The return outlook just got a lot better for this defensive asset

Livewire Markets

Bonds have long been held up as the epitome of defensive asset allocation. For years, government bonds have been the go-to for the investor wanting to make solid returns for very little risk.

For Australian government bonds, which still hold a AAA-rating, the government is borrowing money from itself and is at very low risk of defaulting. In Australia, these bonds have performed exceptionally well, historically. They perform even better because of the "carry and roll" effect, having returned nearly 80% over the past decade.

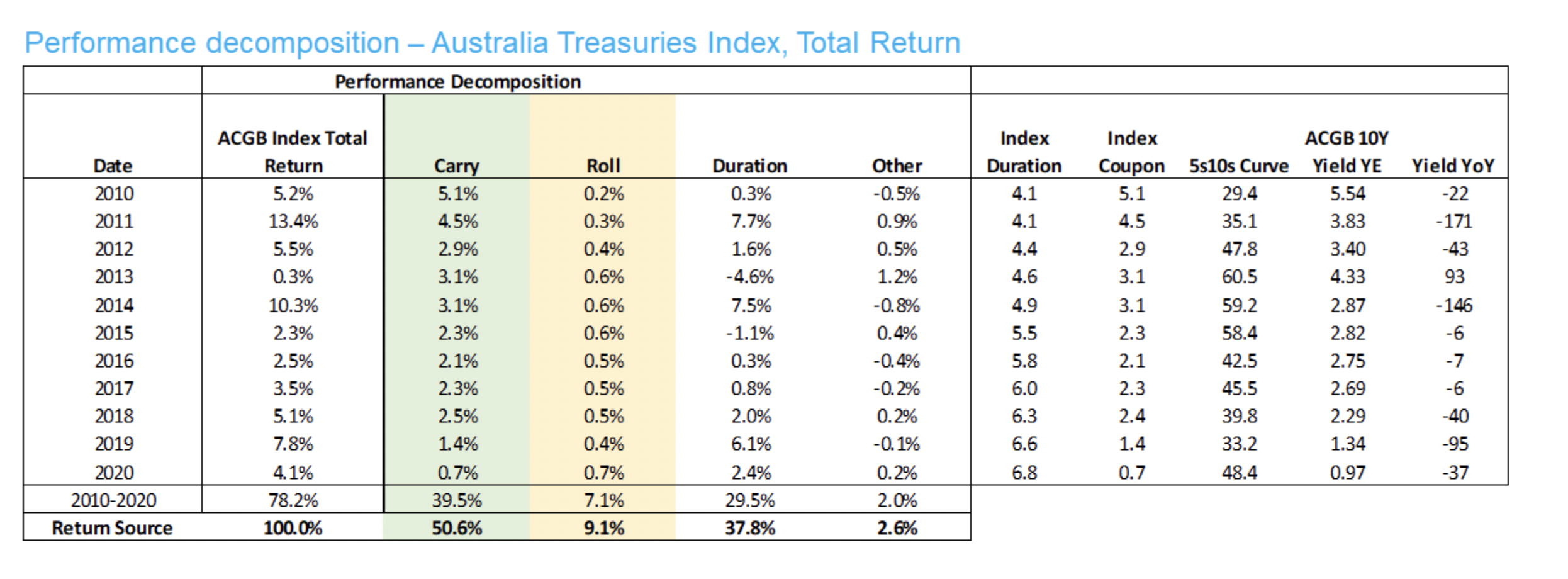

"Generally, if we decompose the returns of Australian government bonds over the last decade, 2010 through 2020, they returned 78.2%," said Charlie Jamieson chief investment officer at Jamieson Cootes Bonds in a recent Livewire Markets podcast, Rules of Investing. About half of this return is the yield, also known as carry, which Jamieson explores in the podcast and in this wire.

More importantly, these kinds of bonds are an asset that can give your portfolio a jolt of liquidity when market opportunities arise in equities. Deployed correctly, bonds can benefit your equity portfolio massively, and provide the necessary liquidity for a portfolio to outperform markets, as well as a sound "defend and protect" element.

Jamieson takes us through this defensive asset class as a means for liquidity and the "carry and roll" effect as a way of achieving great returns.

Without a bullet, a gun is useless

What good is an investment opportunity if you don't have liquidity? Investors can all relate to discovering the next big thing, then having to scramble for liquidity options in their portfolio.

"I often describe it to people as there's not much point having a mobile phone with no batteries or a gun with no bullets," said Jamieson. Bonds can be a great source of liquidity as they have much greater resilience through a downturn relative to equities.

"For those that are underallocated to defensives, it's an interesting time to be talking about it because there is a point at which clearly this thing zigs, when other things zag, it does give you that liquidity to be able to move through the market very quickly," said Jamieson.

During the COVID-19 downturn, many investors liquidated their holdings in bonds in order to "cash in" on deeply discounted equities.

"The 'defend and protect' element becomes so important in episodes like March and April of last year. We had one investor that divested from our fund at that time," said Jamieson.

"The liquidity that you provided to us in April and March of last year allowed us to go and buy deeply discounted equity assets," one client told Jamieson.

"And we made four years of returns in one year because we could get through the market very easily and very quickly coming out of something at a premium to buy something at a discount."

And now that the COVID-recovery is tapering off, the pendulum is swinging back towards a defensive asset allocation.

Jamieson notes an influx of clients ready to re-establish their defensive allocations, and he unsurprisingly applauds this strategy. Now that valuations have been restored, said Jamieson, clients are looking to rebuild their defensive allocation and return to the bond market.

Carry and roll - the bond market dance

The appeal of the bond market as a source of portfolio liquidity is due to the solid returns this asset class can provide. It's "carry and roll" which makes government bonds a much more appealing defensive strategy.

So what is the "carry and roll" effect?

Carry is the yield which the bond provides. Roll, or roll-downs, are a function of maturity decay as a bond surfs down a positively sloping term structure. As an example, if an investor buys a five-year bond, after one year becomes a four-year bond, after two years it becomes a three-year bond and so on.

"Well, we know when it becomes a three-year bond, if the RBA is still under yield curve control at 10 basis points, then it's pretty likely to yield about 30 - that's just a really simple maths equation. Through that process, it essentially augments its capital value. And so that roll becomes very, very powerful," he said.

Together the carry and roll effect comprise 60% of "the totality of bond market returns over the last decade", said Jamieson.

Essentially, as the bond gets closer to maturity it is worth more in a positively sloping term. This is due to the inverse relationship between bond prices and bond yields. In some parts of the bond market, we currently have the steepest yield curve since the early 1990s.

"We've got a tremendously steep curve in Australia as the result of the sell-off that we're just going through. Plus the re-establishment of carry means that the forward returns become incredibly exciting. Now that's not to say that the duration can't bounce around a bit from here, and it almost certainly will," said Jamieson.

It's a dance because government bonds are a continually self-resetting, compounding asset class.

The bond market goes through a sell-off and so markets reset. Investors come back to bond markets because it starts to look appealing again. Then long term rates regain their authority over markets and creep upwards.... before the next sell-off occurs, then the market resets and the dance continues - continuously compounding along the way.

When it comes to investing in the bond market, Jamieson believes the "carry and roll" effect is the key to good returns - if not the only key. He believes that bond duration plays a much smaller role than most investors think.

"The duration is something that everybody would tell you is the real reason why government bonds perform or don't perform it's obvious in a very short run. You can see that the moves in duration change bond prices quite considerably. But in totality, it's actually a minor part of the return profile," said Jamieson.

Jamieson has previously provided Livewire Markets with an example of how these returns have played out over the last 10 years.

Source: JCB team analysis, based on data from Bloomberg. Past performance is not indicative of future performance.

Conclusion

So, where does this leave our savvy investor? As we mentioned earlier, there an attraction back to bonds in a market where a lot of the potential upside for stocks have been priced in already. If you look at the latest earning season (Feb 21), earning upgrades and the COVID-recovery booster have all been accounted for in the current equities market. So as more people look to build out returns and create a "defend and protect" portion of their portfolio, there's a pretty strong case for bonds - with both good returns and the liquidity that's needed for when markets move.

You can listen to the full podcast here: Rules of Investing with Patrick Poke.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics

2 contributors mentioned

Mia Kwok is a former content editor at Livewire Markets. Mia has extensive experience in media and communications for business, financial services and policy. Mia has written for and edited several business and finance publications, such as...

Expertise

Mia Kwok is a former content editor at Livewire Markets. Mia has extensive experience in media and communications for business, financial services and policy. Mia has written for and edited several business and finance publications, such as...