The Match Out: No Christmas cheer for the ASX today, Happy Holidays all!

The ASX keyed off a weak session overnight following more robust economic data from the US – the concept of good economic news is bad for stocks, given the focus on interest rates clearly at play, however, with little volumes and very few at their desks today (the MM Team an exception!) it was always going to be hard going.

- The S&P/ASX 200 lost -44 points / -0.63% to close at 7107 – giving back yesterdays gains.

- Utilities (+0.20%) was the only sector to finish up, Communications (-0.15%) & Materials (-0.48%) were relative performers.

- IT (-1.63%) and Consumer Discretionary (-1.22%) were the biggest drags while Energy (-1.10%) was also weak.

- The ASX200 is currently down 4.53% CY22 to date, while it has clearly been a tail of two halves. The 1H saw a decline of 11.77%, before a recovery ensued, the gain in the 2H has been 8.22%, albeit with some of the shine coming off this month.

- This tells us one important thing, remain open-minded, there were not many in the market thinking such a rebound would occur but alas, it has and we were on the right side of it.

- US stocks fared worse, the S&P 500 down -19.80% overall this year thanks to their bigger exposure to technology.

- While the consensus is bearish for 2023, and we think there will be periods where that plays out, whenever the market is down 20% in the US as it is this year, 80% of the time the next year is positive, and if it’s not, 100% of the time the year after is. Food for thought!

-

Pendal ASX: PDL -0.40% held the scheme meeting today to vote on the Perpetual ASX: PPT -0.57% takeover - we think this will be successful and as PDL shareholders we support the move.

- ReadyTech ASX: RDY -2.86% fell today after saying that PEP failed to put forward an alternative offer after pulling the bid yesterday – this is a stock we would buy ~$3.20. A good business.

- Iron Ore was flat in Asia up +1%, Coal out of Newcastle was lower overnight.

- Gold was up US$3 during our time zone trading $US1795/oz at our close.

- Asian stocks were mixed, Hang Seng was flat, the Nikkei in Japan fell 1%, while China slipped -0.10%

- US Futures are all up circa 0.10%.

ASX 200 chart

Broker moves

- Sezzle GDRs Raised to Buy at DA Davidson; PT A$1

- 29Metals Cut to Sell at CLSA; PT A$1.70

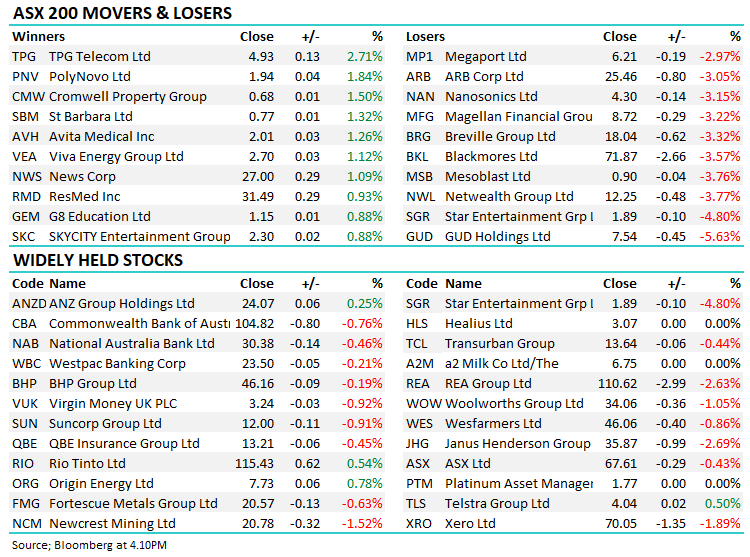

Major movers today

Happy Christmas,

The Market Matters team.

**This will be our last note for the year, with reports recommencing on 16 January. As we bring 2022 to a close, we would like to sincerely thank you for your continued support and trust in Market Matters. We've welcomed more new subscribers than ever before, and we've continued to invest in the platform and insights that we’re providing to our members, with the inclusion of fundamental data and charting, and importantly, seamless integration with our own Opinion + Action framework. Stay tuned, there is more to come!

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

3 stocks mentioned