The Match Out: Minimum wages lifted, ASX tracks higher into the weekend

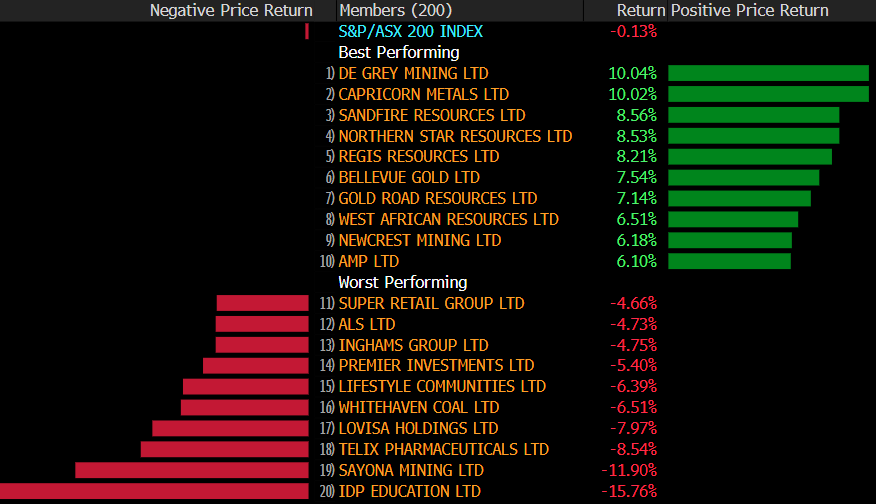

The ASX had a good crack at closing higher on the week today after a very volatile 5 sessions, only just falling short of the milestone in the end. Materials were helped by stronger commodity prices and a softer USD, both reversing moves from earlier in the week with a relief rally for global growth leverage following the US Debt ceiling vote.

Staples were noticeably weaker today with the moves coming on the back of changes to the award wages and a 8.6% increase to the minimum wage, while Coles (COL) was noticeably weaker on their own wage issues. The ASX200 finished -9pts / -0.13% for the week, trading in a big 177pts range.

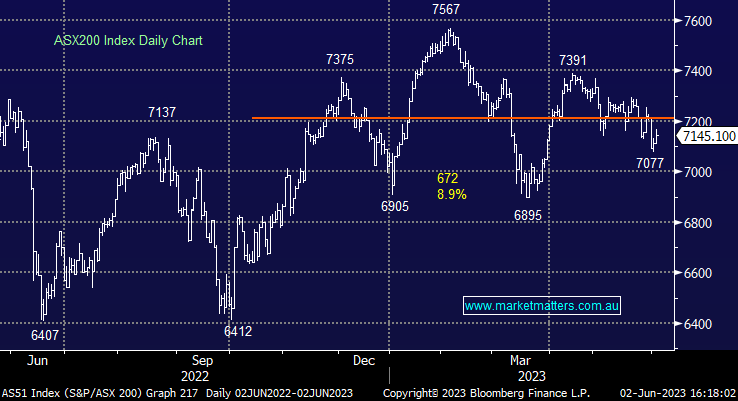

- The ASX 200 finished up +34pts/ +0.48% at 7145

- Materials (+2.44%) sector was the best on ground today, followed by Energy (+1.23%). Other notable gainers were Tech, Utilities and Real Estate

- Staples (-1.27%, Healthcare (-0.54%) and Industrials (-0.50%) were the main drags on the index.

- The Fair Work Commission announced the minimum wage will be lifted by 8.6%, above what was expected, however, this is partially offset by a lower-than-expected increase of 5.75% on award wages.

- Coles (ASX: COL) -1.71% added a further $25m in provisions for the underpayment of wages in proceedings with the Ombudsman.

- Adairs (ASX: ADH) -14.85% struggled after downgrading FY guidance. More on that below.

- Mineral Resources (ASX: MIN) +1.82% announced they have completed the acquisition of Northwest with more than 90% of the shares.

- Iron Ore was strong in Asian trade, up 3.8% with BHP seeing the best of it, up 2.8%

- Gold was flat today, hanging around $US1978/oz

- Asian stocks were very strong into the weekend. The Nikkei was up +1.11%, overshadowed by the Hang Seng (+3.92%).

- US Futures are pointing to a positive start to the Friday session, Nasdaq and S&P futures are up +0.2% each

ASX 200 Chart

Adairs (ADH) $1.605

ADH -14.85%: the homewares retailer provided updated guidance today coming in well below expectations with just a month left in the year. Sales for the first 22 weeks of the second half are running 7% below 2H21 with a -23.8% drop in sales for their Mocka business the main culprit. Group sales for the YTD is still up +1.9% but it highlights how significant the roll-off in growth has been.

EBIT guidance as cut 15% to $62-65m vs consensus expectations of $74m. The company has pullback capex guidance to the lower end of the previous numbers to support the balance sheet for now. The update weighed on peers today, Temple & Webster (ASX: TPW) a notable loser.

Sectors this week

Stocks this week

Broker Moves

- Appen Jumps to Eight-Month High as JPMorgan Upgrades to Neutral

- Aurelia Raised to Speculative Buy at Ord Minnett

- Fleetwood Ltd Rated New Buy at PAC Partners; PT A$2.39

- APA Group Rated New Overweight at Jarden Securities; PT A$10.95

- Liberty Financial Group Ltd Raised to Buy at Citi; PT A$4.15

- Pepper Money Raised to Buy at Citi; PT A$1.90

- Capitol Health Rated New Buy at Ord Minnett

- Integral Diagnostics Rated New Accumulate at Ord Minnett

- Antipa Rated New Buy at Cenkos Securities

- Michael Hill Cut to Neutral at Citi; PT $0.91

Major Movers Today

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

4 stocks mentioned