The Match Out: Materials edge index higher, Star (SGR) earnings crunched

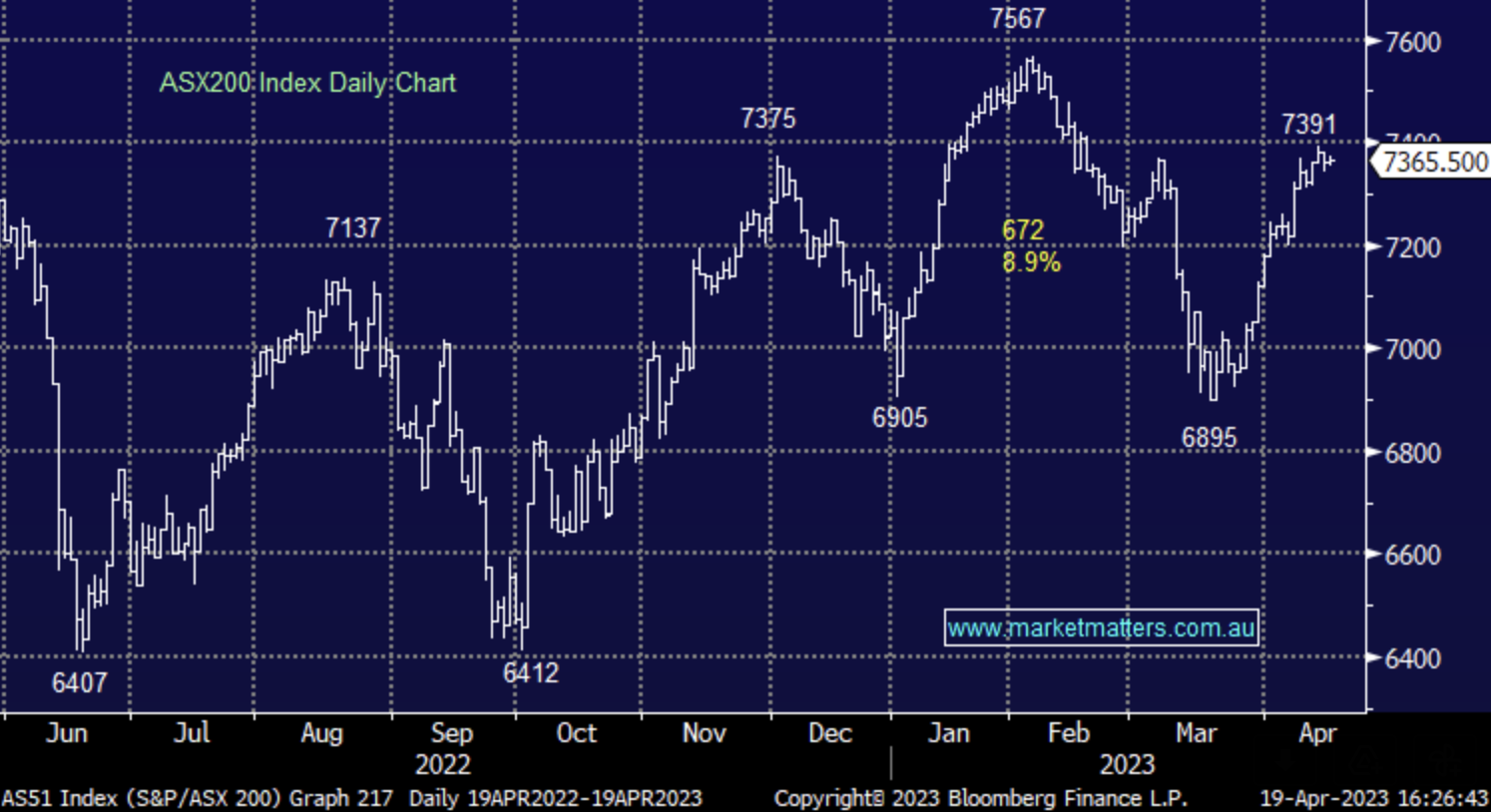

Another fairly flat session by the ASX today, although it’s looking tired and we wouldn’t be surprised to see a near-term top evolve with the first signs of money transitioning from the edgier, high-beta areas into the more defensive plays. Still, with negative market positioning (high cash levels + high bond ownership v equities) very obvious we wouldn’t be running for the hills, meaningful tops don’t often correlate with pessimistic positioning – but a pause, consolidation, and a shallow pullback could easily play out.

- The ASX 200 finished up +5pts/ +0.07% at 7365

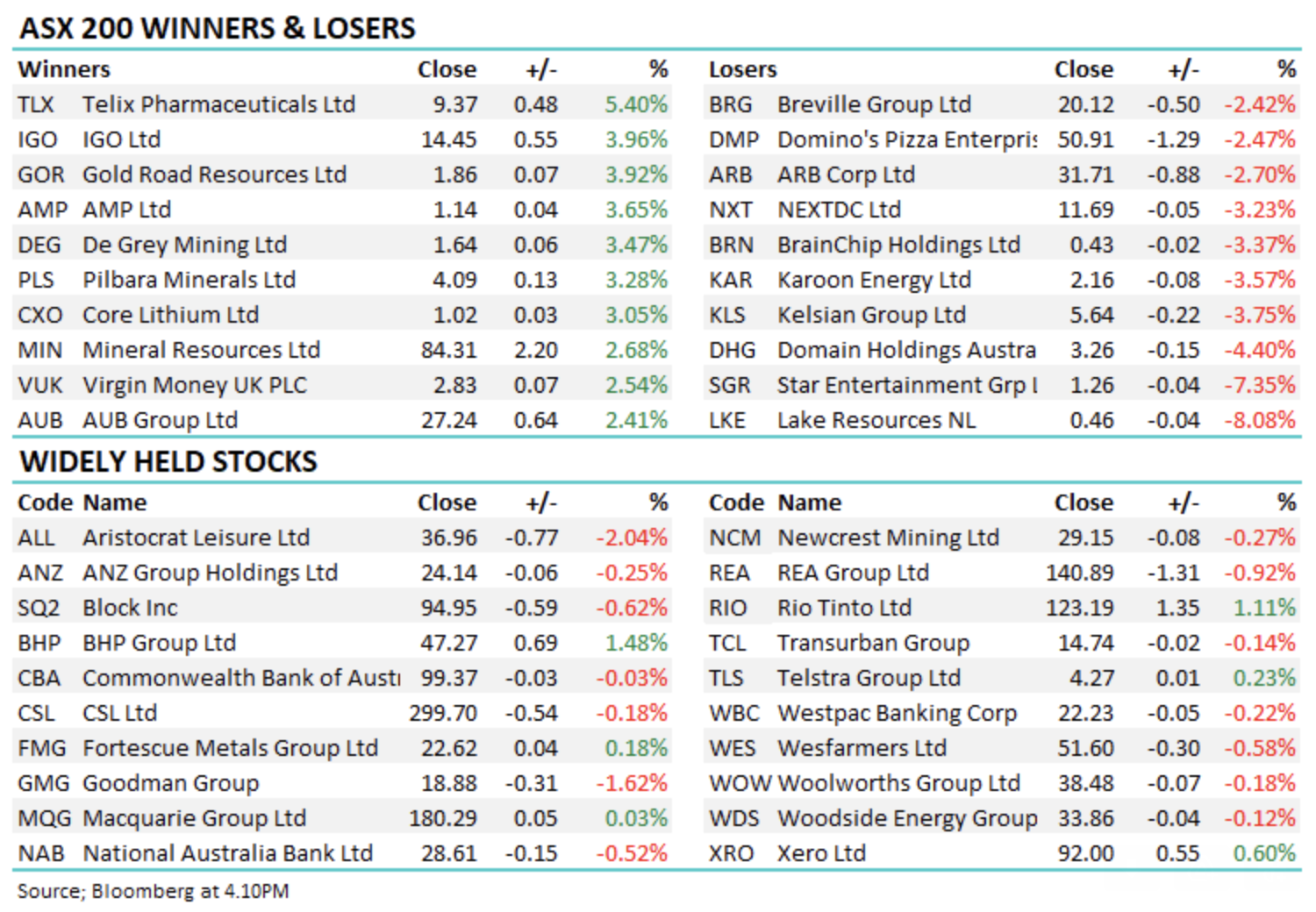

- The Materials sector was best on ground (+1.10%) while Utilities (+0.10%) was the only other sector in the green

- Consumer Discretionary (-1.14%) and Real-Estate (-0.57%) the weakest links.

- According to a Bloomberg survey, Australia now has a 35% chance of a recession, down from a 40% chance last month.

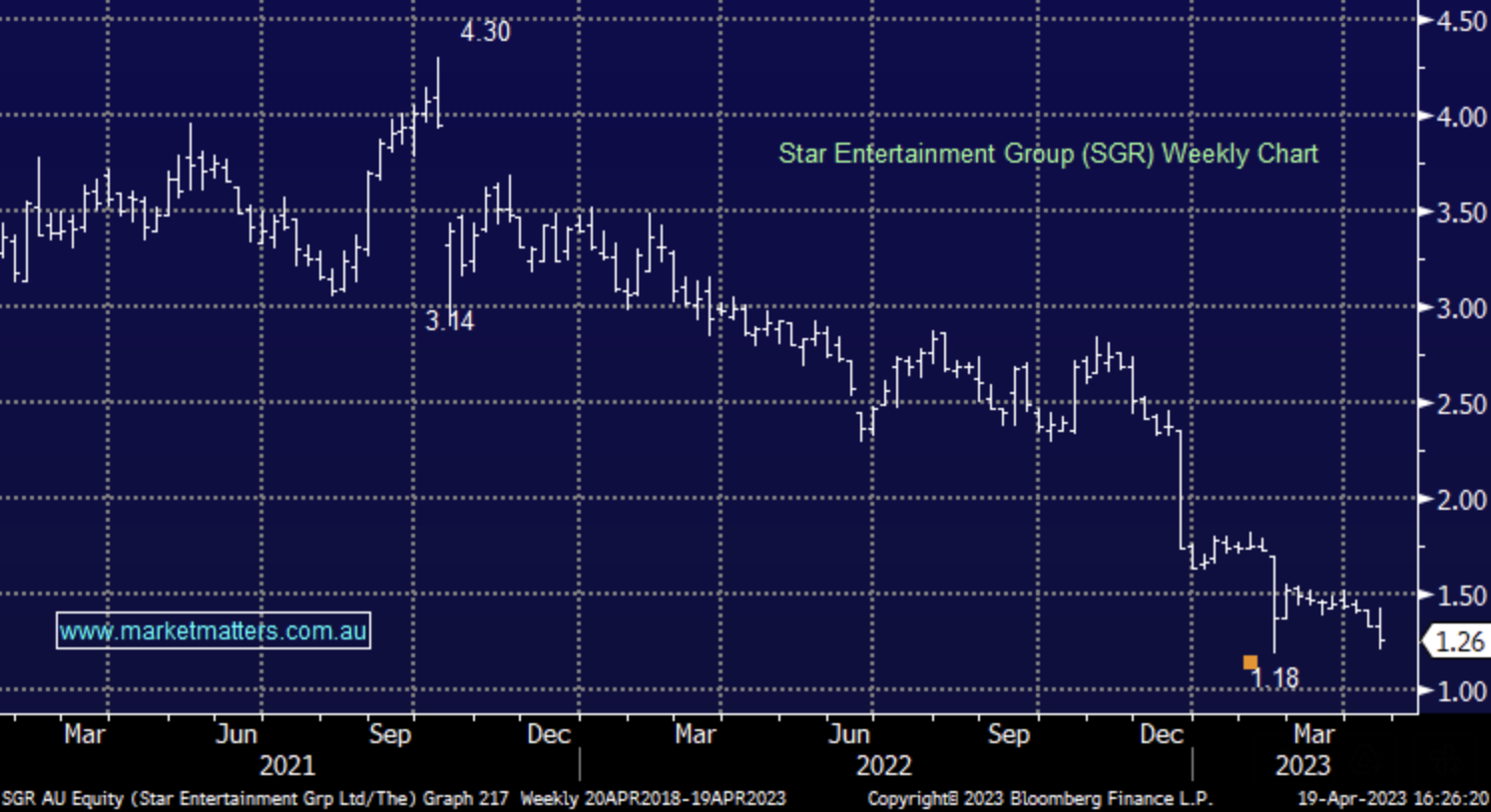

- Star Entertainment (ASX: SGR) -7.35% had another shocker saying operating conditions have continued to deteriorate, now expecting operating EBITDA to be $280-$310m versus consensus of $345m, a 14% downgrade

- WA-based engineering group Decmil (ASX: DCG) +18.18% rallied on an earnings upgrade, they now expect income to be $470-$500m, +30% on FY22 – a rare upgrade after a tough recent history.

- AMP +3.65% was higher after reporting net outflows of $600m in the March quarter, down from the $900m in the prior corresponding period – the pain is getting less! On the bank side of things they slowed loan growth to protect NIM, likely taken as a positive by the market.

- The Lithium sector was on fire again today following a string or more positive analyst updates on the sector, HSBC Global Research the latest to paint a positive short-term picture – Pilbara (ASX: PLS) +3.28%, IGO +3.96%, Global Lithium (ASX: GL1) +4.06% and Min Res (ASX: MIN) +2.68% all enjoying a day in the sun.

- Iron Ore was ~0.25% lower in Asia today, though BHP, Rio and Fortescue (ASX: FMG) were all higher

- Gold fell back below $US2,000/oz in Asian trade, -0.65% to currently trade at US$1992. Broadly speaking most gold stocks were higher though.

- Asian stocks struggled, Hong Kong was down -0.90%, Japan -0.18% while China was down -0.50%

- US Futures are all down, Nasdaq the worst, off -0.55% while S&P pointing to -0.34% on the open tonight

ASX 200 Chart

Star Entertainment (ASX: SGR) $1.26

SGR -7.35%: the casino group struggled today, nearly trading below the price of the February equity raise after downgrading guidance. The group now expects EBITDA for FY23 between $280-310m, around 15% below prior guidance and consensus expectations, blaming regulatory restrictions and a deteriorating consumer environment. In an effort to recoup some of the lost earnings, Star is looking to add to their cost-cutting measures by letting go of 500 full-time equivalent jobs, freezing any non-EBA pay increases and cancelling any short-term incentives aiming to cut an annualized $60m in costs in addition to the $40m that was previously announced. In addition to the above, they have appointed bankers to conduct a strategic review of their assets, signalling a potential sale of their cornerstone Sydney Casino, right when Crown has started competing from the other side of Darling Harbour.

Broker Moves

- St Barbara Cut to Lighten at Ord Minnett; PT 48 Australian cents

- Core Lithium Rated New Hold at Morgans Financial Limited; PT A$1

- Evolution Cut to Lighten at Ord Minnett; PT A$2.60

- Northern Star Cut to Sell at UBS; PT A$13

- Deterra Cut to Sell at UBS; PT A$4.40

- Coronado GDRs Raised to Buy at UBS; PT A$2

- IPH Raised to Add at Morgans Financial Limited; PT A$9.20

- Radiopharm Rated New Buy at JonesTrading; PT 75 Australian cents

- Karoon Energy Rated New Positive at Evans & Partners Pty Ltd

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

6 stocks mentioned