The Match Out: resources weigh on index, BOQ lose their CEO, Healius (HLS) sinks as COVID testing falls

Local shares were soft to start the week as unrest in China hit sentiment for growth assets. Commodity-linked sectors were the hardest hit given the concerns around the world’s biggest economy, though energy was particularly weak on the back of ongoing discussions around capping Russian oil prices. Retail sales landed at 11.30 this morning, badly missing expectations of +0.5% with a -0.2% decline in October. Despite the negativity, support was seen in the telcos and real estate names to stem the index weakness. Overall the market seemed to hold up well in the face of bad news.

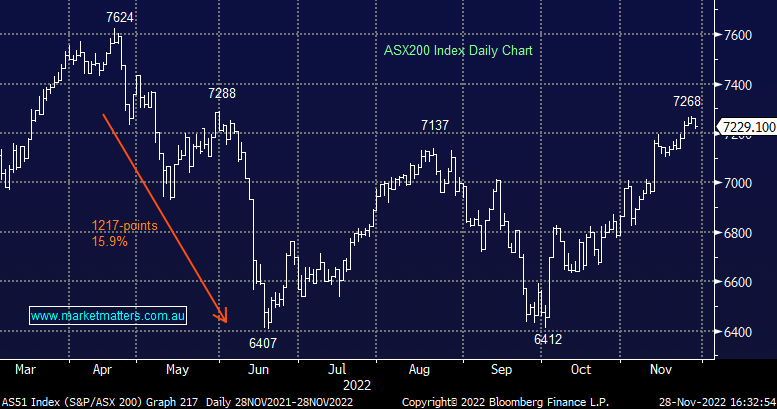

- The ASX 200 finished up -30pts/ -0.42% at 7229

- The Telcos sector was best on ground (+0.62%) while Real-Estate (+0.54%) & Industrials (+0.33%) were the main outperformers.

- Energy (-1.68%) and Materials (-0.91%) the weakest links.

- Retail sales missed the mark today, falling -0.2% in October against an expected +0.5% gain. Consumer discretionary stocks were weaker today, however, the broader market found some support at the time of the print with the hopes that it means the RBA will continue its shift towards more subdued rate hikes.

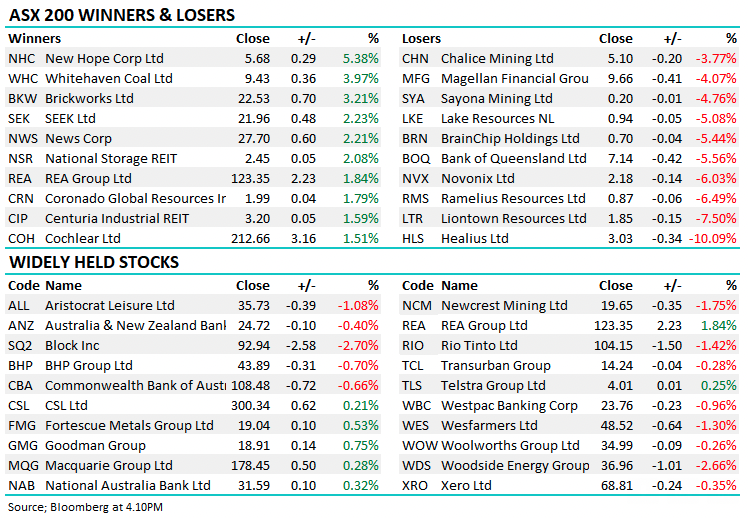

- Bank of QLD (ASX: BOQ) -5.56%, CEO George Frazis has been removed by the board. The Chairman will step into the role for now as the search for a replacement gets underway. Frazis’ swift departure after 3 years with BOQ raised a few eyebrows. The release said the bank wanted to focus on asset quality, technology and optimizing performance.

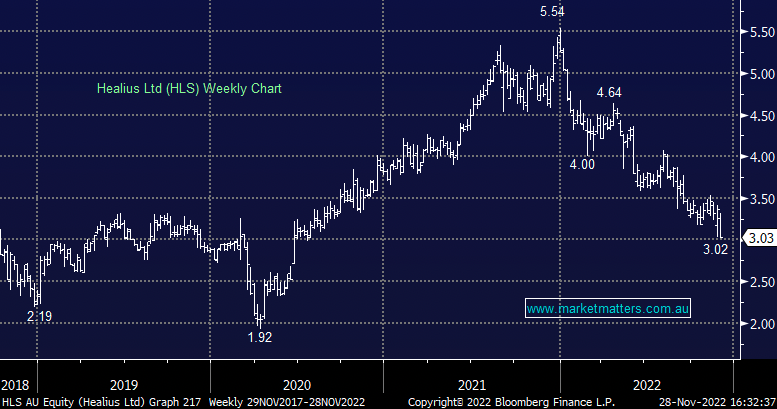

- Healius (ASX: HLS) -10.09%, provided a YTD trading update today showing COVID testing revenue has been hit 85% and margins had been squeezed. More on that below.

- Pilbara (ASX: PLS) -0.9%, fell but largely outperformed peers after announcing a JV with Calix (ASX: CXL) to build a lithium salt demonstration plant using Calix’s calcination technology.

- City Chic (ASX: CCX) -25.63%, saw another leg lower as brokers downgraded on the back of a weak AGM trading update.

- Iron Ore was ~2% higher in Asia today despite the issues in China. Fortescue (ASX: FMG) was the only one of the big three to close higher, finishing +0.53%.

- Gold was flat overnight before drifting lower in our session, down -0.2%/-$US4/oz to ~US$1751.

- Asian stocks were soft, Nikkei -0.5% held up the best, Hang Seng and China are both down more than 2%.

- US markets we weak, S&P -0.75% and Nasdaq -0.9% at our close.

ASX 200 Chart

Healius (ASX: HLS) $3.03

HLS -10.09%: the healthcare and diagnostics company tumbled to a 2-year low today on the back of a weak trading update. Revenue for the YTD was down 32% and the back of an 85% decline in COVID testing revenues. Tests have fallen from an average of 13k per day in July, to 3-4k in recent weeks. Margins have also been hit, almost halving to ~20% in the period with the company saying they are working on right-sizing their cost base as a result of the changes. Normal business revenues, such as other pathology and day hospitals, have seen revenues marginally higher in the period and the company expects this to continue.

Broker Moves

- City Chic Cut to Equal-Weight at Morgan Stanley; PT A$1.20

- City Chic Cut to Neutral at Citi; PT A$1.04

- Fletcher Building Rated New Buy at Goldman; PT A$5.90

- a2 Milk Cut to Sell at CLSA

- Australian Finance Cut to Neutral at Macquarie; PT A$1.81

- Premier Investments Cut to Reduce at CLSA; PT A$26

- Myer Cut to Reduce at CLSA; PT 70 Australian cents

- Costa Cut to Hold at Bell Potter; PT A$2.90

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

1 stock mentioned