The second stage of disruption

If you were to look quickly, the ups and downs of reporting season would suggest that things are pretty much the same, or even slightly better.

This isn’t so. Telstra has just reported its first ever mobile revenue drop – something we flagged here two years ago, which caused a 14% fall in earnings. The stock sold off 5%. It cited competition as if that had recently changed. Really?

Westpac is a little better, but still down. The oil price, on which a chunk of the resources industry depends, has halved in the past two years. Same for the gas price. The Australian dollar is flat to down, so global buying power for Australians has declined.

For offshore investors in most global funds, the story looks better, but it will very much depend on what the manager is holding. The S&P500 index is up 23% in the past two years, but back out the performance of Apple, Amazon, Alibaba and the like, and that growth is significantly lower – maybe even negative. GM is flat relative to 10 years ago. Ford is not appreciably higher. Exxon, the world’s biggest oil company, has gone nowhere. Oracle is flat. Walmart has been on the slide – it is off 15% from two years ago.

For students of economic history, what we have here isn’t a cyclical low in the fortunes of these companies, thus marking a buying opportunity. In fact, the economy, relatively speaking, is not bad. The Trump bump has put some life into extractive industries like coal, or the global banks, but the long-term decline in the value of these businesses, because of disruption, is clear for all to see. Bank of America ten years ago was $50; today it is $25.

We have seen the value of companies in industries like media and telcos collapse for existing players (like New York Times, Fairfax and Telstra). That value has been massively transferred into disruptors like Google and Facebook.

But this marks only the first phase of the disruptive change, in which companies which are at their core already digital, are damaged. “Already digital” means that the product or service is fundamentally consumed as information – music, movies, newspapers and phone calls – and so which lend themselves naturally to a shift on-line.

That is where it started. But now we are seeing disruption impact businesses whose products are physical goods and services – i.e., where the product isn’t digital. For example, when a consumer buys from Uber, it’s a physical ride which is being purchased. US customers buying from Amazon don’t buy technology; they buy soap and nappies.

Sure, Uber uses technology, but that isn’t what the customer gets: Uber injects knowledge into a network which allows unused transport capacity to be unlocked (like AirBnB and hotels) to the detriment of existing taxi companies.

Alibaba and Amazon use connectivity to re-cut the retail transaction, effectively removing the necessity for high street retailers to be in shopping malls, in favour of a direct-to-customer distribution centre. The saving is distributed to shareholders and customers.

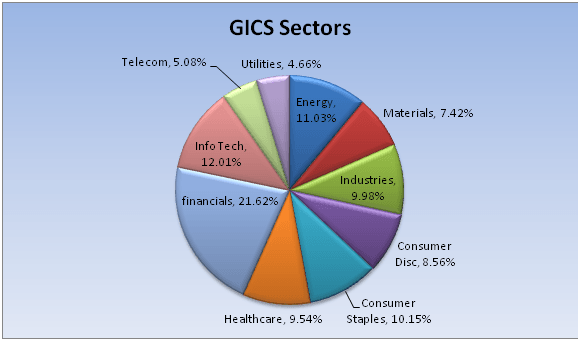

What does this mean? GICS classifications, shown here, are the way most fund managers construct portfolios. For example, industrials, financial, materials and utilities add to around 40% in a typical global portfolio. Consumer discretionary is a further 9%, and consumer staples together add another 19%.

But it’s what inside that counts. Autos and components are a significant part of consumer discretionary, as are media, retail and staples including food. A major component of Industrials is transport – road, rail, marine, airline, construction material and heavy trucks.

Virtually all the automakers have electric and self-driving models in the works. But, as we have noted before, the more successful they are with these, the more the potential for write-offs in their internal combustion engine business – which is basically the whole business.

Banking disruption has started but hasn’t hit the mainstream – yet.

But fund managers typically invest looking to the existing make-up of the global economy, through the GIC’s sectors, which are composed of the companies in those industries. So the fund manager will have investment in oil, automakers, energy and transport, at time when those sectors are heading for massive disruption. In essence, the fund manager is investing by looking backwards!

This is a poor long-term strategy, and one which has already begun to cause drag in portfolios which are underweight ‘technology’ shares (because they form a small part of the index, at the expense of sectors like basic materials and utilities, which are large now but are de-weighting as disruption takes hold.)

We are at a particular point in the economic history where disruptive companies are moving into industries which were previously considered inviolable, companies which couldn’t be damaged because demand for the underlying physical good was thought to stretch out to the horizon. In fact, the demand may still be there, but the way it is delivered, because of technological change, is affecting virtually all industries.

It's why we invest in disruption, and the reason our returns have been solid.

2 stocks mentioned