This latest market rally provides investors with another wonderful opportunity…

The latest US CPI and PPI have come below consensus expectations, precipitating an equity market recovery. Is this the opportunity of a lifetime and the start of a new bull market after months of bear market pain?

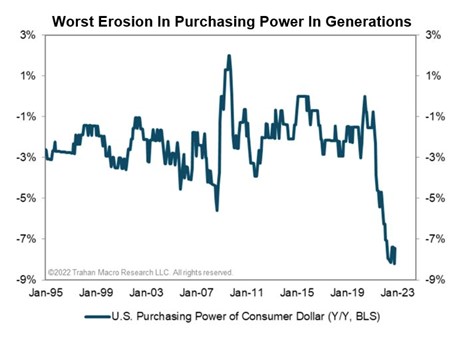

Over a year ago, nearly everyone thought interest rates would have to be low for a very long time and according to central banks, inflation was transient. Hence, the shock of seeing inflation rise further and be anything but transient, combined with escalating geopolitical pressures, has turned 2022 into a harrowing year to remember. Rising inflation and escalating geopolitical risk were foreseeable; I wrote about them at length for Livewire in past articles. Despite this, the extent of the world’s economic and political challenges has been a shock to all and sundry.

However, there is genuine cause for optimism that the worst of inflation and interest rate rises are now behind us. Bulls are excited because higher interest rates and persistent inflation have been the main cause behind the market’s falls. With inflation pressures easing, for now at least, there is less need for further aggressive interest rate rises hurting stock valuations and economic values. This has precipitated a fierce equity market rally and challenged a bearish consensus in October. Bear market rallies can be aggressive and substantial in scope, and seasonally the market may be stronger post-mid-term elections and into Christmas.

Why then, isn’t this the start of a new bull market for equities? The bulls are likely confusing a temporary market rally and opportunity with a permanent one. The lower inflation figures are not just due to a recovering supply chain but primarily due to economies slowing fast as the lagged effect of previous rate increases take their toll. Most importantly, an earnings recession is highly likely in 2023 as historically high margins continue to erode, and recession hits. Importantly, The US equity market isn’t priced for recession. While risk assets may rally for a month or two, eventually they’ll work out that inflation receding isn’t occurring in a vacuum and that a recession is right in front of us in many countries around the world. If history is any guide, this may not only see us retest the equity market lows but possibly even break below this. To put numbers on this, S&P earnings in 2023 of 180 on a multiple of 16.5 could see the US S&P500 at 3000 in 2023, more than 25% below today’s level of over 4000. While these figures and falls may appear dramatic, they are by no means unrealistic.

Hence a market rallying above 4000 likely provides another incredible opportunity - potentially the last one in this cycle (I have written about this before) - for investors to sell out of traditional risk-heavy portfolios in favour of less overvalued and better-suited investment approaches and assets for today’s world.

The second reason the bulls may be wrong is that they continue to assume the Federal Reserve will pivot. But the FED is very unlikely to pivot today (cut interest rates) with inflation still too high, a rising stock market and loosening financial conditions unless a significant financial or economic event force them to. The latter means the market likely has to fall before a FED pivot occurs. The bulls may have their timing about a FED pivot wrong and may be entirely wrong if the FED raises further and then holds interest rates higher for longer - as they say they will. Jerome Powell has been clear that he wants to avoid making the mistake of his predecessors and ensure inflation is under control before changing track. He is emphasising the current data and not forward-looking data, having previously been heavily scarred by the FED’s inaccurate economic forecasts; this is something the market doesn’t seem to realise and means that the FED will likely still raise interest rates well beyond the point when they need to, again causing further damage to the economy and company earnings in 2023.

The third reason why the bulls may be wrong is that they may be utterly wrong about inflation. Services inflation may be more persistent even if goods inflation recedes somewhat. The latest CPI print benefits from a one-off improvement in health insurance inflation. While inflation may recede, it is unlikely to get to target and stay there in a favourable way. If geopolitical risks escalate further in the short term, energy and supply side issues may resume, and inflation may remain sticky and come back in another wave. The boomers may continue to spend and redeem their risky assets as inflationary expectations set in and they consider their lifetimes finite. Waves of higher inflation – or alternating inflation and deflation (i.e. unstable inflation outcomes) - would likely be extremely challenging for policymakers and markets alike, given current valuation levels.

It is also crucial to remember the big picture and see the forest for the trees.

The world and many countries appear to be run in no small part by many bad actors, including sociopaths, autocrats, criminals and frauds with scant regard for anything but their lust and greed. Is it any surprise then that bad things are happening to us? Is this a world which can effectively address some of the most significant governance challenges of all time – some of which require global coordination, including growing diplomatic, governance, corruption and environmental challenges? Some of these bad actors want war for various reasons including the opportunity for graft and funding of their war machines - as well as to further their power ambitions and vision of how the world should look. This could quickly turn the 2020s into one of the most dangerous decades the world has ever seen as our “leaders” take huge risks. They ultimately don’t provide favourable asset price policy settings!

War tends to be inflationary or stagflationary and extremely wealth destructive if you’re on the losing side or are occupied by enemies. Growing corruption turns previously wealthy societies into submerging markets and lowers asset valuations. Real growth is likely to be low for various reasons, including years of mal-investment, higher debt loads, ageing demographics and greater involvement of inefficient governments in capital allocation.

Furthermore, we are coming off one of the biggest bubbles of all time. Much wealth destruction is still required to realign asset values (still high) with the size of the actual underlying global economy and deteriorating real wealth and purchasing power. This will likely need to occur through both higher inflation and lower asset values, as it is unlikely to occur through productive economic growth. This also probably won’t happen smoothly and will be a shock to many who remain confused about why markets don’t always go up, having seen nothing else during their (historically short) careers, or who take their investment advice from promotional material, young and ignorant influencers or the mainstream media. FTX is an example of what happens when you do that and a warning sign to us all.

Note: To put numbers on this, S&P earnings in 2023 of 180 on a multiple of 16.5 could see the US S&P500 at 3000 in 2023, more than 25% below today’s level of over 4000. While these figures and falls may appear dramatic, they are by no means unrealistic (although are purely for demonstration purposes and do not represent forecasts).

In this environment, it is naïve and foolish to bet all on believing that good things will persistently happen to traditional risk-heavy portfolios, which depend on real growth happening, higher valuation levels and markets going up persistently. While equity markets still provide selective good long opportunities, these are the exception rather than the rule meaning the index and index-like approaches (so favoured for their “cheapness”) are well past their use-by date. While we can all hope for a benign and highly favourable but less likely outcome, that is no way to invest safely. Markets are far more likely to range trade, meaning long-only managers will continue to provide among the poorest risk-adjusted returns and miss out on good opportunities to short overvalued loss-making enterprises. Historically, the 2020s are more likely to look more like the 1970s or the 1940s than the 2010s.

In this environment, better risk-adjusted returns will be achieved by genuine value-adding approaches and more active dynamic and long-short approaches that are better suited to today’s macroeconomic conditions and which don’t simply rely purely on markets going up to make money. While still capable of making returns, these strategies should be much less likely to lose substantial sums than buy-and-hold approaches – risk management and capital preservation is equally if not more important in this environment than seeking high returns

Buffett famously says that when the tide goes out, you see who has been swimming naked. If your superannuation fund, broker or fund manager is charging you to provide you with significant double-digit losses so far in 2022 (as we warned may would), perhaps take the hint while you still can and look around for a better option which has adapted to today’s more challenging investment environment. 2022 is a year in which many are flying blind and as for years before that – well any fool can make money in a bull market and many fools did. Seek genuine diversification and preference good risk managers over speculation because the future is uncertain and risky. There will always be great opportunities to make money over time as the world changes, but this is most likely for those who (like it or not) assess and admit to what is going on with the world today. Avoiding and reducing the risk of significant losses is an excellent place to start.

Never miss an update

Enjoy this wire? Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.