The Match Out: ASX ticks higher to close marginally lower on the week, Industrials lead the move

The ASX brushed weakness seen overseas for the second straight session, ticking higher into the weekend. There were limited catalysts to drive markets today with the path of most pain still seen as being higher as investors are caught short on equity allocations. Industrials and Telcos were the main winners today, the latter dragged higher by heavyweight Telstra (TLS), while a rally in Financials also supported the market. Energy was the weakest of the sectors with oil continuing to slide for now. The ASX200 closed down just -6pts/-0.09% for the week.

- The ASX 200 finished up +16pts/ 0.23% at 7151

- The Industrials sector was the standout today, rising 0.88%. Telcos (+0.81%) and Utilities (+0.66%) were also strong

- Energy (-0.36%) was the weakest sector today, Real Estate (-0.18%) and Discretionary (-0.13%) were the other sectors lower.

- Lovisa (ASX: LOV) -7.13%, hosted their AGM with a trading update for the start of the year showing LFL sales up 19%. They’ve opened 61 stores so far, closing 14 as well though. The update was strong, however, there is a lot in the price up here.

- Oz Minerals (ASX: OZL) +3.95%, announced a second bid from BHP today at $28.25/sh which the board intends to approve. BHP will get 4 weeks in the data room to do its due diligence.

- Sandfire (ASX: SFR) halt, launched an opportunistic capital raise via a 1 for 8.8 share entitlement offer. The $4.30/sh price is a 10% discount to last with the $200m going towards working capital and paying down debt.

- NextDC (ASX: NXT) +1.94%, provided inline guidance at their AGM, seeing strong demand across the board and a cashed-up balance sheet to look at new sites to expand their offering.

- Iron Ore was 3% higher in Asia today, Fortescue (FMG) was the only company in the space with a meaningful move, closing up 2.36%.

- Gold was flat today to US$1717. A mixed day for gold stocks, Northern Star (NST) rallied more than 2% but Newcrest (NCM) fell

- Asian stocks were weaker mixed today, Japan’s Nikkei down -0.14, but Hang Send was up 0.8% and China was up 0.36%

- US Futures are mixed, S&P500 -0.1% but the Nasdaq futures are flat.

ASX 200 Chart

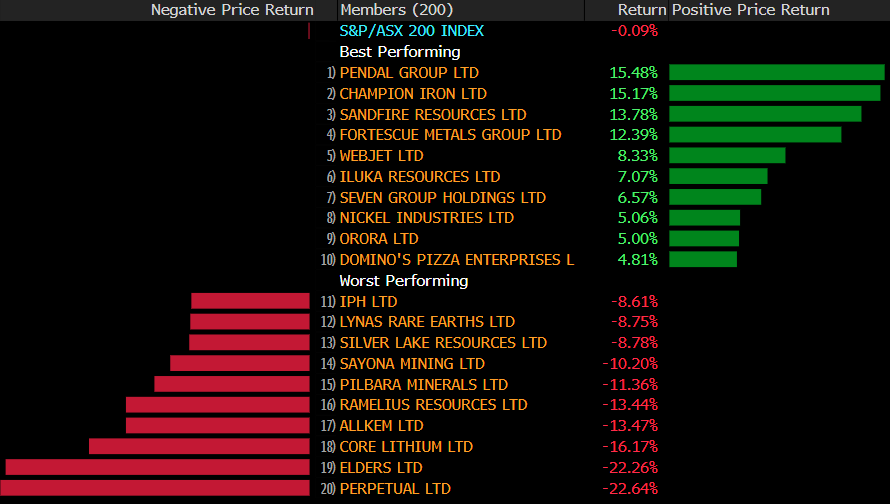

Sectors this week

Stocks this week

Broker Moves

- Hartshead Resources NL Rated New Buy at Barclay Pearce Capital

- ASX Raised to Neutral at Jarden Securities; PT A$70

- Seek Cut to Accumulate at CLSA; PT A$25

- Pendal Group Cut to Accumulate at CLSA; PT A$5.50

- Perpetual Raised to Accumulate at CLSA; PT A$30.60

- Regis Resources Raised to Buy at Canaccord; PT A$2

- Webjet Raised to Outperform at RBC; PT A$7

- Regis Resources Raised to Neutral at Citi; PT A$1.85

- Perpetual Cut to Neutral at Credit Suisse; PT A$27.50

- F&P Healthcare Raised to Buy at Goldman; PT NZ$23.33

- AACO Raised to Buy at Bell Potter; PT A$2.15

- Emeco Cut to Hold at Jefferies; PT 85 Australian cents

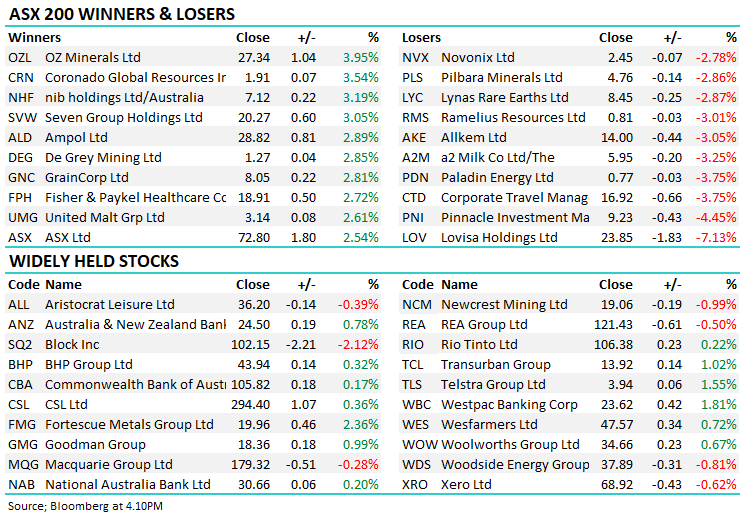

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

4 stocks mentioned