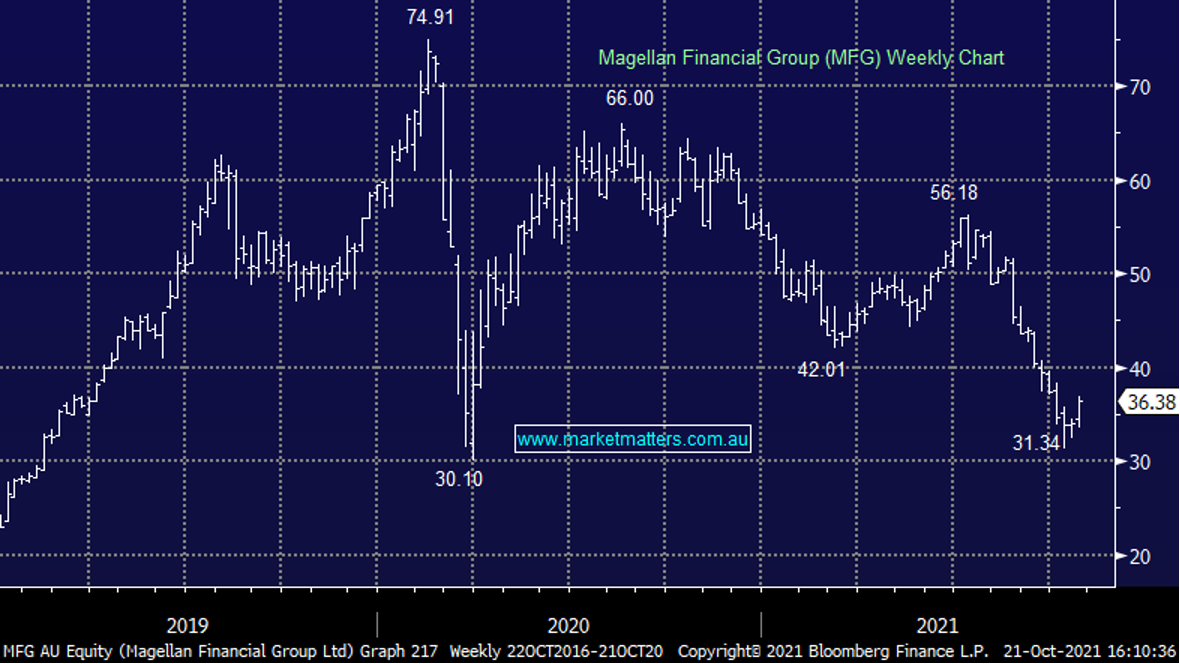

Magellan (ASX: MFG) $36.37

MFG +2.31%%: Held its AGM today and this is where its Chairman and CIO shines. Hamish Douglass is a very accomplished orator and today that was enough to see the shares higher. He focused more on Barrenjoey, the star-studded investment bank that Magellan owns 40% of, saying they have made a profit in the first quarter of 2022 after booking a big loss in FY21 – though, in fairness, that was a result of a full year of costs and only a few months of revenue. As we wrote only a few days ago, the real key will be around addressing the performance of its flagship portfolio which is up just 7.57% over the past 12 months. But Hamish is a smart operator and one of the best pieces of advice I was ever given early on was to back intelligence.

MM has now turned bullish MFG.

Magellan Financial Group

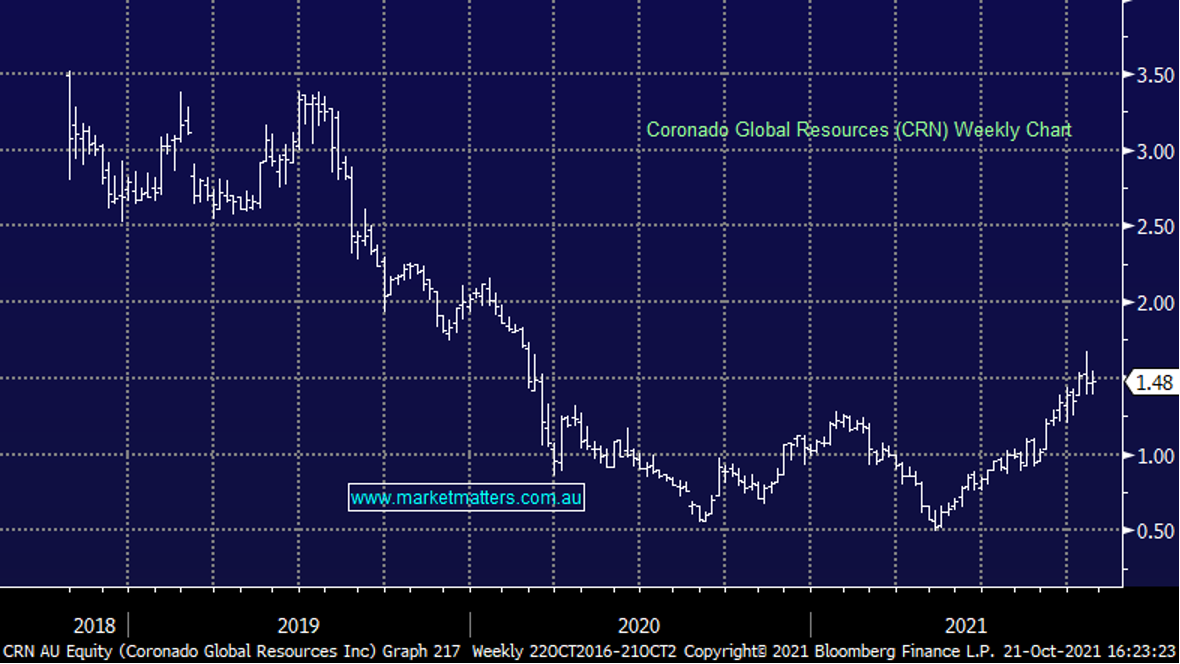

Coronado (ASX: CRN) $1.48

CRN +0.34%: Third-quarter production out for the coal miner today with production up almost 7% on the quarter to 4.5mt. Revenue surged 35% though with strong coal prices coming through. Net debt dropped to a measly $US154m, down $US82m in the three months, compared to revenue for the quarter of $US574m – at this rate Coronado expects to be net cash before the year is out, coming a long way since the capital raise a few months ago. They did flag production for the year would come in at the low end of guidance, while mining costs would be above the previous range as a result of higher AUD however this was overshadowed by positives throughout the rest of the announcement.

MM remains bullish and long CRN

.

Coronado

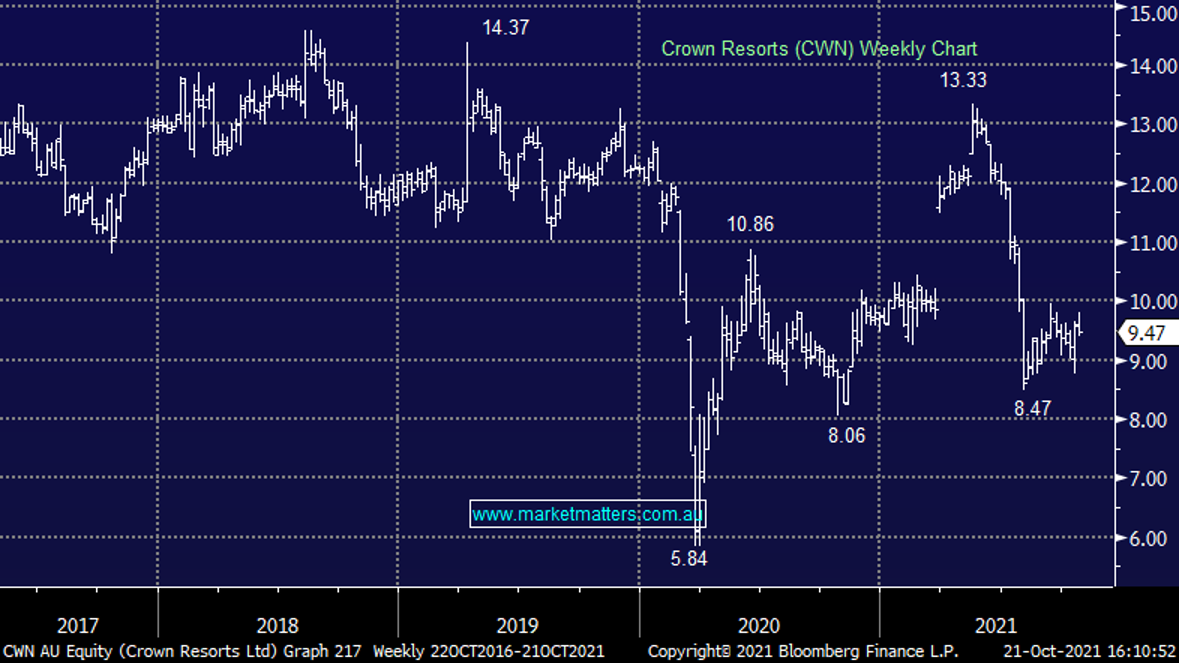

Crown Resorts (CWN) $9.47

CWN -0.53%: held its AGM today and there wasn’t a lot of news to report. Management reiterated the huge refresh that has occurred at board and senior management level, they talked to opportunities in the future but near term challenges, and they copped heat (and rightly so) from shareholders about termination payments that were excessive, delivering the board with a second strike. The only real bright spots were Perth and apartment sales in Sydney, which is going to fuel further delevering of the company’s balance sheet while the outcome around their licensing remains the key variable. When all is said and done, we suspect Crown will retain the licenses under stricter conditions, but if we’re wrong and they don’t, we estimate the property portfolio alone is worth between $8 and $8.50 a share.

MM remains bullish Crown (CWN).

Crown Resorts

Broker moves

- Panoramic Resources Raised to Outperform at Macquarie

- OZ Minerals Cut to Neutral at Citi; PT A$27

- Star Entertainment Cut to Neutral at Evans & Partners Pty Ltd

- Senex Cut to Neutral at Jarden Securities; PT A$4.45

- Flight Centre Cut to Neutral at Jarden Securities; PT A$21.30

- Brambles Raised to Neutral at Jarden Securities; PT A$11.14

- Charter Hall Retail Cut to Hold at Moelis & Company; PT A$4.12

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

7 stocks mentioned