The Match Out: Down today but stocks had a strong week, BOJ pushes yields higher

A soft session to end what has been a positive week overall for equities as the market edged tentatively towards the view that interest rates have peaked. However, as was rumoured overnight, the Bank of Japan (BOJ) today loosened its signature yield curve control measure (artificially suppressing bond yields) which means there is likely more to come. In other words, yields in Japan will likely rise and while it doesn’t directly impact the bulk of Australian companies, it is more important than one might think. The BOJ’s policy effectively anchored long-term bond rates near zero, and as a result, trillions of dollars were forced to venture elsewhere to get returns, such as US or Australian Government bonds. If that is no longer the case, capital is likely to return back to Japan pushing up yields elsewhere.

As Market Matters members would appreciate by now, as long-term bond yields rise, that means higher discount rates on risk assets such as stocks, and lower prices, all else being equal. The implication of this was priced into the US overnight, which sent yields up and stocks down, while the same was true in Australia today, the Aussie 10-year up 14bps to 4.07% while stocks fell 0.70%, with most selling in the interest rate sensitive sectors. While our view remains that yields have peaked, today’s move highlights that this is not going to be one-way traffic.

- The ASX 200 finished down -52pts/ -0.70% at 7403

- Utilities the only sector up (0.12%) while Energy (flat) & IT (-0.01%) were relative performers.

- Property (-1.85%) and Materials (-1.19%) the weakest links.

- Retail sales data was softer than expected, pretty much sealing a pause in rates when the RBA meet on Tuesday, we think.

- For June, retail sales fell -0.8% versus a flat result expected and the prior month of +0.8% (revised from +0.7%).

- NAB expects them to pause, while WBC and CBA have both reiterated their call for a hike, while George Tharenou at UBS, who has called it very well, thinks they will hike once more. When we spoke to him recently, I got the sense that he was wavering on this view, somewhat!

- We think the RBA will pause on Tuesday, and there is now a greater than 50% chance that 4.10% will be peak rates in this cycle.

- Reporting season gets underway next week in Australia – Download the Market Matters Reporting Calendar Here.

- While next week is fairly ‘light on’, things really heat up from Monday 7th August in what will be a critical reporting period for the market. While it’s always important, we think this one has more significance than usual with expectations low, and macro headwinds starting to ease. It is getting easier to construct a bullish case for the market!

- SiteMinder (ASX: SDR) +21.53% rallied strongly as they reconfirmed growth guidance and said they would be EBITDA profitable and free cash flow positive in the 2H of FY24. More on this below.

- Champion Iron (ASX: CIA) -2.67% fell despite reporting solid production (3.4mt) for the 3 months to June 30.

- Other Iron Ore miners were also weaker, Fortescue (ASX: FMG) -5.4% as Iron Ore fell ~3% in Asia, now trading $US106.50.

- A higher $US also put pressure on the gold stocks today, the selling in Regis (ASX: RRL) -8.3% followed through on a raft of broker downgrades.

- Retail stocks held up well despite the weakness in Retail Sales, they care more about the outlook for interest rates it seems.

- Gold was down overnight, but ticked up ~US$5 in Asia to be $US1950 at our close.

- Asian stocks were mostly higher bar Japan, Hong Kong +1.38%, Japan -0.67% while China was up +1.74%

- US Futures are all up, around +0.30%

ASX 200 Intraday

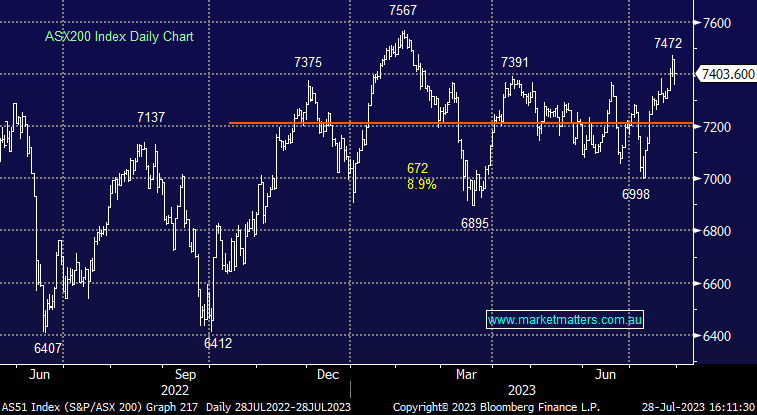

ASX 200 Daily

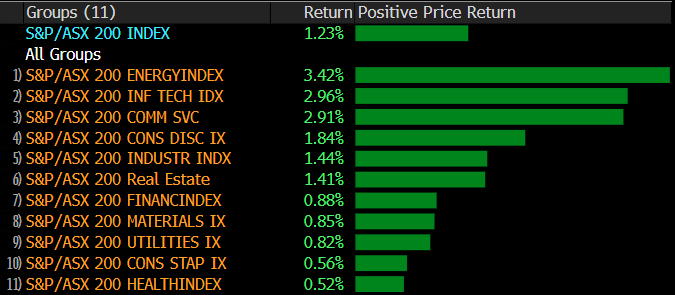

Sectors this week

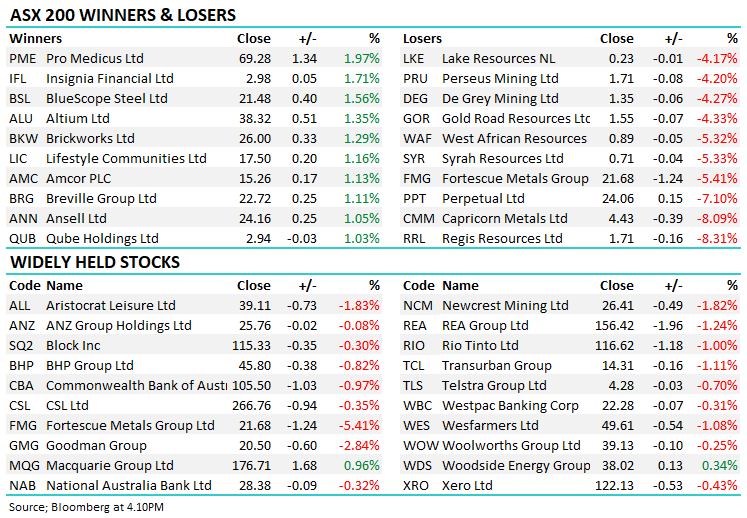

Stocks this week

SiteMinder (SDR) $4.29

SDR +21.53%: the accommodation booking platform hit the highest level since February in the latest upgrade in the travel and tourism space. SiteMinder, the booking and payment engine behind a number of hotels, said revenue for FY23 was expected to grow 30.5% thanks mostly to a 65.6% growth in transaction revenue.

Annualised Recurring Revenue (ARR) will be up more than 24% in the year organically while the number of properties on their platform grew 12.7%. They are still loss-making with FCF loss of $5.3m in the final quarter, however, the company remains on track to hit FCF and EBITDA positive by the second half of this year with $50m+ currently in the bank to get them there. Overall, a great update from the company with strong growth and a massive accessible market ahead of them.

Broker Moves

- Panoramic Resources Cut to Neutral at Macquarie

- Fortescue Cut to Sell at CLSA; PT A$19.50

- CBA Cut to Underweight at Jarden Securities; PT A$97.50

- Regis Resources Cut to Hold at Canaccord; PT A$2

- Premier Investments Raised to Overweight at JPMorgan; PT A$25

- Magellan Financial Reinstated Neutral at Goldman; PT A$8.83

- Platinum Asset Reinstated Sell at Goldman; PT A$1.52

- Allkem Raised to Accumulate at CLSA; PT A$17.75

- Hot Chili Rated New Buy at Beacon Securities; PT A$2.79

- Pro Medicus Raised to Buy at Goldman; PT A$76

- Perseus Raised to Buy at Cormark Securities; PT A$2.23

- Regis Resources Cut to Hold at Morgans Financial Limited

- Megaport Raised to Buy at Jefferies; PT A$12.55

- Downer EDI Cut to Neutral at Credit Suisse; PT A$4.40

Major Movers Today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

4 stocks mentioned