Time to consider the aged care sector?

The aged care space has been battered since late 2015 and Japara's (JHC) result yesterday did not help, with the stock falling 5.9% to $1.90. The question we ask ourselves is it time to step up and buy the sector which clearly should benefit from an ageing Australian population - around 75,000 extra beds are estimated to be required for the aged by 2027. The short sellers are reasonably low in this stock which is probably not a big vote of confidence in the sector, but more a view that the majority of the sector unwind has occurred. The current short positions is: Japara (JHC) - 4.9% / 57th most shorted stock, Estia Health (EHE) - 6.8% / 30th and Regis Healthcare (REG) at 3.7% / 81st.

This morning the Australian Financial Review ran an article on Estia Health describing it as the gold standard on how listed companies should NOT manage their financial obligations. An interesting read in the AFR and not one that gives confidence in EHE at present, importantly this might add further weakness to the stock/sector moving forward. Let's look at a snapshot of each company before forming a conclusion.

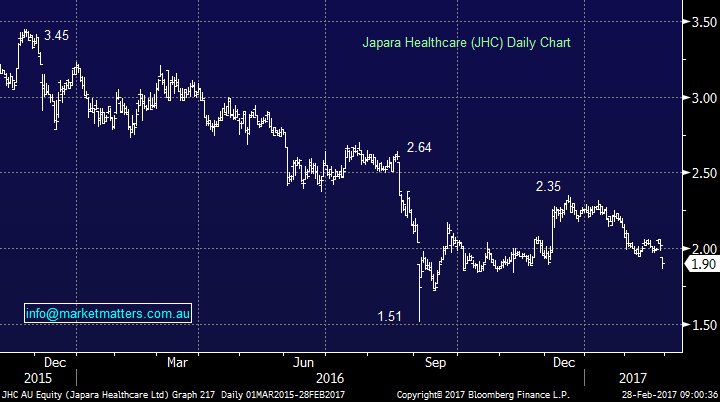

JHC's result yesterday was a poor one with earnings down 10% to $14.6m while the dividend was maintained at 5.5c fully franked, putting the stock on an 8.65% grossed up yield. The valuation still feels a little rich with it trading on a P/E of 16.4x for 2017 while it continues to put its house in order following changes to Government funding. The business is expanding, with 1,100;new beds expected by 2020, increasing JHC's total by close to 30% which should, in theory, lead to higher profits moving forward. They guided to FY17 earnings growth of 7% to 10% on FY16

Looking at the stock technically shows a pretty average picture with a break under $1.50 not out of the question. Also, a company in a growth sector, looking set to expand profitability and trading on a P/E of 16.4x while paying an 8.65% grossed up yield feels too good to be true. Remember while investing if it looks too good to be true it usually is. We feel the best approach to JHC at current levels is wait and see, especially as their result was clearly inferior to its peers.

Japara Healthcare (JHC) Daily Chart

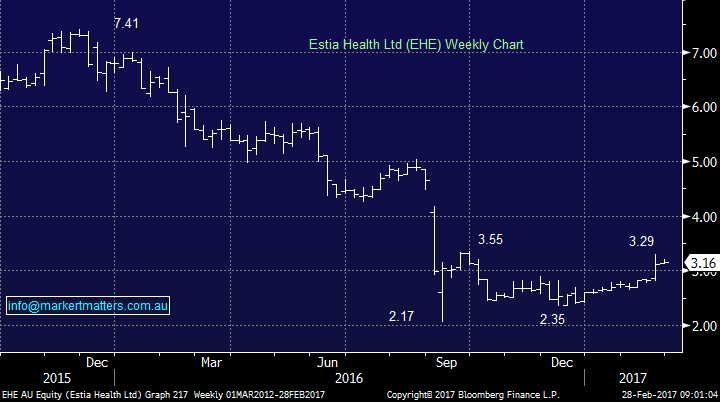

EHE reported last week and the market liked what it saw sending the stock up an impressive 15% on the day, the majority of these gains have been maintained. The company confirmed full-year earnings guidance of $86-90m while producing a strong $19.8m net profit up 85% since its acquisition of Kennedy Health Care Group, plus net debt fell to $140m from $224m following a successful capital raising which was finalised in January. We also noticed they appointed a new CFO from Ramsay Healthcare, on the surface a solid move. The stock trades on a P/E of 17.5x for estimated earnings for 2017, but they recently cut their dividend.

As we mentioned earlier a pretty average article is in the AFR today around EHE, today's price action will be interesting.

Technically we are neutral the stock at current levels.

Estia Health (EHE) Weekly Chart

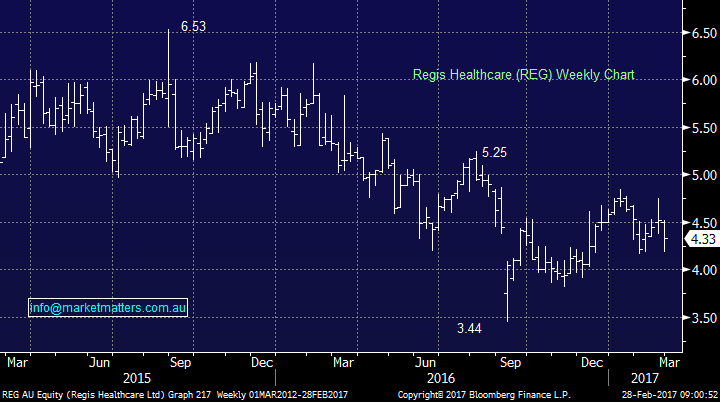

REG reported an increase in revenue of 20% to $284.7m and a half year net profit after tax up 9% to 30.9m. The stock initially spiked up to $4.75, but yesterday it closed at $4.33 after testing the lows for the month. The company's valuation is rich within the sector at 21.4x est. earnings for 2017 while the stock is paying a 5% grossed up yield. Regis is the lowest risk play in the sector.

Technically we are neutral REG at current levels, the same view as both JHC and EHE.

Regis Healthcare (REG) Weekly Chart

Conclusion

We believe value should present itself in the sector moving forward but from a risk/reward perspective at current levels there feels no hurry.

Livewire readers can receive 14 days’ free access to our Platinum level membership by registering here.

1 topic

3 stocks mentioned