This could be the ultimate crowded trade of 2024

This insight was co-authored with Plato's Co-Head of Research, George Platt.

Shrewd investors are always looking for new trends, however one of the strongest trends in markets over the last 50 years has been driven by the argument that picking trends is for the birds!

This refers, of course, to the humble index fund.

Conceived by John Bogle in the mid 70’s, the index fund started as a widely derided concept but has since seen an inexorable rise in popularity. Passive investments have become a style in their own right, with index funds and their ETF variants being applied to almost every widely followed index worldwide. The birthplace of index investing has arguably seen the most explosive growth … as of the end of 2020, 54% of total U.S. equity fund assets were in passive funds, up from around 14% in 2005.

The key argument for passive investing is its low cost. This may seem at first difficult to argue against. The second plank in the argument is that markets are too hard to beat, and every good idea quickly becomes a crowded trade.

However, the sheer scale at which index funds are now invested begs the question, is the very logic used to argue for passive starting to work against it? Is passive investing becoming a crowded trade?

In April, an interesting paper titled “Earning Alpha by Avoiding the Index Trade” was published in the Financial Analysts Journal.

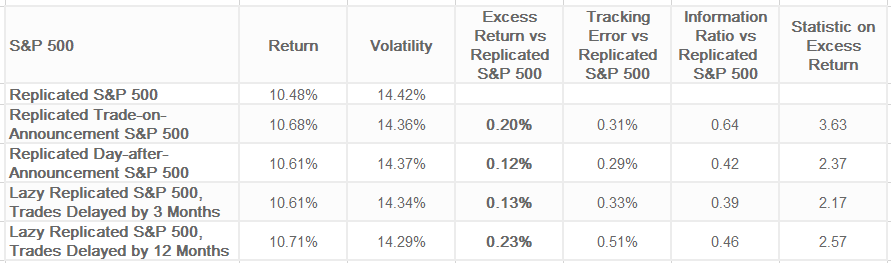

They find that reproducing the S&P 500 index, with simple tweaks to avoid the stampede of trades around index changes can produce a return that is consistently higher than the index itself.

Their approach was simple - what if you wait three months after the official index inclusions and exclusions announcements occur, before making the changes yourself?

What if you wait 12 months?

The study was on the S&P 500 Index between 1989 and 2001. These two “lazy indices” proved to be effective … both produced returns between 13 and 23 bps above the quoted index return.

The returns are comparable to a more proactive strategy of trading on announcement, ie attempting to get set index changes before their “effective date”, which is typically a few weeks prior.

The return improvement of trading before or after the index change highlights the hidden cost of indexing. As the ever-growing index funds are obliged to trade changes as close as possible to the effective date, they create a supply demand imbalance, thus buying high and selling low!

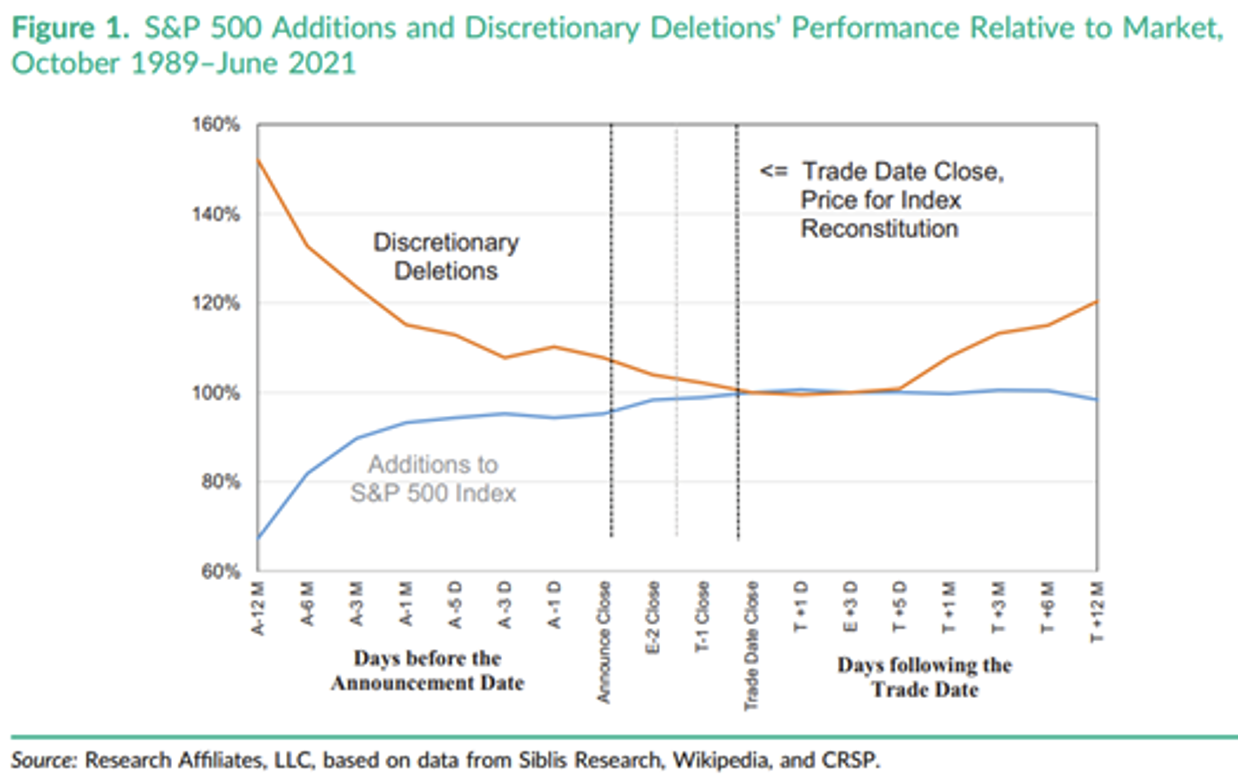

You can see this clearly when you look at performance of stocks around the date of inclusion in the S&P 500 index.

Exclusions, on average are at their lowest price point when excluded, and inclusions, which are typically new market darlings, seem to run out of steam once they are included.

Plato's analysis on the Australian stock market

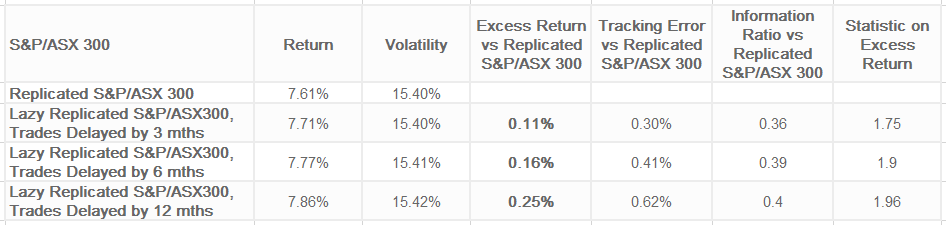

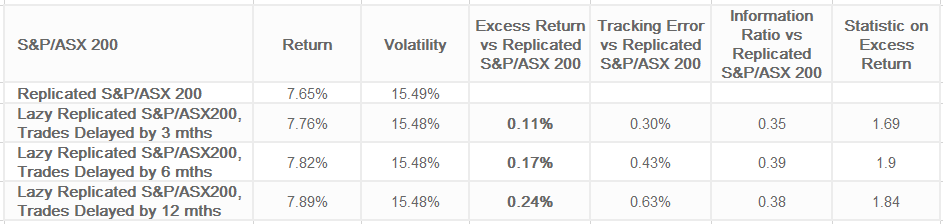

We undertook the same analysis on the Australian stock market and found very similar results.

Our analysis included both ASX 200 and ASX 300 indices and was conducted between April 2000 and September 2023.

The similarity in results is striking!

Taking a relaxed approach to implementing changes to index constituents will lead to stronger returns, in the vicinity of 11bps to 24bps per annum! Who says markets are efficient. The market is rewarding laziness!

Some fund managers see the rise of passive funds as an existential threat to active management.

At Plato, we take a different view.

Passive funds that slavishly follow pre-defined rules are effectively telegraphing their every move to the market. Astute managers can look to profit from this rigidity by taking short (or underweight) positions in companies that are likely to depart a large passive ETF and long positions in companies likely to be added (or ones which have recently been removed and traded down).

The rise of thematic ETFs can also be exploited by active managers. As these ETFs are almost always launched when market fervour is peaking, and it is almost always better to bet against the trend.

If you think about the sheer scale at which passive index funds continue to grow and just how indiscriminately they are invested across markets, it begs the question – is the very logic used to argue for passive starting to work against it?

This crowded trade phenomenon will become more pronounced as index funds continue to attract capital from retail investors, hence why we think index rebalances could be the ultimate crowded trade of 2024

Learn more about investing alongside Plato Investment Management

Plato offers dividend income and global equities strategies with strong track records and highly-experienced investment teams.

Discover Plato's investment solutions and read more investing insights on the Plato website.

You can also follow the Plato team on Linkedin.

1 stock mentioned

3 funds mentioned