The Match Out: ASX gives some recent strength, Commodities weigh, MQG 1H beats

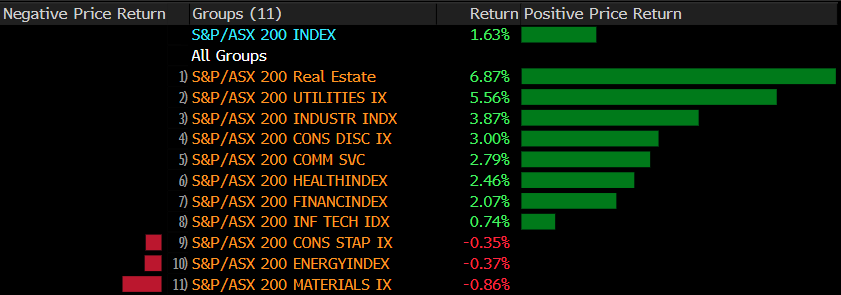

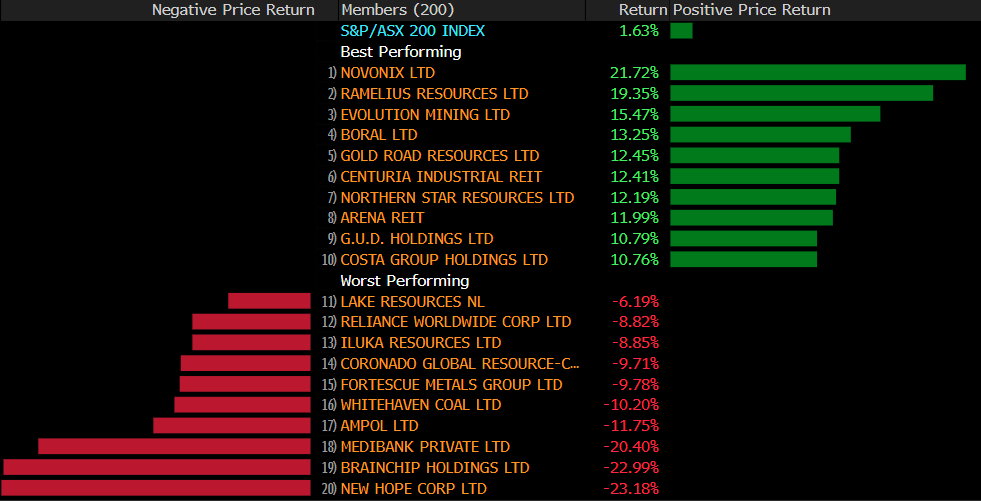

Commodity weakness forced the ASX to give up much of this week’s strong gains, trading lower into the weekend. There was little appetite to buy ahead of the break with markets taking a cautious view. Tech was also in the firing line, finally succumbing to the weakness seen in the Nasdaq this week. Banks found their feet today though to help stem some of the selling, recovering some of yesterday’s slide. Despite today’s weakness, the ASX closed up +108pts/+1.63% this week.

- The ASX 200 finished down -59pts/ -0.87% at 6785.

- The Real Estate sector was best on ground (+1.15%), just ending our Utilities (+1.11%)

- The main drag came from materials (-4.01%), while tech was also week, the sector falling -2.19% today

- Commodity weakness was the main drag on the market today with USD strength overnight flowing into softness across the board today.

- Macquarie (ASX: MQG) -0.02%, posted a strong 1H today, profit beating expectations by ~5%, coming in 13% ahead of pcp though down on the second half of 2021. Better than expected numbers from their commodity and banking arms drove the beat.

- Calix (ASX: CXL) -18.98%, announced the government has pulled two key grants with the stock trading back to the level they raised capital at last week. More below

- ResMed (ASX: RMD) -5.01%, was lower post their 1Q update with margins below expectations the key issue for the market.

- Mincor (MCR) -14.83%, struggled with nickel weakness, combined with a soft outlook as they ramp up their new mine. Production guidance of 8-10kt was below the ~14kt expected this year.

- Iron Ore was ~4% lower in Asia today, weighing on the bulk commodity miners. Fortescue (ASX: FMG) fell to almost 12-month lows, down -XX% today

- Gold edged higher today, but trades below yesterday afternoon’s level, $US1665 at our close.

- Asian stocks were mixed, Hong Kong and China rallying ~2% but Japan falling -0.25%

- US Futures are all trading lower, S&P down -0.55% and Nasdaq -0.85%.

ASX 200 Chart

Calix (CXL) $4.44

CXL -18.98%: the green industrial solutions business was smacked today after it was notified two separate grants announced by the Morison Government had been pulled by the new Labor Government. In May, Calix were granted $11m to a carbon capture project with AdBri (ABC), and a $30m grant for a project with Boral (BLD) both for carbon capture technology in production. While the new government certainly has a more significant emissions focus, it seems carbon capture has fallen by the wayside. In any case, AdBri has confirmed it plans to push on with the project, with or without the grant, but Boral is yet to update Calix on its plans. While disappointing, today’s share price reaction was overdone, likely on the back of volume coming out of recent sellers. We are eligible for the SPP which closes on November 10.

Macquarie (MQG) $166.50

MQG -0.02%: first half results were out for the investment bank came in 5% ahead of expectations today, though the stock gave up strong gains into the afternoon. The result was driven by a $2b net profit from their commodities business, and the company lifted guidance for this segment from a small fall for the full year, to a small increase. Banking and Financial Services also came in better than expected but MacCap and the Asset Management arm were weak. The company was largely cautious near term as financial market activity remains constrained.

Sectors this week – Source Bloomberg

Stocks this week – Source Bloomberg

Broker Moves

- Westgold Cut to Neutral at Macquarie; PT 90 Australian cents

- ANZ Bank Cut to Negative at Evans & Partners Pty Ltd; PT A$21

- Fortescue Raised to Reduce at CLSA; PT A$16.25

- Fortescue Cut to Reduce at Morgans Financial Limited; PT A$14.30

- Ramelius Raised to Buy at Ord Minnett; PT A$1.25

- Altium Cut to Reduce at CLSA; PT A$36

- ANZ Bank Cut to Equal-Weight at Morgan Stanley; PT A$25.50

- Xero Reinstated Buy at CLSA; PT A$96

- Panoramic Resources Raised to Outperform at Macquarie

- Adore Beauty Cut to Hold at Shaw and Partners; PT A$1.80

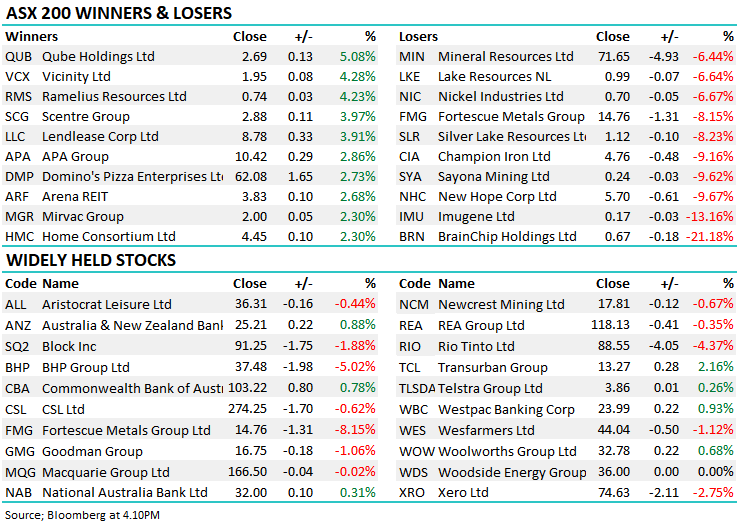

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

4 stocks mentioned