The top performing global share funds for FY22

World events played on global shares funds across the year, be it ongoing challenges from the COVID-19 pandemic to the war in Ukraine. While a focus on value benefitted performance, certain sectors benefitted from the macro environment, with energy, materials and industrials clear winners from supply issues.

“Shares have had an awful start to the year. Portfolios are bleeding and savers are scared. Forget about making money, the problem is holding on to it.” Chad Padowitz, Talaria Asset Management

The following wire is part of our series on fund performance in FY2022, exploring the wins and losses across the year – or to quote Chad Padowitz, which fund managers not only held onto money but made it.

Key points

- An overview of the Livewire fund database

- A list of the 5 best-performing global share funds in FY2022

- Energy, materials and industrials dominated performance, while pockets of healthcare benefitted from covid recovery.

Disclaimer: the following information is based solely on the Livewire Managed Funds list, which contains a total of 244 funds, including 77 global shares funds. It is by no means an exhaustive list and is not meant to reflect the top performers across the entire marketplace.

How we compiled this list

The following list was compiled using the information provided here: (view link)

- In the “Fund type” box, select “Managed Funds”

- In “Asset Class”, select “Global shares”

- We then manually filtered results based on 1 year returns.

*Please note all data is supplied by Morningstar.

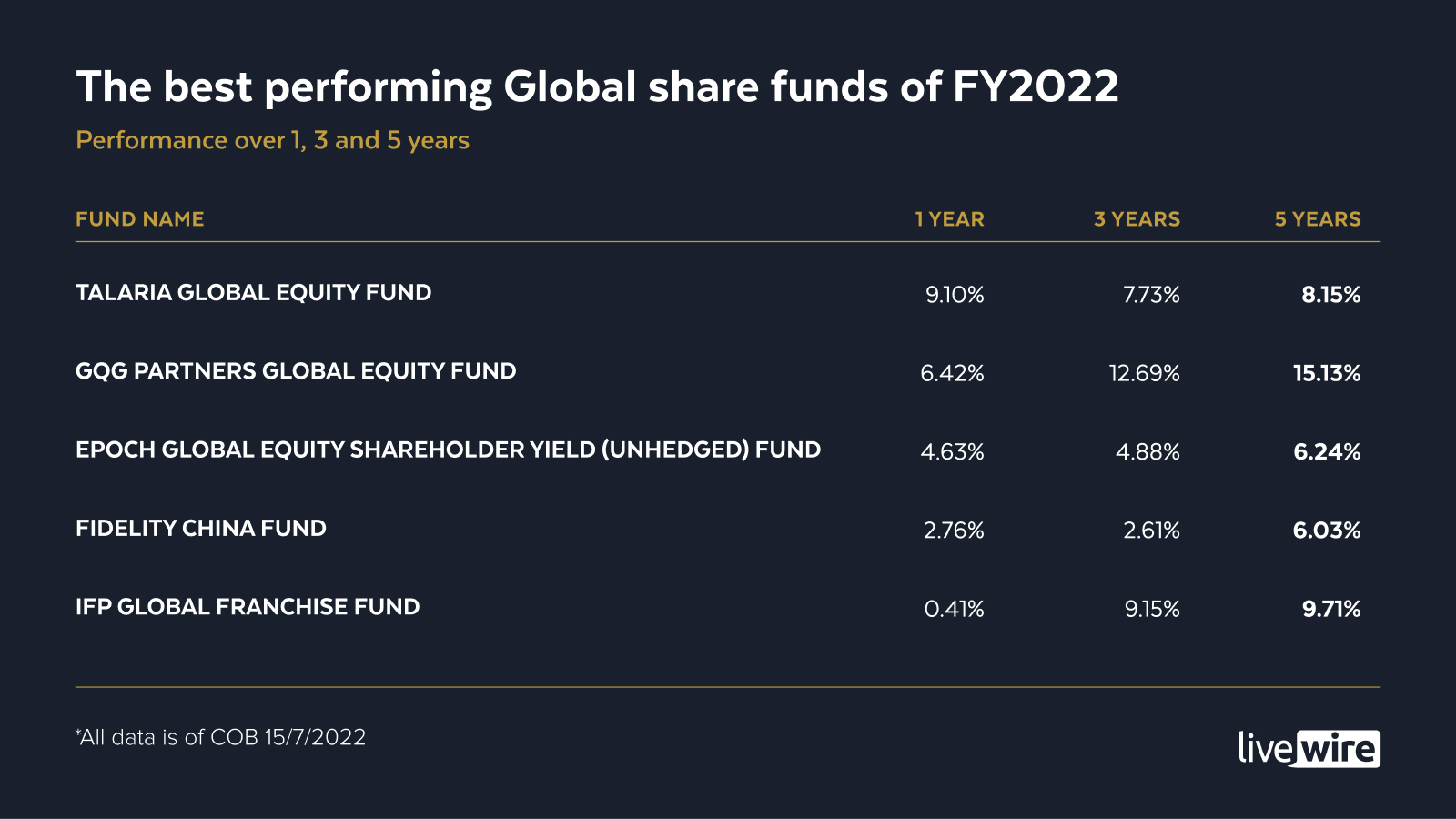

Global shares best-performing funds for FY22

Below are the best 5 performing global share funds in the Livewire database based on 1 year returns.

- Talaria Global Equity Fund +9.10%

- GQG Partners Global Equity Fund +6.42%

- Epoch Global Equity Shareholder Yield (Unhedged) Fund +4.63%

- Fidelity China Fund +2.76%

- IFP Global Franchise Fund +0.41%

In the current macro backdrop, it is unsurprising the top performer used a value-based approach to investing.

Talaria Global Equity Fund

Talaria Global Equity aims to offer a high conviction, global share portfolio of 15-45 shares identified through a value-biased approach focused on consistent income generation and capital appreciation.

Chad Padowitz, co-CIO at Talaria Asset Management believes that investors need to prepare their portfolios for inflation and slowing growth.

“We are almost certainly in the early stages of an economic slowdown – the kind which historically does not end well for equities. Earnings' forecasts are likely to fall as corporates wrestle high inflation and rising interest rates. These challenges, which are also manifesting in falling disposable incomes, threaten to persist.”

He argues that preparation comes down to diversifying geographically into regions beyond the US, such as Europe and Japan, looking for returns uncorrelated to the NASDAQ and bond yields and focusing on quality income.

This is in conjunction with Talaria’s 3 rules to investing in the current market.

- Avoid assets that magnify market moves

- Own assets with shorter rather than longer payback periods

- Do not try to pick the next fund winner

“One of the reasons value stocks have performed well over the last year is because they do exactly that. Diversifying to regions other than the US and sectors other than Tech can offer greater options to reduce your payback period. ”

Top 5 holdings

- Alibaba (HKG: 9988) – 5.9%

- Novartis (SWX: NOVN) – 5.8%

- Roche (SW: ROG) – 5.7%

- Johnson & Johnson (NYSE: JNJ) - 5.3%

- Sodexo (SW: EPA)- 5.1%

Major contributors to performance

- Alibaba: easing pressure from the Chinese government crackdown on tech companies coupled with talks of fiscal stimulus provided respite from the heavy selloff seen throughout 2021 and early 2022.

- Sanofi, a French drugmaker, exceeded market expectations in Q1 and continues to offer steady and predictable future earnings, low beta and low valuation.

- Other key stock contributers were Johnson & Johnson, Sumitomo Mitsui (TYO: 8316) and McKesson (NYSE: MCK)

GQG Partners Global Equity Fund

The GQG Partners Global Equity Fund is a quality focused strategy seeking to identify companies which can offer long-term earnings growth and available at a reasonable price.

In their recent second quarter CIO Perspectives, GQG commented on the switch towards value-focused sectors, noting that many market commentators still hoped the switch in cycle was transitory despite evidence to the contrary.

“Earnings and cash flows have accelerated in areas that were the Covid laggards and waned in the Covid winners. Not only that, in a sector like energy, select companies such as Exxon and Petrobras, despite record free-cash-flow generation, have seen their multiples stay flat or even fall! Generally, this type of behaviour is the opposite of what characterizes the end of a cycle.”

The fund manager believes opportunities are driven by the market environment, rather than existing in a vacuum, and have identified a number of quality companies for their portfolio likely to offer consistent growth in the future.

Top 5 holdings:

- Exxon Mobil Corp (NYSE: XOM) – 6.8%

- AstraZeneca PLC (LSE: AZN) – 5.5%

- Occidental Petroleum Corp (NYSE: OXY) – 5.1%

- Johnson & Johnson (NYSE: JNJ) – 4.9%

- Microsoft Corp (NASDAQ: MSFT) – 4.7%

Major contributors to performance:

- Exxon Mobil and Occidental Petroleum benefited from surging oil prices in the first half of the year

- Johnson & Johnson saw gains in pharmaceuticals and medtech segments. Medtech was supported by market recovery and recommencment of surgeries in many countries while pharmaceuticals benefitted from the launch of two new drugs.

- UnitedHealth Group (NYSE: UNH) is the largest health insurance provider in the US and benefited from the increasing cost of healthcare and a strong labour market.

- Eli Lilly & Co which has outperformed peers off the back of a strong drugs pipeline and had a new diabetes medication approved in May

Epoch Global Equity Shareholder Yield (Unhedged) Fund

The Epoch Global Equity Shareholder Yield Funds aim to deliver attractive total returns with an above-average level of income by investing in a diversified portfolio of global companies with strong and growing free cash flow. It follows the ‘9% approach’, a standard minimum requirement covering dividend returns, buybacks and cashflow growth for the companies it invests in.

“While earnings are bound to be pressured by the current macro backdrop, companies characteristic of the shareholder yield portfolio, those with strong market position, strong pricing power, and the ability to defend margins with efficiency steps, should prove capable of maintaining earnings and cash flow growth despite the challenging environment.” Epoch Fund Update June 2022

Following this philosophy allowed Epoch to offer 1 year returns of 4.63% in the Epoch Global Equity Shareholder Yield (Unhedged) Fund for FY22.

5 highest yielding holdings

- IBM (NYSE: IBM) – 4.7%

- AbbVie (NYSE: ABBV) - 3.5%

- Philip Morris Int Inc (NYSE: PM) – 5.1%

- Broadcom Inc (NASDAQ: AVGO) - 3.3%

- TotalEnergies SE (EPA: TTE) – 5.2%

Major contributors to performance

- Healthcare, Consumer Staples and Utilities were main positive sector contributors to returns.

- Among the largest individual contributors to return were IBM and Deutsche Telekom (ETR: DTE).

- IBM shares benefited from the consistent, recurring nature of IBM's business, which is likely to outperform during a slowing macro environment. IBM pays a well-covered, growing dividend.

- Deutsche Telekom shares outperformed on strong German results despite the Ukraine war disrupting Europe. The pending monetisation of its tower assets and strong U.S. performance from T-Mobile were all supportive of share strength. The company pays a well-covered dividend and is reducing debt in the U.S. post the Sprint merger.

Fidelity China Fund

The Fidelity China Fund invests in 60-80 Chinese companies using a fundamental value approach to investing, with awareness of the macro environment and policy changes.

According to the June report for the Fidelity China Fund, Chinese shares, though volatile, still benefited from easing of Covid lockdowns and restrictions as well as the announcement of fiscal, financial, investment and industrial policies from the Chinese government. Consumer staples and consumer discretionary sectors were typically the top performers.

“China's dramatic growth has been fuelled by its industry sector since decades, and undoubtedly remains a powerful contributor to the nation's income. More recently, the service sector, known as the “new economy”, has shown a growing global presence in wholesale and retail trade and information services. These two pillars should enable China to grow its GDP in the future. “

Top 5 holdings

- Alibaba Group (HKG: 9988) – 10.6%

- China Life Insurance (SHA: 601628) – 5.2%

- China Construction Bank (SHA: 601939) – 4.7%

- Baidu Inc (HKG: 9888) – 4.0%

- Tencent Holdings (HKG: 0700) - 4.0%

Top contributors to performance

- The position in housing transactions and services platform KE Holdings (HKG: 2423) gained on better than expected results in the first quarter. It reported profits, beating consensus expectations of a deep loss.

- Shares in China Life Insurance rose as its valuations turned attractive.

- The position in Zhuzhou CRRC Times Electric (SHA: 688187) benefited from supportive policies for new energy vehicles, as it is a major supplier in the electric vehicle (EV) supply chain.

- Shares in Hansoh Pharmaceutical (HKG: 3692) advanced as investors looked for defensive businesses with strong balance sheets in the current volatile environment.

IFP Global Franchise Fund

The IFP Global Franchise Fund invests in a concentrated portfolio of 25-35 global franchises as identified by fundamental research. To classify as a franchise, the companies must hold a dominant intangible asset (like a brand or patent) which offers a competitive advantage in their market category. Each company held in the portfolio must meet strict quality and valuation standards – meaning that the portfolio is concentrated because there are only a few companies in the market that the investment team believe warrant a long term buy and hold approach.

Michael Allison, Founding partner and investor at Independent Franchise Partners, believes it is important to monitor companies over a complete market cycle as it can take a while to compound wealth over time, and it gives a better understanding of a company’s ability to withstand market movements.

“When valuation is driven by more speculative elements, it can harm returns, but when the tide goes out, that’s when the valuation discipline comes into its own.”

It’s a particularly relevant view in the current market environment.

Top 5 holdings

- Bristol-Myers Squibb Co (NYSE: BMY) – 5.99%

- British American Tobacco (LON: BATS) – 5.69%

- Novartis AG (SWX: NOVN) – 5.13%

- News Corp (ASX: NWS) – 4.90%

- Philip Morris International (NYSE: PM) – 4.58%

Key contributors to performance

- Healthcare, consumer staples and materials sectors have been the dominant contributors to returns in the past year.

- Bristol-Myers Squibb Co was a significant contributor due to its positive data releases, along with a strong pipeline of new drugs in development.

- Holdings in IT, in particular via Salesforce (NASDAQ: CRM), were also supportive of performance.

Conclusion

.jpg)

The top performing managers have emphasised the ongoing rotation to value investments, and the cycle is far from transitory. Avoiding more cyclical industries has, to the most part, paid off for the top performing global fund managers and top performing sectors have been dominated by consumer staples, healthcare, materials and utilities. Diversification and a focus on consistency and income growth has been a common theme across the top performers of FY22.

3 topics

9 stocks mentioned

5 funds mentioned

1 contributor mentioned