The Match Out: Early optimism fades, Zip and Sezzle no longer shacking up, Good update from Eagers

A mixed bag today with defensives holding up while anything growth-related fell away – low volume again for the ASX keying off a similar theme in the US (slowest session of the year overnight) ahead of inflation data tonight + earnings season kicking into gear.

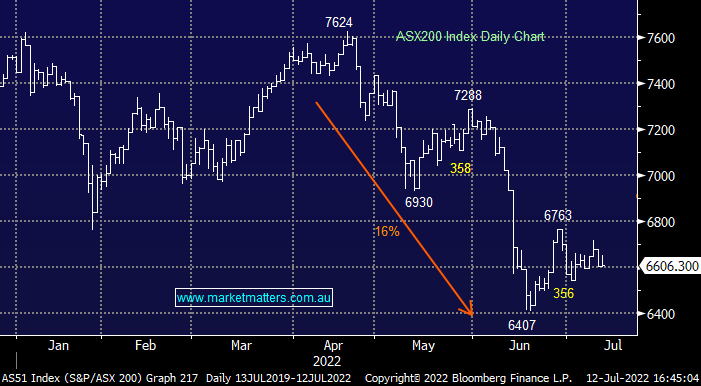

- The S&P/ASX 200 added +4 points / +0.06% to close at 6606 - it was up strongly early on but tapered off in line with US Futures.

- Utilities (+1.24%), Consumer Staples (+1.20%) and Healthcare (+1.11%) standouts on the upside

- Materials (-1.16%) and Telco’s (-0.75%) the weakest links.

- CSL & Resmed (RMD) caught my eye today, CSL now fast approaching our ~$300 target – an easy place to hide.

- Lake Resources (LKE) was in a trading halt following the short report released by J Cap after close yesterday – we covered this in the Market Matters Report this morning – Click Here

- The other Lithium stocks were lower, Allkem (AKE) -4.8% the weakest while our preferred exposure IGO was -0.31% and Pilbara (PLS) -2.18%, both down but not by a lot.

- eCommerce stocks were hit today, consumer confidence ticked lower again according to an ANZ/Roy Morgan survey however after a sharp rally in recent days, the likes of Kogan (KGN) -9.67%, Temple & Webster (TPW) -16.57% and our nemesis Adore Beauty (ABY) -8.88% all fell away sharply.

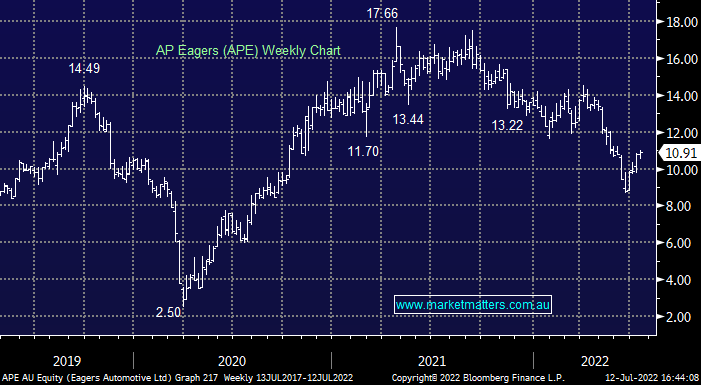

- Eagers (APE) +3.31% rallied on a solid update today - it’s been a tough 12 months for APE down ~30%

- Zip Co (Z1P) +6% & Sezzle (SZL) -38.55% had divergent performances after terminating their proposed merger agreed in February. This is unlikely to help sector sentiment in the short term.

- Overnight Klarna has also confirmed the terms of a major funding round with the valuation down ~80% from May 2022 peak valuation.

- A rise in covid cases is knocking the travel-related stocks again – Qantas (QAN) -3.42% hit hardest.

- US Inflation data out tonight, a hotly watched release with consensus being for +8.8% YoY

- Iron ore futures were down another 2% today in Asia - now trading US$107/tonne in Singapore

- Gold was down US$3 at US$1730/oz at our close.

- Asian markets were down, the Nikkei in Japan -1.38%, Hong Kong stocks fell -1.22% while China was off -0.66%

- US Futures are trading lower and have drifted that way throughout our session – all down ~0.50%

ASX 200 Chart

Eagers Automotive (APE) $10.91

APE +3.31%: the Australian & NZ auto dealership company saw shares trade higher today after a strong first-half update. Underlying pre-tax profit is expected to come in around $195m, around 5% above guidance provided in May of $183-189m. The car market has been struggling to get its hands on supply, so Eagers now has a record new car order book while cost-out programs are further supporting earnings. They completed the sale of Bill Buckle Auto as expected on 30 June, adding another $83m to their pile of cash which now stands at $326m. This balance sheet strength supports plans to buy back 10% of shares on issue over the next 12 months.

Broker Moves

- Beacon Lighting Rated New Positive at Evans & Partners Pty Ltd

- Link Administration Cut to Hold at Morgans Financial Limited

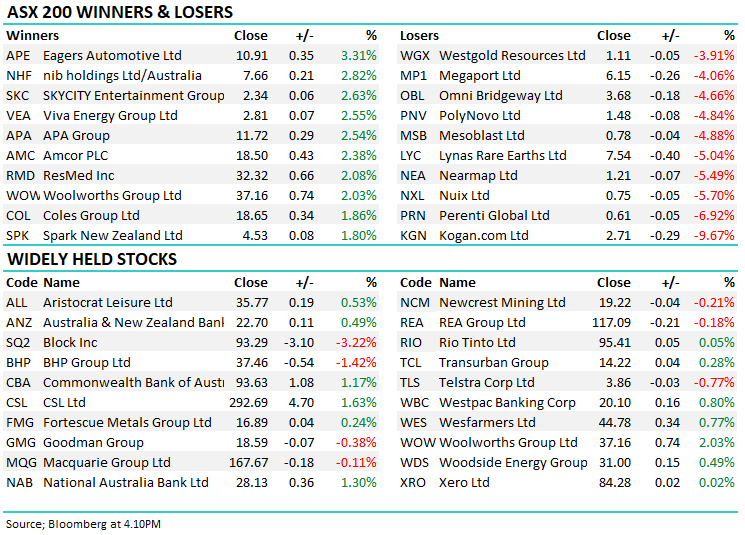

Major Movers Today

Enjoy your night,

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

11 stocks mentioned