The trends that will shape the next decade

The 2021 Fidelity Investment Forum webinar presented a chance to reflect on the past and consider the future pathway being paved. It has been a long time since there was so much uncertainty in the world, with continued divergence in economic re-openings between countries, frothy market conditions and a virus seemingly always one step ahead. But the future presents exciting opportunities and this period has undoubtedly accelerated digital adoption immensely.

"There is a new economic order...dominated by regions that emerged from COVID-19's lockdown first and accelerated trends in digital consumption. There are economic and market forces that are changing or have changed as a result and these we believe are going to shape how we think about investing for the next 5-10 years."

Featuring renowned fund managers and Australian futurist Bernard Salt, the event covered the demographic trends at the front of mind for the future of business and consumers, the opportunities in emerging markets, the role of global trends in investing and finally how to drive real ESG impact.

Demographics provide insights into consumer trends

Bernard Salt, Executive Director, The Demographics Group

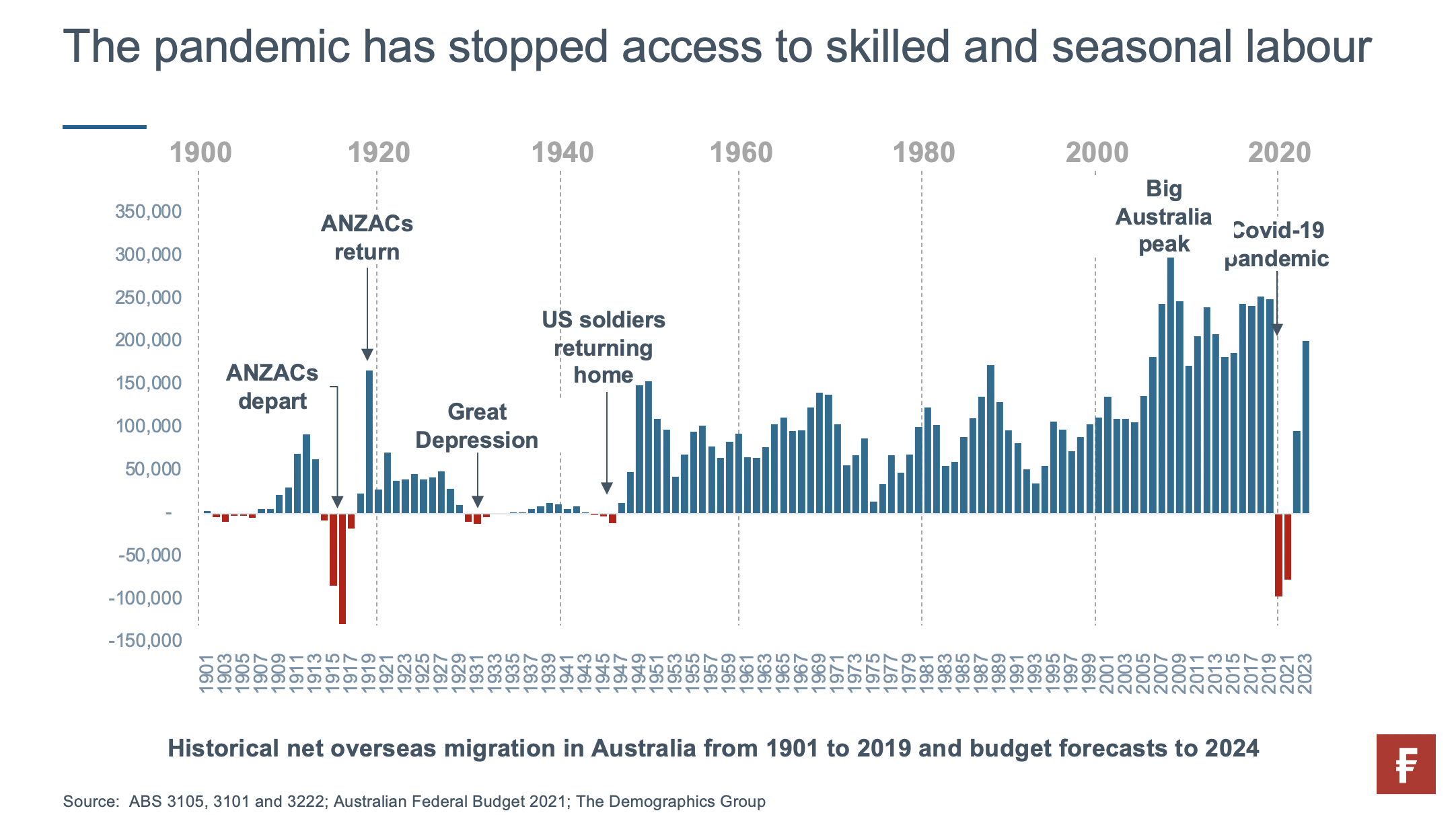

The current and most recent financial years has led to a net outflow of migration, with the likes of foreign students, expats and backpackers all returning to their home countries at great volumes than Aussie expats returning.

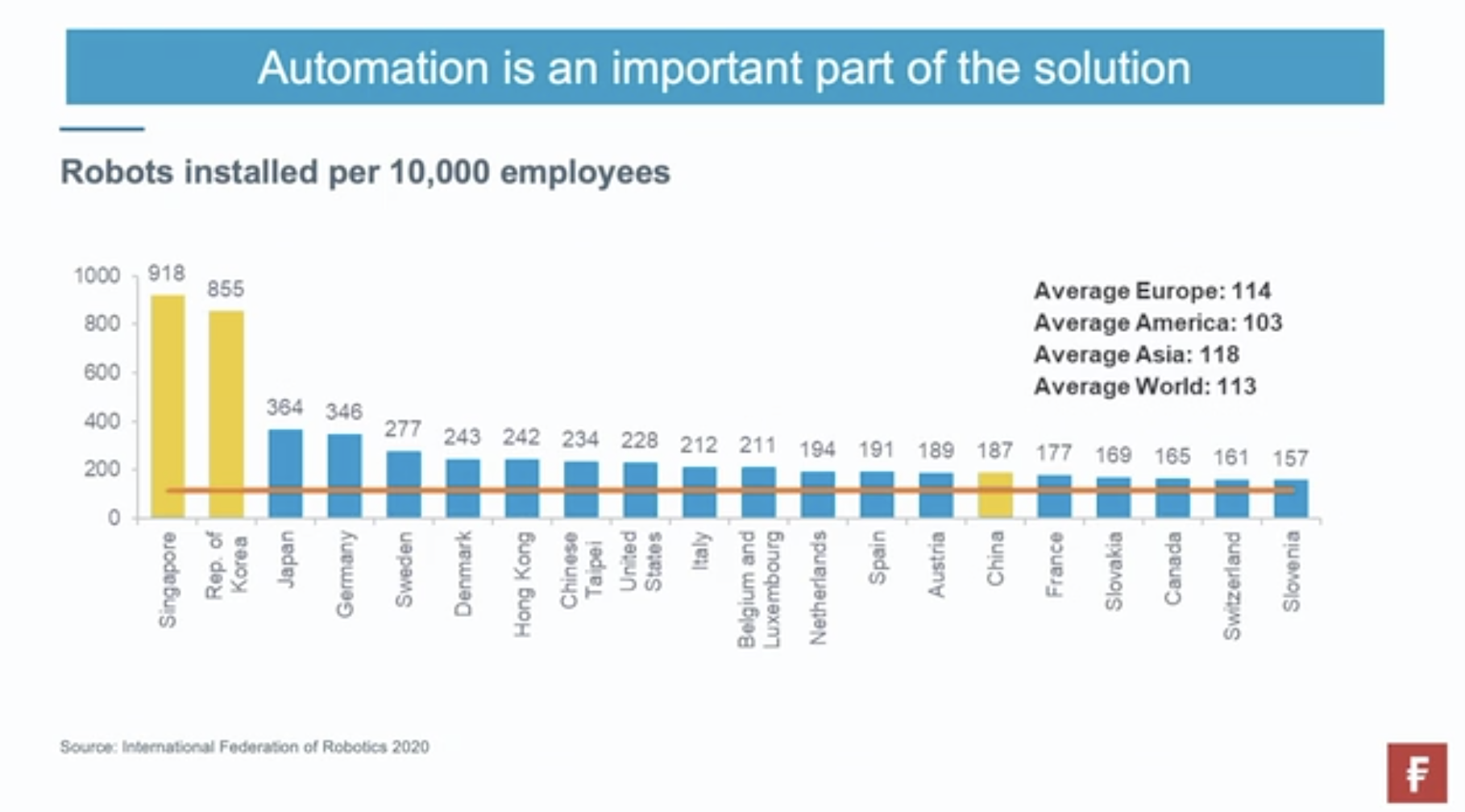

"We have geared our economy around easy access to foreign skilled and seasonal labour. But 12 months into this pandemic, we have soaked up all available sources of employment - unemployment is contracting. The great challenge will be over the next 12 months - getting skills and labour to assist the recovery. It may also hasten our move towards digitalisation, mechanisation and automation."

With this adoption of more skilled labour, certain areas have excelled. The biggest job-gaining occupations:

- Logistics: Store persons, delivery drivers and supply/distribution procurement managers.

- Technology: Software/app programmers, multimedia/web developers, database & systems administrators and ICT security specialists

- Health & Medical: Pharmacists, audiologists and speech pathologists and GPs

- Home Improvement: Gardeners, carpenters and joiners, interior designers

Many of these demonstrate where market trends are leaning. "We are just as consumeristic as ever" and having an online presence for a business is essential.

"We are taking spending that used to be directed to a holiday in Bali or Phuket and instead investing in the family home...We are almost cocooning as we work from home and spend greater dwelling time in the family home."

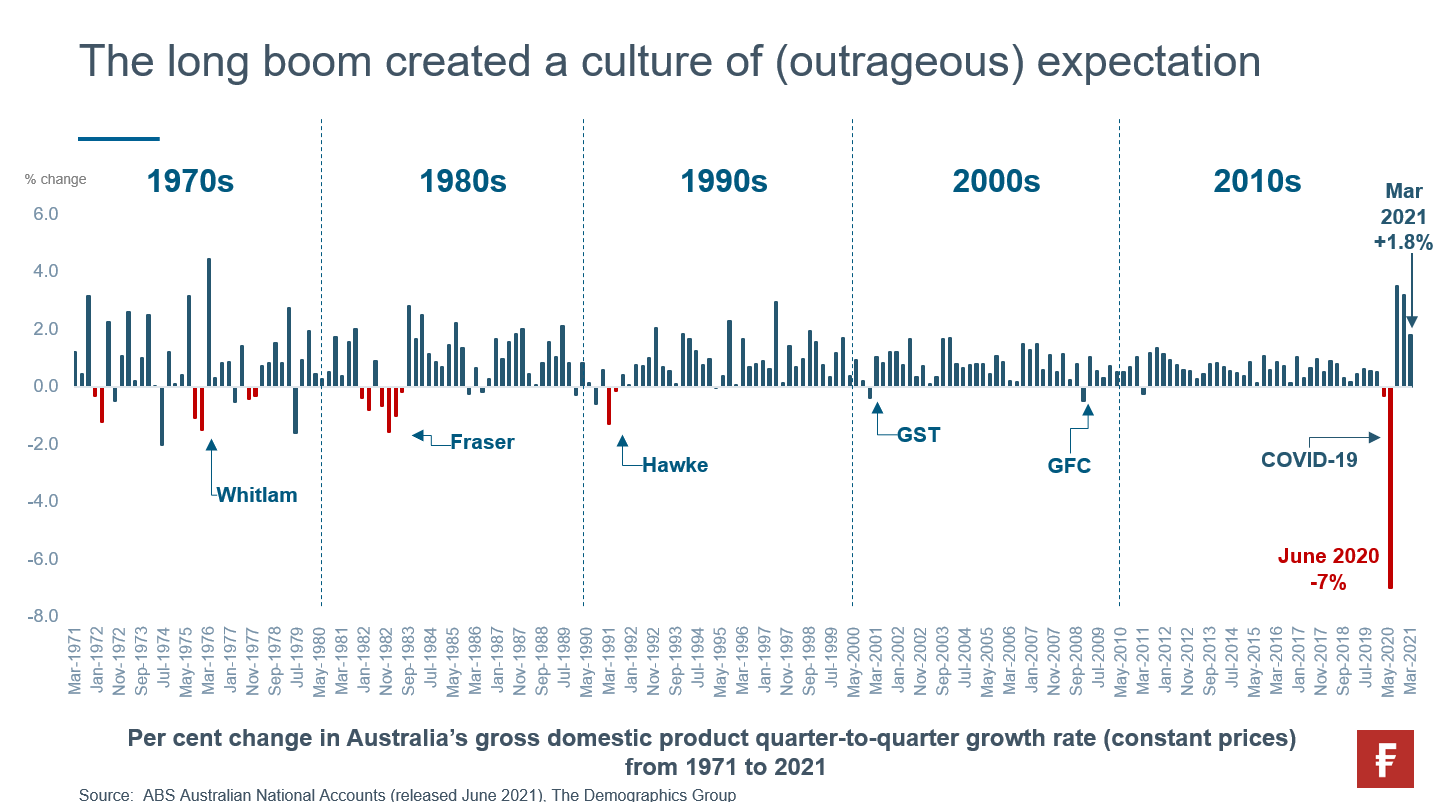

This chart shows the quarter-by-quarter change in GDP. Immediately of note was the 7% decline in GDP during 2020's period of national lockdown, before gradual improvements that should instil us with confidence for the future.

"This is a very different story to how these things were managed in the 1960s, 70s, 80s. You can see there were downturns every three or four years or so. This led to (that) generation always saying to not trust credit, don't get into debt...good times are always followed by bad. Whereas for the last 30 years, we really haven't had a significant recession until the pandemic induced recession of last year."

The recent past may not be the best guide to the future

Paras Anand - Chief Investment Officer, Fidelity International APAC

The pandemic has accelerated three major shifts in the global economy

- The acceleration of the digitisation of the economy and lockdowns for activities online

- The focus on sustainability as societal imbalances and fragility of the natural ecosystem have become apparent

- The rise of Asia in the context of the global economy (china only country posting positive growth)

We have seen the adoption of crisis management strategies, with rampant stimulus and record low rates. With much of this being fed into infrastructure spending, there are 3 main buckets these are allocated into.

- Basic infrastructure

- Renewable infrastructure

- Infrastructure crucial for smart cities.

"This will mean that the era of low inflation and low rates will end as this shift in economic strategy moves from intention to implementation (of real change)."

There will also be areas where the "party is well and truly over." Specifically wide outcome businesses: early stage, loss-making companies currently riding waves of absurdly large valuations - only few will last.

"The herd of unicorns will progressively thin out."

As for the opportunties in markets:

"The case for outperformance among developing markets looks very strong. A combination of a robust rebound in economic activity globally, low relative valuations and strong local currency earnings growth will see global investors in creasing their allocation to emerging markets over time."

Breaking down the Asian market, South East Asia and India are on track to embrace growth. The demographic issues impacting the West and North Asia look very different across these ASEAN regions, and there will be an acceleration in digitisation.

China will continue to represent a rich source of opportunity, however it is entering a very different stage of development as an economy: A more modest level of headline growth as well as the prioritisation of moving up the value chain, to areas such as technology, finished goods and natural capital.

Overall, emerging markets present a unique prospect of portfolio diversification.

"The Japanese equity market represents the opposite of where the action has been in the last cycle. (Domestic) companies hold large cash balances, in comparison to a global corporate sector that continues to have a very high reliance on external funding. Alongside a greater focus on capital allocation that is driving up returns and an economy that continues to have a large export sector, I believe Japan offer an attractive risk reward allocation for investors in the cycle to come."

Investors need to be alive to the risks emerging in traditional areas of high returns, yet maintain focus on the emerging opportunties on a global level.

Buying on the demographics

Aneta Wynimko, Alex Gold and Oliver Hextall - Portfolio Managers, Fidelity Global Demographics Fund

The Fidelity Global Demographics Fund looks to find compounders that will ride long term and predictable trends.

- Ageing populations - Increased spending on healthcare and need for automation.

- Growth of middle classes - Rising demand for global and local brands, increased travel, demand for financial and online services.

- Population growth - Scarcity of resources, need for sustainable sourcing, protecting the environment

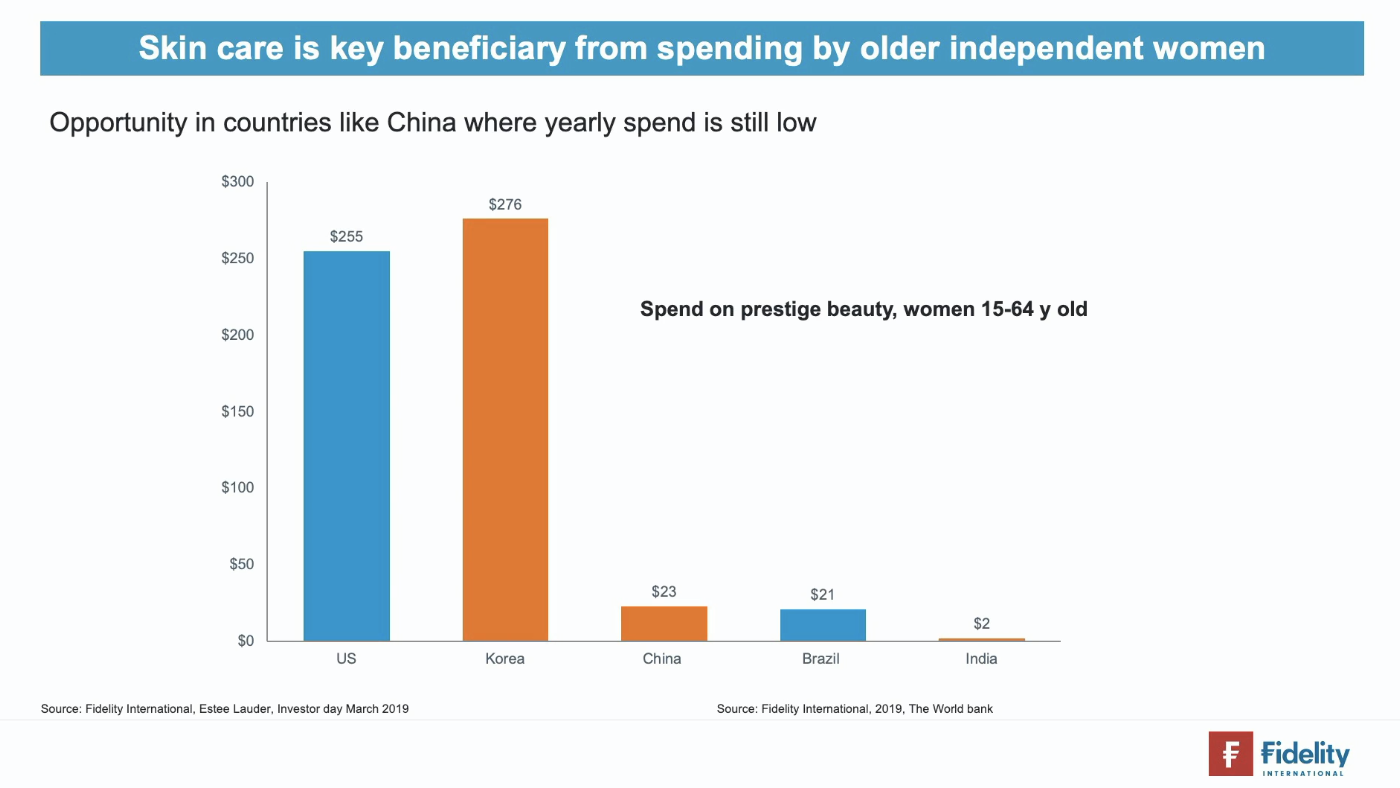

An example of an industry rising with ageing populations is cosmetics:

At the forefront of this movement is L'Oréal.

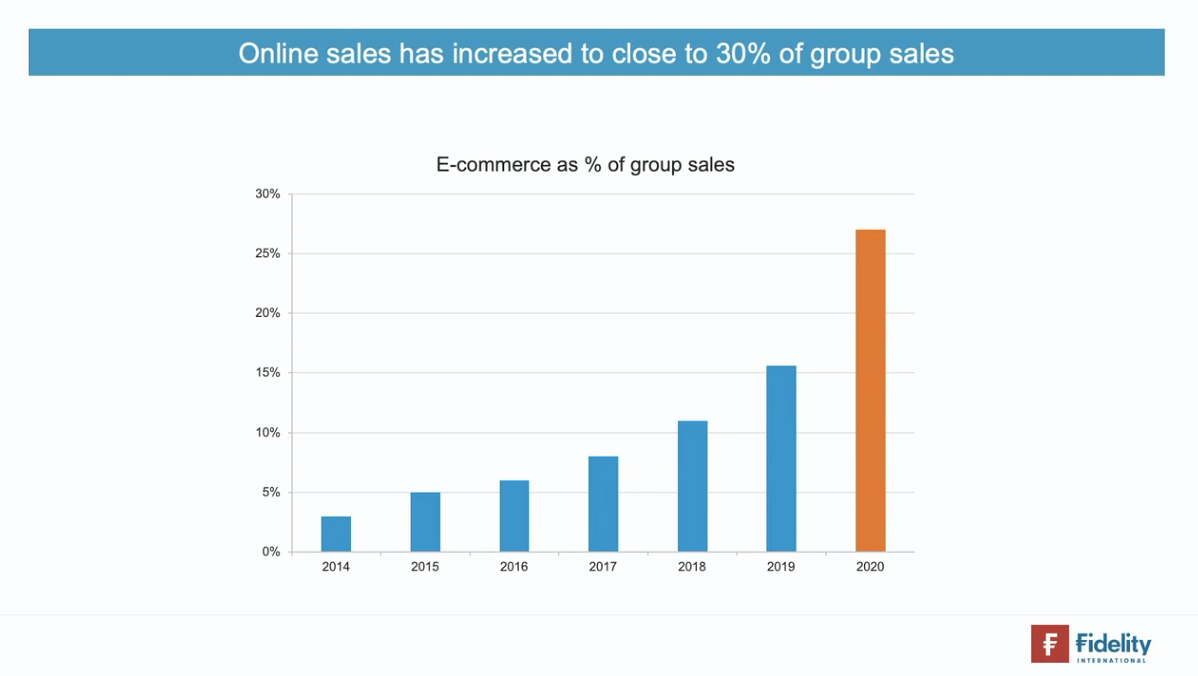

"The company has a very attractive portfolio of brands, at different price points, distribution channels and also catering to different needs. During the Covid crisis, the company has done well versus its competitors and investor expectations...It has actually become a beauty-tech company"

It has made strategic investments in different ways to engage consumers and increase their offering, and have rapidly scaled their online sales.

Underpinning many of the opportunities available is a constantly growing population. The UN estimates the world will have 10 billion people by 2050, which would require more than double the current food production. Alongside the diminishing workforce, this places a huge importance on automation.

Finally, with people living for longer, there will be constant opportunity in the medical and biotech sector. Fidelity takes a particular interest in the tools that will facilitate these breakthroughs.

"The companies we prefer to invest in are those that are running clinical trials, helping supply tools and diagnostics for research, as well as those that are helping manufacture drugs without taking on the binary risk of a specific drug...In the gold rush, we prefer to own the picks and shovels of the industry"

The ESG conundrum

Kate Howitt, Portfolio Manager, Fidelity Australian Opportunities Fund

One of the most important at the front of every investor's mind is ESG. Kate Howitt, one of the world's leading fund managers, believes these factors are certainly here to stay.

ESG is focused on companies internalising their externalities...The world has a problem of consensus as well as coordination.

Fidelity is a global organisation, and this enables information sharing between offices and coordination of resources.

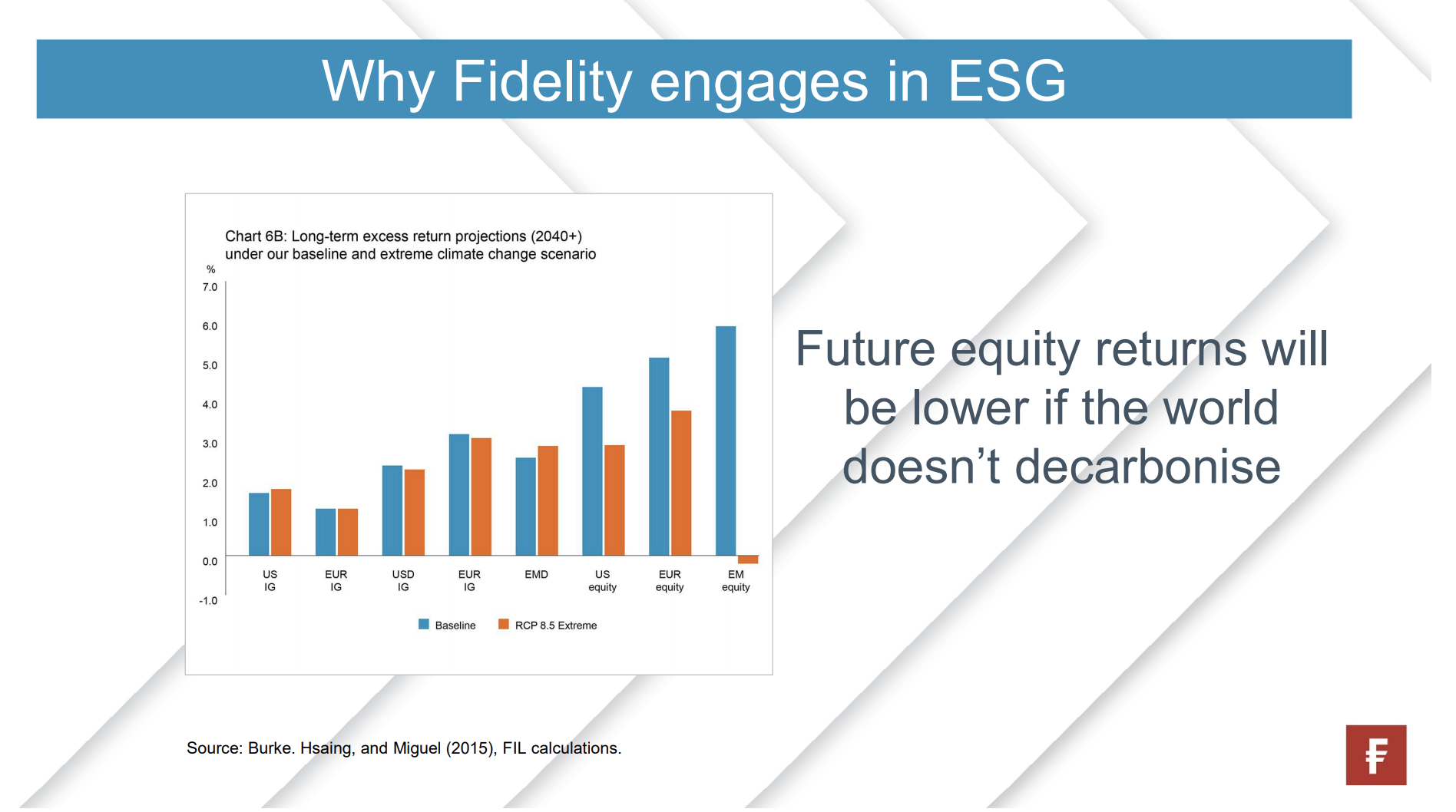

We don't believe in a dichotomy of traditional investing and ESG off to the side... If you think that investing is all about delivering returns for your clients, we believe ESG must be part of this.

In fact, modelling suggests that ignoring these factors will be a deadweight on returns looking at a long term time horizon.

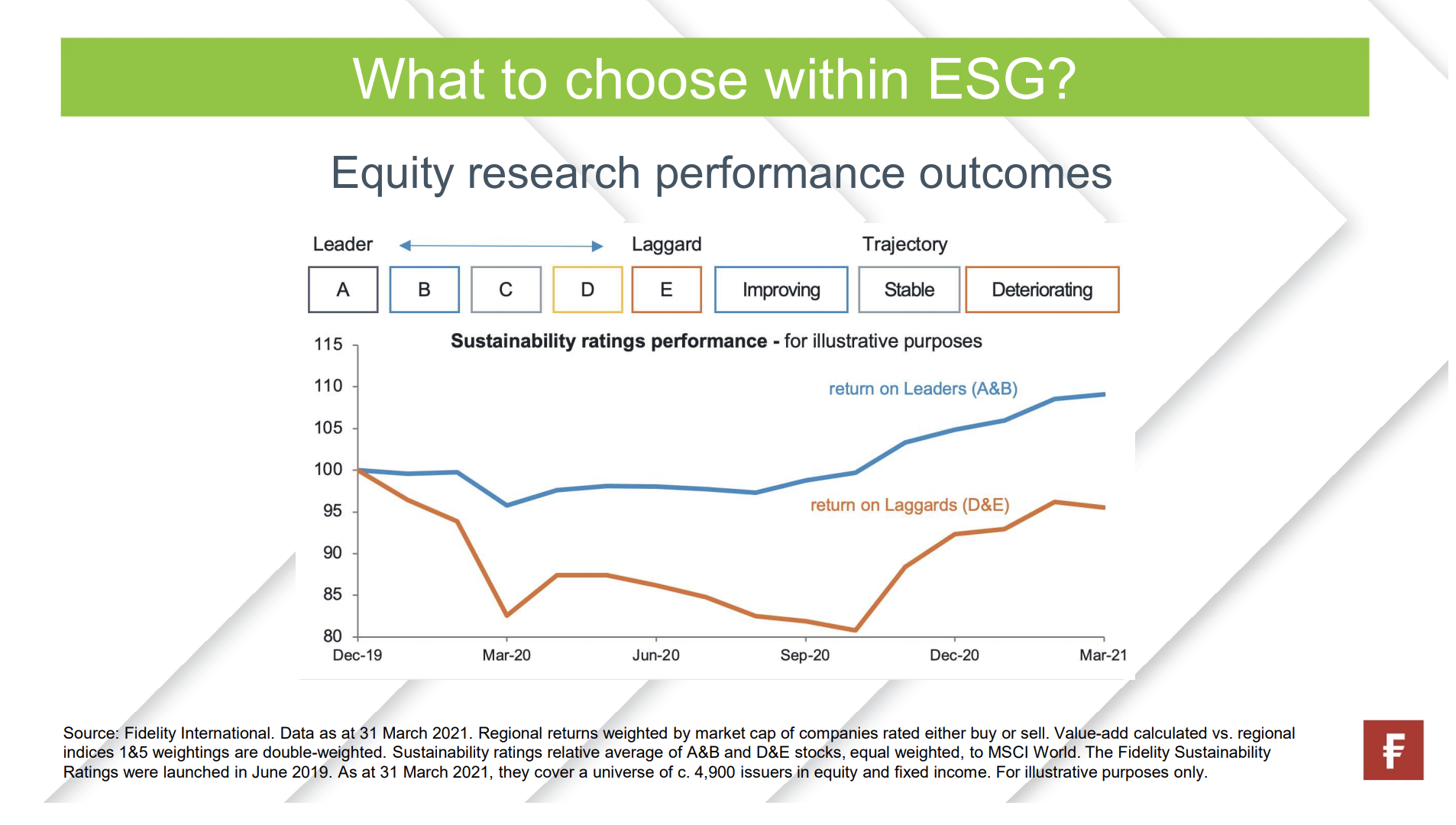

But how can this actually be applied to an investment process? Kate explains that simply divesting traditional brownfield polluters or investing in green companies is not enough to make a long lasting impact.

"There is a huge opportunity in supporting olive companies...brown companies going green. Companies that today are may be making all of their revenue out of selling carbon...but these are the firms that can have the biggest chance to decarbonise in the future because of the brownfield's potential to repurposing existing infrastructure."

The total cost to decarbonise are around US$100-200 trillion. The US GDP is around US$21 trillion. This means a multi-faceted approach is needed in order achieve the eventual goal of decarbonisation.

An example is Australian oil and gas producer Santos (ASX: STO). They are currently selling carbon.

"Santos is one of the world leaders in carbon capture and underground storage of carbon. They are moving rapidly to figure out ways to decarbonise their operations and repurpose some of their capability into hydrogen, turning from exporting carbon to exporting hydrogen and clean energy."

It is crucial to take an active approach to finding opportunties. Simply screening out worrisome companies is not an effective method to driving impact. Instead, Fidelity embrace an 'engage and invest' mindset in order to understand the future plans of companies in depth. There is a possibility of generating both impact and alpha.

Conclusion

Overall, the webinar provided an array of insights into the direction of future capital flows. It is an exciting time in equity markets, and alongside all of the hardship this period has forced upon humanity, an acceleration in development and global connectivity set the scene for an intriguing decade ahead.

Not an existing Livewire subscriber?

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

2 topics

1 contributor mentioned