The Upside of Maintaining Diversification

The phrase “diversification is the only free lunch in investing” is attributed to the Nobel Prize laureate Harry Markowitz. Investors accept this principle with few exceptions, however when faced with market turbulence many will retreat to the set of risks that are most familiar to them. In the process they often reduce the diversification of their portfolio and alter the risk and reward dynamics of their investments.

In the midst of turbulent markets, investors will often err towards familiarity and in doing so they believe they are reducing the risk of an adverse outcome. Whilst the retreat from a diversified portfolio (including divesting assets the investor is relatively less familiar with) may feel good in the short term, there is a real possibility it may bring a set of unintended consequences, the downside of which may not be realised until some point in the future.

At Koda Capital, we have developed a framework for investors to use when they contemplate abandoning diversification, particularly during periods of turmoil. A few simple diagrams and some wisdom from an experienced options trader provide us with a useful model to help unpack the concepts of diversification and the benefit of time.

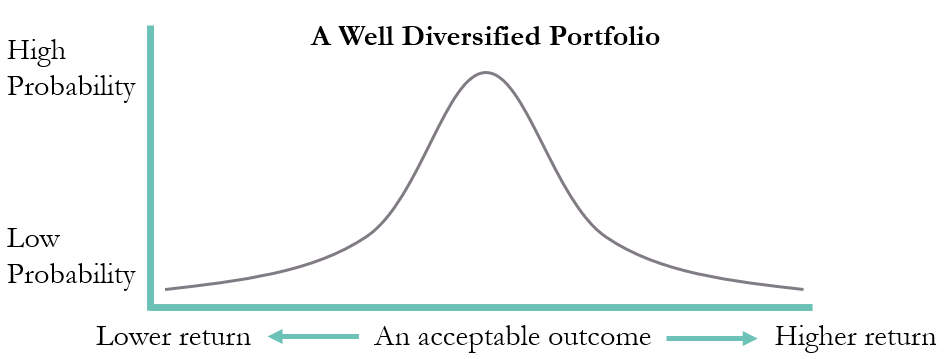

A highly diversified portfolio will hold interests across the capital structure in a variety of different businesses, and the portfolio will receive the returns of those investments over time. Some businesses will perform far better than expected and others will underperform, however the combination will provide an investor with a probable chance of achieving their desired returns. On the other hand, a narrowly diversified portfolio holds an interest in a constrained set of sources of return, and the potential for an adverse outcome is significantly higher.

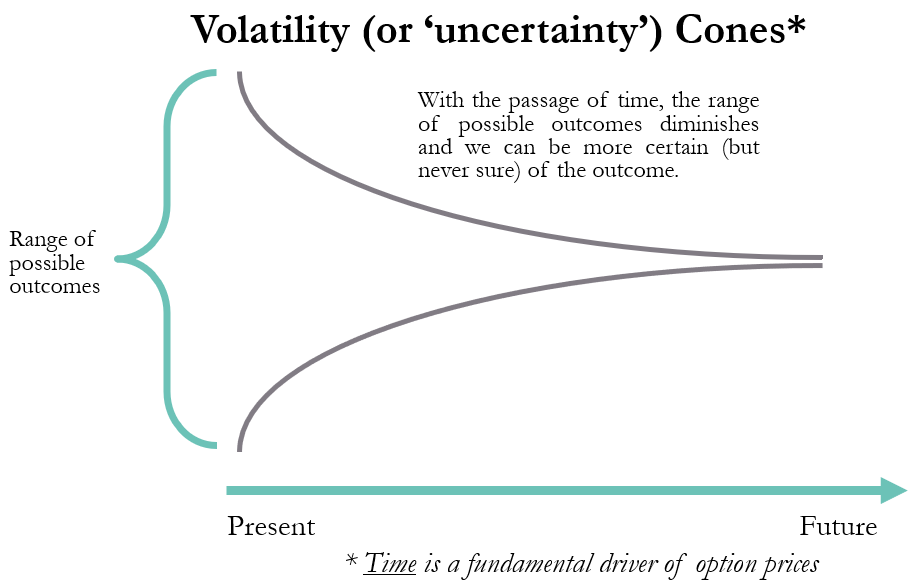

Options

traders must understand the nature of uncertainty over time in order to price an

option correctly. The longer dated an option, the greater the range of possible

outcomes at expiry. The greater the uncertainty, the greater the price of the

option. Good options traders are trained to forget what they think

will happen and trade the true probabilities that an event will happen.

Applying this principle to markets today, we currently face extreme uncertainty and the range of possible outcomes is accordingly extreme. No one can predict when life will return to normal or what impact the COVID-19 crisis will have on corporate earnings, asset prices or global markets.

The best defence in such circumstances is to maintain a portfolio that has the greatest possibility of performing well regardless of any of the possible outcomes. As an investor you want to be very, very well diversified so that you maintain exposure to a broad set of risks and returns that, when combined and with the benefit of time, will deliver acceptable returns.

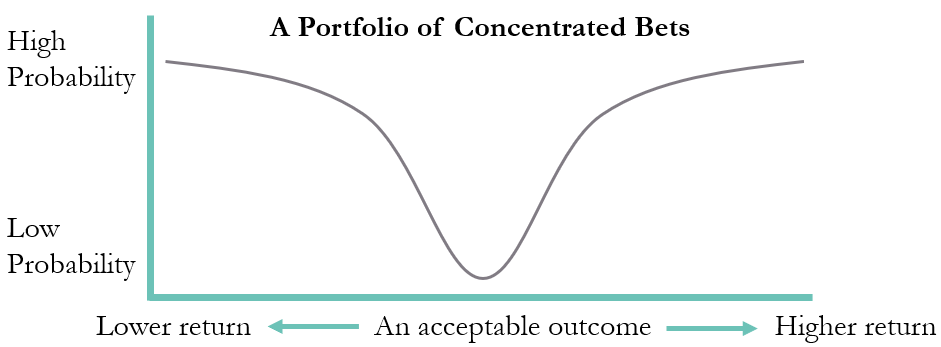

If, when faced with such uncertainty an investor retreats to those risks that they are most familiar with then by implication, they also take a view on which outcomes are certain and therefore increase the possibility they will either be right or wrong.

The distribution profile of a well-diversified portfolio looks like the normal bell curve represented in the diagram below; there is a high probability of an “acceptable outcome” and a low probability of either a “lower or higher return” outcome.

When an investor removes some of the diverse range of risks and return drivers, they shift the “likely” returns from a normal distribution towards a barbell shaped distribution represented by a (upside down) bell curve in the following diagram.

The payoff probability in an investor’s portfolio transforms from one that is likely to give an “acceptable outcome” towards a portfolio with a high probability of delivering a more extreme “lower or higher return” outcome.

Despite occasionally being inclined to act to the contrary, generally our clients do not want the risk profile attached to the narrow portfolio (more often than not, Koda clients have already taken that level of risk on their wealth creation journey). The vast majority of Koda clients want the diverse portfolio and the high probability of an acceptable return.

Resisting “flight to familiarity” in turbulent markets does not mean investments should never be reconsidered, or portfolios never adjusted. On the contrary, from time to time it is necessary to rebalance a portfolio, and occasionally certain investments will not perform as expected. Other times investors will find that a portion of capital could be allocated to assets with more favourable risk and reward characteristics, thereby improving the overall portfolio. Our message is not “never change your portfolio”; our point is rather “don’t make changes in haste and without understanding the broader consequences of such changes”.

Don’t miss out on your free lunch: diversification provides real benefit to investors. Market turmoil can motivate a desire for change and action. If you hold a truly diversified portfolio, often “doing nothing” is a fine strategy. Don’t let the volatility throw you off course; if your portfolio has been constructed with a sound plan, let time move you through the uncertainty cone, comfortably knowing you are heading towards a normal distribution of return outcomes.

Note: this is part one of a trilogy series outlining the principles behind Koda Capital’s investment philosophy: diversification, upside/downside capture and time in the market. Parts two ('The Upside of Minimising Downside') and three ('The Upside of Time in the Market') are also available on Koda's Insights page.

3 topics