The safest bet you'll see today

For anyone looking for a punt today, November's RBA announcement appears as a much safer bet than the Melbourne Cup.

The Central Bank's pre-emptive and forward looking approach in setting interest rates is often hailed as best-in-class when it comes to monetary policy. Recent commentary revolving around a commitment to “maintaining highly accommodative policy settings as long as required” however appears to be a back-flip on its traditional inflation targeting approach, with greater emphasis being placed on past inflation trends.

Whilst forward guidance is a key tool in the RBA's arsenal given the importance of managing expectations, not all statements they make will carry the same gravitas. Accordingly, in Part 1 of this Fixed Income series, I spoke to three experts to discuss whether they believe this change in the RBA's rhetoric was in fact material, and to get their predictions for the upcoming decision.

Responses from:

- Adam Bowe, PIMCO

- Raf Choudhury, State Street Global Advisors

- Stuart Dear, Schroders

Forecasts out the window

Adam Bowe, PIMCO

There are two materially important changes to their rhetoric:

The first is the communication around and the focus on their balance sheet size and composition. This is not something they've focused on previously, their main focus being on price levels, the cash rate, and yield curve control. Their most recent communications have started focusing on balance sheet size and composition, which implies a potential change in the tools they will use to support the economy. It suggests a shift towards a more traditional quantitative easing type programme, where they're targeting a quantity of asset purchases, not a price level. That’s quite a material change.

The other important change in rhetoric is around their response to inflation. Previously, the RBA started to adjust policy higher once they were confident in their forecast that inflation would move back into the target range. Now they have said they're not going to tighten policy until inflation, actual printed inflation, is sustainably back within the range. That's a really important change and it implies they will be patient in removing stimulus.

Decision tip:

We certainly don't make big investment bets on what the RBA will do at each meeting, but we do think the pressure is building for them to ease policy further. They're strongly communicating that this is the way they are pivoting, meaning there is a high likelihood of continually easing policy over coming months and a fairly high chance there will be a cut at their next meeting.

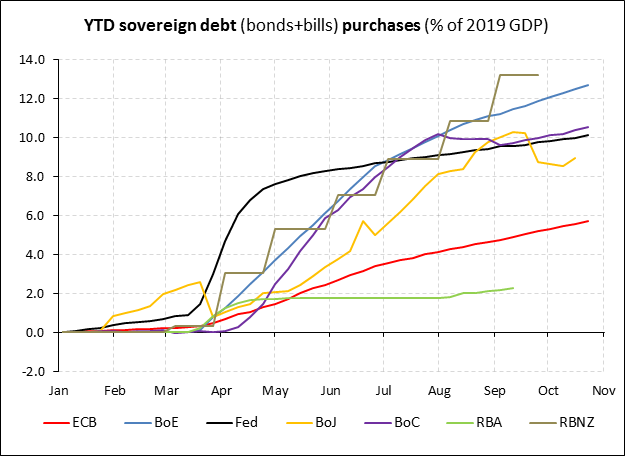

If you look at the chart below, it highlights the shift in rhetoric towards balance sheet size and composition. Since the start of the pandemic, the RBA have purchased government bonds at about 2% of GDP. While that is a substantial increase, it’s important to remember central banking is a relative game. The U.S. Federal Reserve, Bank of England, Reserve Bank of New Zealand, and Bank of Canada, among others, have deployed much larger purchase programmes – in some cases up to around 10%–12% of GDP. That's a big difference in balance sheet usage. The relative size of central bank balance sheets can have important implications for interest rates, government bond rates and exchange rates. I think going forward, that's going to be a very important metric to monitor.

Source: Haver, RBA. Date: October 2020

The power of the pen

Raf Choudhury, State Street Global Advisors

The Reserve Bank of Australia kept monetary policy settings unchanged at the October meeting but we have seen an evolution in the language being used. It is material to some extent but not completely unexpected. Given the global nature and impact of this pandemic, it is not surprising to see the RBA gradually become more aligned with the policies of other central banks.

The RBA minutes mentioned the options under discussion which included reducing the targets for the cash rate and the 3-year yield towards zero, although also emphasised doing so without going negative. The minutes also mentioned buying government bonds further along the yield curve. These policies already exist in the US, Europe and Japan where the balance sheets have ballooned. While we might not see bond purchases to the same level as other countries, we do expect the RBA to implement additional monetary easing with the aim of sustaining the economic recovery.

Decision tip:

The recent change in the rhetoric from the RBA provides strong indications of a rate cut at the November meeting. In our view, the cash rate will be reduced to 0.10%. That is the general consensus view with the market already pricing in a November cut. We still do not see the RBA moving towards negative interest rates, in fact they even emphasised this point in their recent comments. The economy has performed slightly better than expected, and the unemployment rate is expected to peak lower than anticipated earlier.

Domestically we have reclaimed almost half the jobs lost during the initial COVID-19 shock. However, the details show that recovery in jobs has been dominated by improved part-time employment and has been slower across full time employment measures. As a result, the market is pricing in rates around the current lows for the next few years.

A national priority

Stuart Dear, Schroders

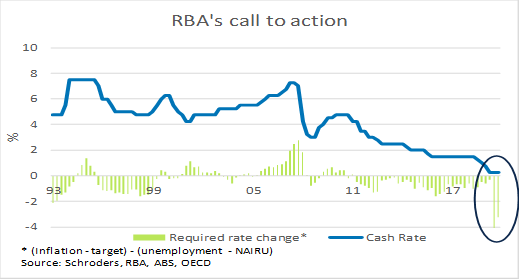

The RBA have now said that they are not going to set policy based on projected inflation, and will respond to actual inflation instead. Presumably the RBA are looking to avoid the problem they've had in the past where inflation persistently undershot predictions, for years now inflation outcomes have been below the RBA's band.

It appears as though the RBA maintain some belief in the Phillips curve: if you lower the unemployment rate, you can push inflation back up, but they do seem to have lower confidence in their ability to forecast that. Instead they are shifting the focus to the unemployment rate itself. Historically, they have had the dual objectives of inflation targeting and full employment, however we are seeing a real shift in emphasis now to the full employment aspect. There was a quote in recent speeches about lowering the unemployment rate as a national priority, implying more easing based on the unemployment rate currently being elevated. The national priority statement seems to be a request for increased fiscal support. That has been a common line by the RBA as of late. They are looking to fiscal policy to work harder because they acknowledge that monetary policy is getting close to limits.

Decision tip:

We think they will cut the cash rate to 0.1% as well as the rate on the term funding facility. Presumably, they will also take the yield curve control target for three year yields down to 0.1% as well. Whatever they do, it will definitely involve more bond buying. Whether they move to pure QE by announcing a certain quantity of bonds that they're going to buy is harder to say. Given all the commentary and build-up, the market will likely be disappointed if they do not announce pure QE. The way they have compounded expectations so much could create some problems for the RBA if they do not follow through.

The traditional objectives of central banks have been inflation and full employment, but financial stability has grown as a priority in recent times. Central banks have backed themselves into a corner that will be hard to get out of in that every time we have market volatility, they seem to step in. This has obviously helped boost financial assets, even if it's had little real economy effect. The RBA has been one of the more cautious central banks when it comes to stepping into financial markets. Now that they've built this up so much however, it will be interesting to see exactly what they deliver and if part of it is to prevent market disappointment.

Caption: Inflation and unemployment gaps place pressure on a change in the cash rate

Conclusion:

During race that stops the nation, the RBA is hoping that their descent to 0 will do the opposite. Their change in tone is not just for show: our experts unanimously agree that an interest rate cut is pending in the upcoming meeting. Given the unprecedented economic conditions we are presented with, it would appear as though falling in-line with other international central banks when it comes to unconventional stimulus is the only option.

With important trading partners bracing themselves for extended crises, join me in Part 2 of this collection as we unpack the implications on currency and consider the lessons Australia can learn from observing other countries.

Ensure you are following my profile by clicking follow to be updated when this wire is posted.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

Enjoy this wire? Hit the like button to let us know.

2 topics

3 contributors mentioned