Three cracking results

An impressive performance from the local market yesterday after some very poor leads from the previous day. The index rallied strongly from the early morning low of -47pts / -0.74% before the banks and some recovery from the hard hit resources saw the index close less than a point lower. Telstra was the biggest addition to the index following a good result, adding 6.5pts on its own. Other holdings of ours QBE & Nick Scali also reported well. On the flipside, Iluka was weak, as was Invocare and Origin.

Telstra the star today was the reason telcos strongly topped the leader board, while weakness in materials stemmed from soft oil and resource prices overnight.

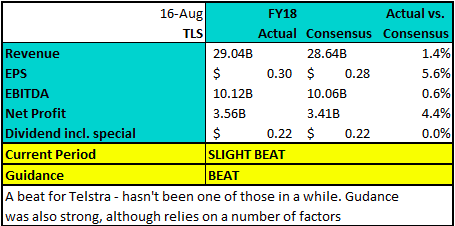

Telstra (TLS) $3.06 / +5.88%

Telstra’s result this morning lead to a wave of buying throughout the day, pushing the stock price through $3 again. The result itself was strong, beating recently downgraded guidance, and guidance was above market. Key to the result was an improvement in the mobile market, something Telstra has struggled with recently. EBITDA guidance for FY19 was set at $8.8b-$9.5b with consensus at $8.97b – a 2% beat to the mid-point.

Telstra (TLS) Chart

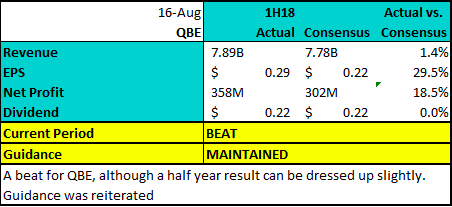

QBE Insurance (QBE) $10.89 / +6.76%

A ‘not bad’ result from QBE was taken well by the market after years of consistently disappointing investors. The half year result saw a tax break, premium rate rises, recommitment to buybacks, dividends and lowering gearing – all an investor asks for! The result, particularly the premium rate rising, shows the improving nature of the insurance market, and hopefully the improving ability for QBE to execute effectively, something they have failed to do for a while. The market’s reaction clearly showed the negative views on the stock took a big hit.

QBE Insurance (QBE) Chart

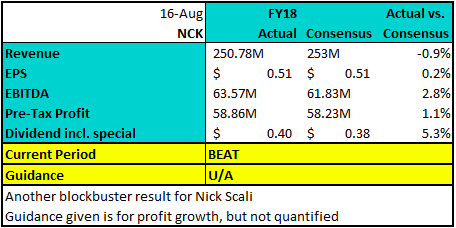

Nick Scali (NCK) $6.78 / +13%

A bumper FY18 result as Nick Scali once again under promise and over deliver – it is becoming habitual for the furniture retailer. The stock was sold off into the result as investors feared a housing downturn and soft retail numbers meant a soft result for NCK, however the result was a beat across most metrics. The market was also a big fan of lowering of costs – shown in the miss to revenue but big beat in EBITDA. No exact guidance was given, but commentary for general profit growth was taken well. The dividend beat was also great for the Income Portfolio which holds NCK.

Nick Scali (NCK) Chart

Want to learn more?

Market Matters publishes daily market reports and sends SMS alerts when we transact on our portfolio. To get our latest market views and hear when we take new positions, trial Market Matters for 14 days at no cost by clicking here.