The OpenAI Saga: Boardroom battles, new leadership, and tech talent tussles

You would have to be living under a rock to have missed the machinations swirling around OpenAI in the last few days. Following the abrupt board decision to remove CEO Sam Altman and chair Greg Brockman on Friday, board members apparently spent the weekend negotiating with different parties, allegedly sustaining themselves on bubble tea from Boba Guys and burgers and fries from McDonalds. The outcome, as of Tuesday morning Australian time, is a new CEO, former Twitch founder Emmett Shear, and a job offer from Microsoft for Altman, Brockman and as many OpenAI employees who wish to join them.

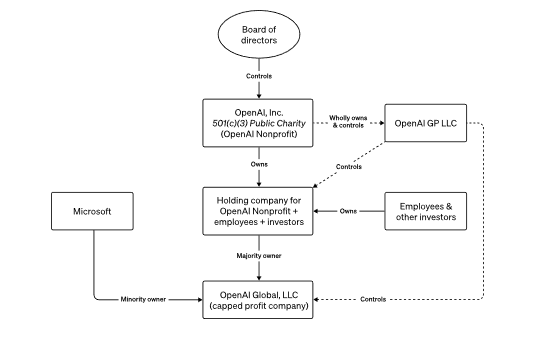

Microsoft’s offer makes a lot of sense. It has invested $13B in Open AI, equating to 49% of the ‘for profit’ LLC Company. In the unique structure of OpenAI the Public Charity ‘Open AI Nonprofit’ entity controls Open AI Global LLC, the ‘capped profit entity’. The board of directors controls the whole structure, and its charter is to ensure the development of AI is safe and beneficial, with no requirement to consider financial or shareholder outcomes. This is how the board was able to roll the chair and CEO without consulting shareholders first.

Practically, as of today, Microsoft sits in the driver's seat. They are the largest shareholder, partner and client of OpenAI. This means they have the ability to cause pain to the business, and we witnessed the first salvo when Satya Nadella, Microsoft CEO, announced the appointment of Altman and Greg Brockman to lead an advanced AI team within Microsoft.

Altman and Brockman are not technical guys, they are visionaries - the Steve Jobs of the AI industry. They need an advanced technical team behind them, and on Monday US time, more than 500 of OpenAI’s 700 employees signed an open letter to the board requesting they stand down or risk the employees exiting to follow Altman to Microsoft. Unfortunately for the board, OpenAI’s most substantial assets are the people who have developed their product. AI talent is in hot demand, and it would be a coup if Microsoft were able to acquire one of the industry's leading teams following this debacle.

This matters because you need the tech talent to continue improving the models. Fortunately, Microsoft has a licence to ChatGPT, and Nadella has already confirmed its existing form can meet the company’s goals laid out at the Ignite conference last week. However, the speed at which future releases evolve could slow following the departure of Altman and arrival of Shear.

Enter Emmett Shear, the bow tie-wearing tech czar formerly of Twitch fame, who sold a business he co-founded to Amazon for c.$1B and is widely known as an AI conservative. In the AI community, there are essentially two types of people, those who see the commercial benefits of the technology, and those who are fearful of AGI destroying the world. It’s probably not that stark but you catch the drift. Shear falls into the latter camp and accordingly, we see his appointment as a potential slowdown in innovation at OpenAI. However, it's early days, and the board may be removed at any time, and Shear’s days may too be numbered.

So what does all this mean for Microsoft?

The potential acquisition of 500 OpenAI employees is undoubtedly a positive. Microsoft retains a commercial licence to use the OpenAI IP and this endures after these shenanigans. I wouldn’t necessarily call it a win but a dramatic improvement from early reports. This could change if Microsoft are able to advance their own models with the former employees of OpenAI. However that is easier said than done as the time required to collect the data for training large language models like GPT4 takes time. Even after a model is released, the data collection doesn’t stop. Models are continually updated and refined, which involves constant rounds of data collection and training.

Given these factors, while it's difficult to pinpoint an exact timeline, it's reasonable to assume the process spans several years, especially considering the time taken to curate, clean and preprocess the data before it's used for training. This period is not just about raw data collection but also involves significant work in data selection, quality assurance and ethical considerations.

It's a long way of saying Microsoft is still heavily invested in this process. We won’t be surprised to hear OpenAI’s board has resigned in the next few days, and Altman and Brockman resume their old roles. Microsoft will no doubt seek to influence the make-up of the future board.

As shareholders, we are happy to hold Microsoft through this turmoil. Microsoft is in a strong position with expertise in AI and scale in infrastructure. It is also led by one of the best in the business, CEO Satya Nadella. And Microsoft has publicly confirmed they will continue to work with Altman whether he is wearing a Microsoft or OpenAI t-shirt. Despite the drama, Microsoft holds the cards, and we look forward to future updates in this regard.

2 topics

1 stock mentioned