The outlook for swap spreads

Coolabah Capital

One of the larger fixed-income anomalies observed in 2021 was the record increase in the spread between interest rate swaps and Commonwealth government bond yields, also known as the “swap spread”. To help unravel this puzzle, we developed a new fundamental model of Aussie swap spreads, which we released as a public good in early December. You can read more about the model and the swaps market here.

Where to for swap spreads?

Since that time, I’ve often been asked about outlook for swap spreads. To recap, the model suggested that Aussie swap spreads were way too wide, and that we therefore favored spread tighteners.

At that time, 10yr spreads were ~30bps (they breached 35bps at one point) and we had a short-term fair value at ~20bps, falling to ~10bps over the medium-term as gross Commonwealth government bond issuance ramped up and the RBA’s share of this market declined.

While spreads have now tightened to be broadly in line with our near-term target, we continue to favour tighteners as we converge with our medium-term target of ~10bps for 10yr swap spreads.

The market is forward looking and recent technical flows, including some important new developments around fixed-coupon bond issuance that we did not previously discuss, favour additional near-term tightening.

Given this, we expect swaps to trade down to ~10bps over the next few months. Note that since the advent of centralised clearing, the average level for Aussie 10yr swap spreads has been ~16bps.

Record Kanga issuance

Over the past month, 10yr swap spreads have tightened from wides of ~35bps in early December to ~19bps (at the time of writing). Normalisation has been helped by hedging flows (receiving) driven by record fixed-rate Kangaroo bond issuance, which has been further amplified by an unusually large amount of fixed-coupon bank bond issuance. All this issuance has to be swapped back to floating.

Fixed rate Kangaroo (or foreign name) bond issuance in the first nineteen days of January has already equaled historical records – and is on track to exceed them (see first chart below). Wide swap spreads and the high level of cross-currency basis have made the hedged-back cost of AUD debt cheap for foreign (Kangaroo Bond) issuers. When these issuers hedge, they receive swap and therefore tighten swap spreads. This has been an important tightening force in January 2022.

Even after the recent moves, AUD issuance remains attractive for Kangaroo issuers, so we’re likely to see more of it. These Kangaroos include both sub-sovereign agencies (SSAs) and foreign corporate and bank bond issuers.

There are just around $40bn of maturing Kangaroo bonds in 2022, of which around $32bn are fixed coupon bonds so replacement of maturing bonds calls for issuance of about $3.5bn per month ($2.7bn for fixed).

With APRA now benchmarking Australian super funds to the fixed-rate Composite Bond Index, the demand for fixed-rate product is likely to boost the share of fixed-rate issuance in Kangaroo deals. (To read more about this APRA move, click here.)

Given the maturity outlook, and the fact that the AUD market remains cheap for offshore funders, we expect fixed-rate Kangaroo issuance of about $5bn in February 2022 with upside risks if issuers try to front-run the end of the Fed’s QE program (there was a similar pattern of issuance in February 2018). Kangaroo issuers receive swap when they hedge fixed-rate issuance, so more fixed rate Kangaroo issuance will tend to tighten swap spreads.

Banks issue record fixed-rate debt

The other factor working to tighten swap spreads has been record fixed-rate issuance by Aussie banks. Banks prefer floating-rate funding, so they almost always swap the fixed-rate debt back to floating. However, being sophisticated issuers, they are indifferent between fixed and floating when they issue. Consequently, their deals basically follow demand.

A key driver of floating-rate demand had historically been banks buying FRNs for their liquidity books. But since APRA is closing the $140 billion Committed Liquidity Facility in 2022, bank demand for FRNs is declining. This was evidenced in a recent Suncorp 5yr senior deal where only 18% of the book was allocated to banks in contrast to a Suncorp 5yr senior transaction in early September 2021 (just prior to the CLF announcement) when 54% was bought by banks.

The demand for fixed-rate bonds, which is escalating due to the abovementioned APRA-benchmarking of super funds, has lifted fixed-rate AUD bank issuance to a modern high as a proportion of supply (see chart).

More specifically, bank issuance of fixed-rate debt in Jan’22 is a record high. In the most recent Westpac transaction, almost one-third of the entire issue was in fixed-rate format. There have been six fixed-rate deals by Australian banks in Jan’22, including two very large fixed-rate tranches as part of the Commonwealth Bank and Westpac 5yr bond deals. This has taken fixed coupon issuance for Australian Banks to $2.6bn face (almost 1mil DV01) in January alone.

We expect similar flows to continue. Our credit analysts estimate that the four majors alone have to issue ~$133bn of debt in CY22, roughly a third of which should come in AUD based on historical issuance patterns. If we assume that 30% is fixed-rate, that equates to an extra $13bn of fixed-rate issuance in CY22 in AUD independent of all the fixed-rate Kanga issuance. This would generate just over 6mil DV01 of receiving flows.

You then need to add in non-majors like Macquarie, Suncorp, ING, Bendigo, Bank of Queensland, etc. Banks receive swap when they issue fixed-rate bonds, so increased issuance of fixed-rate bonds will add to tightening pressures on swap spreads.

Dramatic increase in gross AOFM supply

A change in the AOFM’s issuance patterns, to favour tapping existing bonds that are tight, will also work to tighten swap spreads by reducing the bond premium. Between Nov’21 and 21 Jan’22, about 55% of the ~$18.3bn of bonds the AOFM has issued have been the ‘tight’ 2024 and 2025 lines. The share of ‘tight’ bonds in supply rises to ~70% if we consider Dec’21 to present ($5.5bn of $8bn total issuance).

This pivot of issuance toward improving market function is consistent with the AOFM’s December 2021 research paper, which found that increased RBA ownership of lines impaired market function. As the AOFM taps these tight bonds, they should cheapen, which will tend to cause the bond premium to decline, and swap spreads to tighten.

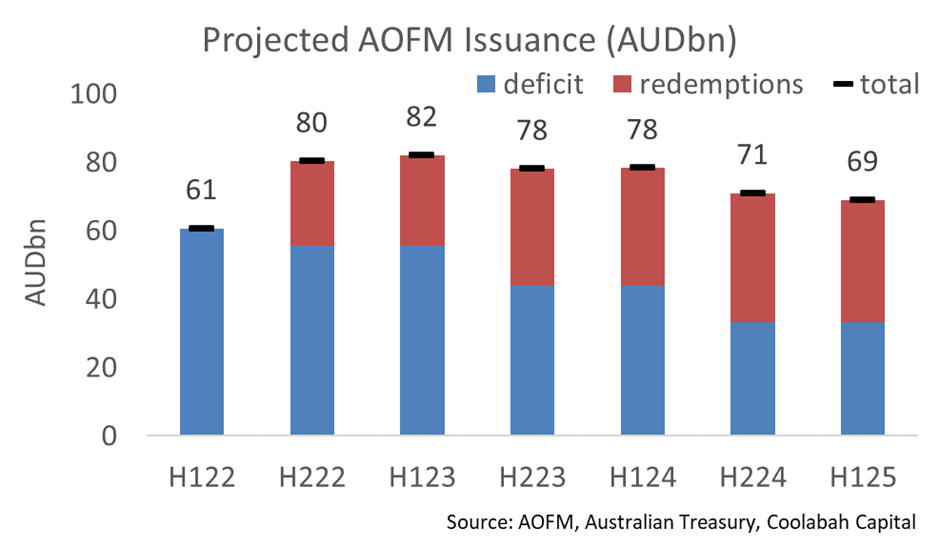

The AOFM has more than enough supply to both loosen the short lines and cheapen bonds in general. Our swap spread model is heavily influenced by gross issuance (excluding RBA purchases) and the free-float of the bond market. With QE widely expected to end February, gross supply excluding RBA purchases will swing dramatically from -$90bn in 2021 to +$116bn in 2022.

The exact profile from quarter-to- quarter will largely be determined by how the AOFM deals with maturities. In particular, the $85bn of maturities in 2022-23 are likely to be pre-funded, which should boost gross issuance in first half 2022. With this in mind, the 11/33 syndication in Q2 could be quite large and may bring swap spreads to our target.

The increase in both the gross supply of bonds and their free-float, as well as the smaller RBA balance sheet, should contribute to the normalisation of repo financing conditions.

With this in mind, we think it’s more likely that repo rates rise than fall looking forward. This would tend to further tighten swap spreads.

Conclusion

In the original swap spread paper, we said that the near-term target was ~20bps and that the medium-term target was ~10bps (noting a post-clearing average of ~16bps). With the fundamentals unchanged, and the emergence of much larger volumes of fixed-rate debt issuance from both domestic banks and Kangas driving spreads tighter, the original medium-term target seems achievable in the nearer term.

As discussed, the market has likely been surprised by some unexpected catalysts: record Kanga issuance, and record fixed-rate issuance by banks, the latter of which has been partly driven by the shuttering of the CLF and APRA’s shift to assessing super funds against fixed-rate benchmarks.

The AOFM’s changed issuance patterns have also helped a little, and should assist much more once QE ends in February.

It’s worth noting that the starting point for swap spreads was extreme. This strongly suggests to us that the Jan’21 mean-reversion will be sustained.

Looking forward, the large increase in gross Commonwealth bond issuance and the AOFM's targeting of tight lines is arguably the most important change. This will ease tight repo and reduce the bond premium. The market is forward-looking and should price this before the increase in gross issuance occurs. We expect this to happen once the RBA confirms that QE is ending, at their 1 February meeting.

There has been some confusion amongst investors as to precisely when QE ends. At its last meeting, the RBA clearly stated that it will “continue to purchase government securities at the rate of $4 billion a week until at least mid February 2022”. This implies that the final week of QE will be the week beginning 14 February.

It’s also worth noting that swap spreads are quite volatile and hard to forecast day-to-day. Investors seeking to capitalize on the move tighter in swap spreads should consider averaging-in over time. We would receive on any widening from current levels and look for spreads to tighten to our ~10bps target after the RBA ends QE.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics

2 stocks mentioned

Matt is a portfolio manager at Coolabah Capital, an asset manager than runs over $8 billion in fixed-income strategies. Matt has 17 years of experience on both the sell-side and buy-side. He spent most of his career (2008 to 2020) at UBS, the...

Matt is a portfolio manager at Coolabah Capital, an asset manager than runs over $8 billion in fixed-income strategies. Matt has 17 years of experience on both the sell-side and buy-side. He spent most of his career (2008 to 2020) at UBS, the...