The Match Out: The local market ticks higher to recover some of yesterday’s pain

The daily Match Out report for Thursday 1st of June with Market Matters' James Gerrish

A pretty quiet day on the news flow front with the market drifting higher to recover some of yesterday’s freefall. The early session sugar hit came from the US lower house passing the debt ceiling relief bill but aside from that there was little to move markets for the first session of the new month. Tech continued its rally while Healthcare was the star performer of the sectors.

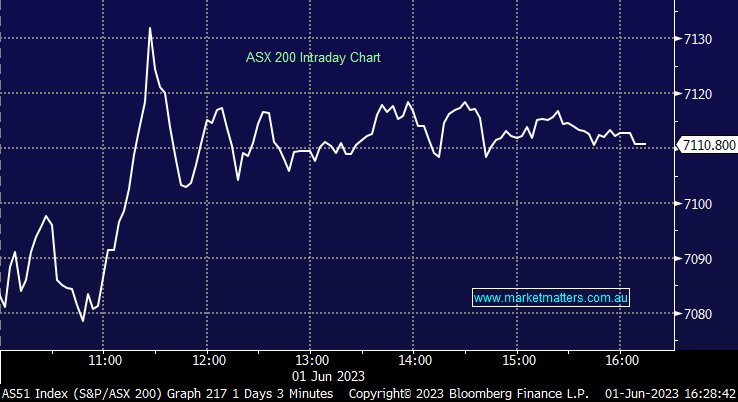

- The ASX 200 finished up +19pts/ +0.27% at 7110

- The Healthcare sector was best on ground (+1.16%), joined by Tech (+1.05%) and Consumer Staples (+0.93%)

- Three sectors closed lower on the session, Industrials (-0.22%) the worst, followed by Utilities (-0.07%) and Financials (-0.01%)

- Bowen Coal (ASX: BCB) -2.22% received environmental approval for its Isaac River mine in the Bowen basin as expected with final Government approvals underway. The company expects to start construction of the min next year.

- BHP Group (ASX: BHP) +0.12% said that it had incorrectly accounted for employee allowances and entitlements which could amount to a cost of $280m, with fines to potentially follow.

- Vicinity Centres (ASX: VCX) +1.08% sold a 50% stake in their Broadmeadows shopping centre in Victoria for $134.5m, a premium to book value. The transaction highlights the desire for quality real estate still remains.

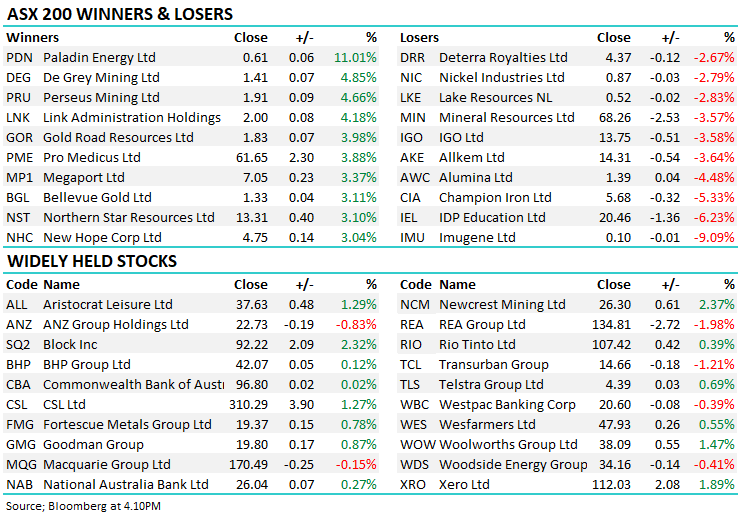

- Mineral Resources (ASX: MIN) -3.57% struggled with most lithium names lower, however, the company also saw a broker new broker publish on the stock, starting off with the equivalent of a sell.

- Iron Ore was up +4.5% in Asia today though the major miners largely underperformed the move. Fortescue (ASX: FMG) was the most notable gainer, up +0.78%

- Gold was flat in Asian trade, hanging around $US19661/oz, but gold equities were mostly strong as investors continued to move to safety.

- Asian stocks were all higher today, Nikkei lead the gains up +0.84%, Hang Seng +0.45% and China +0.23%.

- US Futures are mixed, Nasdaq is flat but S&P500 futures pointing to a small gain to start, +0.13%.

ASX 200 Chart

Broker Moves

- Bank of Queensland Raised to Neutral at Macquarie; PT A$5.70

- Bank of Queensland Raised to Neutral at Evans & Partners Pty Ltd

- Mineral Resources Rated New Reduce at CLSA; PT A$77

- BHP Cut to Underperform at CLSA; PT A$43

- Tabcorp Raised to Accumulate at CLSA; PT A$1.25

- Hartshead Resources NL Rated New Buy at Bell Potter

Major Movers Today

Have a great night

The Market Matters Team

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

James is Director & Lead Portfolio Manager at Market Partners - a collective of highly experienced investment professionals, operating independently, managing discretionary portfolios for wholesale investors.

James is also Portfolio Manager & primary author at Market Matters, a digital advice & investment platform with over 2500 members that offers real market intel & six portfolios open for investment.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies ("Livewire Contributors"). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 topic

5 stocks mentioned

Comments

Comments

Sign In or Join Free to comment