The Match Out: ASX slides, Banks and Tech weigh, Travel stocks hit as global case counts rise

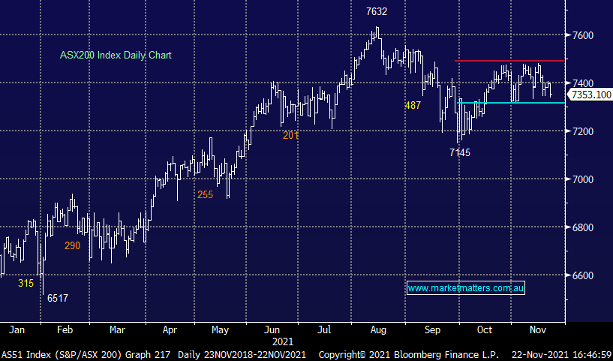

It was another choppy open this morning. The index was jumping at shadows, something that really typified the rest of the day, the broader market finishing down -0.60%. This was weighed down by the IT and Energy sectors, as the Christmas rally remains elusive for now.

- The ASX 200 finished down -43points / -0.59% at 7353.

- Materials were strong, led by the Lithium stocks while Iron Ore also edged higher, Fortescue Metals (ASX: FMG) +2% had a reasonable session.

- Gold stocks were on the nose after weakness in bullion on Friday night and only a $3 bounce in Asia today – Gold is sitting around $US1848.

- Banks struggled again, most down 2% on margin concern stemming from CBA’s update last week.

- Travel stocks hit on rising case counts in Europe, Qantas (ASX: QAN) -4% the one we own in our Flagship Growth Portfolio.

- Nickel Mines (ASX: NIC) +7.98% had a good day as they announce a plan to operate “cleaner”.

- Calix (ASX: CXL) -7.49% down however it was down more early as the ASX queried their last announcement - we like CXL around $7.

- Regis Resources (ASX: RRL) -3% was weak despite hosting its first investor day that focused on exploration.

- Asian markets were mixed, The Nikkei in Japan flat, Hong Kong -0.25% & China +0.19%.

- US Futures are all trading marginally higher.

ASX 200 chart

Regis Resources (ASX: RRL) $2.06

RRL -3.29%: Hosted its first exploration update today and they’ve committed to doing these twice a year to improve communication with the market, the crux of it being they don’t think investors fully understand what they are sitting on. In any case, these updates will provide good insight into RRL’s exploration progress which is important. Exploration increases reserves, more reserves = more cash flow and importantly, longevity in cash flow which over time will increase the net present value (NPV) of its asset base – all of this should be reflected in an increasing share price all things being equal. The key takeaway for us from today’s update is that RRL’s WA operations are likely to have much longer mine lives than currently suggested by reserves and that will be a positive for the share price over time.

MM views RRL as deep value amongst the gold stocks.

Regis Resources

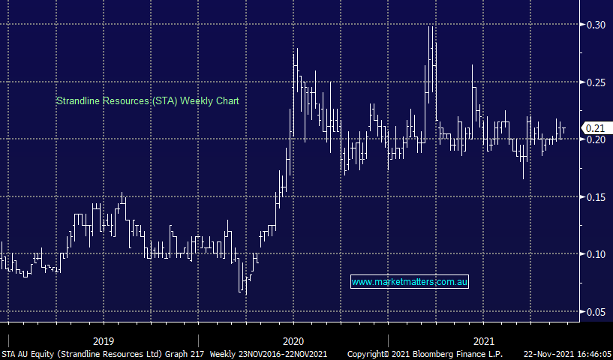

Strandline (ASX: STA) 21 cents

STA +5%: more movement brewing for Strandline as it works towards the first production at WA’s Coburn mineral sands project. Management has signed a 10-year mine-to-ship logistics and port storage contract with Qube, in line with its original forecasts. Prices across the mineral sands commodity deck have soared recently, and with first shipping now 12 months away, Strandline is in the box seat to take advantage. Costs for each stage of the build are coming in at or below expectations, which is important in an environment where cost inflation has clearly increased.

MM is long and bullish STA.

Strandline

Nickel Mines (ASX: NIC) $1.285

NIC +7.98%: the nickel pig iron producer announced a new agreement with partner Shanghai Decent to boost production and reduce carbon footprint, as well as participate in the production of battery-grade nickel. The Memorandum of Understanding outlines the acquisition of four new rotary kiln electric furnaces (RKEF) in Indonesia, each to produce 9ktpa as well as invest in a 200MW solar power plant to help power the kilns. Nickel Mines will need to fund around US$525 million with a cap raise likely to cover a portion of the costs, likely early next year with a definitive agreement due by the end of January. The MoU also agrees to explore the feasibility of developing Nickel Mines high-grade nickel resources. This is the sort of announcement that we should expect more of from resources companies, as they work hard to meet the stringent ESG requirements of end customers.

MM is bullish NIC.

Nickel Mines

Broker moves

- Dalrymple Bay Raised to Buy at Jefferies; PT A$2.35

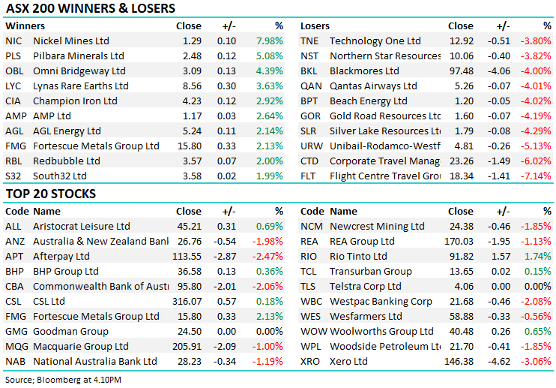

Major movers today

Enjoy your evening

James, Harry and the Market Matters Team.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

5 stocks mentioned