There is yield in global equities!

Retirees are often exposed to substantial income domestically, but in an increasingly global world, where else can they look? This question becomes increasingly pertinent when one looks at the backdrop of an incredibly low yield environment, with bonds at historical lows, even negative levels! In this note, we will discuss the fundamental importance of yield to total return, and how at Plato, we continue to challenge conventional wisdom to develop a truly global income offering for clients.

Yield or Total Return. Do we need to sacrifice either?

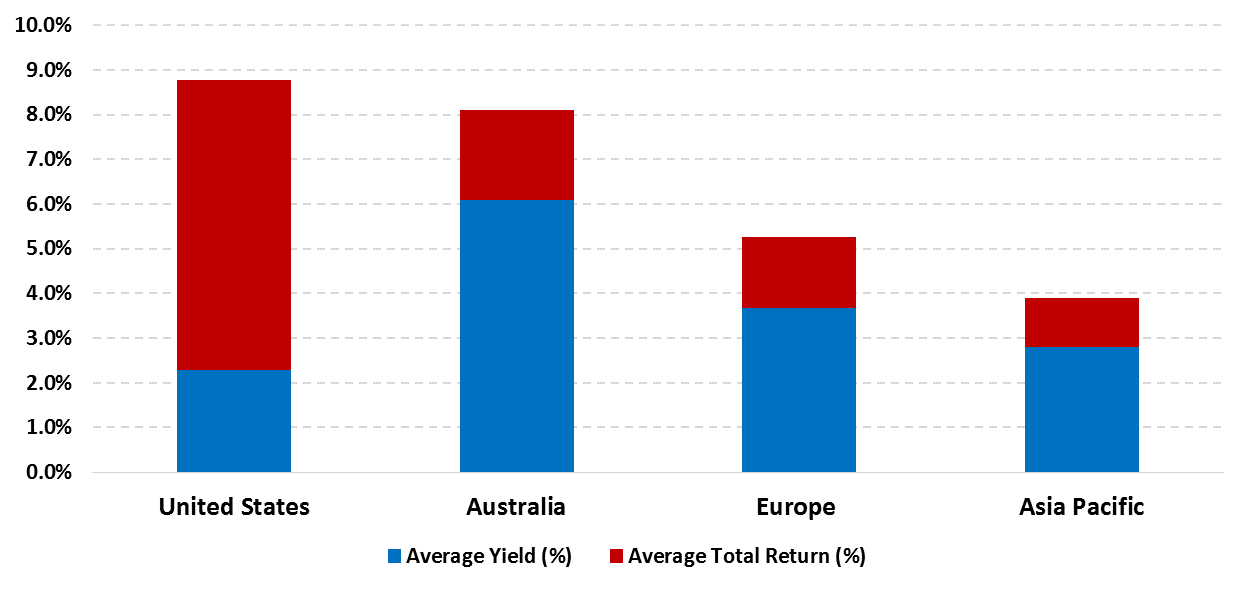

Using a simple 10-year average of both total return and net yield, we can see the yield contribution is surprisingly high (figure 1), with a substantial impact coming from outside the U.S. Unsurprisingly, this is true domestically, but yield accounted for ~70% of total return in Europe and the Pacific region over this period. When coupled with the current low growth outlook of many analysts, this highlights the increasing importance of yield to headline returns. Consequently, any strategy that maximises income would be a useful addition for yield starved clients.

Figure 1. Yield as a Percentage of Total Returns Globally (10 year average % as at 26 Jun 2017)

Source: Factset, Plato Investment Management

But is there yield in global equity?

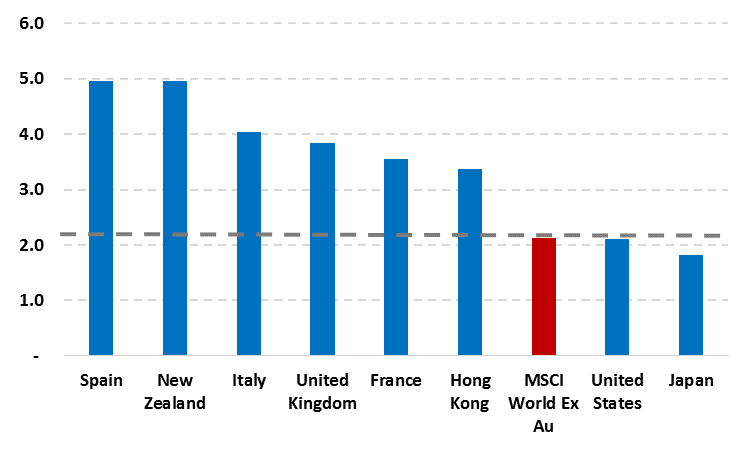

With a primary income objective, retiree clients understandably shy away from global equity when they contrast the global yield (~2%) with the appetising levels (~6% franking credit adjusted) they can currently get domestically. In itself, this could have significant impact on future lifestyle, but before we write off a global allocation, alternative country indices illustrate that there are pockets of strong yield in global equity. Figure 2 shows some of the high yielding developed countries that comprise the MSCI World index, highlighting the 10-year average income yielded by some major developed countries. The US dominance reduces overall global yield levels, but you can see compelling income can be harvested across other regions, like Europe. Immediately this highlights the benefit of geographical diversification for a yield hungry investor. This diversification can also reduce the industry concentration of stocks that generate the bulk of domestic income.

Figure 2. Dividend Yield by Country (10 year average % as at Dec 2016)

Source: Bloomberg, Plato Investment Management

Where are these Global Opportunities?

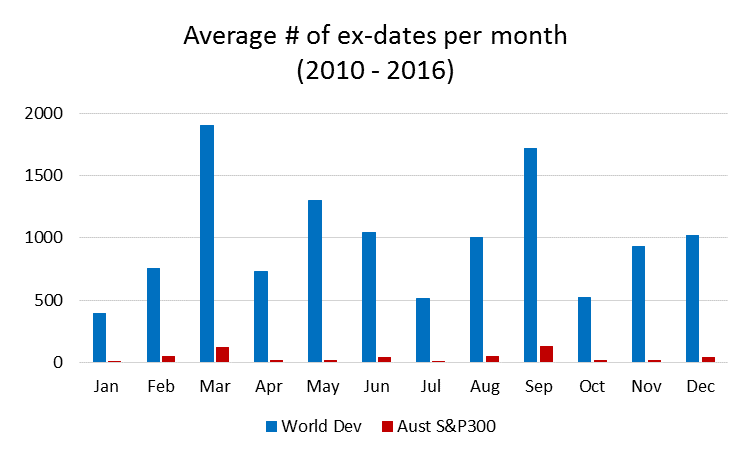

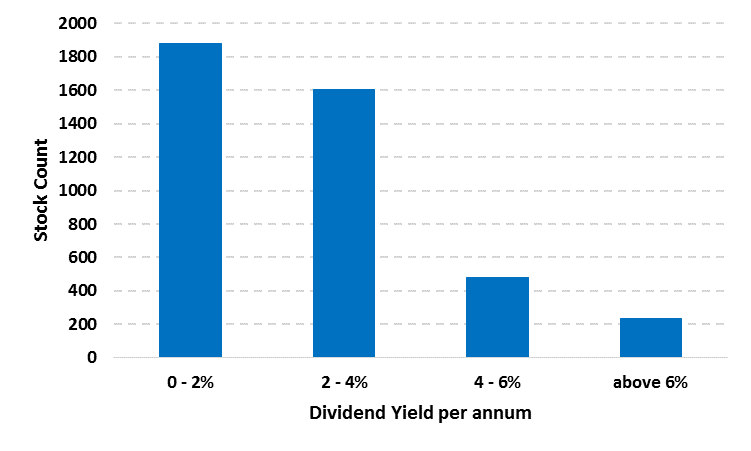

In the global universe, there is a vast opportunity set to search for sustainable high yield stocks, which are not available domestically. This allows investors to diversify their industry and country exposures. In figure 3, you can observe that global opportunities (blue) dwarf those domestically (red). Globally, there are a significant amount of income events, with even the lowest month (January) still offering around 400 individual ex dates. At a micro level there are many stocks that offer substantial income to a yield starved investor. This is true even in low yielding countries like the US, which on average has offered a dividend yield around 2% p.a. based on Figure 2. Even in such a low yield country there are currently in excess of 210 stocks in the universe1 that yield more than 4% p.a. Well known examples include huge mature businesses from US auto’s firm General Motors (+4.4% p.a.) to US Telco AT&T (+5.0% p.a.). Figure 4 represents the number of stocks in the global universe, bucketed by their yield. In excess of 700 names offer at least 4% p.a. of income (compared with 84 domestically). This vast universe is rich in income opportunities, requiring a strong income objective and systematic approach to both forecast and ultimately harvest yield for clients.

Figure 3. Ex-dates per month

Source: Factset, Plato Investment Management

Figure 4. Dividend paying stocks by annual yield (as at 26 Jun 2017)

Source: Factset, Plato Investment Management

Domestic demographics demand an increased need for the funds management industry to focus on retirees and objective based solutions. Let’s not write off the fantastic global income opportunity when investing to meet future client needs. Plato’s next note in this series will further investigate the exciting global yield landscape.

For further insights from Plato Investment Management, please click here

Disclaimer

Plato Investment Management Limited ABN 77 120 730 136 (‘Plato’) is a Corporate Authorised Representative (No. 304964) of Pinnacle Investment Management Limited ABN 66 109 659 109 AFSL 322140.

The information in this communication is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. This communication is for general information only. It has been prepared without taking account of any person’s objectives, financial situation or needs. Any persons relying on this information should obtain professional advice relevant to their particular circumstances, needs and investment objectives.

Any opinions or forecasts reflect the judgment and assumptions of Plato and its representatives on the basis of information at the date of publication and may later change without notice. Any projections contained in the information are estimates only. Such projections or estimates are subject to market influences and contingent upon matters outside the control of Plato and therefore may not be realised in the future.

Plato believes the information contained in this communication is reliable, however its accuracy, reliability or completeness is not guaranteed and persons relying on this information do so at their own risk. Subject to any liability which cannot be excluded under the Competition and Consumer Act 2010 and the Corporations Act, Plato disclaims all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information.

Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this document is prohibited without obtaining prior written permission from Plato.