The Match Out: Financials and Materials weigh, ASX ends the week lower

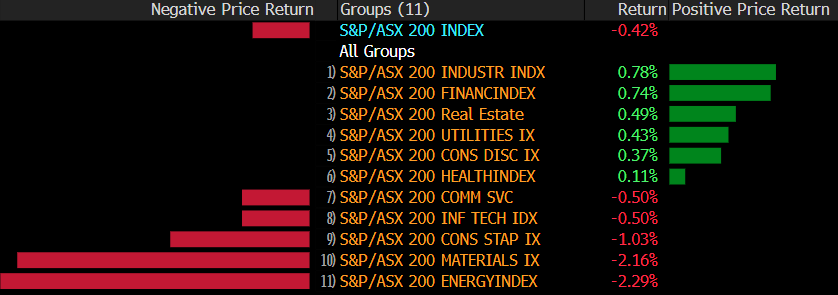

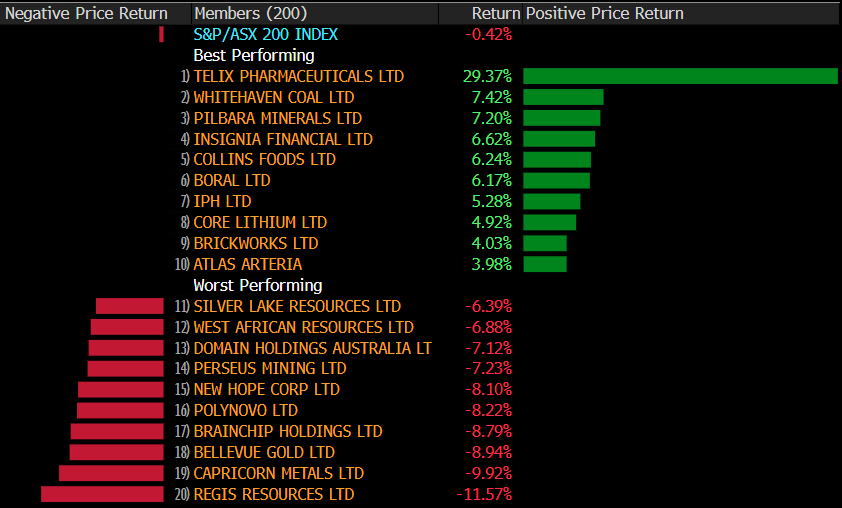

A mixed bag across the board today with sectors split pretty much down the middle, however, the heavy-weight sectors dragged the overall index lower. Quarterly reports from the miners dominated the news flow though it was the softness in commodity prices that mostly weighed on the sector. Bank of Queensland (ASX: BOQ) copped a few downgrades overnight and concerns around bad debts and competition for mortgages put pressure on the financials sector. The ASX 200 was down -31pts/-0.42% for the week.

- The ASX 200 finished down -31pts/ -0.43% at 7361

- The Industrials (+0.65%) sector was the best on ground today, followed by Healthcare (+0.62%) and Energy (+0.57%) in a close podium finish.

- Materials (-1.48%) and Financials (-0.66%) were the main drags on the index.

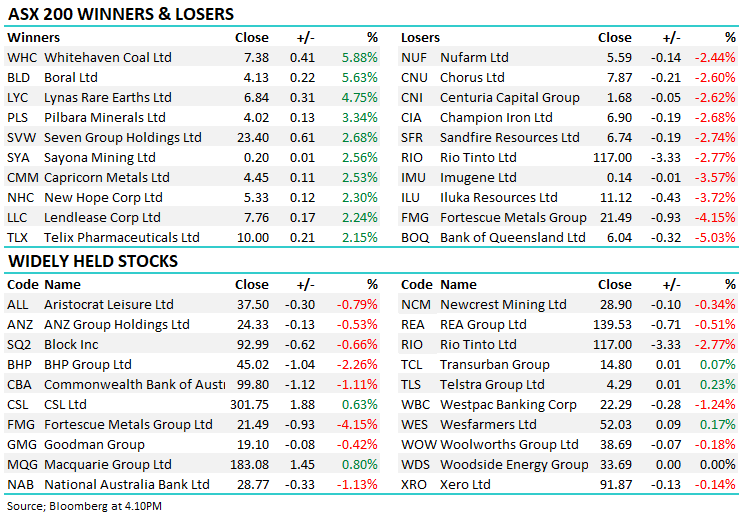

- Lynas (ASX: LYC) +4.75% reported their 3Q production numbers which were solid. They still expect to see the Kalgoorlie operation up and running before the end of this quarter.

- Whitehaven Coal (ASX: WHC) +5.88% largely pre-released their quarterly, more on that below.

- BHP (ASX: BHP) -2.26% struggled today, though the quarterly was for the most part as expected. We cover the report below.

- Iron Ore fell around -0.75% in Asian trade, with weakness seen in the miners as a result. Fortescue Metals (ASX: FMG) the worst, down -4.15%

- Gold slipped back below the $US2000/oz level, falling 0.5%/-$US9.50. Gold stocks were a mixed bag though.

- Asian stocks also rallied into the weekend. The Nikkei was up +1.14%, Hang Seng +0.30%

- US Futures are pointing flat finish to the week.

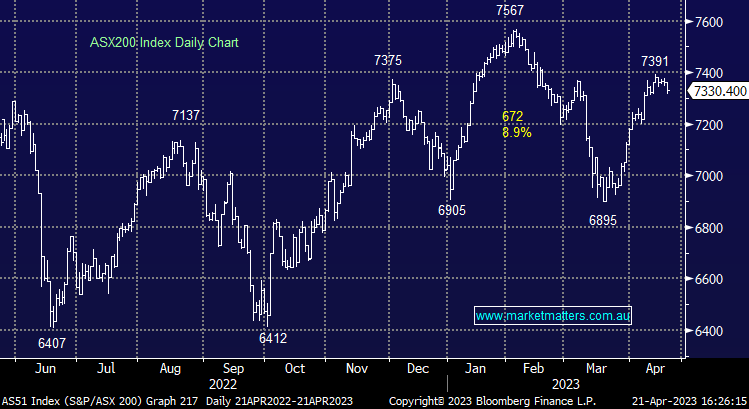

ASX 200

Whitehaven Coal (WHC) $7.38

WHC +5.88%: Shares in the coal miner popped hit 6-week highs today, supported by coal price but also a strong quarter of cash flow. Numbers were largely pre-announced with a slight fall in production as expected.

On the analyst call, they talked to coal markets remaining tight, supported by recent commentary out of China which is looking to add more coal power to the grid. There continues to be a lack of investment in new supply and still no sign of slowing demand which should further support prices. Whitehaven had a positive cash flow of $1.2 billion in the quarter, which compares to their Enterprise Value of ~$3.5 billion, less than 1x Operating Cashflow on an annualised basis.

BHP Group (BHP) $45.02

BHP -2.26%: The Big Australian was out with 3rd Quarter production numbers today, though much of the weakness can be attributed to softer Iron ore today. Their iron ore production was strong, hitting a record for the 9 months to March. The 3rd quarter was flat on 3Q22, but could have been better if not for some unplanned downtime, and -11% below the 2nd quarter mostly on seasonal weakness.

Coal production was mixed, energy coal seeing better numbers on improved strip ratios but met coal was soft and lowered guidance on the back of wet weather. Copper was weak though with grade issues at Escondida causing problems. They maintained FY guidance, expecting to see better performance out of their smaller operations to offset. Overall a decent performance and it sets BHP well for a strong full-year number in a few months.

Sectors This Week

Stocks This Week

Broker Moves

- Bank of Queensland Drops to 2020 Low as MS Cuts to Underweight

- Evolution Raised to Neutral at Jarden Securities; PT A$3.08

- Silk Laser Australia Cut to Neutral at Jarden Securities

- Challenger Raised to Outperform at Credit Suisse; PT A$7.10

- Link Administration Raised to Buy at CLSA; PT A$2.50

- Bank of Queensland Cut to Underweight at JPMorgan; PT A$5.70

- Allkem Raised to Neutral at Credit Suisse; PT A$13

- Link Administration Raised to Buy at Citi; PT A$2.45

- Iluka Cut to Neutral at Macquarie; PT A$12

- Woolworths Group Cut to Hold at Jefferies; PT A$42.50

- WiseTech Rated New Overweight at Barrenjoey; PT A$79

- Challenger Raised to Buy at Jefferies; PT A$7.99

- Alumina Cut to Underweight at JPMorgan; PT A$1.40

- Challenger Raised to Add at Morgans Financial Limited; PT A$7.52

- Corporate Travel Cut to Sell at CLSA; PT A$17.50

- Centuria Industrial Raised to Overweight at JPMorgan; PT A$3.60

- Iluka Cut to Underperform at Credit Suisse; PT A$10.60

Major Movers Today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

5 stocks mentioned