Three takeaways from reporting season

Reporting season was a very busy time. Overall, it felt like the fairly low expectations going into the August results were broadly met. One area that was very surprising was the amount of companies that were willing to give guidance. Why was there more guidance? We do not believe it was more certainty on the outlook, but more likely a mix of defensive businesses as well as other companies who want to set or reset expectations for the year ahead.

Some of the interesting takeaways for investors from this August’s results season were:

1. The Australian Consumer is booming

Australian consumer stocks have benefitted from two key tailwinds, both of which we see as very much temporary:

- Shift away from travel, entertainment and eating out – with excess cash being funnelled into consumer discretionary purchases

- Stimulus – both in the form of JobSeeker and superannuation withdrawals

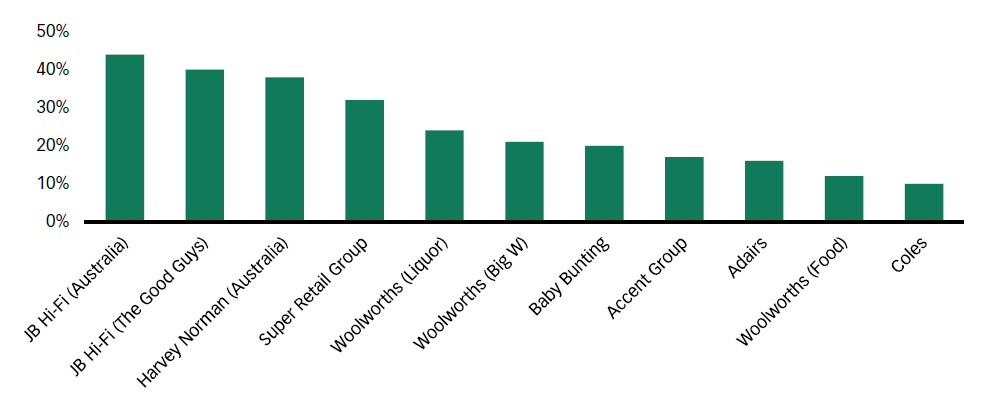

Retailers have started even stronger in FY21. Below are the Like-for-like sales trends to begin the new financial year.

FY21 YTD trading performance

Source: Firetrail, Company reports

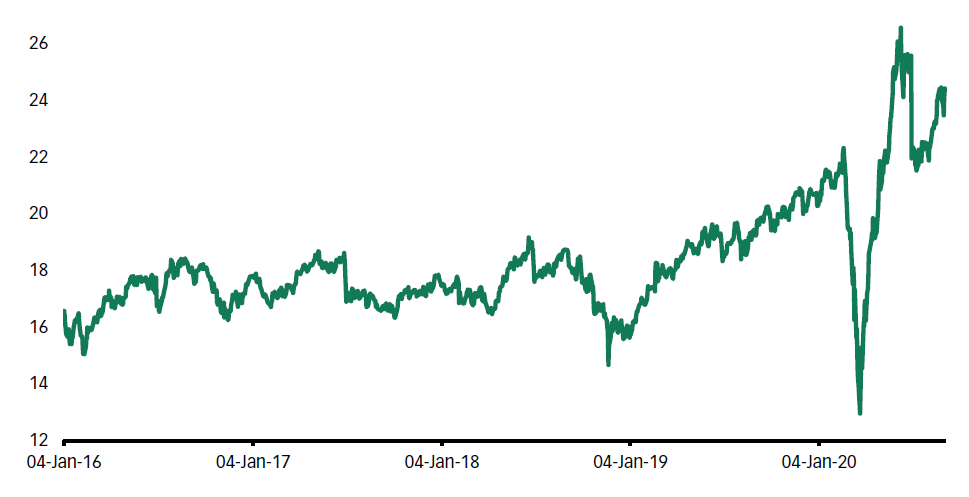

It is interesting to note that while earnings are being strongly bolstered temporarily, the market is assigning the highest multiple to those earnings that we have seen in a long, long time. You have to go all the way back to the year 2000, when online shopping was a long, long way away and Amazon was making less than $1bn in revenue (vs $360bn today)…

S&P/ASX200 Consumer Discretionary Index 1yr Forward P/E

Source: Firetrail, Bloomberg

2. Dividends were withheld more than expected

Our analysis shows that Research analysts cut dividend estimates on more than 40% of ASX200 listed companies post reporting. We saw APRA’s guidance for banks to “seek to retain at least half of their earnings” applied to the letter by CBA and ANZ, which paid out 49.9% and 46.0% of six-month profit respectively. Decisions from some companies to pay no dividend were due to a varied emphasis on earnings and balance sheet. For example, WBC had adequate 1H20 earnings to pay a dividend but did not presumably because of its below-peer capital position, whereas on the flipside IAG reported a capital position well above the top-end of its target range but chose not to pay a dividend due to reporting a loss in the June half.

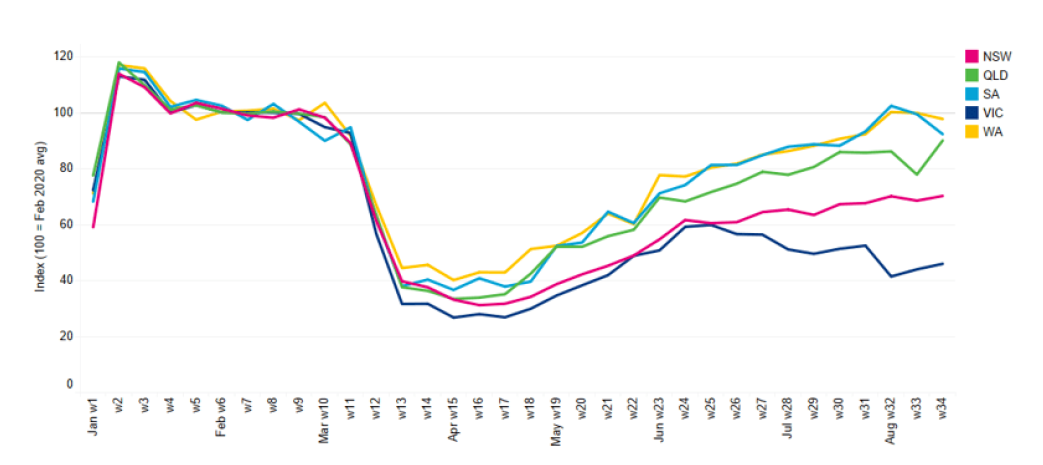

3. High frequency data supports a ‘cyclical recovery’

The data supporting a cyclical rebound continues to strengthen. For example, SEEK reported data on the number of job ads by state. Victoria and NSW have broadly been trending in the right direction. Whilst QLD, SA and WA are almost back to pre-COVID levels.

SEEK New Job Ads (2020)

Source: SEEK

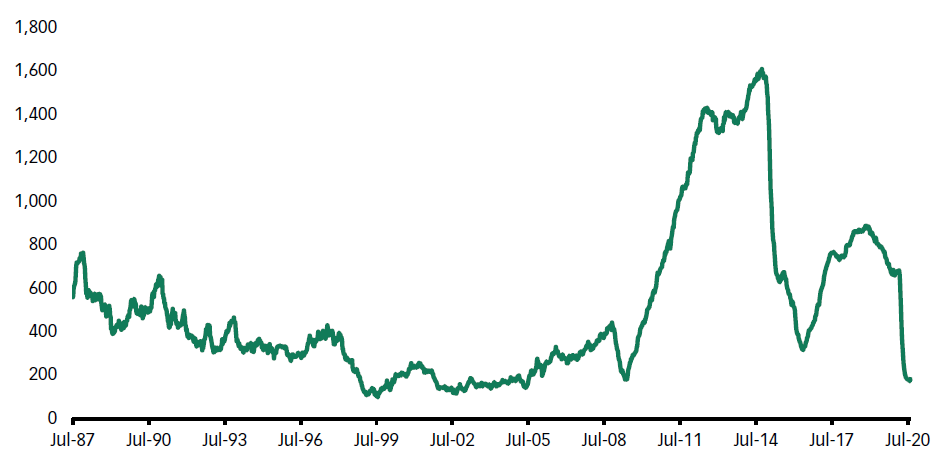

The cyclical space is an area that we continue to gain confidence in. As demand continues to return around the globe, many commodities where supply has been rationalised are likely to see material upward pressure. In Oil, continued low levels of investment have become pervasive. European oil companies are turning their back on oil due to ESG pressure, including BP, who made a point of advertising that production is set to fall by 40% by 2030. At the same time, higher cost US players are massively cutting investment activity (see rig count below).

Baker Hughes US rig count -a long-term perspective

Source: Baker Hughes, Firetrail

While in the long-term, oil demand is set to decline due to EVs and fuel efficiency, in the next 5-years demand is likely to be either side of 0% growth, once returning to pre-COVID levels. We believe the lack of investment is likely to drive a large up cycle for oil prices as modest demand outstrips declining supply.

Oil is one of the most depletive industries in all of resources with base declines average 7% without investment.

As we have seen recently, share prices tend to capitalise near term trends into valuations (see the performance of Australian consumer stocks). From current depressed levels, oil stocks are a potential opportunity to play the global recovery in an unloved part of the market.

Never miss an insight

Stay up to date with all of our latest Livewire articles by hitting the follow button below and you'll be notified every time we post a wire.

1 topic

5 stocks mentioned