The Match Out: Tech rallies again, ASX up for second consecutive week

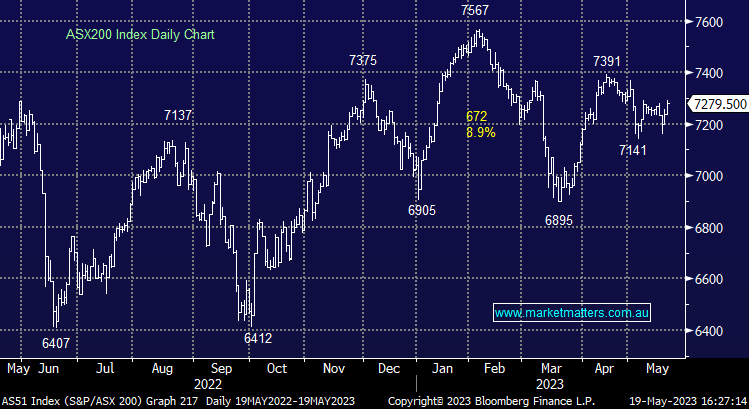

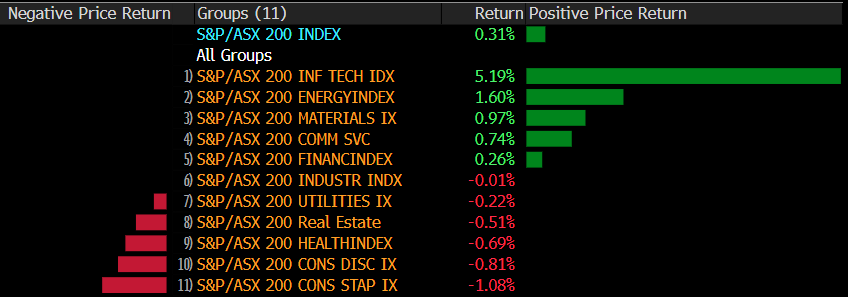

The easing of rhetoric around the US Debt Ceiling seems to have lifted markets again today with a broad rally for local shares carrying the index higher into the weekend. 70% of the local bourse closed higher with the Tech sector seeing the best of it for the second day in a row. Financials were the main support for the index while Utilities and Materials were the only sector to close lower. The index added 22pts/+0.31% this week for its second consecutive weekly gain.

- The ASX 200 finished up +42pts/ +0.59% at 7279

- The Tech sector was best on ground (+2.22%) while Fins(+1.54%) & Telco (+1.24%) were also strong.

- Utilities (-0.46%) and Materials (-0.24%) the only two sectors to close lower

- Coal stocks gave up the gains seen yesterday with the active contract falling -6% today. No news in the space but particularly volatile price action this week.

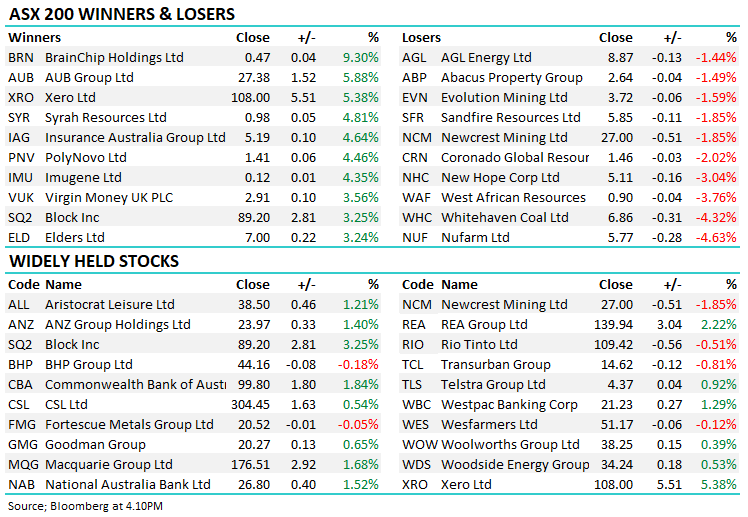

- AUB Group (ASX: AUB) +5.88% back online post a $150m capital raise, deciding to self-fund the UK-based Tysers instead of pursuing a JV after the business showed strong performance. Funds will boost capital flexibility and potential acquisitions.

- Austal (ASX: ASB) +26.02% announced a big contract win with the US Navy, first to design a patrol boat with the opportunity to build 7 steel-hulled boats for ~$US3.2b.

- Core Lithium (ASX: CXO) +1.81% confirmed a $50m capital investment will be made to complete early works at their next segment of the Finnis Lithium Project.

- Qantas (ASX: QAN) +1.09% are taking on another 4 aircraft under their lease agreement with Alliance (AQZ) to add capacity. Qantas have the option to take on an additional 8 aircraft under the deal.

- Dusk (ASX: DSK) -18.81% the candle retailer provided soft FY23 guidance, looking for a small fall in revenue but facing a ~35% drop in EBIT, guiding to $16-17m They said Mother’s Day trade was weak and consumers are getting cautious.

- Iron Ore was ~1% lower in Asia today with BHP, RIO and FMG all finishing marginally lower.

- Gold was up $US8 in Asia today but not recovering the weakness seen overnight.

- Asian stocks were mixed with Nikkei up +0.77% but Hong Kong and China bother lower.

- US Futures are all up, around +0.10%

ASX 200

Weekly Sector Moves

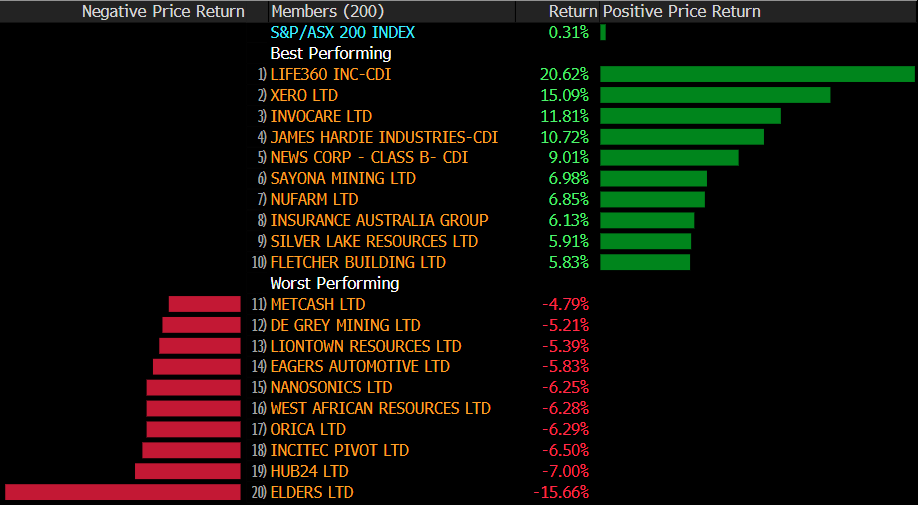

Weekly Stock Moves

Broker Moves

- Xero Raised to Accumulate at CLSA; PT A$115

- Austal Raised to Overweight at JPMorgan; PT A$2.10

- Xero Cut to Hold at Morgans Financial Limited; PT A$101

- IDP Education Rated New Hold at Bell Potter; PT A$30.45

- Bank of Queensland Raised to Neutral at JPMorgan; PT A$5.70

- Beach Energy Raised to Buy at Citi; PT A$1.65

Major Movers Today

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

5 stocks mentioned