The unloved business that Tribeca believes has 250% upside

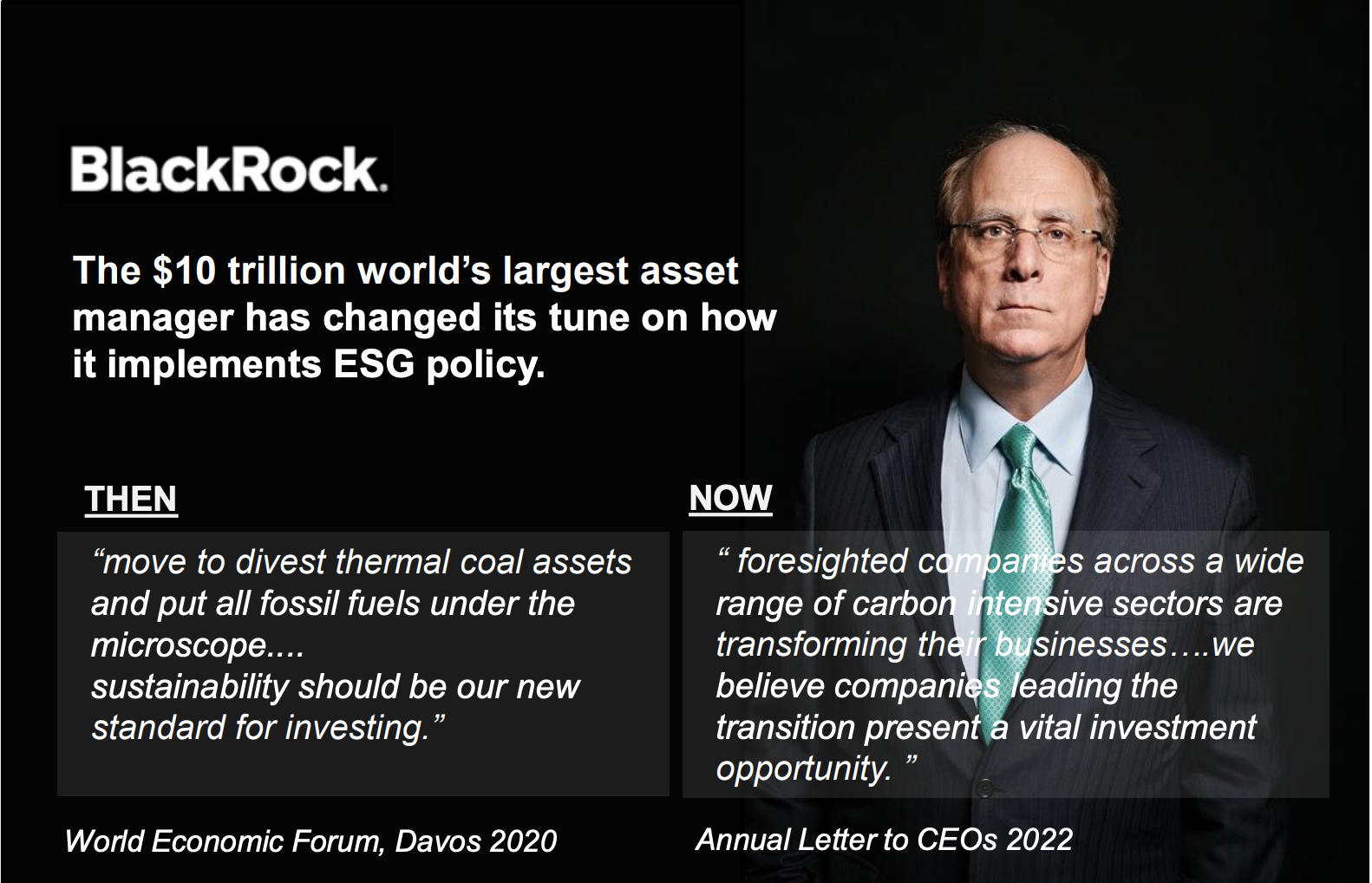

When the largest money manager in the world shares an opinion, everyone tends to pay attention - even more so when they revise it.

BlackRock recently backflipped on its January 2020 decision to fully divest non-sustainable industries, now re-opening its investible universe to include carbon-intensive companies undergoing carbon transitions.

The gradual realisation among investors that simply screening out harmful sectors is not driving the desired impact represents a significant inflection point for markets.

“Divestment, to date, probably has reduced about zero tons of emissions.” - Bill Gates, 2019

Instead, engaging with traditionally carbon-intensive companies focused on pivoting their strategies can offer the greatest impact in reaching global emissions targets. Goldman Sachs recently published a report discussing the tradeoff between exclusion and engagement.

In our view, placing significant constraints on the investable universe risks impairing the risk/reward profile of ESG portfolios, potentially impacting their long-term competitiveness.

Our work also suggests that, while divestment can impair valuations in the short-run, in the long-run stocks tend to return to their fundamentals (profits), meaning divestment movements risk merely creating buying opportunities for those indifferent to the ESG case.

Finally, divestment denies the ability to engage with the companies that need it most—an increasingly important selling point for ESG funds—and can limit alpha opportunities in ‘ESG improvers’.

With this change comes renewed investor enthusiasm for companies at the forefront of the transition.

One such company is Santos Ltd (ASX:STO).

In a recent report from the Tribeca Global Natural Resources team (attached), they shared their view on Santos, which currently represents the largest position in their portfolio (~10% weighting).

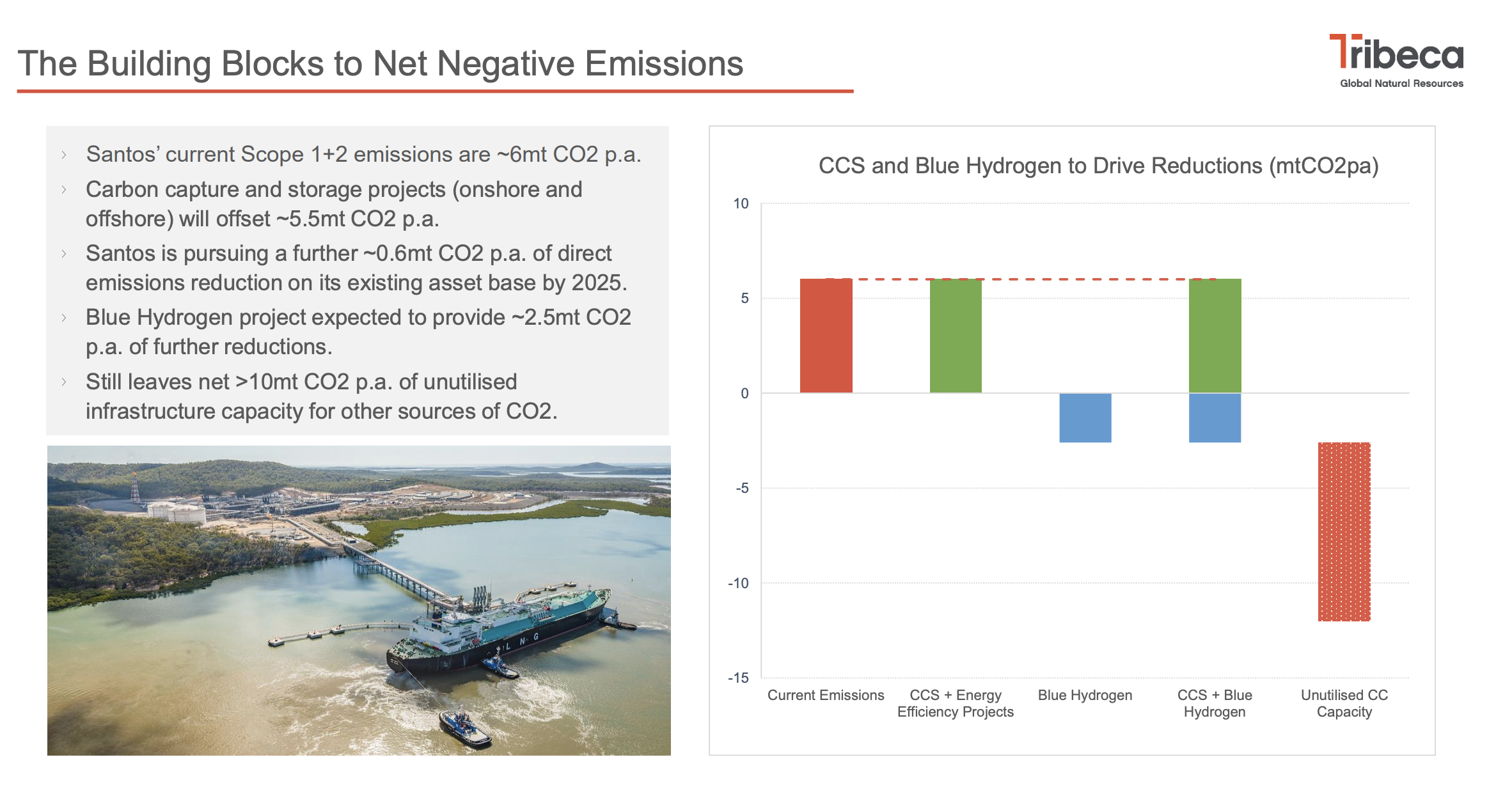

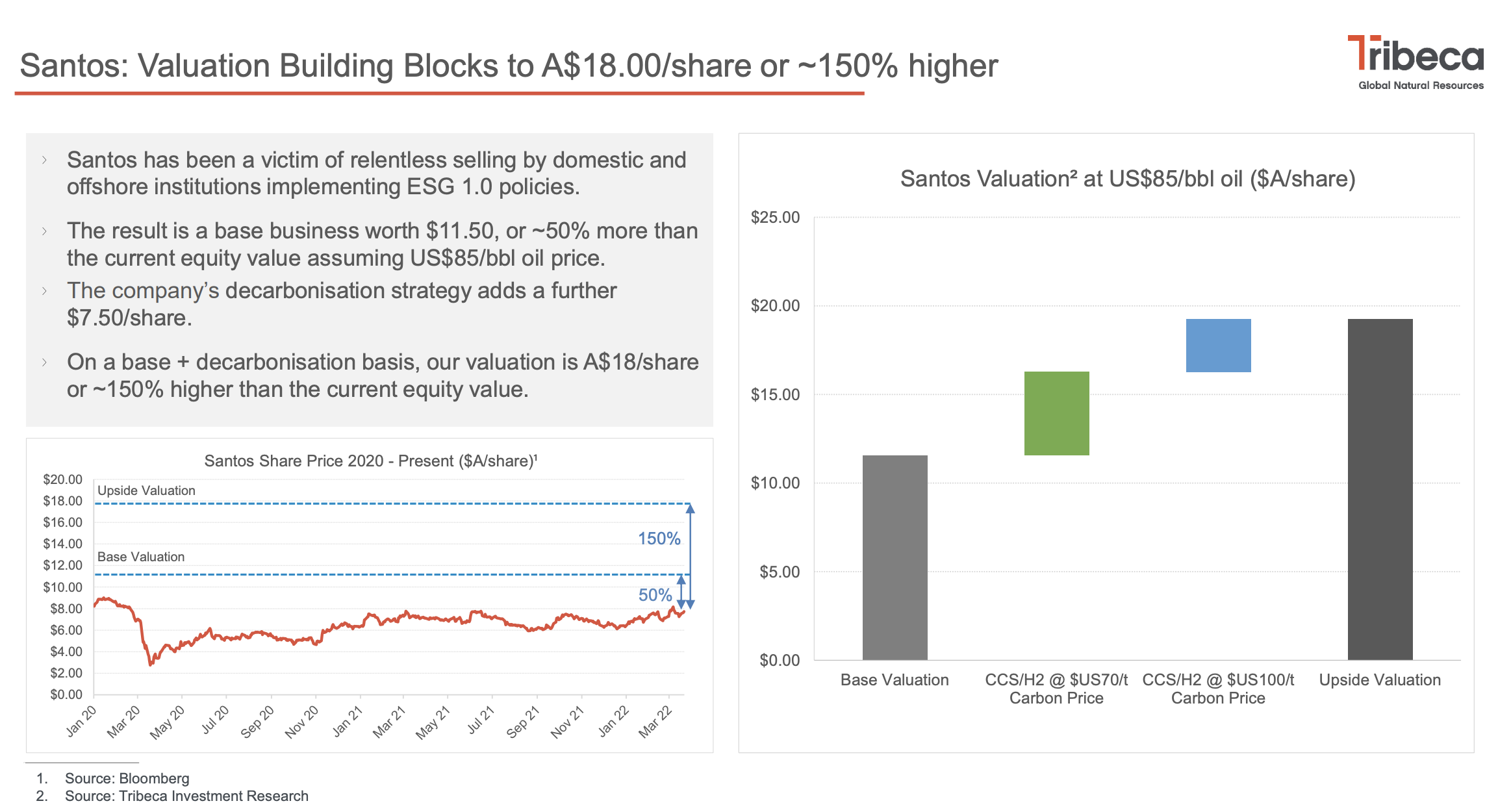

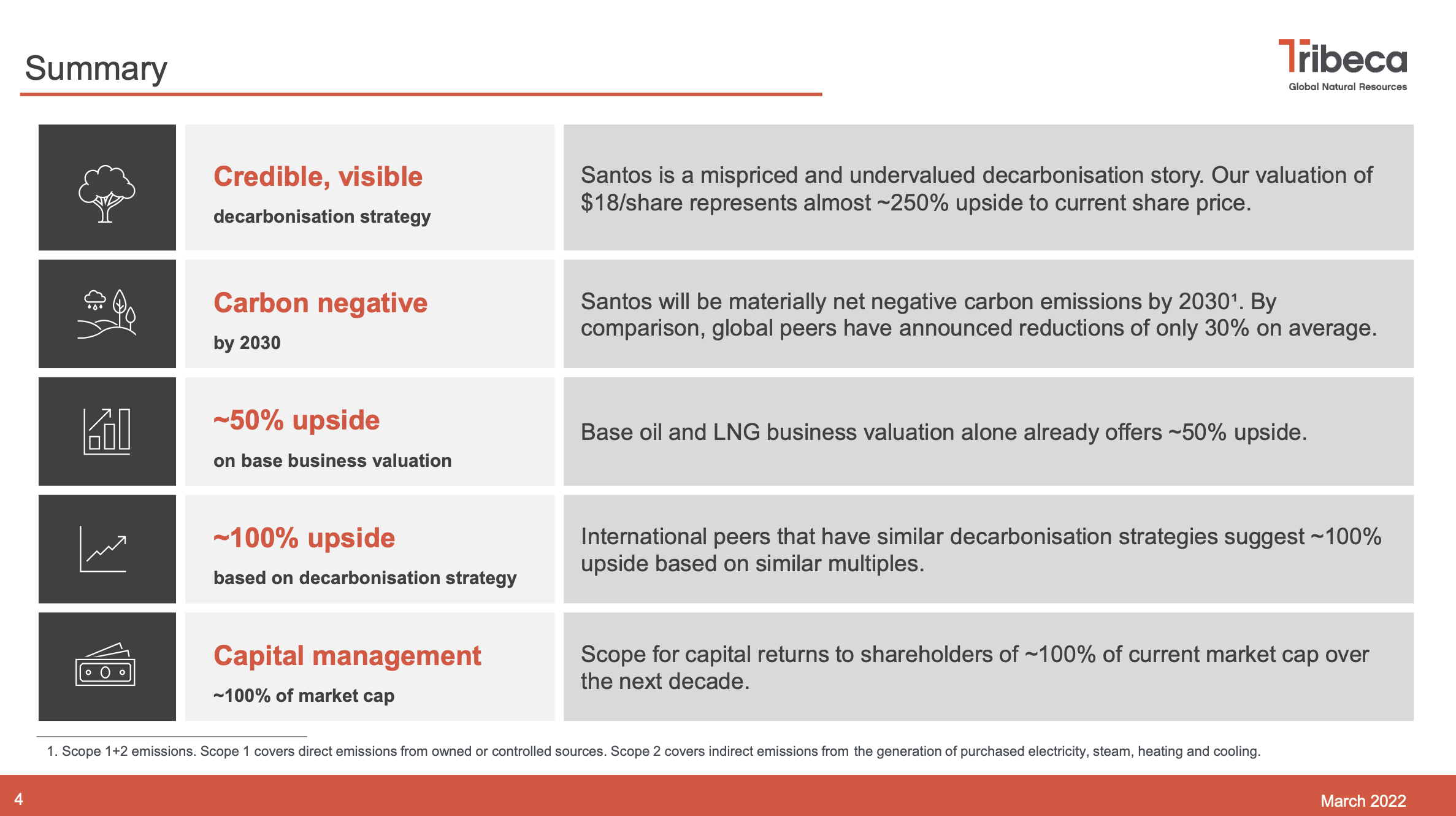

Their analysts noted that Santos’ equity is mispriced by the market. As Asia’s largest oil & gas producer, they believe that Santos' base business is undervalued by at least 50% versus its current equity value. In addition, there is a significant decarbonisation story at play with the company expected to be carbon negative by 2030 through a combination of Carbon Capture & Storage and Blue Hydrogen projects.

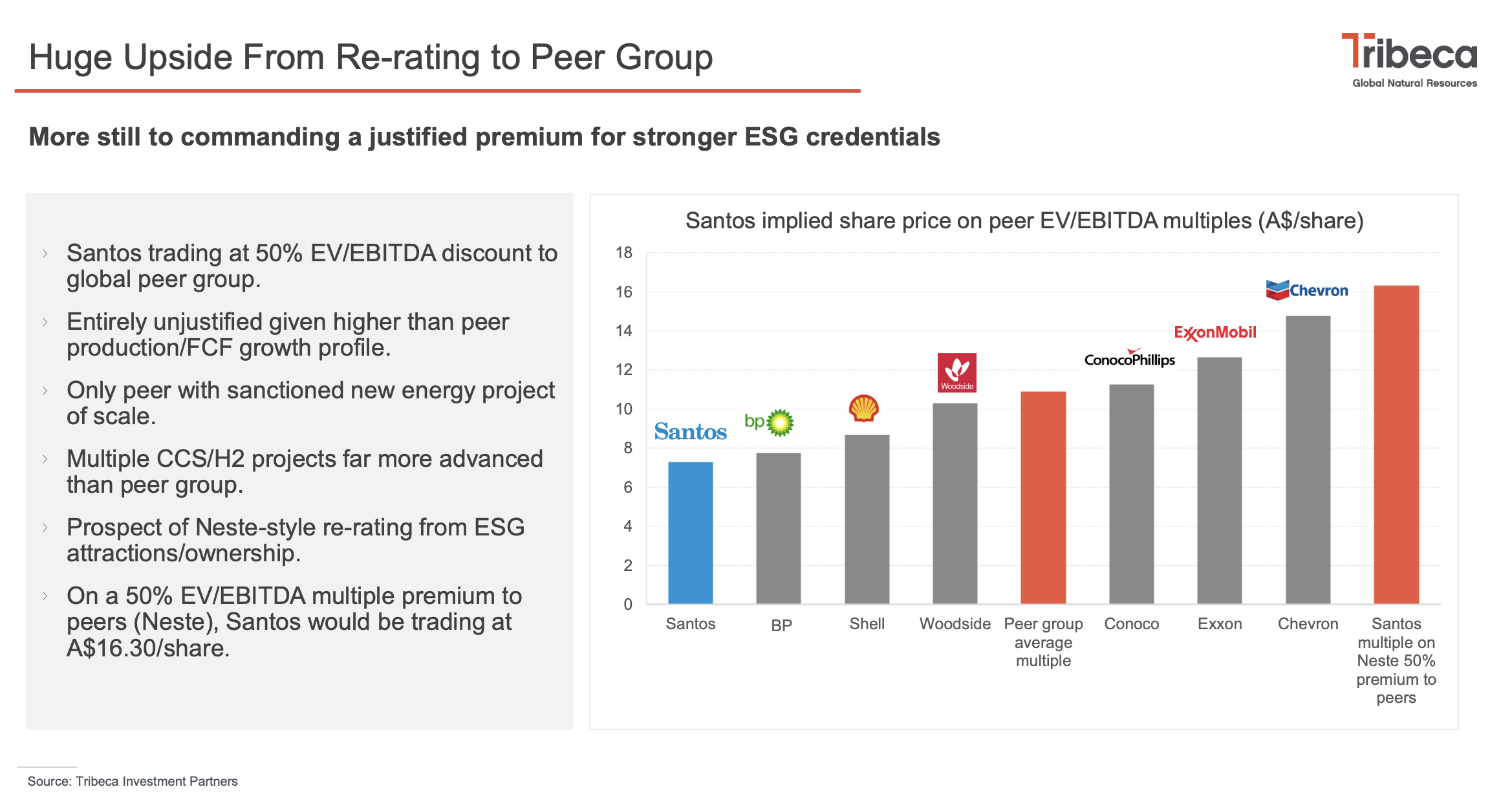

At a time when large global allocators of capital such as BlackRock have changed their investment stance toward fossil fuel companies from ‘divestment’ to ‘transition’, a company such as Santos with a visible and credible decarbonisation story should attract higher multiples and investor following.

To dig a little deeper into all of this I spoke to CEO of Tribeca Investment Partners Asia, Ben Cleary.

Why have you put this report together?

ESG has been one of the biggest investment themes within the natural resources sector that I have seen in my career. You had this immediate exit from the sector following Blackrock's decision to completely divest from these industries. This divestment versus transition debate has dominated the natural resources sector over the last couple of years.

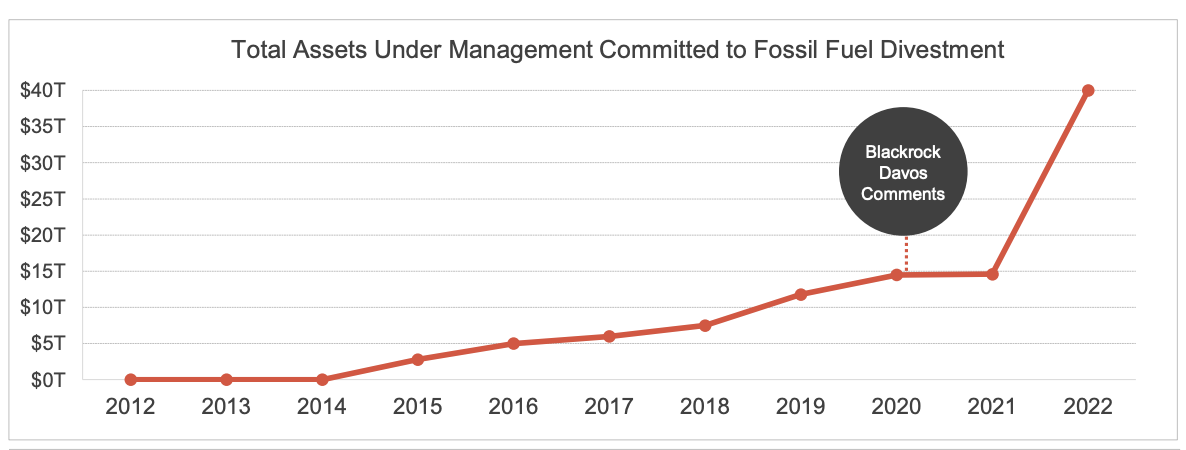

The nearly $40 trillion of assets under management around the world committing to divesting has led to a massive de-rating for the sector. We have hit an inflexion point and we are going to see it unwind. This is not just one stock, this is an entire sector that has been unfairly punished in our view, and you're likely to see some pretty material unwind of that.

I wanted to put a flag in the sand and highlight the broader issue. The energy crisis in Russia obviously perpetuated a lot of these sorts of issues.

So, why have we put the report together? I think we are seeing one of the biggest investment opportunities in the last 20 years to take advantage of this policy change of direction.

Blackrock have changed their tune when it comes to investing in ESG linked assets – from complete divestment to including carbon-intensive sectors that are transitioning. Why is this important for stocks?

The first point regarding BlackRock is their scale - With $10 trillion under management, they're effectively another country. This means their actions are a good proxy for the rest of the industry. They made this decision as a response to the massive amount of pressure that they were receiving from all angles, whether it was their investor or member base, individuals or countries.

A lot of these policies were implemented reasonably impulsively - where investors just chose to divest in place of investing in what was clearly going to be a transition period. We have seen that full divestment is now starting to be recognised as being a fairly shortsighted type of policy and the pressure is starting to come back the other way. We all want to transition to a fully renewable world, but it's going to take some time.

The key to all these policies is that there was initially a blanket view that divestment was the way forward. There was a significant amount of pressure that came down the food chain from investors and onto companies.

For example, BHP and a range of other companies have divested their fossil fuels brought on by pressure from governments and investors. These assets have ended up in the hands of much smaller operators. All this does is reallocate the production of these emissions. It reallocates to a higher cost of capital so the chance for operating issues goes up exponentially.

What exactly are Santos doing to transition and is it feasible?

We have noted that for most of their peer group (major IOCs around the world, Exxon, BP, Shell), the average emissions reduction goal is about 30% by the end of the decade. Most of that is coming from buying offsets with some gains from new technology. Now compare that to Santos, who is going to reduce emissions by 100% and actually be a producer of carbon offset credits. Santos is in a completely different league versus its global peers in terms of decarbonisation and reducing emissions.

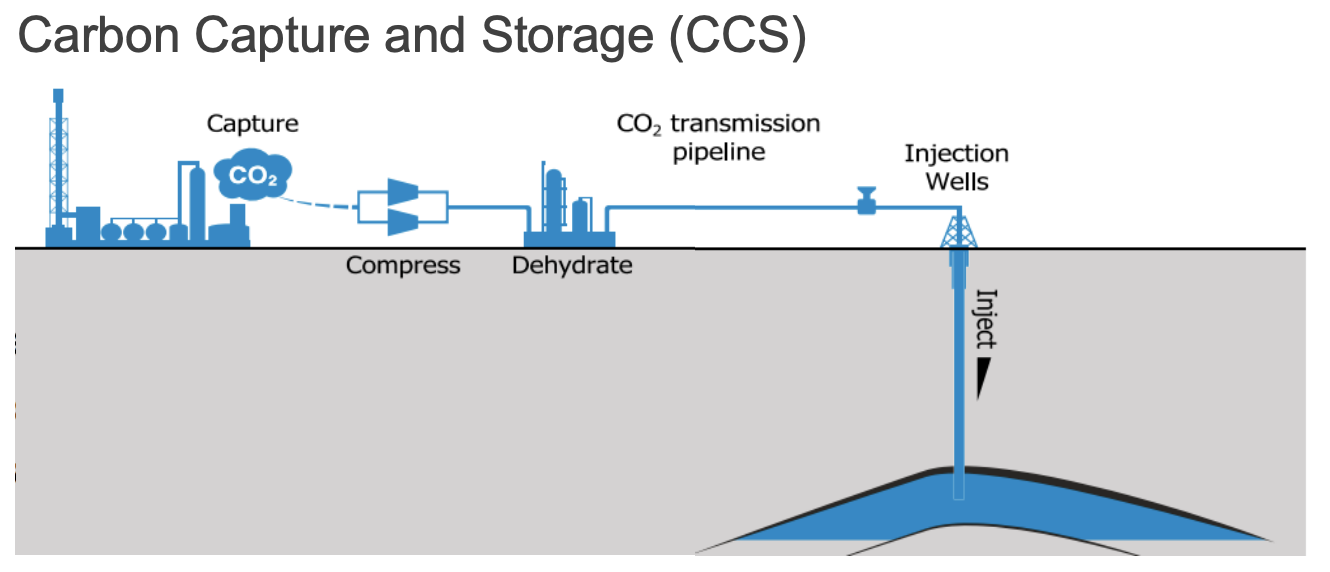

Understanding how Santos is getting there is important too. Looking at Carbon Capture and Storage technology (CCS), in Australia it's a pretty dirty word because of Gorgon, the major oil gas project in Western Australia. They tried to do CCS and it was a huge failure - the numbers they delivered were 50% less than their guidance.

The main issue came from a flawed approach. If you think about an oil reservoir, it's a big underground box underground. You are capturing carbon from the production above ground and then injecting carbon back into that reservoir.

The issues with carbon capture can arise when you're reinjecting if the reservoir is leaking unstable. These geological and technical issues are all magnified when you're using reservoirs that you're still producing from and also offshore - which is exactly what they were doing.

The bulk of negativity in Australia has been based on this one project versus Santos' plan to exclusively use depleted reservoirs that are limestone hosted, onshore, and technically quite easy projects to reinject into. This is a very common process in the U.S. Santos' all assets really lend themselves to this process. So, that's a key point.

CCS is undoubtedly a key pillar of the decarbonisation story. It's had a bit of a bad name in Australia for the wrong reasons - or for those not linked to Santos - That's going to change pretty quickly.

The International Energy Agency Net Zero 2050 Roadmap assumes 20% of all emissions reductions by 2050 will be from CCS. This will require a ~200x increase from current project capacity.

There's going to be plenty of government capital that gets invested behind carbon capture, and Santos is going to be at the forefront of that in Australia as well as in the Asian region. They're a long way ahead of most of these global competitors.

They've got a lot of capacity in their existing infrastructure to go net negative by a large margin. Santos is talking about this pathway to being net negative two million tonnes of carbon, but this capacity of empty reservoirs could take them to minus 15 million tons. What happens when you go net negative? It becomes a saleable asset and they could sell those offsets to other heavy emitting industries.

What makes Santos a compelling investment opportunity?

One of the things we're always looking for is some asymmetry in any investment. This is a great example of an asymmetric investment opportunity because you have limited downside on the existing business - in fact, there's a pretty clear path to 50% upside from the existing oil and gas business. Consensus is already close to a $12 valuation for the existing business, and that is likely to be upgraded. There is a high probability of consensus upgrades will be coming through with higher commodity prices in the coming weeks, and that's simply for the base business.

What makes it asymmetric is that you have significant upside optionality via their decarbonisation story, which is not being priced at all. Very few analysts on the street have any valuation in their numbers for these decarbonisation strategies (CCS and the Blue Hydrogen). This will start being priced in sooner rather than later.

When they fully announce their plans, their transition plans are going to go from a pipedream that's way down the track to a clear pathway to being net negative within five years. This warrants valuation from the street, and as we roll forward and get closer to that carbon production, then I think that $7.50 valuation that we have for the decarbonisation strategy will look increasingly conservative.

Can you talk through an example of a stock that has benefitted from a re-rating based on pivoting its business model towards the energy transition?

In Europe you probably have more examples of peers that are rotating or changing their company strategy towards decarbonisation, and they're getting rewarded for it. Accross Asia, we've been looking for companies that are actively decarbonising and actually have a strategy in place that can be delivered, however it has been sparse. Santos, on that metric, is a huge outlier and hence there are not many comparisons. There are global comparisons to stocks like Neste that have definitely got that re-rating, see below:

This is a global industry and concern. Massive pools of capital have previously committed to divesting oil and gas companies globally. You'd expect that when that capital comes back, it is going to flow into companies that fit into that mould globally. And Santos is the best option in the Asia-Pacific region. So using a comparison like Neste - who are benefiting from that re-rating currently underway in Europe - is entirely defendable.

Conclusion

Overall, this shift in attitude from divestment to engagement among investors opens compelling opportunities for unloved sectors to rebound.

"While stocks tend to be tethered to profits over time—even in industries that have faced material divestment movements —nearer-term shifts in flows can significantly influence share performance." - Goldman Sachs

The outcomes of this pivot from BlackRock and the industry are yet to be seen, but it does open renewed capital flows for companies with feasible transition plans.

Never miss an update

Enjoy this wire? Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

1 stock mentioned

1 contributor mentioned