The RBA is between a rock and a hard place

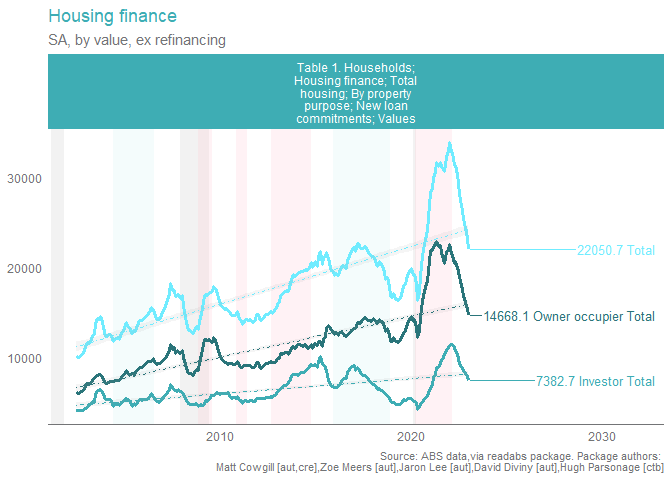

The credit cycle is all that matters. Shown below is today's housing finance data, plotted neatly by value.

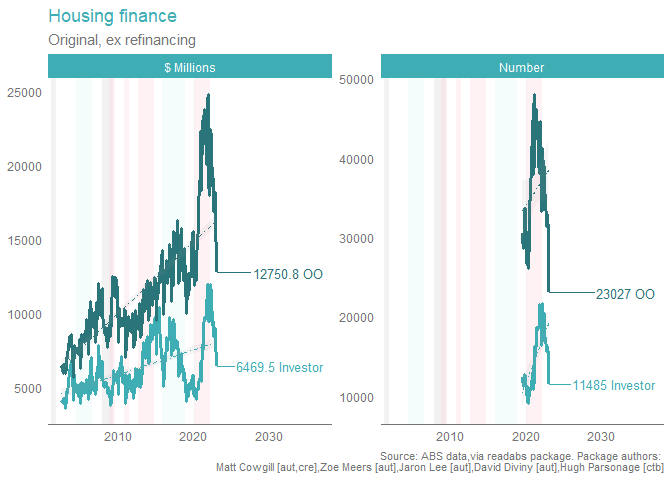

The graph below is by both value and number. We care about both. The economy lives or dies in nominal terms (nominal dollars are what you get paid in, and in turn, what you pay others with), but we do want to see what's happening with volumes, which are "real" indicators of how many people are doing what.

To avoid saying the worn out cliché of "this doesn't end well", we'll go with another. "The chickens are coming home to roost", meaning massive demand predicated on a favourable rates environment enduring forever is swiftly evaporating.

Because that second series is the original, and there's enormous volatility in both the underlying trajectory of credit demand given mortgage rate repricing, as well as the normal impacts of what Dec-Jan do for really any time series, we'll just go with "overshoot to downside likely".

But it is really, really hard to believe that this doesn't or won't have meaningful negative macroeconomic ramifications.

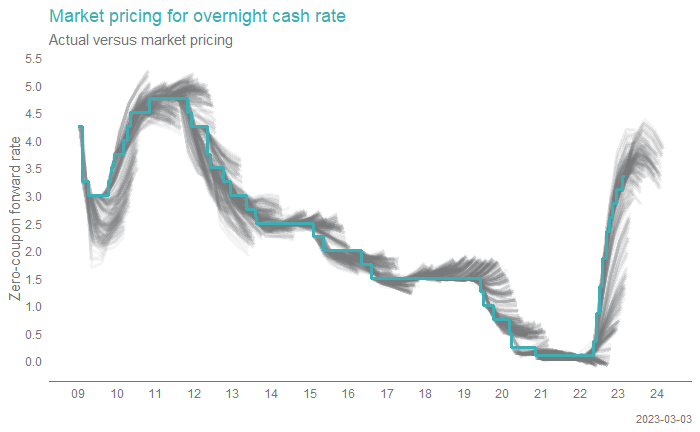

And we are set to hike the rates a whole bunch of times more.

The RBA is between a rock and a hard place.

From an asset allocation perspective, we are underweight Australian shares, and within Australian equities, we are positioned in quality defensives.

If we are wrong, and the economy muddles through, well, Aussie shares will probably do quite well, and perhaps better than our overweights to international equity (where we see the risks and rewards as much better balanced). But it would hardly be disastrous.

However, if the RBA tightening into an already underway downturn in credit really is a meaningful harbinger for a much worse outcome, then we will be pleased with our efforts to diversify away from the local market.

At the stock level, if we are wrong, and the economy muddles through, well, our defensive equities selection within Australian shares (think healthcare, telecos, to a lesser degree some of the insurance companies) will probably underperform the pointier parts of the market, like domestic cyclicals (think builders, materials, advertisers, retailers, consumer discretionary, the 2nd tier banks), and although we think our defensives will do fine in an absolute sense, they'd clearly lag behind the riskier names if the risks don't actually materialise.

Still, our punchline remains: If it really is a meaningful harbinger for a much worse outcome, then we will be pleased with our efforts to diversify into lower beta, defensive, higher quality names.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with content like this by hitting the ‘follow’ button below and you’ll be notified every time we post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics