The opportunities in global equity markets right now

Firetrail Investments

This year the script has been flipped on investors.

With both bonds and equities registering negative returns in 2022, many investors have been struggling with their asset allocation. This has led to debates on the merits of regional allocations, growth versus value, cyclicals versus defensive, etc.

Once again, investors risk making the same unintended factor bets.

The current environment – higher interest rates and slowing economic growth – has blunted the ability of the market to deliver similar returns to what investors have experienced over the last decade.

No longer can investors rely on cheap money to drive equity valuations higher or fuel earnings growth through share buybacks or other forms of financial engineering.

Hope has developed in the last month that interest rate hikes are nearing an end and high inflation is subsiding. It is often tempting to take a short-term view.

This reflects our desire for certainty despite our knowledge that the only constant in investing is change.

At Firetrail, we follow three simple fundamental rules of investing to guide out company research and investment decision making:

1. Every company has a price

2. Focus on “What Matters”

3. Take a longer-term view

In investing in a company or equity market, starting points matter.

For active investors, a downbeat mood can create rich pickings for those who can take advantage of depressed prices. Over the last seventeen years, we have found that some of the best investment opportunities have occurred during the periods of greatest uncertainty.

Following our fundamental rules of investing, we are uncovering opportunities in both value and growth companies.

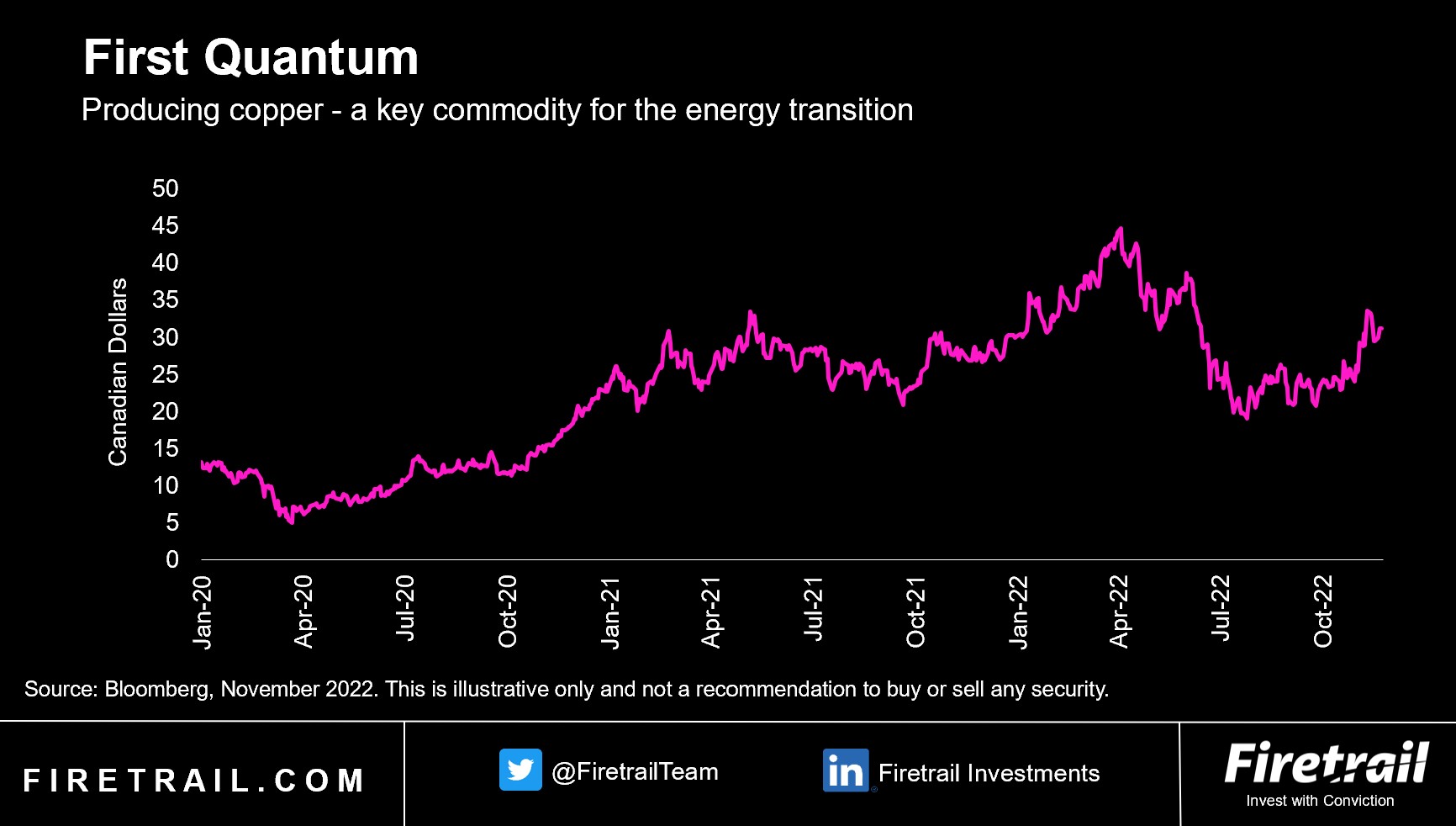

One such company in the Firetrail S3 Global Opportunities Fund is First Quantum, a Canadian copper miner. Copper is essential in meeting the demand requirements for the energy transition. After years of underinvestment, the copper price over the medium term is likely to remain resilient even in the face of a slowing global economy.

First Quantum operates mines with low cash costs, and long term mine lives. The company plans to reduce carbon emissions by 30% by 2025, has a strong governance framework, and a good record on corporate social responsibility policies. At today’s copper price, First Quantum has a 13% FY25 free cashflow yield.

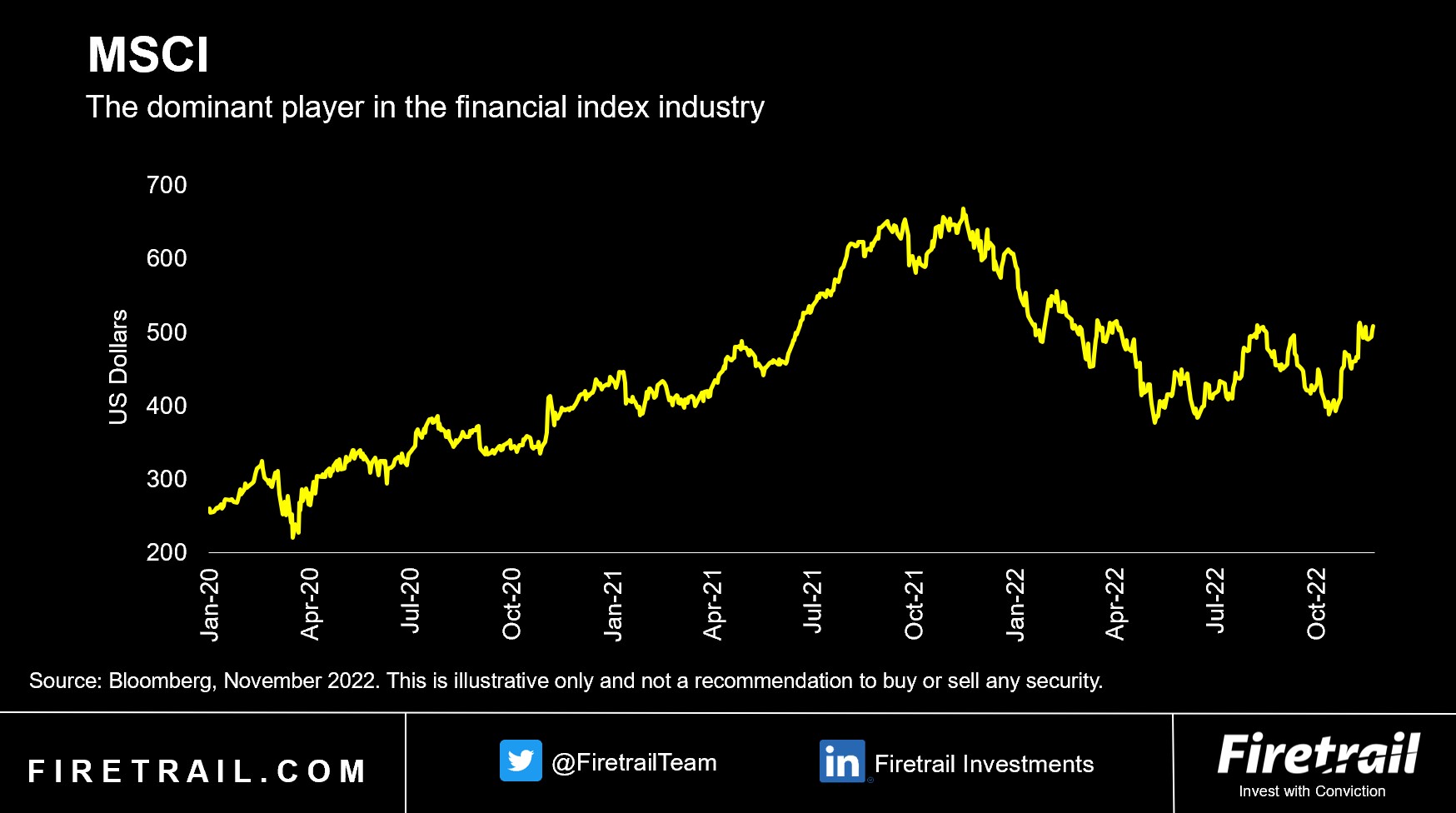

Another is MSCI. MSCI is a leading provider of equity indices, portfolio analytics, and ESG solutions for the investment industry. What matters for the company is that there are substantial switching costs and barriers to entry into the index industry, and MSCI is the dominant player.

We expect earnings growth for MSCI to come from both new customers and cross-selling, especially as demand continues to grow for its ESG products. In Q3 2022, growth in subscriptions of MSCI’s climate index products grew by 90% year-on-year.

These are examples of companies that will likely prosper in an uncertain economic environment, whether investors want to classify them as a value, growth, or somewhere-in-between company. Forget the old factor debates, do the research and there are always opportunities to add alpha in any market.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.